Why this question about the Bitcoin dominance rate now?

By Guy Avtalyon

The bitcoin dominance rate is a very important indicator of crypto market preferences. It is the measure of how Bitcoin is important in the crypto world. To know the Bitcoin dominance rate observe its market cap as a percentage of the entire market cap for all cryptos. The traders and investors pay a lot of attention to it.

Okay, it isn’t shocking news that Bitcoin is dominant. Everyone knows that. It is here for a long time, it was the first, it has attention like a rock-star.

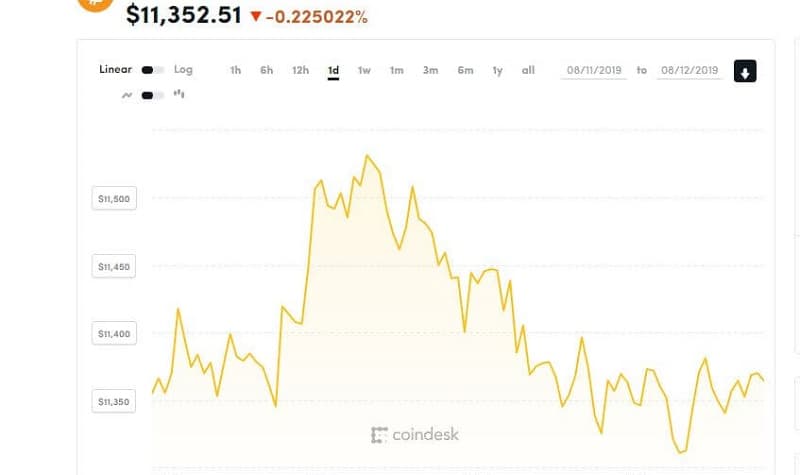

So, why this question about the Bitcoin dominance rate now? The alarms are a turned-on because of Bitcoin’s current climbing.

In the crypto markets, it covers about 70% of the market cap as a whole. The same level was seen in April 2017.

So, there we have a concern on the scene!

Some are afraid that this is a sign that the bull run is close. That will accelerate bitcoin’s dominance to over 90%. The existence of any other crypto would be doubtful. That high dominance rate would destroy the others.

The altcoins are on the edge of return, think others. Or no-return, the opponents are kidding. As always, when it comes to data interpretation you can see and hear literally everything and anything. But to be serious, the bitcoin dominance rate may show us many things. Even the increase isn’t always good news.

Why increasing dominance rate isn’t good news?

Well, Bitcoin’s dominance rate is not an independent measure. It is related to momentum, inclination, confidence. In one word – popularity. Bitcoin is the most popular cryptocurrency without a doubt.

The price of Bitcoin is the measure of its reputation. On the other hand, dominance is related to bitcoin’s relationship to other cryptos. There is one trick: the dominance may increase when the price is going down and vice versa. To repeat, it isn’t an absolute measure.

Bitcoin’s high dominance

It could be a double sword.

Bitcoin is an extremely volatile asset and risky this attribute often led investors to less risky assets and, can we say, safer. But, on the other hand, thanks to its popularity the whole sector of crypto assets may benefit if there are more investors in Bitcoin.

This new increasing Bitcoin dominance is proof that investors’ sentiment that this crypto is relatively safe to invest in. The sentiment indicator is just a current opinion, be careful with that.

How can you be sure the trend will continue? With what energy? What sentiments do is give power, to push things to go further, to build a chain of very convinced investors and traders who are buying bitcoin.

The added importance is market trust, particularly at the initial steps of institutional engagement.

Big traditional funds are not worried about the relative value of one token related to another. Their consideration is their portfolio. They will decide what is better to invest in, crypto, or some other asset. Having that in mind, it is more likely they will invest in Bitcoin if they want to have crypto in their portfolios.

Why is that?

Bitcoin has the liquidity, active derivatives market and is registered in most jurisdictions. With the rising dominance rate, Bitcoin has the opportunity to boost investors’ trust in the overall crypto market.

But nothing would last forever.

Prior run-ups in the dominance rate were followed with a change altogether with investors’ attention to new choices. That is a calculation. When market leaders grow extremely, wise investors take profits and re-invest in other winning assets. The last bull market noticed bitcoin’s dominance decline from above 85% to under 40%. This time it is something else.

How? During the previous bull market, we had plenty of new tokens. Where are they now? They are not exciting anymore? No, they are not existing anymore.

Moreover, the interest of institutional investors with a focus on bitcoin will launch bitcoin’s dominance to jump even more.

Stay tuned and keep your eye on what is happening behind the stage. Traders-Paradise has a fantastic example of how to MONETIZE BITCOIN