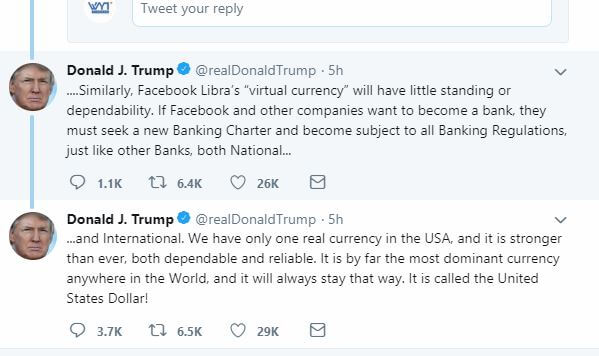

Alexandria Ocasio-Cortez had a dispute with Facebook’s crypto boss, David Marcus.

By Traders-Paradise Team

Two days of US congressional hearings were quite enough for everyone to reveal what problems may arise with a new cryptocurrency named Libra. We are not sure it is crypto at all, by the way.

AOC asked Marcus about who are the members of the Libra Association and how did they selected, trough election or on some other way. He answered that they are not democratically elected instead governed by membership criteria.

Ocasio-Cortez concluded that Libra is “a currency controlled by an undemocratically-selected coalition of largely massive corporations.”

Alexandria Ocasio-Cortez centered on a commentary David Marcus, CEO of Calibra. He said he would trust all of his assets in Libra.

“You said yesterday you would be comfortable taking 100 percent of your pay in Libra. In the history of this country, there is a term for being paid in a corporate-controlled currency,” and asked, “Do you know what that term is?”

Marcus’ answer was negative.

Who controls the Libra

Ocasio-Cortez proceeded,

“It’s called ‘scrip.’ Do you think there’s a risk in taking your pay this way?”

There was no answer from Marcus again.

What is ‘scrip’?

Scrip is a replacement for the government-issued legal tender. Some companies practice this to pay their workers. It is possible to use scrip only at those companies’ shops. For example, recently Amazon gave to their top-employees “Swag Bucks” and they could make purchasings only Amazon-themed merchandise.

This tactic is well-known from the past. It was used to pay miners in the faraway mining camps where the cash was rare. And, of course, the price in such stores are under the control of the company.

So, TP may conclude the Libra is fake currency. But, who controls the Libra is still unknown.

Business insider published a transcript of their conversation in the US House Financial Services Committee.

The full article you can read HERE

The other AOC’s attack happened when she asked Marcus about who support Facebook’s Libra digital currency.

He said that Libra will be supported by real financial assets, particularly pointed to the US dollar, the euro, and government securities. To pacify the audience, Marcus has accentuated that Libra will be conducted by a consortium of organizations.

“So we are discussing a currency controlled by an undemocratically selected coalition of largely massive corporations,” AOC concluded.

We have to say that national currencies are under the competence of governments. Do Marcus claims and Facebook’s plans show their influence on broad of governments or they want to say that their Libra, even declared as digital money isn’t crypto in essence.

This aspect of Libra could become a stumbling rock for Facebook.

Who will trust it?

About Traders-Paradise’s doubts, you can read HERE

Jamie Dimon, The CEO of JP Morgan Chase, said that he thinks Facebook’s future cryptocurrency Libra will not have a short-term influence on the bank.

When asked about Facebook’s approach to the financial sector by creating its own cryptocurrency, he said:

“We’re going to be talking about Libra three years from now. I wouldn’t spend too much time on it. To put it in perspective, we’ve been talking about blockchain for seven years and very little has happened.”

Anyway, JP Morgan has its own plans connected to crypto. They plan to employ JPM Coin, but internally in order to speed up transactions, as he said. Is this script too? We’ll see.