The company is a biotech pioneer establishing a new category of long-lasting neuromodulators.

The company is a biotech pioneer establishing a new category of long-lasting neuromodulators.

The Revance Therapeutics stock can be a good addition to the investment portfolio

by Guy Avtalyon

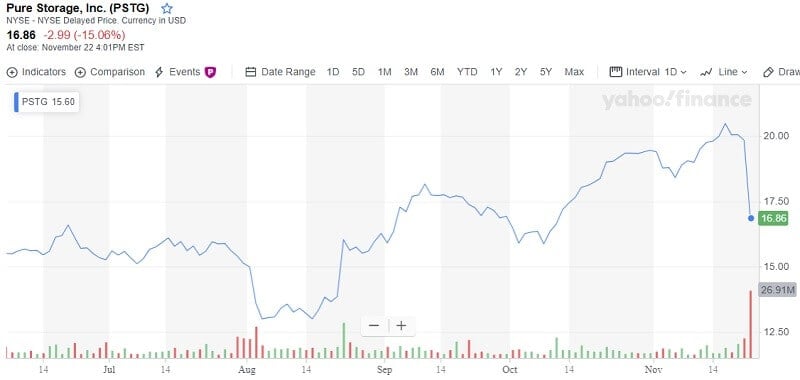

Wednesday was a rough day for shares of Revance Therapeutics (NASDAQ: RVNC). Investors were surprised by lowered the biotech stock for 16.4% on Wednesday and traded at $16.61.

Only a few days ago, or the day before, the shares had been rising. But the company submitted an application to the FDA for DAXI in November. On Monday, shares rose over $20 per share until the end of Tuesday’s session. On Wednesday it was announced $17 per share.

What happened with DAXI?

For a long time, DAXI is a neurotoxin, but better than Botox, a global favorite. Revance Therapeutics has proof that it works better. Botox sales have risen to $2.7 billion per year and the producer AbbVie has a lot of reasons to be satisfied.

But let’s go back to Revance

FDA’s evaluation of DAXI could take months and we still don’t know if and when it will start. Revance Therapeutics’ partner Mylan announced the possibility to fund late-stage development of DAXI until April 30, 2020. What if FDA doesn’t start its review until then? You see, despite a published good result of DAXI and great expectations for selling it, one paper can disappoint investors. Yes, it is an important paper and a lot of things depend on it. For example, the future of Revance Therapeutics and its partnership with Mylan.

If Mylan supports DAXI and gives Revance a two-digit percentage on sales, it could deliver a great return.

On an investment of $10.000 in less than 2 months, you may have a nice return of $1.047 if you set your stop-loss at 19,25% level from the current price and take-profit at 40,25% level. But once again check yourself.

Revance Therapeutics had the problematic announcement

Revance Therapeutics, Inc. is a biotech company. It develops next-generation neurotoxins for treating aesthetic and therapeutic conditions. On December 4, it announced the pricing of an underwritten public offering of 6,500,000 shares of its common stock at a price of $17.00 per share.

Revance has allowed the underwriters a 30-day option to buy up to 975.000 additional shares. The gross incomes from the offering are expected to be approximately $110.5 million. The offering is supposed to close about December 6, 2019. Revance Therapeutics plans to use this net profit of common stock to proceed to fund the commercialization of DAXI. The additional income will spend mostly on research and development.

Revance Therapeutics

Revance is fusing new science with the entrepreneurial vision of Silicon Valley. It is a modern biotech company with an innovative approach to aesthetic and therapeutic treatments.

The company stated on its website:

“Our lead investigational product, DaxibotulinumtoxinA for Injection (DAXI), combines a proprietary stabilizing peptide excipient with a highly purified botulinum toxin that does not contain human or animal-based components.”

It has been completed a Phase 3 program for DAXI in grimace lines. It showed fantastic efficiency and duration, and the company is seeking FDA approval.

The company is focused on developing products and treatments in dermatology and aesthetics. Its products are RT001, botulinum toxin type A (BoNT-A) for cosmetic and dermatologic treatments. The previous name of the company was Essentia Biosystems, Inc. Under the name Revance Therapeutics, Inc. it is founded in 2002 with headquarters in Mountain View, California.

As Traders Paradise can conclude the stock price of Revance Therapeutics can easily hit at least $18 in the next 10 days.

At the moment of writing this article, it is December 05, Thursday, the current price of RVNC stock is $16.840 which is a bit more than yesterday. This stock had a declining tendency for the past 12 months. Biotech stocks are really tricky. But Traders Paradise thinks the stock price could rise significantly in the next 2 months. Over the one year, the price could be almost doubled. Hence, this is a strong BUY stock.

Axsome Therapeutics gained 1.70% in the last trading day ( Friday, Nov 29), increasing from $38.71 to $ 39.37. Will the company be able to continue growing?

Axsome Therapeutics gained 1.70% in the last trading day ( Friday, Nov 29), increasing from $38.71 to $ 39.37. Will the company be able to continue growing?