The lending process is much faster if you are taking out a personal loan online. The whole process can be made from your home. Very often, you’ll get the funds deposited into your account within one or two days.

By Guy Avtalyon

Personal online loans can be easy to apply for. Online lenders usually offer low-interest rates, so it is important to note when you have to decide should you do or not that. The other benefit of personal online loans is that it is so easy to compare different offers from different lenders. Easy and quick. Besides specialized online lenders, many others are allowing you to apply for a personal online loan. Sometimes, you may get a loan under better conditions using their services.

A personal loan from some online lender can bring money into your account instantly. Sometimes during the same working day.

Also, for personal online loans, you can apply through solely online lenders or through some financial companies or institutions that also have online loans as an offer.

What is a personal loan?

It is a loan that you, as a private person, take out for a short, limited time. It can be between two and five years. The time is fixed and doesn’t vary, which is different from the line of credit or a credit card. For most US residents personal loan amounts are from $1.000 and $100.000. This depends on your demands and your creditworthiness. Banks and lenders have individual limitations, a set of rules, on how long and how much someone can borrow for a personal loan.

One of the characteristics of personal loans is that they are typically unsecured. And that is an advantage of this kind of loan because you don’t need to provide some kind of collateral. For example, you don’t need a house as collateral backing the loan.

There are many lenders that offer personal loans. Lenders could be traditional brick-and-mortar banks or online-only. They accept borrowers with various credit scores, income, and other conditions needed to get personal online loans.

We will walk you through the process of how you can find the right lender for you depending on your income, credit history, interest rates. We will explain to you what you can’t use the loan for. Picking the right lender may save you a lot of time but, as more important, a lot of money.

Personal online loans offer a handy solution

For example, you need cash and you need it quickly. The main advantage of online lenders is that they can give you a quick answer to your request. So, online lenders are a quick, suitable choice, maybe more than banks or credit unions.

The other benefit is that online lenders usually offer lower rates but there are also some other things, very important and useful if you choose to apply for personal online loans.

First of all, the majority of online lenders allow you to pre-qualify. That is a unique offer because you can compare rates from different lenders by pre-qualifying online and find the lowest. The other benefit is that they can fund a loan very quickly, the approval will come on the same day, sometimes in the space of several minutes. The loan will be funded inside a day or two.

Those are important things that make online loans different from others.

The purposes to get personal online loans

Personal loans are not an answer to all financial circumstances. Yes, sometimes they are simply a band-aid on incorrect money management. But it can help you if you have credit card debt with high-interest rates, for example, that is almost 25% per year. If you succeed to get a personal loan with a lower interest rate, you’ll be able to pay off your credit card debt faster and pay less on interest.

Such refinancing is a good example of the purpose to spend your personal loan.

But we have bad purposes too.

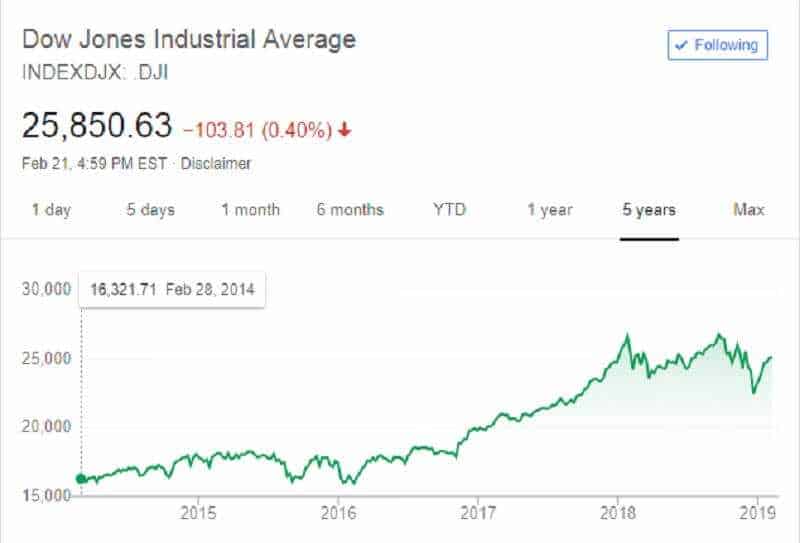

Don’t try to get a personal online loan if you want to invest in stocks, for example. For that kind of purpose, it is better to save and then invest.

