Morgan Stanley believes that IT and Transportation stocks will benefit the most from any de-escalation of trade tensions.

Morgan Stanley says there are some Chinese stocks that will benefit from phase one deal between the US and China.

Almost half of them belong to the IT sector. This sector suffered in the trade war because the companies took place on tariff lists. Also, some of them are from the consumer sector.

Morgan Stanley said in last week’s report: “These two sectors saw the biggest scale of valuation re-rating based on their previous reaction to de-escalation events.”

These 29 stocks have significant exposure to U.S. revenues, according to this investment bank.

The so-called phase one trade deal, the US President and President of China, was made several days ago. It is a kind of initial agreement but nevertheless, it caused some optimism. Anyway, it is progress in this situation. The US President said in his tweet on Saturday that the US and China would “very shortly” confirm the deal.

Morgan Stanley wrote: “We believe IT/Internet-related and Transportation stocks will benefit the most from any de-escalation of trade tensions.” The airlines’ stocks or in general, transportation stocks, is going to benefit from, as bank wrote, from “strengthened CNY/USD” and “improved global trade outlook.”

What are the Chines stocks that will benefit?

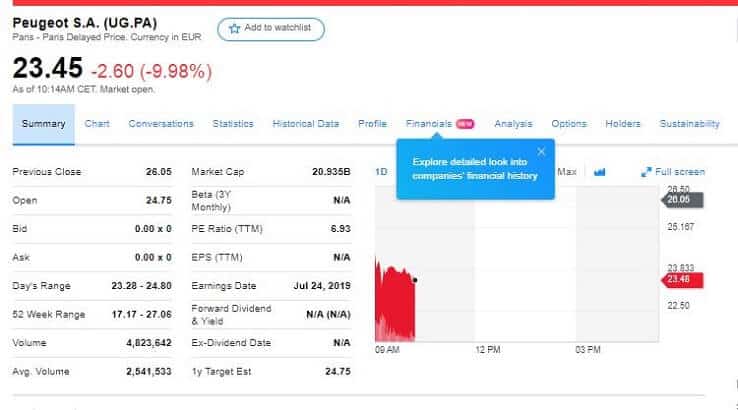

First on the list could be AAC Technologies, with 58% publicity exposure. It supplies Apple. Further, Lenovo. This laptop producer has 31% exposure to the US revenues. Also, Samsonite could benefit.

As much as Alpha Group, Goodbaby International, Nexteer Automotive Group, Ningbo Joyson Electronic, Regina Miracle International, Zhongji Innolight, Sunwoda Electronic, WuXi AppTec, Crystal International Group, SMIC, Bestway Global Holding, Jiangsu Changjiang Electronics Tech, Cosco Shipping, Jiangsu Yangnong Chemical, Lens Technology, Shandong Nanshan Aluminium, GoerTek, WuXi Biologics Cayman, GigaDevice Semiconductor Beijing, Luxshare Precision Industry, Shenzhen Sunway Communication, Universal Scientific, FIT Hon Teng, or Legends Holdings are also Chinese stocks that will benefit.

All of them are publicly listed on Chinese exchanges.

Morgan Stanley warned that the final outlook for the sector depends on the talks’ “dynamics” among the U.S. and China, including the signing of a deal.

The bank said that both countries have been so close to signing a deal several times in the past 18 months but it didn’t happen.

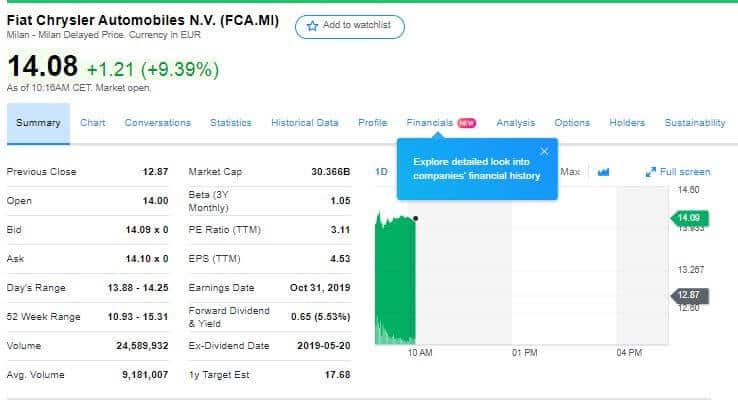

Some US stocks could benefit too

Intel, the largest producer of semiconductor products in the world. Also, Harsco, a service, and engineered products corporation. Diodes Incorporated, a leading producer and supplier of discrete and analog semiconductor products could benefit from the deal between the US and China, for example.

Unexpectedly, on Dec 11, China made new offers to the US to end the trade deadlock. China proposed to reduce tariffs on U.S. vehicles from 40% to 15%.

It seems that both sides are looking to end this trade war. For example, President Trump has offered to mediate in the case of Huawei’s executive whose arrest had increased trade tensions.

More about China’s economy

China’s economy began this decade in growth and it looks like it will end with the slowdown, the worst seen since 1990.

Well, policymakers have the chance to avoid a crisis and they know how to do that. The question is, do they want. For investors, it is a buying opportunity after Chinese stocks dropped to record lows in comparison to world peers.

The main topic for China for the next 10 years is it going to fix these problems more quickly and dynamic way. The other choice is to have them forever.

It is surprising how they maintain the pace of growth with the state sector involved. The progress away from a state-controlled economy to a more private-sector is lacking.

Further, China has very little or low motivation to allow complete fluidity of capital flows into and out of the country.

Michael Pettis, a finance professor at Peking University recently commented on Bloomberg:

“China was unlikely to experience a financial crisis and a sharp depreciation of the currency. I think the market didn’t understand that these are mainly balance sheet events, and as long as China’s financial system was closed and its regulators powerful, Beijing could easily extend and restructure liabilities so as to prevent a crisis.”

Bottom line

Supplies, Technology, and Industrial are Chinese stocks that will benefit the most from ending a trade war. So, pay close attention to the stocks from those sectors and make your investment choice.