by Gorica Gligorijevic

The financial markets, what is that? It comes in many terms. We can find them among financial markets, the capital market, Wall Street, and even simply “the markets.” The financial markets are places where traders buy and sell assets. That can be stocks, bonds, derivatives, foreign exchange, and commodities.

The financial markets are where businesses go to raise cash to grow. Hence, the place where companies reduce risks and investors make money are the financial markets.

Why do financial markets matter?

Financial markets provide finance for companies.

What’s our role in financial markets?

Setting standards for financial markets. By doing this, we want to make sure financial markets are fair and there when we need them.

The financial markets are the place where the trade is done.

Financial markets refer to a marketplace, where creation and trading of financial assets. Hence, the financial markets play a crucial role in allocating limited resources, in the country’s economy.

Furthermore, financial markets act as an intermediary between the savers and investors by mobilizing funds between them.

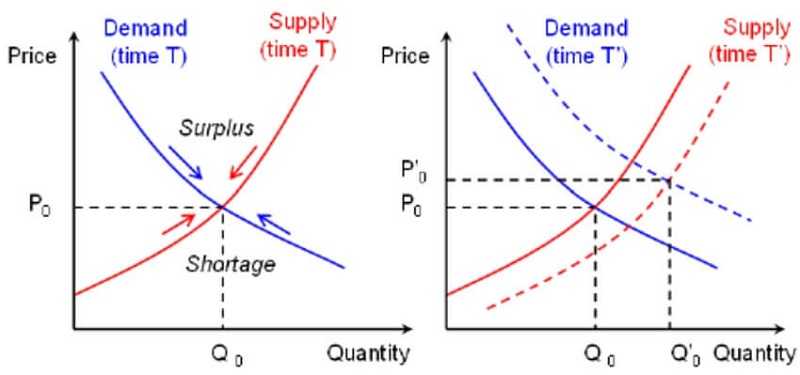

The financial markets provide a platform to the buyers and sellers, to meet, for trading assets at a price determined by the demand and supply forces.

There are different types of financial markets. We recognize several types of financial markets.

* Capital financial markets

* Money financial markets

* Foreign exchange financial markets

* Derivatives financial markets

* Insurance financial markets

The explanation about each of these types of financial markets you will find in this article Financial markets – Basic and Important guide for beginners.

First of all, let’s understand what is trade.

Answer this question could be: It is an exchange of goods or services in return of money, goods or services. But there is a shorter version: it is given and take.

Everybody is familiar with the term “trade”. Actually, we are trading every day. Everything you purchase in a store is trading money for the goods.

In earlier days, trade took place with the exchange of goods without exchanging of money. With the invention of money, it took its form as an exchange of items with money.

The term “trade” indicates “exchanging one item for another”.

It usually means the exchanging of goods for money. You know, it is just buying something. Speaking about trade in the financial markets, you will see it is the same system.

Let’s say you trade shares. You are actually buying shares, which are a small part of a company. If the value of shares jumps, then you make money by selling them at a higher price.

This is trade.

You buy something for one price and sell it again for another, thus making a profit or loss. I’ll explain how this differs, of course.

Let’s say, you don’t sell it. In the world of trade, it is also known as stay in a position. The consequence is you’re not losing but you are not profiting. But when you monetize the position you will lose or profit.

Trade has taken birth with the beginning of humankind and shall continue as long as human life exists on the earth. It enhances the standard of living of consumers. Thus we can say, answering the question, what is it, that is a very important social activity. Those who want to trade cryptocurrency should start by choosing a company with a good reputation that offers an exchange and wallet. A beginner should also start with prominent coins.

You can find those companies by searching Google, or just visit the Traders Paradise web site, and you’ll find it there.

Currently, we are referring to coins like Bitcoin (BTC) and Ethereum (ETH). In the future, this could be changed.

Free and open trade has produced competition and innovation. More about this topic you can read in this article HERE

The economic revolution is afoot. You can either be a part of it or get left on the side of the highway feeling dumb.

