2 min read

The analysts from Morgan Stanley claim that we are in a bear market.

Any proof? Don’t tell me you missed it!

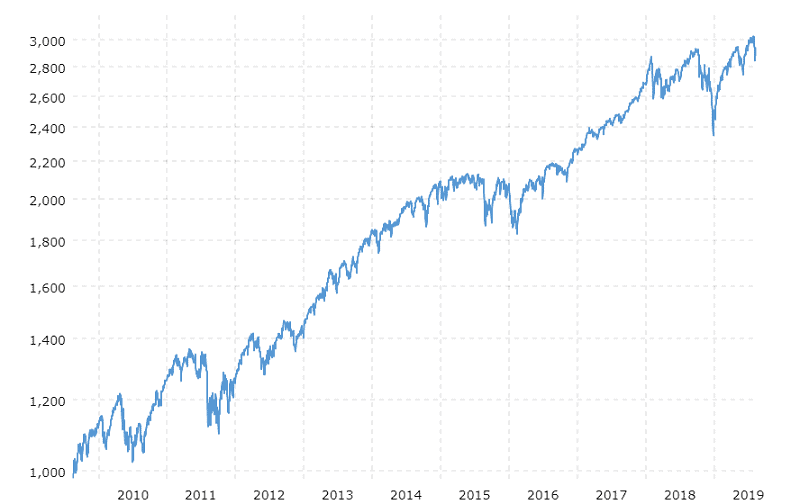

The US S&P 500 Index was closed on Friday down by 3% compared with the highest level in late July, 26, registered in intraday trading. Bear market means the stock prices drop 20% or more but the corrections include price falls about 10%.

So, you may ask how we already enter the bear market if prices dropped by 3%, it so far away from 10%.

Morgan Stanley anyway claims that “we are still mired in a cyclical bear market” pointing three spots in this estimation.

The proofs of the bear market

First, compared to the beginning of 2018. the S&P 500 is “roughly flat”, but Friday’s closing was less than 1% over the intraday high noticed on January 26, 2018.

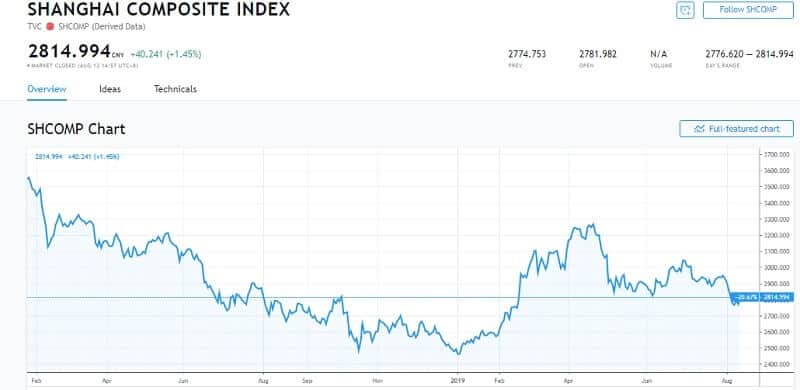

The other evidence is the fact that 80% overall equity markets dropped by 10% already.

And third, the other US market indices are down by approximately 10%.

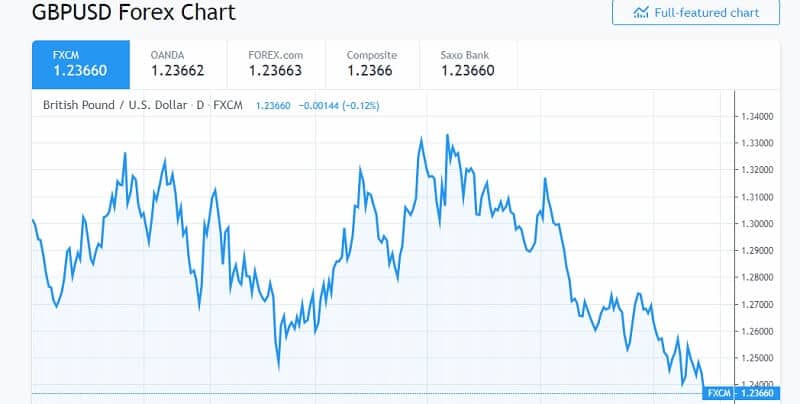

Morgan Stanly further noticed that during the past year and a half, a majority of global stock market indices dropped notably from their highs. Actually, all stock markets were more volatile than during the previous two years when we had the bull market profits.

“At this point, we would view our call in January 2018 for a multi-year consolidation and cyclical bear market as well established and documented,” said Morgan Stanly in conclusion.

The Morgan Stanly report notes that both the small-cap S&P 600 and the mid-cap S&P 400 didn’t reach new highs in 2019. Also, both dropped by more than 10% from prior highs noticed set in September. 2018.

The statistics

The statistics show, among eleven S&P 500 sectors, five have reached new highs this year with consumer staples, utilities, and REITs as leading. The two others are consumer discretionary and the IT sector.

Morgan Stanley states “…the fact that long-term Treasury bonds have defeated the best equity market in the world over the past 18 months, especially since September [2018].”

So, according to Morgan Stanley, we are in the middle of the bear market.

The previous bear markets

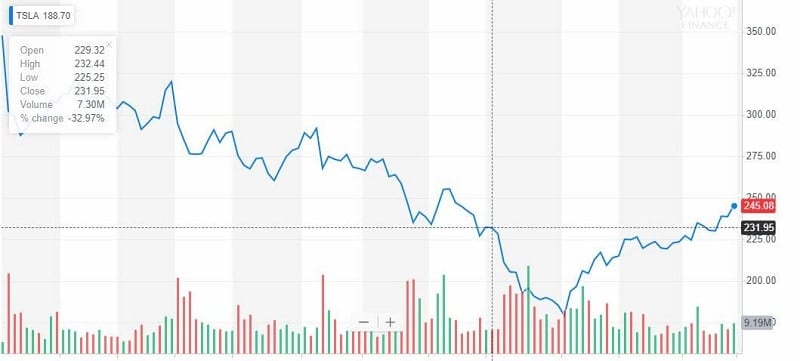

But there is no difference from the first four months of this year. We had a bear market rally. Yes, it came like a storm but a very long one. It was Christmas when the 25% rally started and ended on May 1 when the all-time highs were recorded. But all benefits from that short bull market period was gone with the wind. The bulls were so close, but still incapable to make a change.

Morgan Stanley is right. Since October 2018 we are in a bear market. At the time of the mentioned rally, all had some hope based on historical performances. The fact is that some of the biggest rallies have happened throughout bear markets. But not now.

The bottom line

What you have to pay attention to is the overall trend. It will show you the right spot. The best way to do that is to use the long-term charts to set your trading correctly. Anyway, there is no good or positive prediction. Be ready to see the large bear rallies, there will be a tremendous loss. Having this information in your minds, you will know what to do and how to stay objective. Over one century, we had 32 bear markets and 123 market corrections.

The bear market lasts shorter than bull markets. So, this one will pass.