Bonds and stocks have only interacted negatively in the past 20 years. Their average correlation throughout the previous 65 years was positive. When this correlation isn’t negative, the 60/40 portfolio is weak in protecting your investment.

We all had believed, for a long time, that the ideal is a 60/40 portfolio, which consists of 60% in equities and 40% in bonds. That excellent combination provided greater exposure to stock returns. At the same time, this mix gave a good possibility of diversification and lower risk of fixed-income investments.

But the world is turning around and markets are changing too.

Experts recently noticed that this 60/40 portfolio isn’t good enough. Portfolio strategists claim that the role of bonds in our portfolios should be examined. They argue we need to allocate a bigger part toward equities.

Strategists report

Bank of America Securities (a.k.a. Merrill Lynch) published research last year named “The End of 60/40”. The strategists Jared Woodard and Derek Harris wrote:

“The relationship between asset classes has changed so much that many investors now buy equities not for future growth but for current income, and buy bonds to participate in price rallies.”

That note by Merrill Lynch caused great turbulence among investors. The point is that your conventional sense of investing 60% of your portfolio in stocks and 40% in bonds is no longer so smart.

Merrill Lynch strategists explained that there are grounds as to why the 60/40 portfolio will not outperform portfolios with more stocks versus bonds in it. Therefore, investors have to allocate a bigger percentage of equities to their portfolios instead of bonds.

This is the opposite scale compared to what investors used for many years. They were investing in equities for price rallies and buying bonds for current income.

How did the 60/40 portfolio die?

For the last 20 years, the golden rule was a portfolio of 60% stock and a 40% bond. Everything was good with that: investors had the bonds in portfolios, a 60/40 portfolio provided them the upside of equities, their investments were protected from downturns. But they gave evidence to investors as to why this ratio should be changed and why they have to add more equities than bonds.

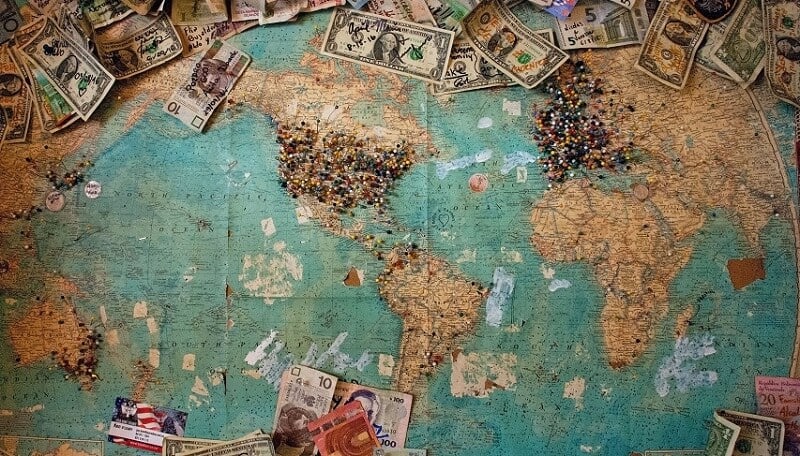

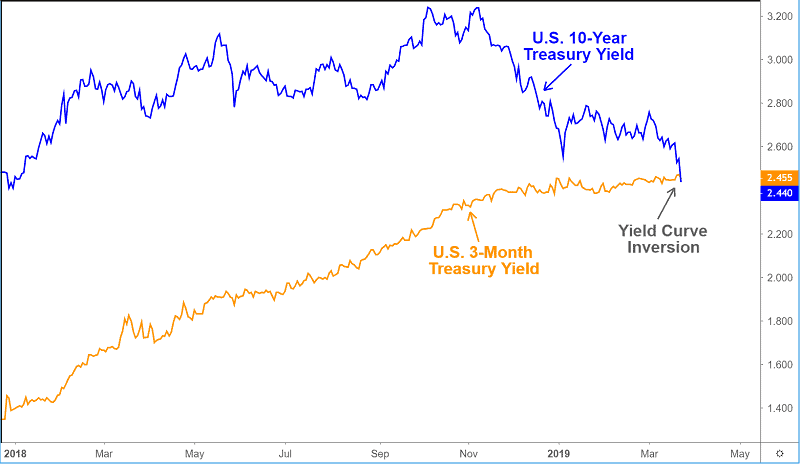

Here are some. Data is for the markets globally. During the last year, $339 billion were in inflows to bond funds but almost $208 billion were in outflows from equity funds. So, we now have a tricky situation. Bond yields had fallen. The consequence is that we have about 1.100 global stocks that pay dividends higher than the average yield of global government bonds.