Traders Paradise wants to lead you, step by step, through this important activity. Read this post from the last word and learn about trading.

Yes, we have more articles about it and you can also find how you can become the trader in 10 minutes.

But first of all, you must understand the essence. It’s up to you now!

What will you find here?

Our experience, our knowledge, everything we know about the financial markets, TRADING, INVESTMENT about cryptocurrencies, stocks, trading, investing and markets in general.

We, in Traders Paradise, want to show how wonderful is that, what are the PROS but also what are the CONS. The trading world is a world of freedom. No matter what other opponents want to say. Don’t let them frighten you.

In this post Financial markets – Basic and Important guide for beginners we’ll show you how wrong they are. At first, we want to show you how bad and wrong lessons we got from our teachers about money, finance, education system all over the world.

In this tutorial Financial markets – Basic and Important guide for beginners, you will find which investment or trading strategies actually work.

You will learn how to trade. No matter if you have a big or small amount of money. We will explain everything about Forex (Foreign Exchange) and how you have to act like a professional trader because it’s a sum-zero game. Our surveys and also many types of research shows this statistic: 20% of traders take the money of the other 80%.

You DO NOT want to be on the 80% side. This post is aimed to prevent you from falling there. In this tutorial Financial markets – Basic and Important guide for beginners, you will also find basic terms.

Well, if you don’t know them how you can trade or invest?

With this article, you will have everything you need to start trading or investing.

We want to prepare you to step into this wonderful world and become a respectable trader. We will show you how to trade and invest some time on examples of cryptos sometimes it will be stocks or shares. But the principle is the same for all financial markets.

So, let start!

Wish you a nice reading.

What Do You Know About Forex Trading?

The Forex trading takes place on the Forex exchange. Let me introduce you the concept of Forex trading.

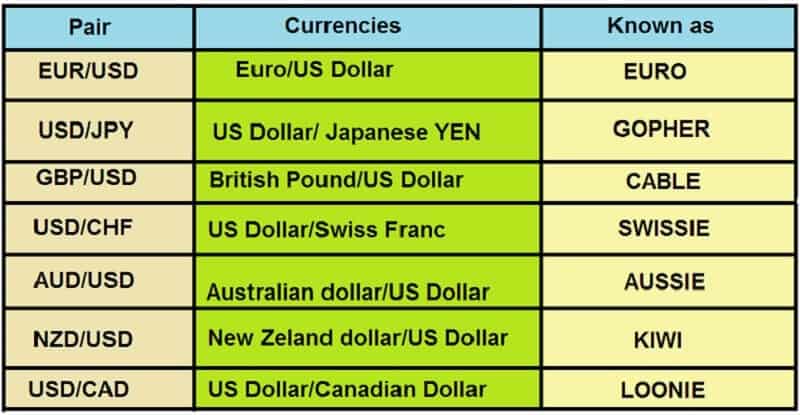

Forex represents the foreign exchange/currency market and it the largest among all financial markets. The word forex itself is made of two English words: foreign and exchange and signifies the purchase of currencies from different countries.

As an exception of other stock exchanges, Forex does not have its physical office. It exists in an electronic network consisting of financial institutions. Also unlike other financial assets – currency needs to be at a balance point! Why is that?

Because let’s think about a country, like the US. Its currency is USD and you can invest your money on USD comparing, say, Euro. So if the USD is increased (or Euro is decreased) you gain a profit.

But inside the USA – the interests are different. There’s an industry of importers and an industry of exporters. Let’s say I’m an importer that lives in the USA, and I import apples from Mexico. Just for this example, let’s say that 1USD (US Dollar) = 2 MXN (Mexico’s currency).

Now I make a deal with my Mexican fellow that I buy apples for the worth of 2 million MXN (and it costs me 1 million USD). Now, if the USD will get stronger, and now we say that 1 USD = 3 MXN. Now I’m losing money because I could have bought more goods for the same amount of money at the same price I spent (1 million Dollars).