Maybe the worst purpose of getting a personal loan is for vacations, expenses such as a wedding, expensive rings, or similar. Also, it is better to save for that.

Someone would like to repair a home and think the personal loan is the best solution. Well, it couldn’t be more wrong. For that purpose, it is better to use a home equity loan since it has a lower interest rate.

Steps to take before applying for personal online loans

Before you start the process, decide how much money you really need. The sum you want to borrow should be based on the debt you have to cover and your income. Avoid stretching yourself too thin. If you take out a too-small loan it wouldn’t cover your needs, but also, the too-large loan will put you into paying interest on a larger amount than needed. So, you have to calculate the amount you can handle and do it before applying.

Also, pick the right type of lender.

Banks and credit unions take much longer to process your request than online lenders. They also require fewer documents and the application itself is less complicated. And sometimes the speed is most important in getting personal loans.

The advantages of personal online loans

Personal online loans have a big advantage – they are comfortable.

Doesn’t matter if you choose an online-only or branch-based lender. Both will provide you the loan application online and the possibility to upload verification documents. For example, you’ll need a driver’s license. Well, some branch-based lenders will require your signature on the final documents at a real branch. That is a kind of disadvantage since you would like to apply online. You will not have such a problem with online-only lenders. The whole loan application process will be done online for sure.

Prequalification will not hurt your credit score. Moreover, you can submit several prequalification forms to expand the list of possible lenders.

The next step is to complete a loan application and agreement to a hard check on your credit reports. Both types of online lenders, online-only or branch-based, require a hard credit check before you sign for a loan. Generally, these inquiries could affect your credit score. But one inquiry will have a small influence on your overall credit score and shouldn’t discourage you from applying for a loan.

The particularly great advantage of personal online loans is that you can easily compare all your options. The benefit is that you could get the best rates and loan terms for your needs this way.

If you want to compare lenders, find a website that allows you to instantly classify and match lenders and loan options based on your situation, and wanted loan sum.

Disadvantages

Online loans may cost you. They are not cheap and usually, they are costlier than loans from credit unions. The problem can arise with different formulas for underwriting because almost every online lender has its own. Also, sometimes it can be difficult to go through the application process for some types of personal online loans. For example, secured personal loans or co-sign loans have complex processes.

Also, if you want a loan under $2.000 it might be hard to find a lender since most of them have a minimum at that sum.

The main problem is to find reputable online lenders. You can see the ads of some lenders that they don’t care about your credit score or something else that may sound very lucrative at first sight. In most cases they are scammers. Legitimate online lenders will always check your capability to pay the loan. Yes, they will charge you the annual rate from 10% to 30%. The rates will differ based on your creditworthiness, the period of the loan, the loan amount, and, of course, the lender.

So, you must be very careful when choosing the lender.

How to shop for personal online loans?

Here are several questions that you’ll need to find the answers for while looking for lenders.

Online lenders examine extra factors, for example, your education, profession; but only those information related to your credit score and credit history. If you have a bad credit score, you’ll need to fix it first. But remember, it isn’t impossible to get a loan even with a bad credit score.

What you have to know is the annual percentage rate (short APR) below 36%. That is the amount of the interest rate and all fees. If it is below 36%, financial experts agree it is reasonable for you as a borrower. If some online lender offers APR over 36% you can be certain the loan is unreasonable even if your budget can afford it.

Do you have all your documentation ready? You can get rate quotes by providing several personal data. But when you decide to apply for a loan, lenders will expect documentation. That is ID form and proof of income, a pay stub or W-2. Still, you can easily upload all documentation, some lenders will accept screenshots, PDFs, scanned documents, or photos taken by your phone.

The cost of personal online loans depends on your credit score. If you have a better score, you’ll pay the lower rate and less interest. Pay attention to interest rate since it can influence your complete monthly payment as well as the term of payment. If you get a longer-term loan you’ll pay less per month, but the interest amount can be bigger.

Traders-Paradise presents you the best money apps that we examined, and use.

Traders-Paradise presents you the best money apps that we examined, and use.