The global economy slows

We must have in mind that the global economy lags due to the aging society and there were rallies in bonds almost all over the world. It was like a bubble. Hence, the investors who manage a traditional 60/40 portfolio are in a situation that threatens to hinder returns.

“The challenge for investors today is that both of those benefits from bonds, diversification and risk reduction, seem to be weakening, and this is happening at a time when positioning in many fixed-income sectors is incredibly crowded, making bonds more vulnerable to sharp, sudden selloffs when active managers rebalance,” said strategists from Merrill Lynch.

The 60/40 portfolio canceled

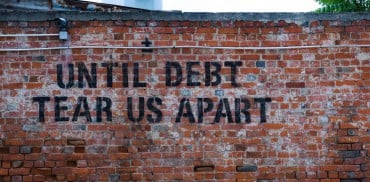

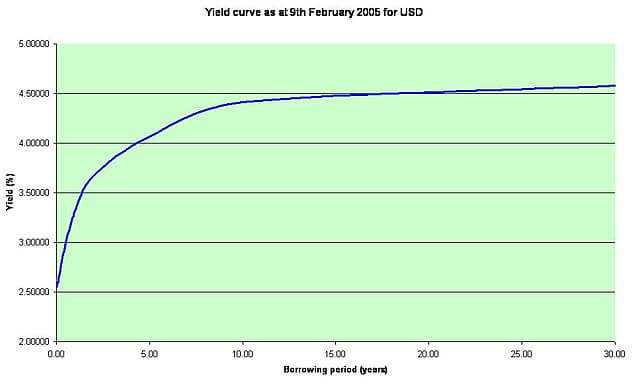

The popular rule of thumb: investment portfolios 60% in stocks and 40% in bonds, is smashed. The finance industry did it. Moreover, financial advisors urging investors to hold riskier options since, as they claimed, bonds no longer offer diversification. Hence, bonds will be more volatile over the long run. Further, the 60/40 portfolio has sense in the market conditions when stocks and bonds are negatively correlated. The stock price falls – bonds returns rise both serving as a great hedge, bonds against falling stock prices, and stocks as a hedge against inflation. According to strategists, no more.

This will completely change the portfolio management.

The benefits from bonds, diversification and risk limitation, seem to be missing. The bonds are more vulnerable to unexpected selloffs. The mentioned rule of thumb was accurate for 20 years but not for the past 65. Also, it is noticed that this period of negative correlation between bonds and stocks is coming to an end.

Also, Morgan Stanley warns that returns on a portfolio with 60% stocks and 40% bonds could drop by half in comparison to the last 20 years. Earlier, the analysts and strategists from Guggenheim Investments, The Leuthold Group, Yale University, also prognosticate distinctly lower returns.

How to replace the 60/40 portfolio?

The 60-40 portfolio is dead and it is a reality.

Be prepared, you have to replace it. Some experts suggest keeping 60% in stocks but to hold a position shorter, as a better approach.

But you have to hedge your portfolio. Experts suggest single-inverse ETFs and options for that purpose.

The others think the best way is to replace the 60/40 portfolio with some hedged equity portfolio. This actually means you should have more than 60% in stocks since the stock market is more liquid in comparison to the bond market. For this to implement, it is necessary to have tools. Also, the knowledge on how to use them. From our point of view, it seems that time to forget the 60/40 portfolio is here. All we have to do is to change the mindset and stop thinking about the mix of stocks and bonds. Instead, it looks like it is time to think about changing the net equity exposure.

Maybe it is the right time to hold more cash, which can be a tactical defense. For example, cash can be a part of your 60% holdings when you are not fully invested in stocks. Or you can hold cash in the percentage that previously was in bonds. Also, you can combine it. You MUST build a hedged portfolio to avoid the 60/40 portfolio hurricane that is likely coming.

For example, build a portfolio of, let’s say 75% stocks and 25% your hedge combination. This range can be tighter also.

Honestly, it is so hard nowadays to fit the excellence of the 60/40 portfolio.

Bottom line

The 60/40 portfolio was really good but it had a wild side too. The stock portion was down over 25 years of its 91-year existence. Over those 25 years, the average loss was above 13%. But there were bonds with a gain of above 5%, which reduced some of the losses. This portfolio was stable and reliable and you could use it for a long-time.

The other problem with the disappearance of the 60/40 portfolio is diversification. Is it dead too?

Peter L. Bernstein said, “Diversification is the only rational deployment of our ignorance.” Investors have to figure out different access if stocks and bonds no longer balance one another. This great portfolio will miss everyone. Maybe, one day, we will meet again. But some conditions have to be fulfilled. The interest rates should be 6% again, the stock market valuations shouldn’t go over 15x the previous 10 years’ worth of average earnings. That is hard to achieve now.

R.I.P. the 60/40 portfolio.