Are we deep in the global recession? Yes, we are, and if we are not yet, we will be in a short time. There is no doubt about that.

By Guy Avtalyon

It isn’t a question, the global recession is here without a doubt. But how long will it last? Will it be short-living or painful? Is there any chance of recovery by the end of the year? What will come in the aftermath of this recession? What will the world look like when the coronavirus outbreak ends? So many questions!

The COVID-19 pandemic is making changes to the global economy very quickly. Hence, giving any prediction is extremely challenging. One thing is so obvious, this is a shock with a great impact on the economy.

Some economists are expecting the global economy to decline by almost 2%. The GDP is down, unemployment is growing, inflation is rising almost all over the world. It looks like the whole world is on its knees.

The rapidity with which this COVID-19 pandemic is growing has required another cycle of huge cuts to any GDP predictions.

How can we know the global recession is here?

First of all, no one expected that the virus would spread this fast and only rare economists warned of the impact of the coronavirus outbreak on the global economy. Today, we can claim with the high level of certainty that we entered the global recession.

We have lockdowns across Europe, the US, parts of Asia, and many other countries. That has to be the baseline for any predictions. These lockdowns could degrade GDP across the EU and US, for example, by 7% to 8% this year, experts said.

Moreover, the global GDP for this year is equal to the planetary financial crisis. The direct stroke to enterprises and jobs in the first six months of this year will be much worse, stated economists.

The lockdown policies have prompt and dramatic effects on daily economic activity reducing them daily by about 20% from their regular levels. For example, the three-month crisis with a five-week lockdown period reduces GDP by 20% a day. That means a 7% to 8% drop in quarterly GDP.

Something is very wrong in the global economy right now

The coronavirus crisis has sent the global economy into a fall. So many industries have ground to a halt. For example, tourism, restaurants are closed, hotels, air travel. Also, many factories reduced production and fired their workers. Unemployment is rising almost everywhere. Everybody stays at home. Almost the whole world is producing less and we’re spending less.

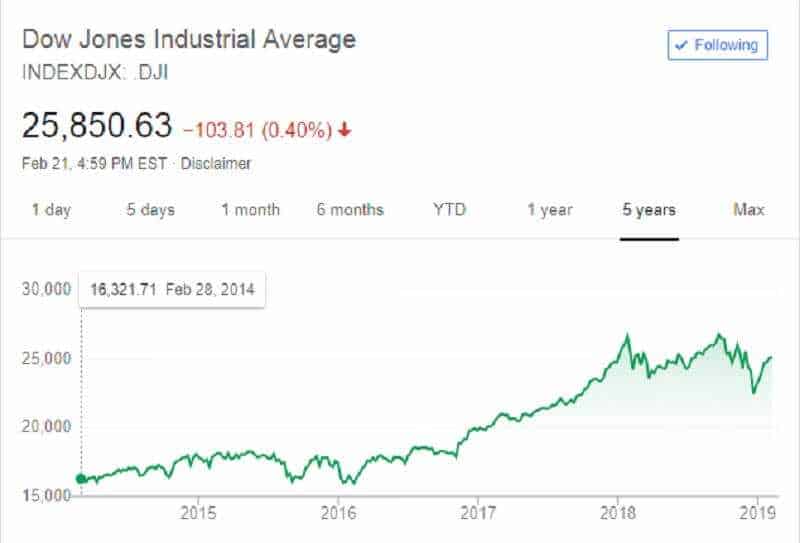

The stock market suffered huge losses and enormous daily changes. The trading has been almost halted.

So, the global recession is here. But what are the full magnitudes of this? It is pretty obvious we cannot know that now and the question is will we be capable of estimating it soon? Some experts are trying to explain the situation in which the global economy is right now. Also, some of them warned before the coronavirus outbreak there is a possibility of the recession to come this year. Of course, no one could predict the coronavirus pandemic. That just gave speed to the downturn.

The economic consequences of the exponential spread of the virus is shocking financial markets all over the world. Market volatility exceeded its peak during the global crisis 2009 and equity markets and oil prices falling to their lowest lows.

