Bonds as an investment are not free of risks. For many investors, the bonds market is still mysterious.

By Guy Avtalyon

Investing in bonds isn’t as easy as you might think. Anyway, read this post to its end and things will be more clear.

If you are OK with the lower return but with considerably fewer risk sounds as a good investment for you, it’s time to invest in bonds. Reducing risk is essentially what bonds will provide you.

Bonds are securities. They are very similar to loans. They are issued by governments or companies. And you can buy them. Governments and companies issued them because they want to fund some new projects, to continue the realization of plans, or some other reasons can be on the scene.

The issuer gives periodic interest payments and compensates for the full investment at the end of a prearranged time frame. The bond ends “maturity” when the investor can expect the principal will be returned, plus all accumulated interest.

How to start investing in bonds?

It is not so simple

You can’t simply purchase bonds and hope you have a low-risk investment. Bonds are complex instruments in comparison with stocks. There are some risks involved. For example, the bond can be less worth after some time if the interest rate rises. If the interest rate rises continuously until the maturity of the bond, the value of your bonds will be lower even worthless in some extreme situations. That is the interest-rate risk.

There is no bond protected from interest-rate risk. So it is likely to get a lot of risk with bonds. And it is not the case with low-grade bonds issued by the company with financial problems. The risk of investing in bonds may appear with high-grade bonds too because of interest-rate changes.

Bonds are assumed to be the firm and low-risk part of your portfolio, but the bond investing is still full of traps.

Let’s find them!

Are bonds risky?

Bonds Market is still enigmatic.

It’s hard to recognize are you aiming at a good price. Let’s say you want to buy individual bonds. You have to be sure you are not overpaying. If you buy stocks, your broker will charge a commission.

But when you buy bonds, instead of a commission, you will pay an unrevealed margin on the cost of the bond.

What is most important when investing in bonds?

You have to reveal is the closing price you are paying for your bonds matches the price which other investors are giving for the same security. But even institutional investors with lots of money have the same problem: to identify pricing data. The reason is simple. Almost all bonds are traded over-the-counter not on some exchange.

Bonds are rarely traded. Individual investors will hold bonds until they mature. So prices based on recent sales usually don’t even exist. They are changed or invisible.

High liquid Treasury bonds and notes are some other stories. Their prices are broadly announced. But this kind of market is the exemption to the rule.

The issue price of a bond

It depends on the relation between the interest rate that your bond pays and the market interest rate on the same date.

You have to determine the interest paid by the bond. For instance, a bond pays a 5% interest rate per year. That means on an amount of $1,000, the interest payment is $50.

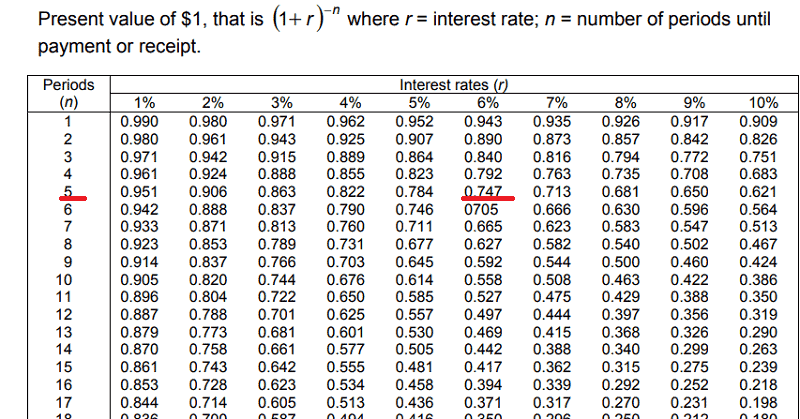

How to find the present value of the bond? Say the bond matures in five years, its present value factor is 0.74726, as taken from a table for the present value of 1 due in n periods, and based on the market interest rate of 6%.

The present value of the bond is, therefore, $747.26.

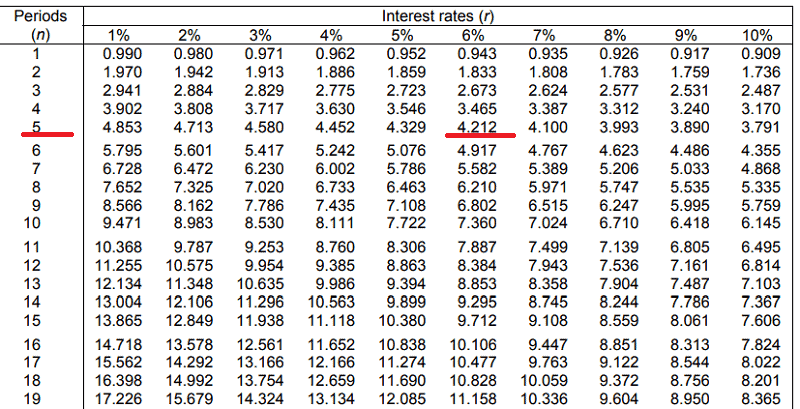

Now, calculate the present value of interest payments. The present value of an average annuity of 1 at 6% for five years is 4.212.

When you multiply this factor by the annual interest payment of $50, you will come to a present value of $210.62 for the interest payments.

Now, calculate the bond price. The result should be $957.88. That is the amount of the present value of the bond repayment at its maturity in five years, and the present value of the associated with future interest payments.

You see, the price of the bond is lower than its face value. So we can say that the interest rate on the bond is below the market rate. Investors are therefore offering its price below. In order to reach an effective interest rate that equals the market rate.

Hence, if the result of this computation a higher price than the face value of the bond, then the interest rate on the bond would be more expensive than the market rate.

So, we can easily conclude, as interest rates rise, current bond prices normally fall. But these modifications do not change all bonds fairly. It is a matter of duration. Duration regulates how a bond’s price will change in interest rates. Interest rates also affect the duration. The higher the interest rate, the lower the duration.

Leave a Reply