2 min read

When ordered to produce evidence of alleged danger presented by a short-seller, Tesla withdraws its request for a court-ordered restraining order. Tesla’s claims fall short once again.

Earlier this year Tesla has filed a request for a restraining order against a member of short-seller community TSLAQ known as “skabooshka”, real name Randeep Hothi, to the Alameda County Superior Court in Alameda County, California. In filing Tesla has claimed that Mr. Hothi has injured a security guard at Giga Factory in a hit-and-run incident, and also nearly caused a traffic accident while pursuing a test model of Model 3 during a test run on April 16. Upon being granted a temporary injunction by the court, Tesla was requested to provide audio and video recordings of those two incidents as evidence.

Surprising turn-over

But, in a surprise move the car producer has withdrawn request for the restraining order on July 19.

In the letter to the court, Tesla’s lawyers have expressed the opinion that the request of the audio and video recordings of the incidents are an undue imposition on the privacy of their employees, stating that such materials contain personal and private conversations. They have expressed a belief that “restraining order against Mr. Hothi is necessary and appropriate to protect its employees at their workplace.” Further claiming that the company was forced to choose between employees’ safety and exposing their personal conversation to the public. Thus, the document states, the company has decided to pursue the safety of its employees “by other means”.

And what those other means could be should make people worried, as the history of Tesla’s retaliation against its critics illustrates.

Tesla’s claims fall short

Shortly after the Reveal from The Center for Investigative Reporting has published a piece alleging that Tesla is under-reporting the work-related injuries, one of the CIR’s insiders have alleged retaliation. Said doctor alleged that a complaint to the relevant Medical Board was lodged against her, while also an anonymous call was placed to state’s Child Protection Service accusing her of negligence to her children and requesting that her kids be placed under the protective care of the state.

But such false accusations look to be the modus operandi of Tesla when handling the critique.

Last year Ars Technica has published a story about the alleged attempt of a mass shooting at Giga Factory by a whistleblower Martin Tripp. At that time the Tesla representative has told Ars that they have received an anonymous call at Giga Factory by a male caller claiming that Mr. Tripp is “extremely volatile” and “heavily armed”. But according to the information provided to Mr. Tripp’s attorney and then to Ars the alleged call was made to Tesla’s call center in Las Vegas and then forwarded to Giga Factory’s head of security, Sean Gourthro. Gourthro then has texted to Story County Chief Deputy Tony Dosen that an anonymous female caller has alerted them that Mr. Tripp is en route to “shoot up Tesla”, per Story County Sheriff’s Office report. According to an in-depth investigation by Bloomberg, when police officers have tracked down Mr. Tripp they have discovered that he presents no danger for Tesla’s employees.

Bottom line

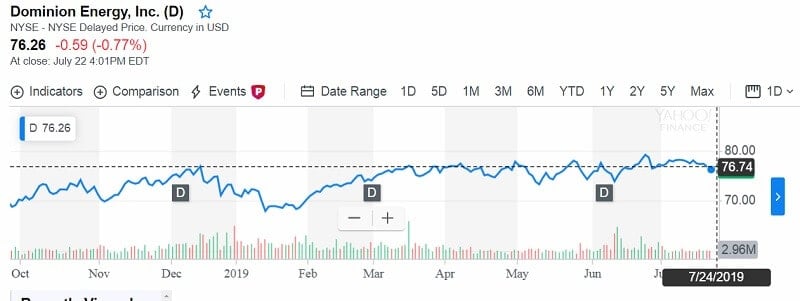

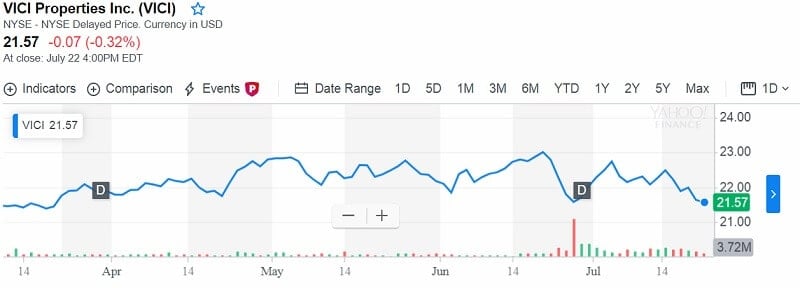

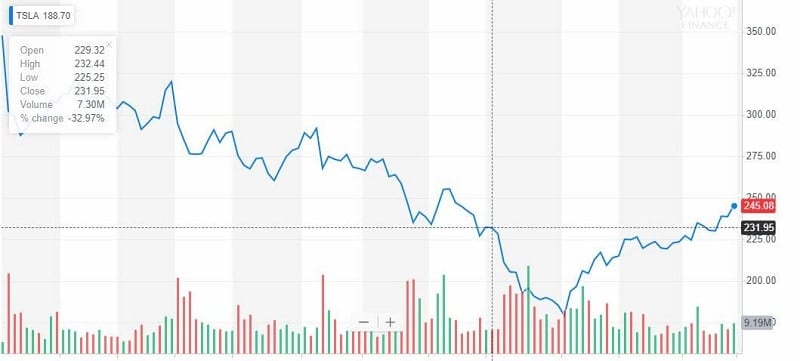

Since we wrote so many times that any news may have an influence on the stock price of some company, it will be interesting to make a comparison in stock price before and after incidents like this one. Do investors take care of how companies treat their employees? Is the company’s public outlook important for them? We will see. Today Tesla’s stock looks like this:

Tesla stock target price: $890.00

Current price: $255.68

Stay tuned and follow the market