But let’s say it’s the opposite – I’m the exporter. My fellow Mexican buy from me apples at the same deal. This means he buys from me at 2 million MXN. Now I have 2 million MXN which are worth 1 million Dollar. But then, the Dollar is rising and now it’s worth 1 USD = 3 MXN. He still bought .at 2 million, right? So now those 2 million worth approx. 0.67 million USD. Now I’m LOSING money because of MY OWN currency worth more.

That’s Forex. It has to have a balance point because if not traders are going to lose.

Today, Forex is the largest financial market, which has a daily turnover of around $ 5.5 trillion a day. Moreover, you can complete this whole process online.

The term currency market means the sale of one currency with the simultaneous purchase of the other. As currency pairs are traded, to profit from the shift in the exchange rate, you need to buy the currency that you think will strengthen and sell the other. There is no need to wait for a growing market to profit. At any moment, one currency will strengthen in relation to the other.

The Forex market is constantly creating opportunities for investment.

Since nothing concrete and tangible is bought and sold, this type of trade can be a little confusing. You should think that you are buying a part of the value of a country.

If you buy a Japanese yen, you are buying a part of the Japanese economy that is in direct correlation with what the market thinks about the current and future health of the Japanese economy.

Generally, the established exchange rate of the two currencies is a ratio that reflects the state of one economy concerning the state of another economy (the state, the currency).

.

Forex is opened 24 hours a day, except on weekends, so that Sunday trading starts on Sunday from 21:15 CET and runs until Friday at 23:00 CET. During the day there are several time intervals that coincide with the working hours of the world’s largest stock markets.

Who trades on the FX market?

Forex traders can be classified into two groups, hedgers and speculators.

Hedgers: governments, companies (importers and exporters) and some investors who are exposed to exchange rate changes.

Speculators: This group, which includes banks, funds, corporations, and individuals, creates artificial pressure on the course in order to profit from variations or price movements.

Basic terms

Pip – represents a change in the ratio of the currency by one decimal. It is the smallest unit change course. Pip is the fourth and the last digit after the decimal place in a currency pairs

