2 min read

The bear market has seen the price of bitcoin decline more than 75% from all-time highs set in January. It is defined as a period of depressed activity and sentiment. A total of $60 billion has been erased from the value of all cryptocurrencies over the last week. That’s why many are wondering if the ongoing bear market for the asset class has finally come to an end.

Bitcoin makes up more than 50% of the entire cryptocurrencies market, in terms of total capitalization. Our prediction is that the bear market may end when bitcoin bulls refuse to cede more ground.

In the same period, traditional assets were down too. DOW had worst Thanksgiving week since 2011, oil is down 30% in 7 weeks, FAANGs (Facebook, Apple, Amazon, Netflix, and Google) is down almost 40%.

But somehow, for many people, FAANGs get more attractive as they fall and Bitcoin gets less.

Markets reverse

Markets can be reversed in three ways: by the following capitulation, by following a strong trend-setting upwards break, by slowly rolling over reversal which is the hardest.

Alex Krüger, economist and trader tweeted:

”Bitcoin crashed hard in the last month, yet the market has not seen capitulation yet. Market direction is uncertain.

Trying to figure where will the market stops falling, its bottom, is beyond fruitless. Those charting and calling bottoms are best ignored.

BTC has extremely well-defined resistance areas.

Books are so empty and volume so low that a whale can make a >5% pop/drop within a few hours.

I’d expect more 2-way action now and still lower lows eventually.

Wouldn’t be surprised to see 8200 within weeks.

A $BTC ETF will launch, making crypto go viral again.

Security tokens will go mainstream.”

What is capitulation in the market?

Capitulation is marked by extreme panic selling, consisting of extreme selling over a short time period. It is backed by high volume that builds momentum until an eventual “bottom” is found. The bottom is a price level where the asset looks too cheap or undervalued to investors for them to allow it to fall any further. In order for a true bottom to be found, many claim a capitulation needs to take the place because it is traditionally the last stage of a prolonged bear market. It’s difficult to consider something to have officially capitulated until after it has occurred. By looking at previous capitulation stages and market bottoms for bitcoin, there are a few similar signs traders and investors can watch out for. That may refer to an official market bottom.

Market conditions aren’t the same as they have been in past years. Bitcoin’s 2017 boom has brought new attention. Traders and investors who are left wondering if the asset can ever return to its former glory.

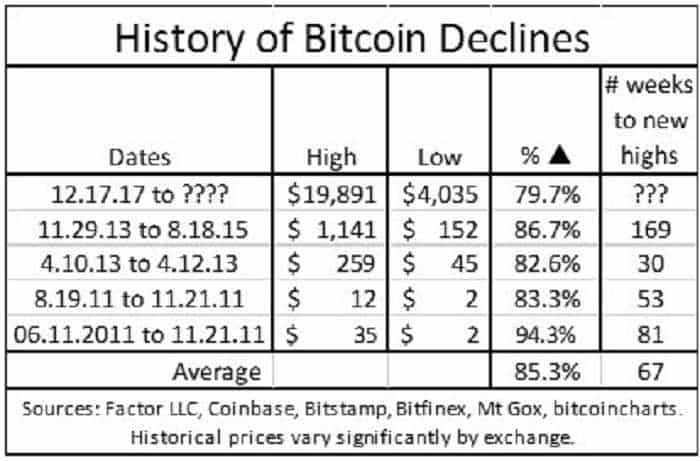

Such an event can be measured and understood in real-time. But in order to predict bitcoin’s future, taking a look at its price history is perhaps the best place to start.

It’s not an exact science, and there’s no guaranty history will ever repeat. That said, observing the bitcoin’s past price action yields three possibilities for potential market reversal worth of being discussed and considered.

If there’s no bitcoin ETF approval, one could argue there’s no reason for bitcoin to resume its bullish uptrend until a market bottom occurs like it did in 2014-2015.

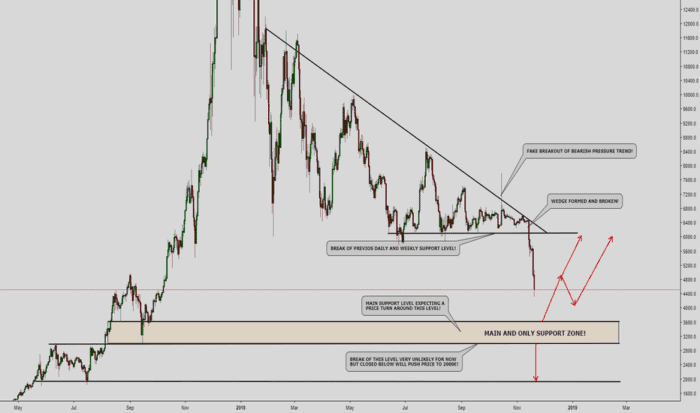

Bitcoin falls under $4,000

After days of stagnating at the $4,200 price level, on Saturday afternoon (EST), Bitcoin (BTC) suddenly fell under $4,000, a highly-touted level of support for the cryosphere’s foremost asset. It wasn’t clear why this bout of selling pressure occurred. But within minutes, sell-side orders pushed BTC (on Coinbase) under $4,200, then $4,100, then $4,000, all the way to $3,800, where the digital asset is situated at the time of writing. Of course, this is worrying. It seems that a temporary floor has been found at $3,800. Crypto traders mentioned this key level before. It is unclear whether there was a catalyst that triggered this sudden loss of support, sending BTC plummeting into its third freefall in a week’s time.

This rapid 10% loss can be caused by a number of supposed catalysts: the aftermath of the Bitcoin Cash’s November 15th fork, an influx of institutional selling orders, the Bakkt Bitcoin futures vehicle delay, regulatory measures from the SEC, and, arguably the most convincing, the final bout of capitulation from crypto’s “weak hands”.

Many traders exclaimed that they didn’t expect to see BTC foray under $4,000 ever again.

The fact of this most recent move downward is that many believe crypto’s bear market isn’t done yet. At least not until a bottom of $3,000 is reached, which is claimed by many traders, including Tone Vays, Anthony Pompliano, and other lesser-known yet knowledgeable industry analysts. That could mean that the $3,000 zone would be a good time to start accumulating.

The bottom line

If the current ascending trend line breaks, the price may not find its “bottom” until reaching the high of the prior “mega” bull run, which in this case lies in the $1,200 area. If prices fall to this level, the last hope will be to find new rising support for the entire “bull cycle” to repeat.