NIO is one of the most volatile stocks on the market and analysts’ consensus is to hold it

With 33.4 million shares NIO has one of the highest average daily trading volumes

NIO is one of the most popular and very liquid stocks in the market. However, the volume of stocks like Nio may give an impression of the market’s raised interest. The volume is measured in shares but stocks like Nio have current prices under $2.

This is a Chinese automobile maker from Shanghai. It is specialized in designing and developing electric autonomous vehicles. And it is NYSE listed under the ticker symbol NIO. This electrical carmaker’s stock has dropped over 70% from the beginning of this year.

The reasons are numerous, from a vulnerable macroeconomic climate to the geopolitical tensity.

These worries could be ended since the EV market is rated as recovered. Something like that said Li Bin, the founder and CEO of Nio, according to the National Business Daily. But let’s take a deeper look at the NIO stock.

Where is the spring for NIO?

NIO’s CEO Li said “spring for electric vehicles is near” after the sale of Nio’s car a bit rose in September and October.

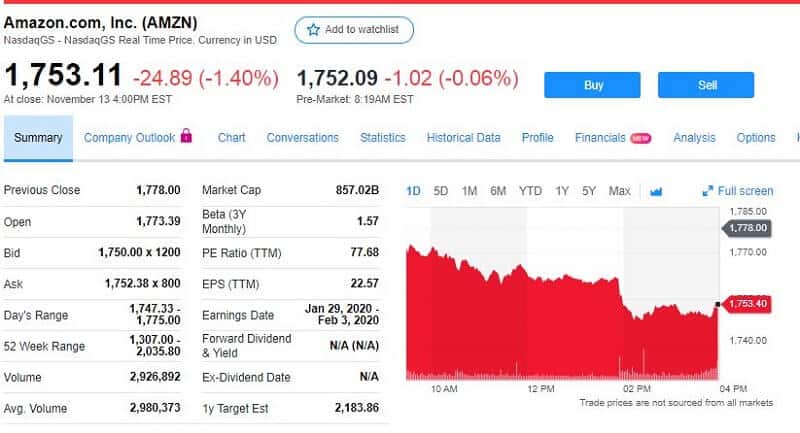

Nio is always compared with Tesla Inc and called China’s Tesla. Nice wishes, but not realistic. Tesla (NSYE:TSLA) is a stock worth $354.83 (Nov 22).

The company had a very bad start this year. The company delivered to the market 1,805 vehicles in January and 811 in February. March was a bit better with 1.373 delivered vehicles, in April the company reported of 1,124, in May 1,089.

In June Nio introduced the new model ES6 and increased its sales to 1,340 cars in that month which was almost 70% higher than the previous.

With new model ES6, sales deliveries were raised in August to 1,943 vehicles, it was sold 146 ES8s and 1,797 ES6s.

But even with this, the achievements for the beginning of this year were weak. Hence, the company reported a loss for the second quarter and the management announced restructuring with possible job cuts.

Spring in September

Nio’s luck reversed in September. The company reported an increase in deliveries, they managed to deliver 2,019 vehicles. And that increase was followed by good results in October when deliveries jumped for 25.1% or 2,526 units.

At the same time, the management of the company has been very active in solving the gaps, it announced a deal with Intel Corporation’s Mobileye for driverless consumer cars in China.

NIO shares were trading at $1.98 at the time of writing this article.

Bottom line

The analysts’ forecast for NIO has a medial target of $14.36. The high estimate is at about $88 and a low estimate of $6.41. The median estimate signifies a 625% rise from the current price of $1.98. The analysts’ consensus is to hold NIO stock.