Lot – 100,000 units of currency

Mini lot – 10,000 units of currency

Micro lot – 1,000 units of currency

Nano lot – 100 units of currency

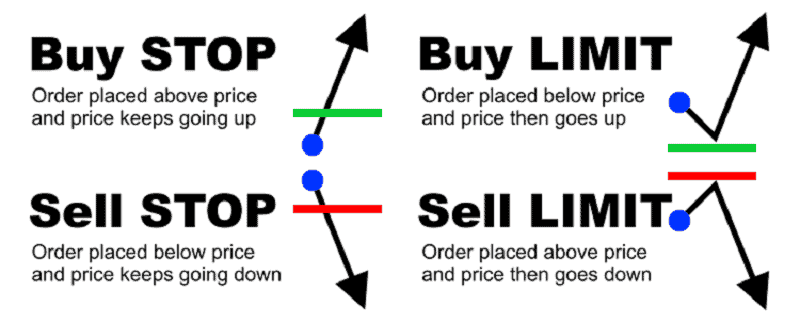

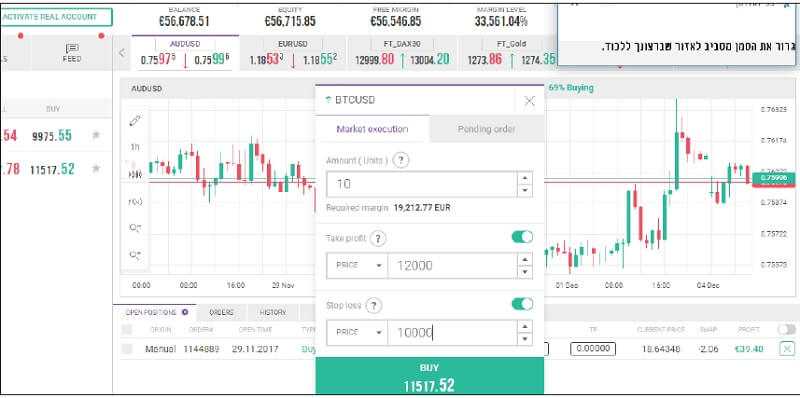

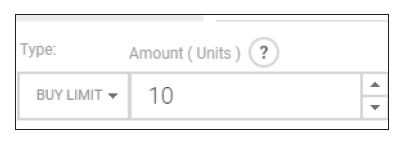

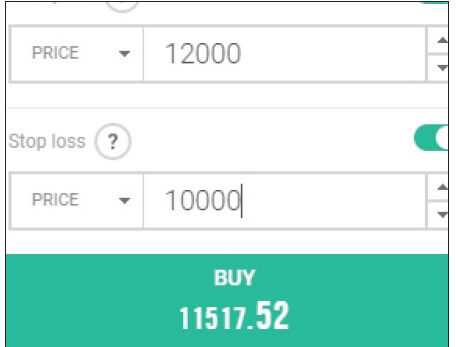

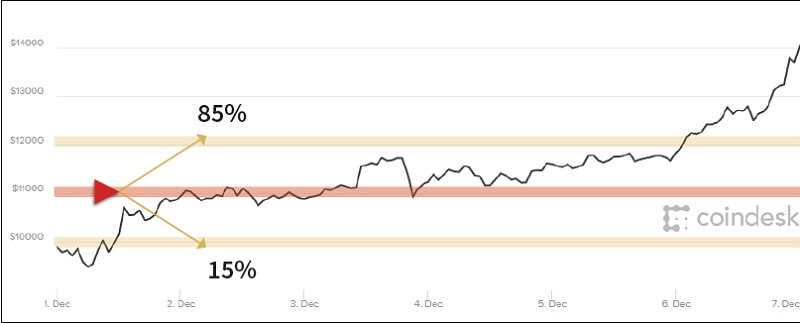

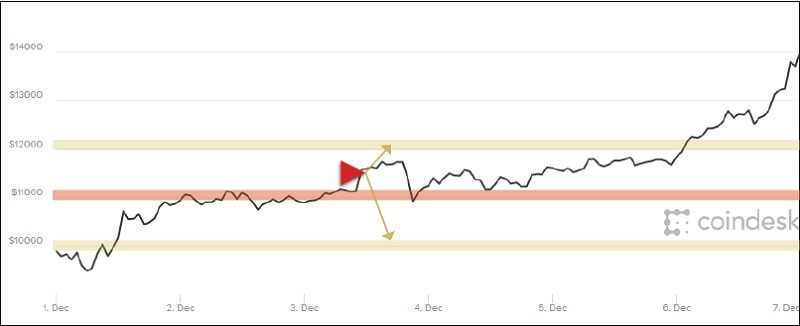

Stop and Limit – Orders – Often the trader wants to limit the loss in the position he has opened (in that case he sets the “stop” order). Or the trader wants to take profit at a certain level, which is acceptable to him/she (in this case he sets a “limit” order).

