Is it possible to start trading bussines from home? Rea to the end.

By Guy Avtalyon

You start trading business from home! Hey, great! You became a trader! A real expert at buying and selling stocks.

If you have a lion’s instinct and power, puma’s speed, scorpion’s perspicacity, you are all set for this wild world.

And you think you have that natural instinct that some of the best traders seem to have?

Then let’s step into this world! I’m joking, you’re not ready yet.

You have to learn to trade stocks. It requires certain skills and knowledge as well as in any other profession. You must develop your skills and apply a high degree of commitment and attention to detail for every aspect of the job.

But before getting started, it’s important to follow all of the required steps to give yourself the greatest chance of success. If you think that having an idea is enough to run a business, I have to tell you are completely wrong.

The main goal when start trading business from home

First of all, you have to know that the only goal of starting a trading business from home is TO MAKE MONEY!

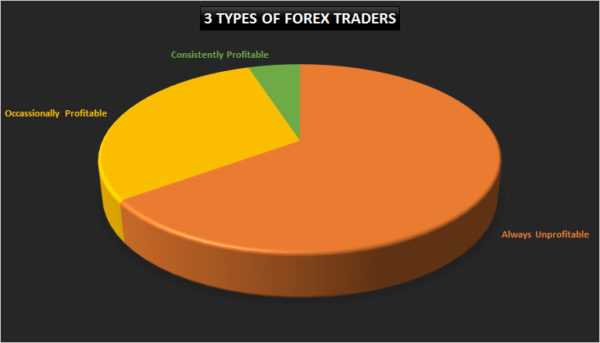

Many traders are looking at trading as a hobby or a side project, but that cost you money. You can’t earn from that. To be a professional trader you have to get educated. You have to understand every piece of the job down to the microscopic details, like in any other profession. Just because you watched a few videos or tutorials and read several books doesn’t make you a trader. You must have a specific method that you know from A to Z and have practiced over and over. It is necessary before a dollar is ever risked.

How you can start A Trading Business

Let’s see that on an example of currency trading.

- Start by opening a demo account – The virtual account will give you an idea as to how you can use the trading platform offered by the broker. It will also be helpful in getting prepared for using the real platform. This means that you will not be using real money without testing the broker’s platform through the demo account. Practice and learning! All for free!

- Practice well – It is important to train yourself extensively. You should trade on the demo account for a few weeks to learn how to avoid losses or considerably reduced them. A demo account helps you to learn to implement various trading strategies successfully and develop a trading style of your own.

- Learn the basics of currency trading – It is highly recommended for you to work with an expert to understand the nuances of trading. Furthermore, you should attend seminars or webinars and read more in order to grow and sharpen your skills.

- Organize the trading capital – Luckily, it is not required to have a large amount of money to start currency trading. It is a good idea to start with at least $1,000 as it will ensure a little bit of buffer if you happen to incur losses. But you can start with $10 to set up an account on the broker platform or you can use the no-deposit bonus to start trading.

What else you can do

- Choose a reliable forex broker – You should go through the terms of trading before choosing any of the brokers. It is important that you work with the right forex broker in order to achieve your financial goals.

- Start trading with real money – Finally! After you have practiced enough and gained the confidence to go live, you can open a live trading account with the forex broker (you should be able to convert the demo account into a live account).

Start trading business from home

Some trading strategies will bring you huge profits, some others will not be good for you and will fetch less money. The secret to increasing profits is repeating what works for you and avoiding what does not.

But always keep on your mind, you have that natural instinct that some of the best traders have. Good luck!

Share your experience with us!