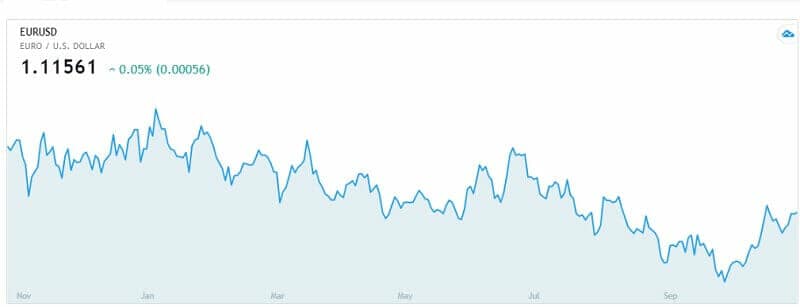

Everyone would like to know how to find big opportunities in investing. That’s the point, right? One of the best ways is to notify where traders are overreacting to the news.

By Guy Avtalyon

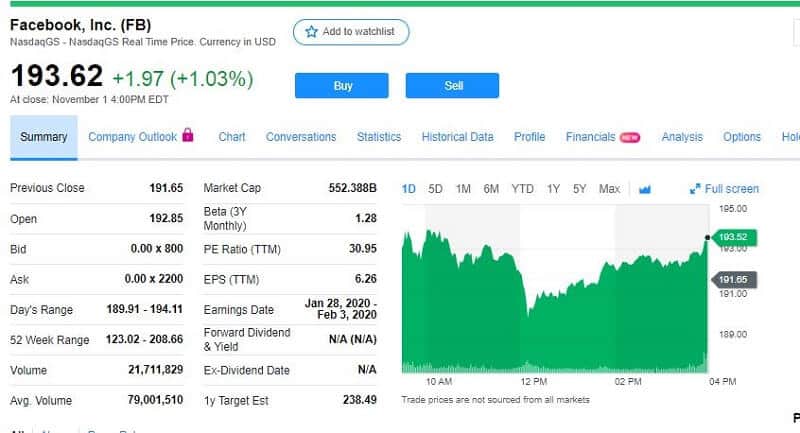

To find big opportunities in investing, other traders’ extreme fears will help you. For example, traders reacted to news that brokers were cutting their fees. But did you notice a massive rise in their stock price? During the past few weeks, online brokerage stock took hits.

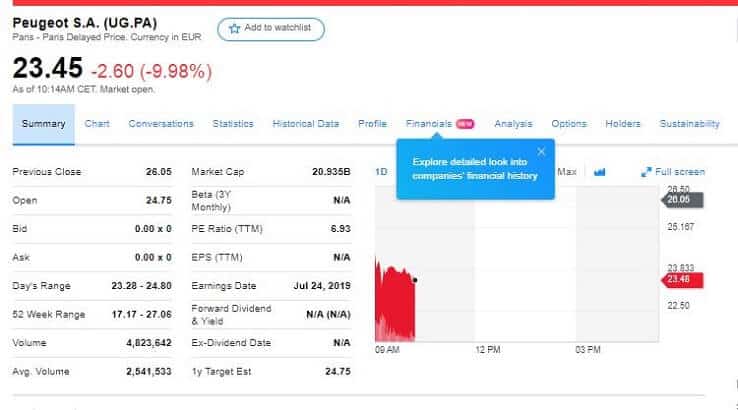

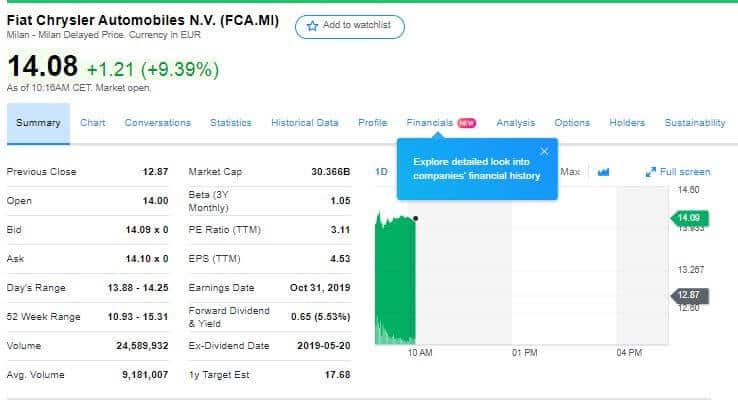

Let’s go step by step. When Charles Schwab announced it would cut all commissions for all trading, E-Trade, Interactive Brokers and TD Ameritrade fell. This news sent brokerage stocks lower because the traders overreacted.

