5 min read

by G. Gligorijevic

Stock investing isn’t just buy and sell stocks. It is the whole philosophy and math. Well, you have to learn more about the logic behind the stock market.

When you want to buy a stock, that means someone else has to sell it. Be aware, that someone has worked on the numbers and concluded that the wise move is to get out of the position right now. Do you know why that one decided like that? How to be sure you are doing a good job if you pick that stock?

Stock picking is a struggle against other investors.

Maybe they know just like you, maybe more, maybe less.

The basic formula is easy: Pay a value that’s smaller than the long-term, per-share price of the underlying business. The philosophy of investing is in understanding how to determine that value.

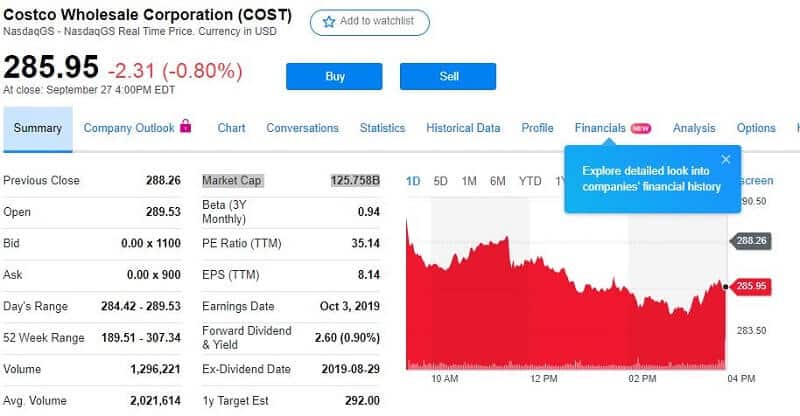

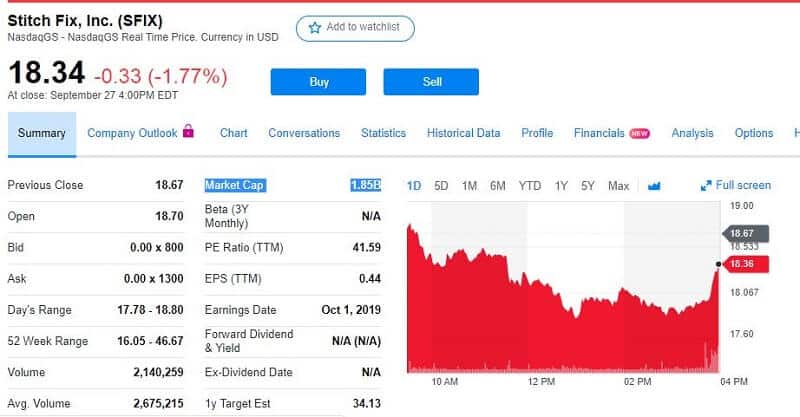

Maybe you prefer to be a “growth” investor. So, your focus should be on the analysis of a company’s potential for future profits. You should choose the one growing fastest. As a growth investor, you are interested in great earnings. The P/E or price-to-earnings ratio is a popular metric for valuing stocks. Growth investors often are willing to pay P/Es of 20 or more.

Value investors usually buy stocks with lower P/E ratios. This appears more traditionally. But buying cheap has some risks. Very often when some stock is cheap it is a sign that the company has some problems. Is this true? No! Simply NOT! There is no easy way or formula that helps you to pick a fabulous stock to deal with. You have to research and make a decision.

But maybe you should invest in funds than individual stocks.

Stock investing demands time and intense analysis. It also needs notable cash to create a fully diversified portfolio. A choice is a mutual fund. That will spread your bets between hundreds of stocks.

Stock investing is attractive and enjoyable for a lot of people. If you want to enter the market on your own, you can use funds as the essence of your portfolio. Later, just set aside a small account for your selection of the individual stocks.

One of the main benefits of investing in the stock market is the chance to grow your money. Over time, the stock market performs a rise in value. Yes, the prices of individual stocks rise and fall daily. But, investments in solid companies that are able to grow, tend to make profits for investors. Moreover, investing in many different stocks will boost your wealth by leveraging growth in different areas of the economy. It will bring you a profit even if some of your individual stocks lose value.

Stock investing gives a lot of benefits to investors.

Owning stocks means to take advantage of a growing economy.

How does it come?

That is a kind of chain of good fortune. Everything is connected and logical.

Assume you want to buy a stock you’ve been examining for some time. And finally, they announce a surprise bit of good news and the price rallies sharply higher and so you jump in.

Let’s say, you have a sudden profit on your hands but, the stock reverses. It has retracted back to your entry price. Actually, it has gone beyond your entry price and you are a loser! You may think that it’s just market games and “shaking out weak hands”. So, you decided to hold on, knowing that patience is a trading power. Finally, you’re down further than you expected to be in the stock.

