Fiat Chrysler Automobiles will merge with PSA Groupe, owner of Peugeot automobiles

Fiat Chrysler (FCA) and Groupe PSA (Peugeot is the largest PSA brand), have agreed to continue a merger. That would form the fourth-largest carmaker in the world. Their boards are working together on a new relationship. The Wall Street Journal reported the companies are moving forward with a merger. Both companies confirmed this news.

The merger will give shareholders of each group equal ownership in the new entity.

On Thursday morning both companies stated that their boards have a mandate to finalize the negotiations in the next few weeks, which means FCA will not tie-up with Renault as was thought this summer.

The merger would create a company with revenues of €170bn, with an operating profit of over €11bn and vehicle sales of 8.7m. That would lead them ahead of General Motors and Hyundai-Kia in sales. The new potential entity would have a market value of between €45-50bn.

The model of the merger is a 50-50 all-stock.

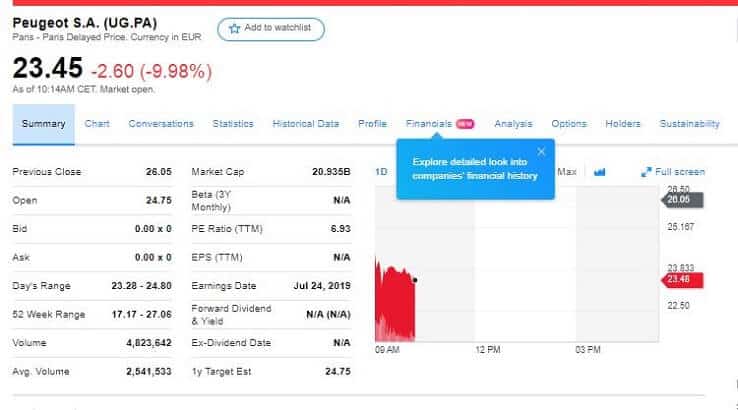

PSA is listed on the Euronext Paris stock exchange.

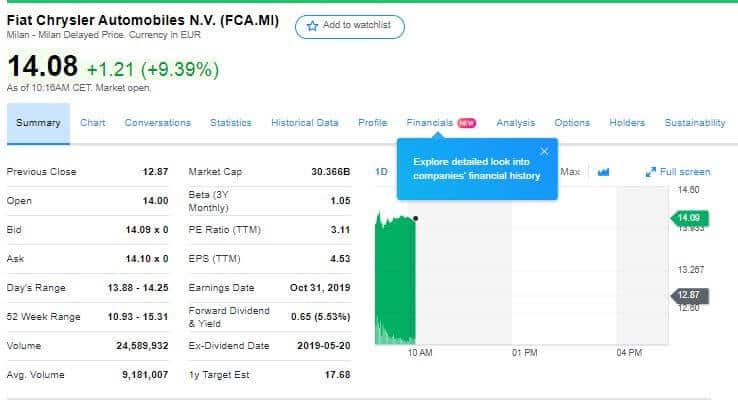

Since 2014, FCA is officially listed on the NYSE.

After the Fiat Chrysler and Peugeot Merger

When the two companies do a merger, PSA chief executive Carlos Tavares is assumed to lead that new group while John Elkann, Fiat Chrysler’s chairman will hold the same position at the new entity.

Despite this speed, a final agreement of merger needs time and regulatory scrutiny.

According to Reuters, a merger between FCA and PSA could build a “$50-billion giant better placed to tackle a host of costly technological and regulatory challenges facing the global auto industry.” Details were not published, but some aspects have known.

For example, the Journal published that the new company would be “legally domiciled in the Netherlands,” with “operational headquarters in the U.S., France, and Italy.”

Further details and any influence on employment are not yet transparent. The known fact is that FCA has plans to add nearly 5,000 jobs to the Detroit factory to build SUVs. So, the obvious conclusion is that a merger would eventually help FCA in Detroit.

It isn’t a secret that the Peugeot Group has plans to re-enter the U.S. market. The merger with FCA would provide it through the Chrysler/Dodge/Jeep/Ram dealer network.

To adjust the value of the two companies, the PSA shareholders should get about a €3bn dividend from the sale of the 46% stake in parts carmaker Faurecia.

FCA shareholders will receive a €5.5bn ($6.12 billion) cash payout and incomes from the sale of its robot-making Comau unit, estimated at between €200m to €300m.

New headquarters

The new group will be based in the Netherlands, a neutral location, where FCA is domiciled and listed in Paris, Milan and New York. The Financial Times reported the FCA will “continue to maintain a significant presence in the current operating head-office locations in France, Italy and the US.”

Around €3.7bn in predicted annual run-rate synergies are targeted, 80% during the first 4 years. The total one-time cost of achieving the synergies is estimated at €2.8bn, the two companies revealed in the statement.

Bottom line

Carmakers are facing large investments in electric cars. That is the reason behind the merge. Costs. This merger would create one of the biggest carmakers groups in the world with well-known brands Citroen, Jeep, Opel, Alfa Romeo, Peugeot, and Vauxhall. This has the potential to be a true rival to Volkswagen, Toyota and the Renault-Nissan Alliance.

The merger of those two companies looks as wise given the global competition, capital power, and industry complexity from autonomous technologies.

This could create a global automotive leader.

Leave a Reply