3 min read

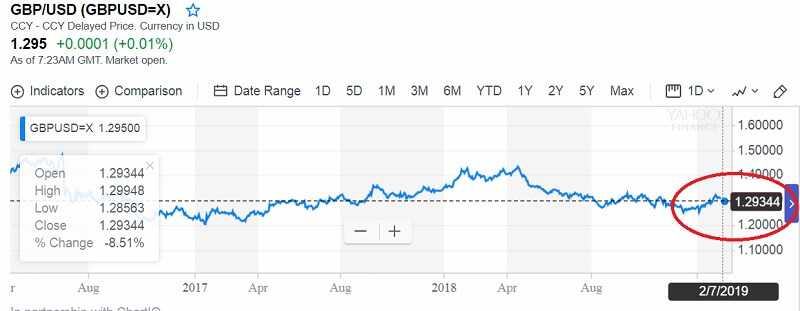

More and more of British companies have already triggered emergency plans to manage with a no-deal Brexit. If the UK crashes out of the EU. Many of them will move operations abroad, claim the British Chambers of Commerce.

It said that in recent days alone, it had been told that 35 firms had activated plans to move operations out of the UK, or were stockpiling goods to combat the worst effects of Brexit.

It looks that many companies had acted to protect themselves since May’s Brexit deal was decisively rejected by MPs in the Commons earlier this month.

The worst effects of a no-deal Brexit

Actually, it has seen a sharp increase in companies taking actions to try and protect themselves from the worst effects of a no-deal Brexit. No deal has gone from being one of several possible scenarios to a firm date in the diary.

Last week the Airbus, Europe’s largest aerospace manufacturer, which employs 14,000 people in the UK and supports another 110,000 through supply chains, warned of potentially disastrous effects of no deal on its UK activities.

Tom Enders, the boss of Airbus, said: “Please don’t listen to the Brexiters’ madness, which asserts that because we have huge plants here we will not move and we will always be here. They are wrong.”

UK exporters need access to the EU’s customs union

Ever since the vote to leave the EU in 2016, business groups including the BCC and the Confederation of British Industry have lobbied ministers, arguing that UK exporters need access to the EU’s customs union. Because it allows goods to be imported tariff-free.

The CEO of Airbus, the global leader in aviation, clearly warned that Brexit threatens to destroy the developmental life in the UK. He urged the British to “not listen to the madness of Brexit’s supporters,” who argue that Airbus will remain forever in the UK because there are huge factories in that country.

Airbus has more than 14,000 employees in the UK. Another 110,000 people work in related activities.

Britain should leave the EU on March 29th.

The Dutch authorities have announced that they are in contact with more than 250 foreign companies planning to move to the Netherlands due to the UK leaving the European Union.

“It is not so easy to move huge factories to other parts of the world, but the Airplane Industry is a long-term business. We will redirect investments quickly in case there is no agreement on Brexit with the European Union. Do not be misled, because a lot of countries are barely waiting to be opened factories of Airbus parts there”, said CEO of Airbus Tom Enders.

But the prime minister May has insisted that the UK must leave both the customs union and EU single market. And that the referendum result of 2016 is to be fully respected.

YOU WOULD LIKE TO READ Brexit deal, is it to be or not to be?

Political debates about no-deal Brexit

Labour MP Yvette Cooper has revealed to the Observer that two major employers in her West Yorkshire constituency had written to her. They are warning of the damaging effects of no deal on their UK operations. Burberry, the luxury goods manufacturer, employs 750 people in Castleford and Haribo, the confectioner, 700 across her constituency.

Cooper is pushing for a Commons amendment that would pave the way for Brexit to be delayed until the end of this year. It looks that MPs may need to work longer and lose their February half-term break if Brexit is to be delivered on time.

The extra hours will be needed to get its legislation onto the statute book before the planned 29 March exit.

Theresa May will seek backing for her deal in another Commons vote on Tuesday.

