2 min read

A Stop Loss is a type of closing order to automatically close a trade once prices hit a specific level in the market, normally for a loss It is one of the most popular tools for traders to minimize their risk

A Stop Loss order is automatic – so you don’t have to manually monitor your positions. This provides a certain level of control and comfort.

Experienced traders will testify that one of the keys to achieving success in financial markets over the long term is prudent risk management. Utilizing a stop loss is one of the most popular ways for a trader to manage their risk, around the clock.

What is a Stop Loss order?

A stop loss is a type of closing order. It allows the trader to specify a specific level in the market where if prices were to hit. The trade would be closed out by systems automatically, typically for a loss. This is where the name Stop Loss appears because the order effectively stops your losses.

In simple terms, Stop-Loss is an automatic order to buy or sell an instrument once its price reaches a specified level, commonly known as ‘the Stop Price’. The order is executed automatically, which saves you having to constantly monitor your deals. It also serves as protection from excessive losses.

When it comes to a market as volatile as a cryptocurrency, the hardest part is to reduce your losses. Many novice investors have quickly learned the importance of controlling losses. Some may have, sadly, had to learn it the hard way.

A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. They are designed to limit an investor’s loss on a position in a security. Most investors associate a stop-loss order with a long position. But it can also protect a short position. In this case, the security gets bought if it trades above a defined price.

How does a Stop Loss order work in practice?

The concept of a stop loss is quite flexible in terms of application in practice. In fact, there are a variety of applications to the concept of stop loss. Firstly, you can use it to keep a check on the risk of your trading positions. This is the basic role of a stop loss. Secondly, you can also apply this concept when the stock price is rising and use the concept of stop-profit or trailing stop losses to constantly keep upping your targets with inbuilt risk management.

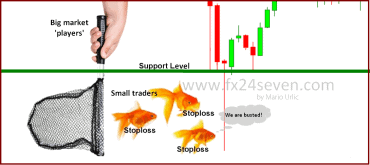

The price at which a stop loss order is placed is a personal decision and depends on the trader’s risk tolerance. Traders should consider not setting their limit too low. Doing so would result in the orders getting filled too fast, even with normal market volatility. The price at which stop orders are placed should allow room for a currency pair to rebound in a favorable direction while providing protection from excessive loss.

What this means is that stop loss is not meant to eliminate all risk. The price should be set far enough into the ”loss” territory or at a place from where a return to profitability for that trade seems unlikely. A Stop Loss helps to manage your risk and keep your losses to an acceptable and controlled minimum amount.

How to set up a Stop Loss order

Setting a Stop Loss order is very easy. When you open a deal, you will see an option to ‘Add Stop-Loss’. Simply choose an amount you are willing to lose on the specific deal. Alternatively, set an exact in which the deal will automatically close.

The real challenge with Stop Loss is figuring out which rate to set, but with a bit of practice, you will discover that automatic orders are extremely useful.

Do stop losses provide complete protection?

They are one of the best ways to ensure your risk is managed and potential losses are kept to acceptable levels. Stop losses orders are great and can assist in a variety of ways including preserving your money, preventing your position to become worse or for guaranteeing profits. But they don’t provide 100% security.

They protect your account against adverse market moves, but they cannot guarantee your position every time. If the market becomes suddenly volatile and gaps beyond your stop level it’s possible your position could be closed at a worse level than requested. This is known as price slippage.

The advantages and disadvantages of the Stop Loss order

Novices will just bump the keyboard and hope their money is still there tomorrow. But not you. You’re ready to make some smooth love to the charts. Stop Loss order is an extremely important tool for traders. Experienced traders understand that Stop Loss orders are not a perfect solution. They should be used carefully because they can also limit potential profits by effectively closing a deal too soon.

The advantages: Stop order offers protection from excessive losses and enables better control of your account. It helps monitor multiple deals. Stop order is executed automatically, at any time and it’s easy to implement. And allows you to decide what amount you are willing to risk.

The disadvantages: Stop Loss order could result in deals closing too soon, hence limiting profit potential. Traders need to decide which rate to set, which could be tricky.

The bottom line

Having a losing position is certain, but you can control what you do when you are caught in that situation. The ultimate goal for online traders is to take advantage of price changes in order to profit. By carefully using Stop Loss order you can both minimize risks and maximize your profit potential.

Risk Disclosure (read carefully!)

Leave a Reply