4 min read

Forex trading could lead to high returns of investment. This article will explain how

Forex trading – the CONCEPT:

Forex represents the foreign exchange/currency market. The word forex itself is made of two English words: foreign and exchange and signifies the purchase of currencies from different countries.

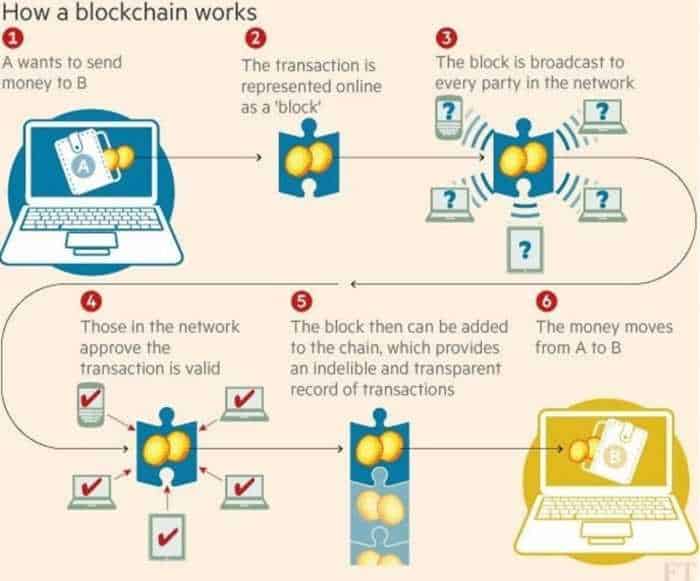

Unlike other stock exchanges, Forex does not have its physical seat in a city. It exists in an electronic network consisting of large financial institutions.

Also unlike other financial assets – Currency needs to be at a balance point!

Why Forex industry has to be at a balance point (UNLIKE STOCKS for example)?

Because let’s think about a country, like the USA. Its currency is USD and you can invest your money on USD comparing, say, Euro. So if the USD is increased (or Euro is decreased) you gain a profit.

But inside the USA – the interests are different.

Forex trading is an industry of importers and industry of exporters.

Let’s say I’m an importer that lives in the USA, and I import apples from Mexico. And just for the explanation, we say that 1USD (US Dollar) = 2 MXN (Mexico’s currency).

Now I make a deal with my fellow Mexican that I buy apples for the worth of 2 million MXN (and it costs me 1 million USD).

Now, if the USD will get stronger, and now we say that 1 USD = 3 MXN.

See? I’m losing money because I could have bought my goods for a lot more money at the same price I spend (1 million Dollars).

But let’s say it’s the opposite – I’m the exporter. My fellow Mexican buy from me apples at the same original deal. This means he buys from me at 2 million MXN and I get 1 million Dollar. But then, the Dollar is rising and now it’s worth 1 USD = 3 MXN. He still buys at 2 million, right? So now those 2 million worth approx. 0.67 million USD. Now I’m LOSING money because of MY OWN currency worth more. That’s Forex. It has to have a balance point because if not we’ll have our own people losing.

Today, Forex is the largest financial market, which has a daily turnover of around $ 5.5 trillion a day. You can complete this whole process online.

The term currency market means the sale of one currency with the simultaneous purchase of the other.

As currency pairs are traded, in order to profit from the shift in the exchange rate, you need to buy the currency that you think will strengthen and sell the other.

YOU WOULD LIKE TO READ about How to Become A Trader or Investor in Just 10 Minutes

There is no need to wait for a growing market to profit. At any moment, one currency will strengthen in relation to the other.

The Forex market is constantly creating opportunities for investment.

Since nothing concrete and tangible anything is bought and sold, this type of trade can be a little confusing. You should think that you are buying a part of the value of a country.

If you buy a Japanese yen, you are buying a part of the Japanese economy that is in direct correlation with what the market thinks about the current and future health of the Japanese economy.

Generally, the established exchange rate of the two currencies is a ratio that reflects the state of one economy in relation to the state of another economy (the state, the currency).

Forex is opened 24 hours a day, except on weekends, so that Sunday trading starts on Sunday from 21:15 CET and runs until Friday at 23:00 CET. During the day there are several time intervals that coincide with the working hours of the world’s largest stock markets.

Who trades on the FX market?

Forex traders can be classified into two groups, hedgers and speculators.

Hedgers: governments, companies (importers and exporters) and some investors who are exposed to exchange rate changes.

Speculators: This group, which includes banks, funds, corporations, and individuals, creates artificial pressure on the course in order to profit from variations or price movements.

