4 min read

LUPA stocks are Lyft, Uber, Pinterest, and Airbnb stocks. This makes LUPA nickname. The other nickname for these stocks is PAUL stocks. Some of them are already publicly traded but some are waiting to be in the coming future, for example, Airbnb. The common thing for all of them is that they all are companies funded by venture capital and private capital. They have become well-established brands and widely recognized businesses. The other common thing is that all of them enjoy users’ support, but profits have been mysteriously absent.

LYFT

Lyft went public in March this year. In August its shares dropped 30% compared to their $72 initial IPO price. But there’s good news too, as not everything is bad for Lyft.

Several days ago, actually one week ago, Guggenheim Capital declared it’s improving Lyft’s shares advisory from neutral to buy. At the same time, they announced a targeted price is at $60 which is a 19% increase.

The main reason behind is calming down of the price war with Uber.

Uber is expanding its business to several new fields like food delivery in the domestic market, but more importantly, Uber is expanding its operations internationally. So, the price war with Lyft now seems pretty much tricky. Uber is making loses in these parallel business and has to cover them somehow. The price war with Lyft is exhausting and without the expected result. Moreover, Uber has to earn money in the domestic market to cover losses caused by international competition and the intention to expand the business. It likely went about it too early.

The consequence is that Uber has to raise its prices for ride-sharing if they want more cash. That is an opportunity for Lyft to do the same.

Lyft is still an unprofitable company. Its share price is five times its annual sales. But Guggenheim claims that it is the question of the day when Lyft will start to earn profits from its business. Lyft is targeting a valuation of $21-23 billion. Fidelity Capital Markets holds about 7% of the Lyft’s non-public shares.

Uber Is part of LUPA stocks

Uber is Lyft’s main rival in the ride-sharing industry. The last decade was pretty eventful for them. This ride-sharing app is funded by venture capital. Their first appearance on the market was under the name UberCab in 2009. They expanded their business internationally and now they have food delivery, trucking, and scooter rental included domestically. Uber is one of the biggest tech IPOs and became publicly traded since May 2019.

The early investors made millions, maybe even billions of dollars since the company came into the stock exchange. Anyway, their investment is increased in value.

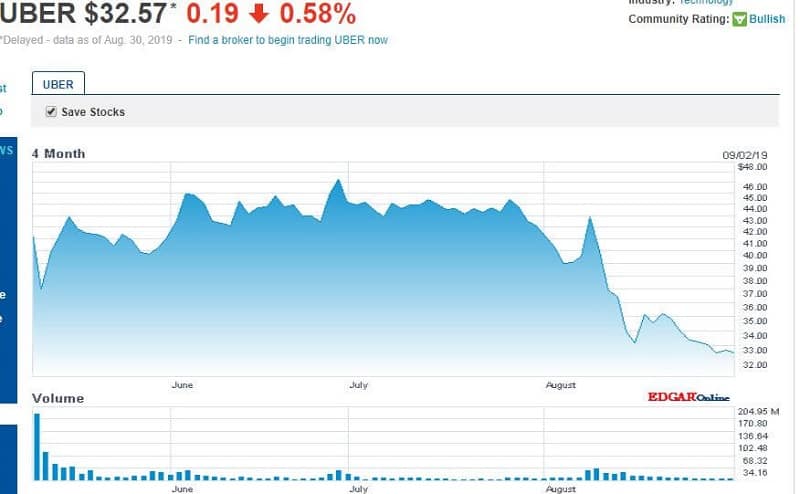

This somewhat controversial company has many challenges. Uber market cap on August 30, 2019, was $55.69B.

Honestly Uber, which is not posting profits, is an overvalued company.

In Jun this year, Uber predicts that the value of its initial public offering will be from $44 to $50 per share. That would mean a valuation of up to $91 billion. But it is lower than $100 billion what was prior expected. Still, Uber is one of the highest offerings in history.

Uber has another problem. Their attitude toward drivers was the subject of many scatting news reports and even strikes.

Drivers have complained about their pay. The criticism of unfair labor practices has caused a public resentment toward the company.

Shares of Uber were at $33.96 in mid-August, which was the lowest since the stock’s appearance in May. And Uber shares continued to slip and the shares dropped below $36.

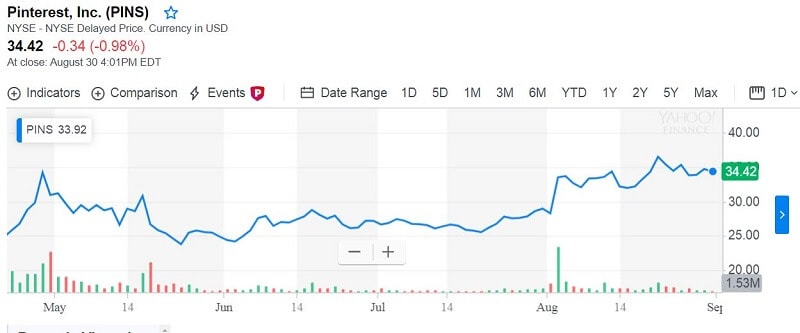

Pinterest is one of LUPA stocks

Pinterest, another one among LUPA stocks, is a popular photo-sharing social-media online platform.

The company claims that it has 250 million active users every month. The company started to be publicly traded in April this year and its stock price registered more than 28% rise on its first day of trading. The company’s stock started trading at $23.75, above the initial offering price of $19 and finished the day at $24.40 in April this year.

It will anyway be tough for this social media company to be able to be a real rival of Twitter or Facebook. However, Pinterest management has reaffirmed a much less competitive path to growth than its rivals.

Their market cap is $18.68 billion and stocks are traded at $34.42 in August this year.

Airbnb is LUPA stock

The company was launched in 2008 and probably surpassed the founders’ expectations.

This popular short-term apartment rental platform has upset the whole travel industry. For example, the best example of how huge it can be is the case of New York. This city has limited Airbnb’s ability to operate. The powerful lobbying forces from the hotel industry caused that.

This service has long been in the spotlight for an IPO. Now it looks the Airbnb is reading for its market debut. The company declared they made “substantially more” than $1 billion in revenue in the 3rd quarter of 2018. Some experts claim that the company’s profitability makes it a top candidate for the direct listing.

It looks that the Airbnb can be the next big play. And their IPO may happen in 2020.

Bottom line

These four companies are among the most important ‘unicorns’. All of these LUPA stocks are startup companies valued at more than $1 billion. LUPA stocks are interesting to investors who are currently willing to reward tech businesses that lose money. They already did so with Amazon or Netflix in their beginnings. LUPA has been able to develop their businesses with the support of venture capital and private investments. But the public markets are not so welcoming to them at the moment. The stock prices show that. Still, they are worth investing. Maybe now more than ever as their current low prices suggest large raises in the future. And the future currently belongs to the tech companies.