Commons leader Andrea Leadsom described bids by MPs to prevent a no deal as a “thinly veiled attempt to stop Brexit”.

Writing in the Sunday Times, she said this would be an act of “constitutional self-harm”.

The UK is due to leave the EU at 23:00 GMT on 29 March and the prime minister has faced repeated calls to rule out the prospect of leaving without a deal if no agreement can be reached.

There is a grave concern about a bill, proposed by Labour MP Yvette Cooper. It could extend Article 50 – which triggers the UK’s withdrawal from the EU by nine months. That means the prime minister has to secure a deal by the end of February.

The Queen does not show any political views but…

The British Queen has called on citizens to find “common language” and respect “different points of view”.

Commentators say the remarks are considered the debate about the Brexit, while deputies will have to vote again next week on an agreement to leave the European Union.

BBC journalist who follows the royal family, Nicholas Bichel, believes that there is no doubt that the queen “sends a message”.

The Queen, as head of state, remains neutral in political matters and usually does not express her views on the controversial issues.

However, speaking at the event marking the 100th anniversary of the Sandringham Women’s Institute in Norfolk, the queen said: “The continued emphasis on patience, friendship, a strong community-focus and considering the needs of others are as important today as they were when the group was founded all those years ago.

Of course, every generation faces fresh challenges and opportunities. As we look for new answers in the modern age, I for one prefer the tried and tested recipes, like speaking well of each other and respecting different points of view; coming together to seek out the common ground, and never losing sight of the bigger picture. To me, these approaches are timeless, and I commend them to everyone.”

The queen’s call touched the same questions as her Christmas message, in which she invited people to treat others with respect, “even when there are deepest differences.”

The Brexit rises tensions on the once-bloodiest border in Europe

Thousands of people travel every day for over an hour and a half across the Irish Sea to the United Kingdom. This is not only an important commercial line but an important cultural connection for many in Northern Ireland, which now directly depends on the parliamentary majority Theresa May.

The city Larne shows its loyalty to London. The roads through the nearby villages are painted in the colors of the crown. Local Unionists the Irish, angry opponents of Catholic Irish, have their MP, Sammy Wilson.

“We have strong historical ties with the rest of the United Kingdom for hundreds of years. It’s a common faith, a common language, and we will not give up on that,” he said.

Unionists, who support the government Theresa May, refuse to support her proposal for Brexit if their relationship with the rest of Britain become more difficult. And the prime minister has not given them a satisfactory proposal so far.

The main concern of the Unionists is whether the peace agreement for Northern Ireland which has ended decades of bloodshed will be respected.

May is facing the problem that Wilson is not ready for a compromise.

Their interests would be satisfied if they would leave the EU without an agreement. Then, they could say that this item has been removed from the agenda.

Wilson argues that the Union’s insistence on the status of the border is a violation of the terms of the peace agreement.

“This would mean that our laws are written in Brussels, not London. In other words, we would be constitutionally separate from the rest of the United Kingdom, which is a breach of the Belfast agreement,” said Wilson.

The MPs also proposed a number of amendments with alternative proposals, which include postponing the deadline for abandoning the EU on March 29, in order to avoid issuance prior to reaching an agreement.

Many MPs fear that leaving the EU without a formal withdrawal agreement would cause chaos in ports and business disturbances, although some supporters of Brexit support this option, and believe that this view is excessive.

YOU WOULD LIKE TO READ The Brexit deal that risks “letting the British people down”

Another amendment concerns the escape and ensuring that the border between Northern Ireland and the Republic of Ireland will not be returned.

Both the UK and the EU believe that restitution of border controls could jeopardize the peace process, but Brexit’s advocates are afraid that the safeguard mechanism could connect Britain with EU rules for an indefinite period without any declaration of them.

Risk Disclosure (read carefully!)

Analysts have black predictions for the coming year. The crisis is knocking the door.

Analysts have black predictions for the coming year. The crisis is knocking the door.