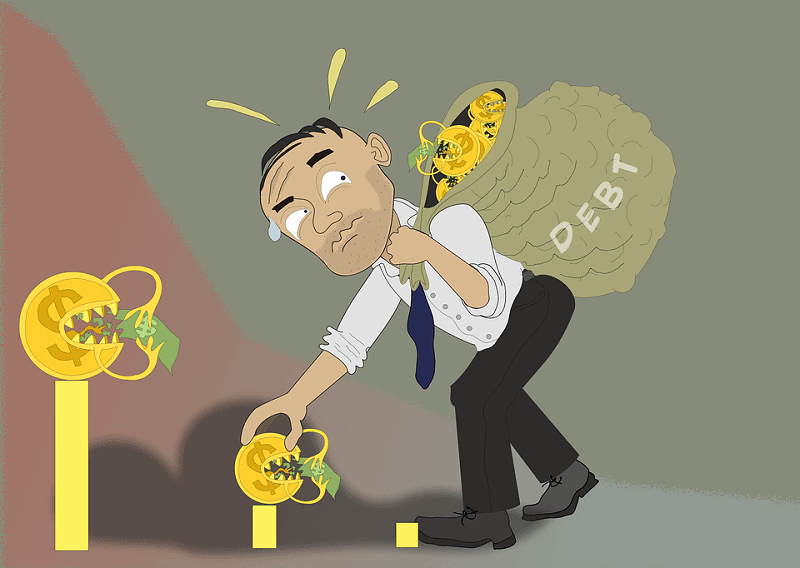

Large drops in asset prices and high volatility will impact economic actions, for example, through credit and investment flows. Lower stock prices can grow the debt-to-equity ratio and restrict their access to credit. The logical end can be bankruptcies. Banks can reduce lending because companies’ and customers’ defaults of loans rise. The result in banks’ balance sheets will be worse. Do you understand that the global recession is already here?

How to survive the global recession?

Recession is defined as two consecutive quarters with negative economic growth. It can be caused by, for example, monetary panic. That caused the Great Recession, for instance. Also, the recession may come due to the rising oil price which is defined as an economic shock. One of the reasons behind the recession can be something that John Maynard Keynes described as “animal spirits.” We experienced it with the dot-com bubble. Also, the mixture of all three may cause a recession.

Today it is coronavirus and lockdowns caused by its outbreak and the focus on health protection due to it. The companies halt, workers are fired, demand and revenue fall. The only thing that increases is our concern on how to overcome the global recession we have now. But there are several ways to decrease the loss.

In the article “Roaring Out of Recession,” Ranjay Gulati, Nitin Nohria, and Franz Wohlgezogen noticed that through the recessions of 1980, 1990, and 2000, 17% of the 4,700 public companies they examined done terribly: some went private or went bankrupt, or were sold. Nevertheless, 9% of the companies did manage to recover in the next three years after a recession. They succeeded to exceed rivals by 10% or more in the meaning of sales and profits growth. Moreover, their earnings rose regularly and the companies remained to rise.

May the global recession last for a long time?

Almost the whole world is caught in the recession caused by the coronavirus pandemic. The fears are growing. As long as people’s physical communication is a possible danger, companies cannot move to regular conditions. And once, when this pandemic ends, maybe the regular condition before the pandemic will not be regular. What if people start to avoid shopping malls, cinemas, theatres, restaurants, crowded concert halls? Even after the virus is contained or the vaccine is available? The economic recovery may take years and years. The global economy is frozen, the global recession is on the scene. But life will bounce back. The coronavirus will be tamed and put under control, and people will come back to their factories, offices, and shopping malls, of course.

But even after that, the new world that will begin will be gagged with stress. And, when that will be? No one knows. Millions of people lost their jobs and that affects the societal costs. What if bankruptcies leave the industry in a vulnerable status, exhausted from investment and reforms?

The families may stay upset and risk-averse. What if this pandemic makes them tend to save? Some social distancing measures could remain indefinitely. If this situation endures and people continue to hesitate to spend, the whole world will have a big problem. Yes, life will bounce back, but psychology cannot just like that. It is more likely the recovery will be very slow and last for a long time.

Bottom line

Developing countries have severe consequences already. The money is running away, commodity prices are falling, oil for example. This scenario is visible in Chile, Mexico, and many other countries. China is a slowdown and that has a great impact on countries where the factories with components are. Europe is in recession, the US is still fighting with the coronavirus pandemic.

People are lonely now, but they will be starting to return to normal life. But if they had to spend all their savings, and if they destroyed the credit ratings or declared bankruptcy, then they will not be capable back to normal life.

No one can say with a hundred percent certainty how long the global recession will last. We are pretty much sure that the recession started in March in the US but we cannot say when it will end. Well, the recession in the US or the global recession isn’t officially declared nor it can be. We all hope it is a remarkably deep but short-lived recession.

If your days are too long try to short them, learn something new, for example. Read the “Two Fold Formula” book, it may give you some interesting ideas. But before you start to implement the new knowledge, test it by using the our preferred trading platform.

Stay safe! #StayHome

If you have no other option you’ll take a bad credit loan. But it isn’t the end of the world.

If you have no other option you’ll take a bad credit loan. But it isn’t the end of the world.