This is the full explanation of what you have to do in your first contact with the broker.

By Guy Avtalyon

We assume you already made your decision to start investing or trading but you don’t know how to start and what to ask a broker. That is the situation where you would need a broker’s help. You already examine and find several and it is time to contact them.

What you have to do that before you open an account.

Before you open an account, you should use the internet browser. Traders-Paradise’s advice is to visit the web pages of every brokerage company you want to analyze. That first feeling about the brokerage’ site will be maybe the most important part if you want to start trading online. You must feel comfortable while you are checking section after section and it has to be user-friendly for you and you will find if the broker has a free demo account and how long you can use it before the switch to the real.

Some websites may be slower at the first visit but try them again, maybe when you first visited them the traffic was high. A large number of visitors can make the website operate slower sometimes. This doesn’t mean the broker isn’t good.

OK, you picked several brokers. So what is the next step?

First of all, you have to make the first contact. The best way is to make some phone calls or to fill a contact form and let them call you.

Be prepared, on the first call, they will tell you precisely what you like to hear. It will be so good but also, it might not be a truth. You must be aware. So, never play on the first hint. Try them more.

Always keep in mind, you need to find the right broker for you. So, you have to talk.

What to ask the broker?

You will pay for financial advice, and you will entrust your hard-earned money to some person who will act as a genuine servant of your financial future. So, you have to ask, you have to talk.

Ask if the firm has possible conflicts of interest regarding reasons to sell particular funds or products. Just ask. If you get a precise response, then the answer will satisfy many of the next questions.

Ask the broker about trading commissions.

It might be surprising but lower commissions are not always the better.

Take care of it and examine all the information you can get.

The price per trade may explain the level of customer service. If you don’t want to trade so often it shouldn’t be the subject of your consideration. In such a case it isn’t the primary if you need 30 seconds or 3 minutes to execute your trade, so the difference in commissions isn’t important too much. Will it be $5 or $25 per trade isn’t important if you don’t plan to trade very often, for example, 15-20 trades per year. But if you plan to trade on a daily base it is important.

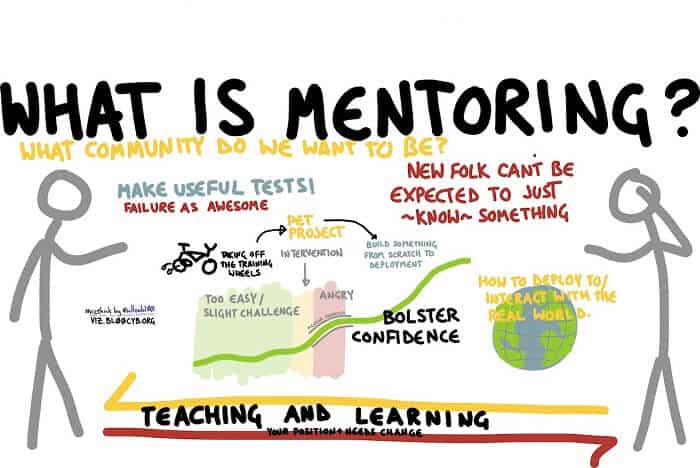

Training and education

Also, you would like to know what kinds of training and education do they provide.

Traders and investors, both advanced and novice need constant training and education to stay up to date with the laws and practices in the trade. This includes mentorship and copy trading. Mentorship is extremely important. The legal field is changing and you would need a good mentorship to follow the best practices in order to keep mistakes minimal. On the other hand, copy trading is good for novice traders and investors but leading traders may make mistakes too. At the beginning level, they are good. After you master the trading, you should build your own strategy and approach to the trade. That will depend on your personal goals, risk tolerance, and character.

Also, important information is about other fees.

Ask the broker about them. That is information about costs of account-maintenance and inactivity fees. So, it is good to make a list of services and transactions you might need before you start the conversation with the broker. Ask them how much all of them will be a charge.

Ask a broker about the minimum initial deposit

Minimum initial deposit is something you should know before you open the trading account. We assume you know how much you can invest but does it meet the broker’s regulation? Some brokers have account minimum and you have to know is it adequate for you. This minimum has to matches your budget.

Withdrawals

You need to know how much you can withdraw and how much time it will take. On some websites, you will find wonderful information about it but once when you talk with a live person you might find there are so many differences for almost every case. For example, on the website brokerage can write the withdrawals take a few days. That is true but sometimes it isn’t. Very often it depends on how big withdrawal is or in which circumstances you want to withdraw. Ask for every single detail about it.

Customer support

This is a huge question. Ask a broker’s about customer support and services before you sign up. Is it easy to find what you want on their website or you will need to spend the whole day and click through 100 pages? Can you access to their customer support fast? Does your broker have live chat? Is there any possibility to talk face-to-face?

Banking services

Maybe this isn’t a big deal but still, you have to know all about payment methods.

The best choice is a brokerage account that can serve your banking need. The brokers now offer Visa or Master cards, direct deposit, ATM cards, etc.

Ask a broker about investment assets selection

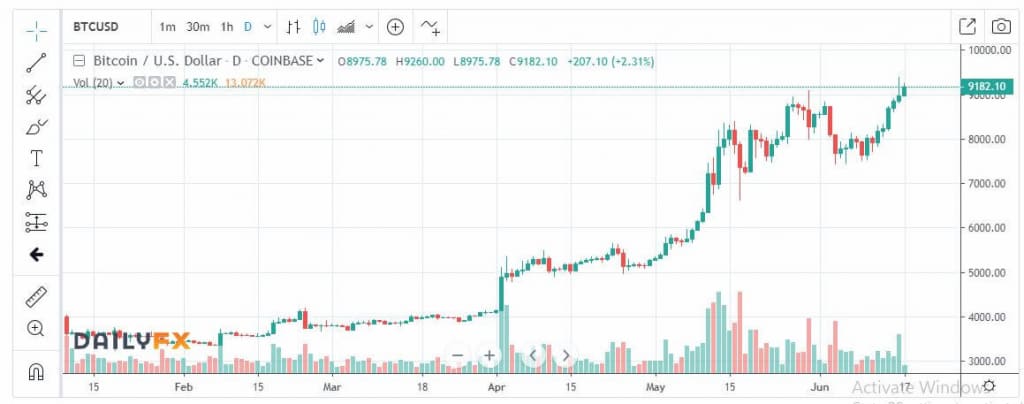

All brokerages offer stocks traded on the major exchanges. But if you’re interested in options, bonds, currencies, cryptos ask if certain brokerages offer them. They’re not available in all brokerage.

A good broker will set realistic expectations in front of you. They will provide some valid information from their experience. They will be based on the current market and on details about your goals.

Beating the market is hard but at the same time exciting. Since it is hard for the majority, you need to add some weights to your portfolio. Without a broker, it is even harder. Statistics show that only 5% of market participants are successful. It is smart to use the best brokerage to be one of them.

Traders-Paradise recommends you to ask these questions as far as possible. Your broker has to truly serve you well. So, they should have no problem to give you honest answers.

To get started on your broker research, use our Walls

Traders-Paradise Team wishes you successful trading and investing.