How to find stock trading opportunities – the easiest way in the world.

You see, before using Traders-Paradise.com‘s live search algorithm, traders would have search their opportunities on free tools that offers a list of the most profiting stocks, or stocks that made the highest percentage jump – on random tools on the internet or on their broker’s platform or whatever.

This is the WORSE way to find opportunities.

If it’s on that list – It’s no longer an opportunity! You missed the train.

It reminds me of a quote I read years ago – “If you read it on the newspaper, it’s no longer news” – meaning: You must know ahead of everyone else in order to make any profit.

Another reason why not to use these tools is a statistical one:

There’s a simple statistical law that I used to apply on my old trades and it’s called “Regression toward the average“. What it actually means is that if you calculate the average price of the past month, for example, and you check what is the current price – If it’s below the average, most chances it will rise back to average, and vise–versa if it’s above average price, most chances it will drop back to average.

Only thing is you don’t really know when.

You don’t when it will return to average, which can take minutes, days, months, years. You can’t never be sure.

And you also don’t know when the average price is changing and new average price takes control.

For these reasons above, we’ve created Traders-Paradise live trading opportunities scanner algorithm.

This scanner is finding trading opportunities BEFORE they happen! It’s like it can predict the future.

But can it really predict the future?

No! No one can predict the future.

So how does it work?

It took us over 6 years of full time job, to research and develop this algorithm, so it might be a bit difficult to explain it in simple short words but I’m gonna try.

We run on every stock on our data (more than 2,000) a statistical analysis. This statistical analysis calculates each stock’s strength according to other traders dimension.

Other traders dimension means we measure traders’ (who trade this particular stock) reactions and behavior on various types of situations that happens in the markets.

For the final part of the equation, we need to compare this stats with all other stocks’ stats we have.

The equivalent metaphor for this comparison is like SAT exams, where one’s score is only calculated in comparison to all other scores.

Once we have all scores in our hand, the algorithm can finally point out those who have the most chances to potential trading opportunities.

The proof for this concept can be found on our homepage, under the searching app.

This is a list of all the stocks our scanner has found, on the stated dates, and how much it went up until current time. This shows you the scanner is doing its job with finding trading opportunities.

Please note that our scanner is measuring only other active traders in the market, and does not consider stock’s price at all.

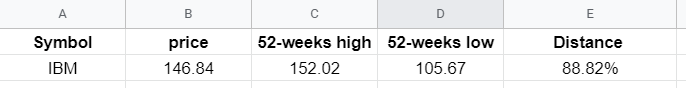

So in order to take into consideration the current price you need to calculate the distance, in percentages, of current price inside its 52-weeks highest price and lowest price scale. This 2 prices can be found in Yahoo Finance.

Then you simply input all these numbers in this simple equation we developed:

1- [ (High-Current) / (High – Low ) ] = Distance in percentages

Here’s an example of how it looks on IBM stock (symbol IBM):

From our experience, the best scores to trade are 65%-80%, above it – it’s too close to ATH (all time high). Below it – too risky of a drop.

In this example the distance is too high. See what happens afterwards (red circle is the price on above table):

So to sum it all up, here are the steps to become a successful trader, free of charge:

- Go to our homepage, wait for a green stock (labeled as an opportunity), and write it down

- Go to Yahoo Finance and search for this stock

- Fill in the formula above the prices you have on Yahoo finance

- If it’s in the 65%-80% range – you got yourself an opportunity

Simple, right?

I hope you enjoyed reading this,

Guy Avtalyon,

The founder