3 min read

When interest rates are low you may think: Oh, what a good opportunity. Loans are cheaper, banks or and peer to peer sites will fight for loan clients. Yes, at some point of view and for a short time it is favorable.

But on the other side, the low-interest rate means lowering returns for lenders. If interest rates are low for a long time, where is the benefit for lenders? That is the very clear relationship between demand and supply. Low-interest rates can damage lenders, and the borrowers can be damaged too because borrowing money becomes difficult.

In periods when the interest rate is low, banks are in a difficult situation. They don’t have a strong deposit base, the income from loans is lower too which causes the banks to don’t want to take a risk by giving cheap loans to borrowers with the lower credit rating.

And here we come to the point. It is difficult to finance, for example, small businesses, and investing becomes more difficult too. But not impossible yet.

Low-interest rates inhibit investors from putting money in savings accounts. They rather use the funds to pay their debts or use their money to invest in shares or buy some property.

For example, if the interest rate on deposit is about 1%, why would you put your money on savings? The better choice is to buy shares, the return is bigger.

Instead to put your money on your saving account, invest it

When the interest rate is low, investing is a great opportunity for many people. The truth is, if you put your money in the bank, the returns will not follow the inflation rate. Investing demand more risk, that’s the fact. But the returns, if not defeat the inflation, will follow the speed of it.

You don’t want to miss this: Economic downturn – How to prepare for it

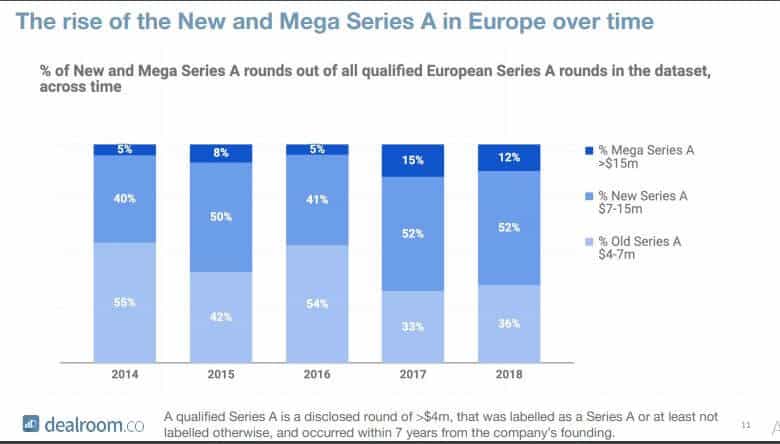

The point is that you will take more risks to get bigger returns. How much risk you should take and stay calm? You can decrease risk by diversifying your investment portfolio. Investing in higher-risk assets gives higher returns.

So, where to invest when you withdraw your money from the bank account?

The most popular are bonds and stocks that are paying dividends.

The yield is what every single investor wants, no matter if it is an individual investor or institutional. The aim is the same.

Invest in fixed income assets, that will give you a high return. But if you invest in different asset classes, meaning you build a diversified portfolio which is the best strategy, you may be sure you will have increased yields.

In any case, bigger than if you leave your money in the bank while the interest rate is low.

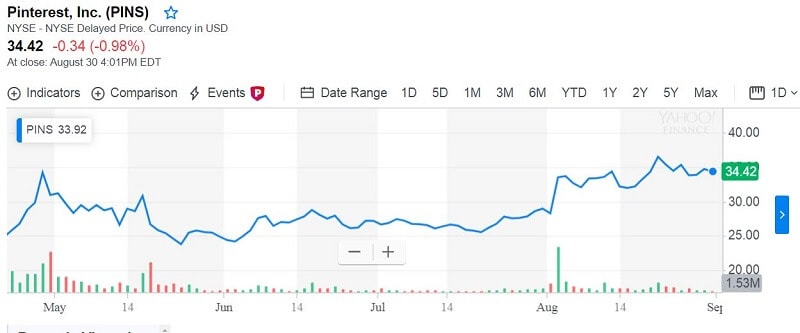

The stock market is one of the best long term capital raising opportunities.

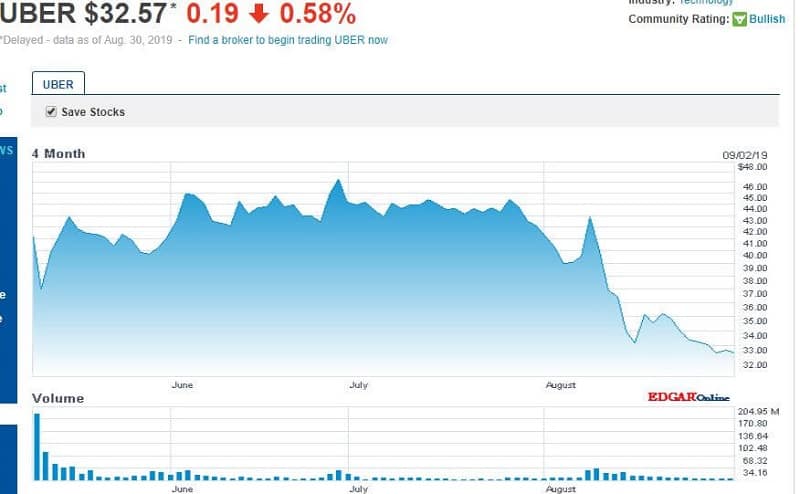

Yes, the stock market levels are high at this moment. To explain this. When interest rate drops, people will think they are safe and accumulate their capital or savings into stocks.

This action is driving the markets higher. The demand is bigger and the prices are high.

Increased stock markets are a difficulty for many people. So, what you have to do is to keep your money for a while, just wait for the market correction or invest for the long term. The long-term investing is a good choice because how could you know the market will weaken.

The stock market doesn’t like high-interest rates but likes the low-interest rates. High-interest rates can boost costs for companies which can lead to lower profits, hence lower stock prices. But it is a great opportunity for everyone who wants to buy. Low-interest rate rises the price of the stocks because the people will rather invest in stocks than to keep their money in the banks. So, the demand is bigger, hence stocks prices are higher.

The worse scenario is to leave the money in the bank during the period of low-interest rate or inflation. You don’t want to watch how smart people defeated inflation and you were the victim. Don’t be the looker-on, take your place in the game.