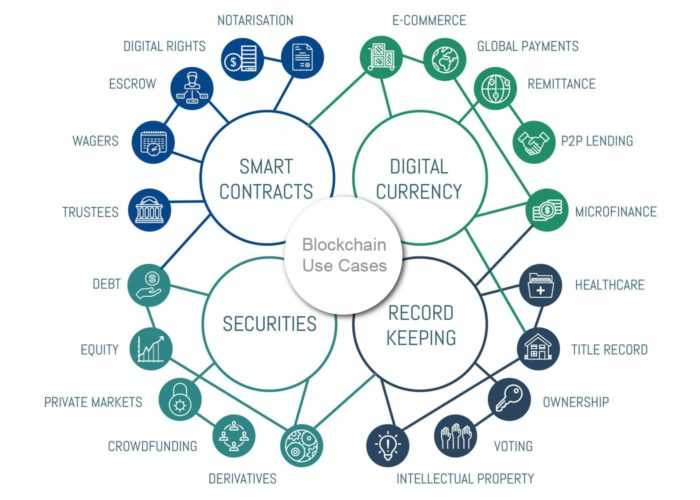

YOU WOULD LIKE TO READ about Algo/Algorithm trading in financial markets

Basic terms of Forex trading

Pip – Represents a change in the ratio of the currency by one decimal. It is the smallest unit change course. Pip is the last decimal in a currency relationship

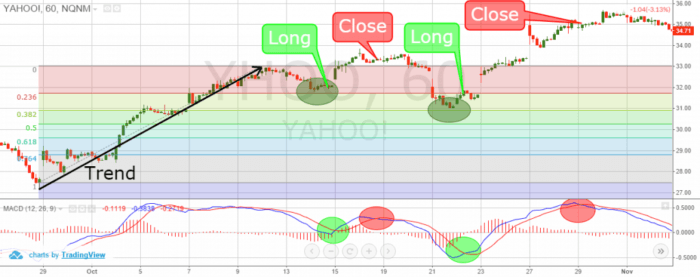

Stop and Limit – Orders – Often the trader wants to limit the loss in the position he has opened (in that case he sets the “stop” order). Or the trader wants to take profit at a certain level, which is acceptable to him/she (in this case he sets a “limit” order).

Long – Used for the purchase order

Short – Tension used for a sales order

Bid – Bid price

Ask – The price that is claimed

Buy – Shopping

Sell – Sale

Spread – The difference between the sale and purchase price

Chart – Graph

Timeframe – Time period

Leverage – Multiplies the amount of money you invest

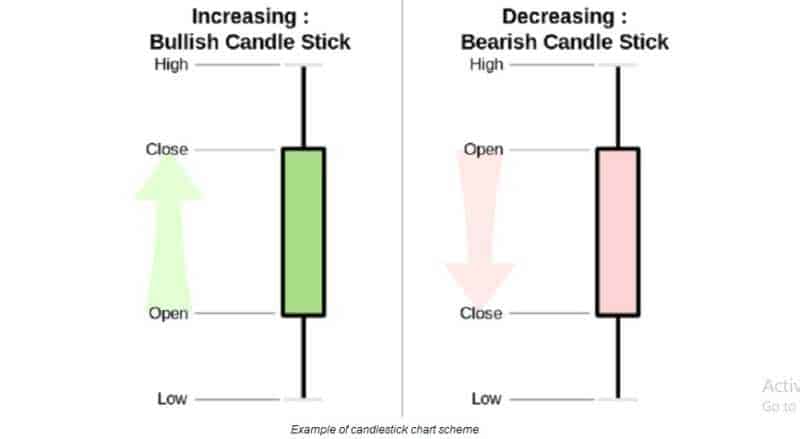

Candlestick – Candlesticks show that emotion by visually representing the size of price moves with different colors. Red means the starting price was higher than the closing price at a certain time. Green means it ended higher than the starting point.

How to read candlestick graph: To every time period

Open – The price of an asset at the start of a time period

Close – The price of the same asset at the END of the same time period

High – The highest price the asset reached during that time period

Low – The lowest price the asset reached at the same time

Time period – Can be from 1 minute to one year

What is needed to trade on Forex?

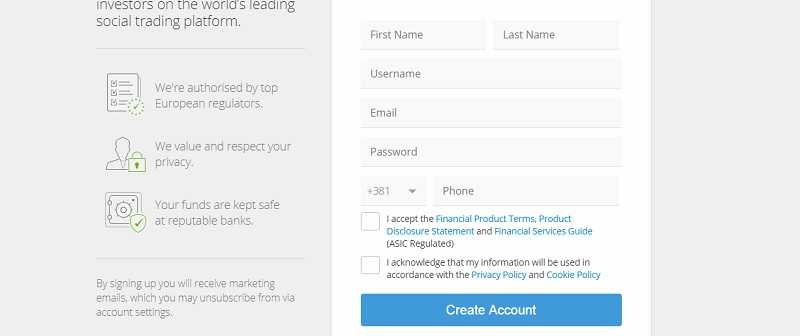

Before you start trading the currency, you need to open an account with a Forex broker. Our recommendation is that before you decide on trading on Forex, open a demo account with one of the brokers.

You can use a trustworthy Forex broker.

So that through the use of the platform, you will be able to monitor market activities and learn more.

YOU WOULD LIKE TO READ about the best Forex trading styles

Conditions for Success Forex trading

You must have a good knowledge of technical and fundamental analysis, as well as managing your account. You should also know the psychological aspect of the trade and that you are disciplined. Also, in Forex trading, you should learn about the country you’re betting on or against.

To be able to trade Forex successfully, there is a whole world of education, really extensive analysis. Also, the countless hours of tracking a very large number of relevant and potentially relevant information.

YOU WOULD LIKE TO READ How To Choose The Best Forex Program

All without any guarantee that the right decision will be made.

So once again, the investment rule has been confirmed: high risk must be taken to achieve high income.

Risk Disclosure (read carefully!)

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether

you can afford to take the high risk of losing your money.