In that period, for example, TD Ameritrade (AMTD) dropped from $48 to $33. The other brokerages experienced a decline in stock price too. Interactive Brokers (IBKR) fell from nearly $54 to almost $45, Charles Schwab Corp. (SCHW) dropped from $43 to $35, etc.

The traders responded to news that brokers are cutting their fees. They had fears about brokerage future without that income and started to sell. But the point is to overcome the fears and recognize the opportunity. When you recognize the bottom in some stocks you actually can see great returns. And let’s take a look at our example again.

What happened with these stocks a bit more after?

Charles Schwab moved from $35 to $42, TD Ameritrade moved from $33 to $39, Interactive Brokers stock rose from $45 to $48, etc. How did this happen? There are no tricks. When some stock becomes oversold and gets stretched in one direction too quickly, too far, you will notice bounce back. That is exactly the time when you have to buy the stock. So, you are profiting while others are feeling fears.

It is simple to recognize when the stock dropped on extreme fears. How to find those big opportunities in investing?

Key technical pivot points

Bollinger Bands

Let’s say you noticed that traders picked a moving average of 20 with two regular deviations up and under that average. When a stock reaches or enters the lower zone, you can be sure the stock is oversold.

RSI and W%R

Use RSI to confirm the indicators that are higher. The oversold condition will appear when RSI goes to or below its 30-line, also when W%R (Williams’ %R) comes to or up the -80-line the stock is considered to be oversold.

MACD

Moving Average Convergence-Divergence is helpful and simple. It helps to confirm the info we get from previously mentioned indicators. MACD is calculated by subtracting the 26-period EMA from the 12-period EMA (Exponential Moving Average).

How to identify investment opportunities?

You will need a bit of magic to find big opportunities in investing.

These four indicators must be matched with one another if you want this to work. They have to be aligned. And moreover, you don’t want to rely on one indicator. You must have all four.

So, what we had with brokerages in October this year? Just to be said, we can use other examples, but this is fresh. We saw the stock dropped due to the fees-pricing fight. Though, we saw the precise time of extreme fear and, at the same time opportunity.

When you see the stock dropped to its lower Bollinger Band, it is a sign that the stock is oversold. Use historical data for that stock and you will find that whenever the lower Bollinger Band is reached or entered the stock turned and bounced back higher from that point.

Use RSI to find big opportunities in investing

But you have to check RSI also. Find the confirmation on what Bollinger tells you. If the RSI is a below-set line the stock is oversold. That the confirmation of Bollinger Band’s story. Check this info in historical data to have a sense of how the stock was performing in case it had lower RSI and if the stock moved to its lower Band.

If you see the stock bounced back higher quickly that is the confirmation and you should buy.

And as we mentioned before MACD and Williams’ %R have to confirm the described condition to be sure you can trade with 85% of success.

Examples of how to find big opportunities in investing

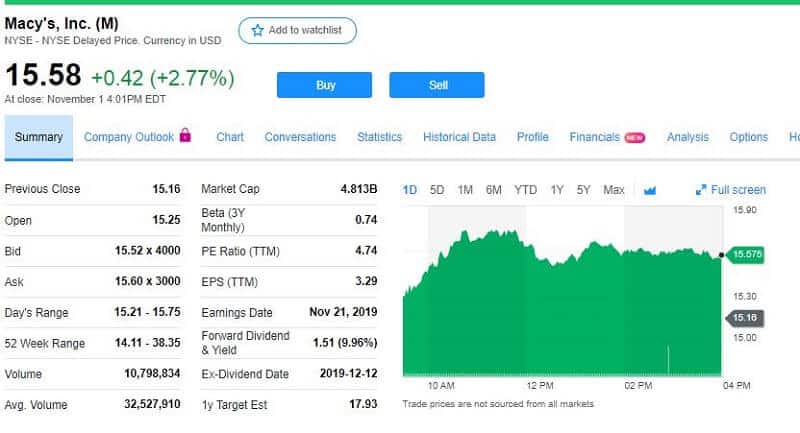

The list is really endless. Big investments may come fro different fields, different companies. For example, some small but developing company can be a better choice than a famous brand.

In case you don’t believe this, let’s see what stats tell us. Small companies are the spine of any national economy. That’s the fact. Small companies employ many people, actually the majority. So, it is easy to conclude that the can be a big opportunity to invest in.

Just keep in mind before you invest in one of them to examine its potential for growth, financial strength. When you go through this process try to find out how passionate management is about business, sometimes that will tell how serious they are about future growth and the company’s future. Especially if you want to invest in some startup.

Big opportunities in investing can be detected in up to 85% of cases.

Put all these indicators together with extreme traders’ fears based on news, and you will see how to find big opportunities in investing.