If you were ultra convinced of the upside potential, you may see this as an opportunity to buy more shares at a better price. On the other hand, you may panic and sell as you continue to watch the price trend further against you.

What happened?

Experts developed the “Efficient Market Hypothesis” which states that stock prices instantly diminish all news. So, there’s no possible way for a trader to profit from news releases. That experts feel that strongly.

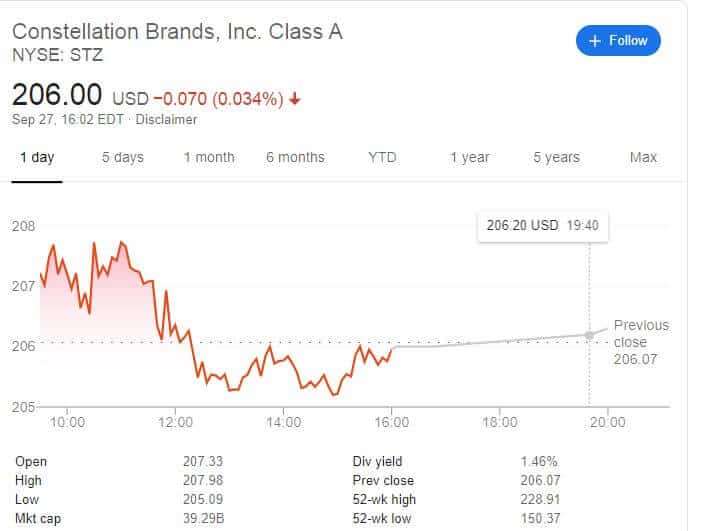

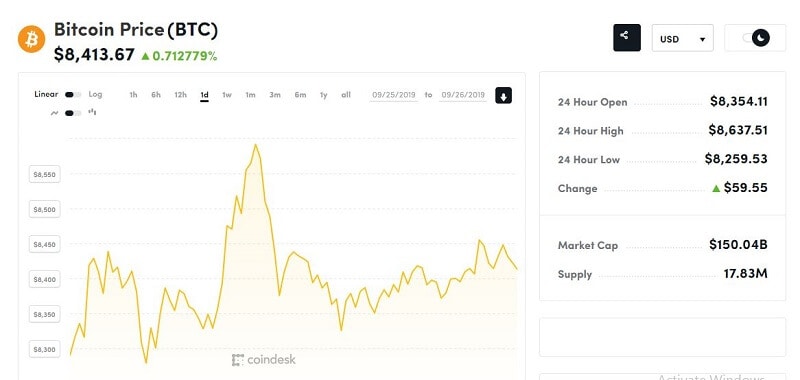

Maybe two years ago, Samsung announced it is expecting profits to hit record levels in the third quarter. And almost three times as much as the same period the year before.

Following the announcement, their share price dropped.

That might seem counter-intuitive. But there are other factors at play. At the same time as announcing this expected profit win, Samsung’s CEO quit. He told that the company was going through an “unprecedented crisis” and that “a new spirit and young leadership” was needed to respond to the challenges. In this case, the decline in stock price can be understood. You know, if the CEO is worried, perhaps investors should be too.

But sometimes share prices drop on good news and it is really hard to understand why.

Market expectations are always priced into the market price. Say, for example, a company has a forecasted earning per share of $1. They’ve never missed an earnings target. So investors expect the firm will actually earn $1.10 per share. They think it’s currently undervalued. The firm then announces an earnings report of $1.05 per share.

Good news, right? They beat their forecast.

But, crucially, because investors thought the firm should earn more than this $1.05 per share, the stock’s price was bid upwards to a price that reflected earnings expectations. Because the real earnings are less than the current market price, the stock price drops as investors sell off their shares.

This effect can be intensified by investors who completely copy what everyone else is doing. In this case, selling off their shares. Every investor must have the bigger picture. That’s the point.

What you have to do?

If the stock is basically strong, hold the stock despite the stock price going down. It won’t matter much in the long term if the company. Most of the great companies focus on their long-term goals. This means that a few times, they might miss the short-term expectations.

But, short-term interests shouldn’t be ignored completely by the company or investors. Nevertheless, if the company is overall performing good in the long run, then there’s no point of worry. In any business, there will be few difficulties in the short run.

Additionally, do not get connected to short-term expectations. Analysts will keep on making expectations every quarter. It’s their job and this is what they are paid for. If a company keeps on working for the short-term goals, it might never be able to focus on long-term growth.

Overall, if the temporary setbacks are not going to affect the long-term profitability of the company, then ignore the short-term fluctuations and hold your stock.