Long – Used for the purchase order

Short – Tension used for a sales order

Bid – Bid price

Ask – The price that is claimed

Buy – Shopping

Sell – Sale

Spread – The difference between the sale and purchase price

Chart – Graph

Timeframe – the Time period

Leverage – Multiplies the amount of money you invest

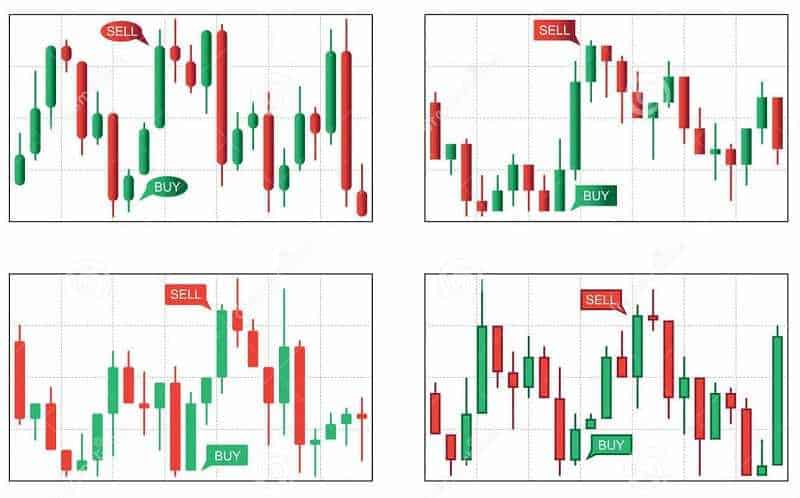

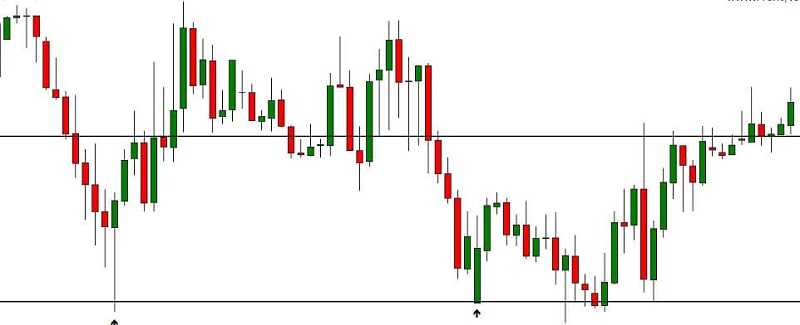

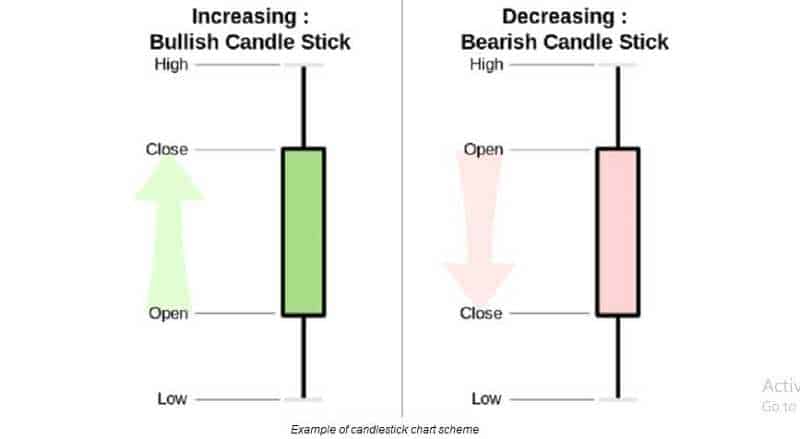

Candlestick – Candlesticks show that emotion by visually representing the size of price moves with different colors. Red means the starting price was higher than the closing price at a certain time. Green means it ended higher than the starting point.

Example of a candlestick chart scheme

What is needed to trade on Forex?

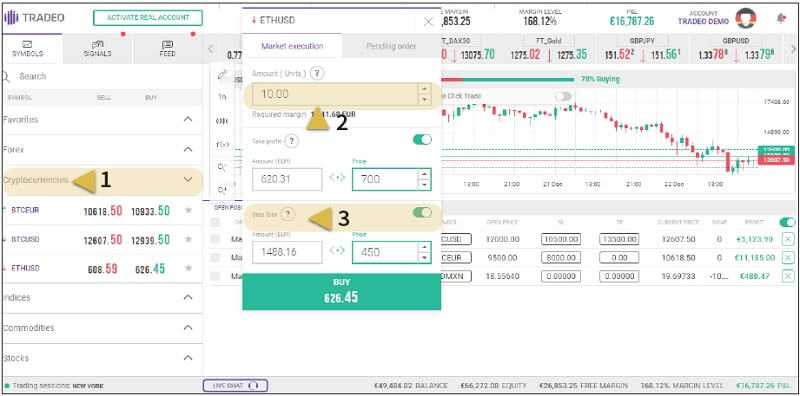

Before you start trading the currency, you need to open an account with a Forex broker. Our recommendation is that before you decide on trading on Forex, open a demo account with one of the brokers.

So that through the use of the platform, you will be able to monitor market activities and learn more.

Conditions for Success

You must have a good knowledge of technical and fundamental analysis, as well as managing your account. You should also know the psychological aspect of the trade and that you are disciplined. Also, in Forex, you should learn the country you’re betting on or against.

To be able to trade Forex successfully, there is a whole world of education, really extensive analysis. Also, the countless hours of tracking a very large number of relevant and potentially relevant information. All without any guarantee that the right decision will be made. But I would like to show you some examples of how to make a successful trading. First, you must know the math behind the Forex trading.

Actually, you can become a millionaire trading forex. But you have to know it is not easy like you see on the internet advertising and TV. It depends on how much money you start trading.

If you start with $5,000 and make 10% of your capital each month, yes, you will be a millionaire after 5 or 6 years. Just 10% of your capital each month can make you a millionaire. And if you start with $100K you will be in 2 years. You can’t do that in any other industry.

Tell me, where you can start at $5K and become a millionaire in a few years.

But remember, if your dream is to become indecent rich in a week or a month, forget about the forex. Go far away from forex. Because you will lose all your money, your car, your house and in the end, your family.

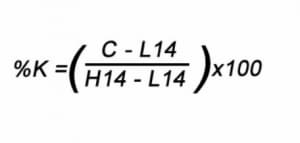

Math Guide for Forex Trading

I know, math has never been your excellent skill. The truth is that you are afraid of it. Anyway, I want to show you how simple it can be. I want to show you some mathematical formulas that every trader have to know if wants to make success in the Forex market. And you will see how these math concepts are very simple and easy to learn even if you think that math is a great challenge for you.

Change in currency pairs value is estimated in pips. The minimum pip you can see in the fourth digit after the decimal place. The exception to this rule is Yen pairs. The minimum pip there you can see in the second digit after the decimal place.

I’ll use the imaginary values, they are nor real.

For example, if the EUR/USD currency pair increases from 1.2530 to 1.32560. It is an increase of 30 pips for this currency pair. In Yen pairs, if the USD/JPY pair rises from 85.20 to 85.40, that is an increase of 20 pips for this pair. The value of a pip is different for different currency pairs. Let’s use the forex math formula to calculate the pip value of a currency pair:

Value of a pip is calculated

1 pip/exchange rate x trade size

We are going to use the EUR/USD currency pair with imaginary values.

One Pip = 0.0001

Base Currency: EUR

Exchange Rate: 1.3500

Trade Size: 1 lot meaning 100,000 units of currency

Pip Value = 0.0001 / 1.3500 x 100,000 = 7,407 EUR

How it works on the example on the USD/JPY currency pair?

One Pip = 0.01

Base Currency: USD

Exchange Rate: 85.50

Trade Size: 100,000 units of currency which is 1 lot

Pip Value = 0.01 / 85.50 x 100,000 = 11.468 USD

Or let’s see this example GBP/CHF:

One Pip = 0.0001

Base Currency: GBP

Exchange Rate: 1.3840

Trade Size: 100,000 ( 1 lot)

Pip Value = 0.0001 / 1.3840 x 100,000 = 7.22 GBP

Let’s talk completely about probability and numbers to see what lies behind the successful forex trading. I want us to find if a math genius essential for good trading. Making money in the currency markets demands that you first have to predict the activities of policymakers and central banks. But it is best to leave it to the economists and stay focused on short-term forex strategies.

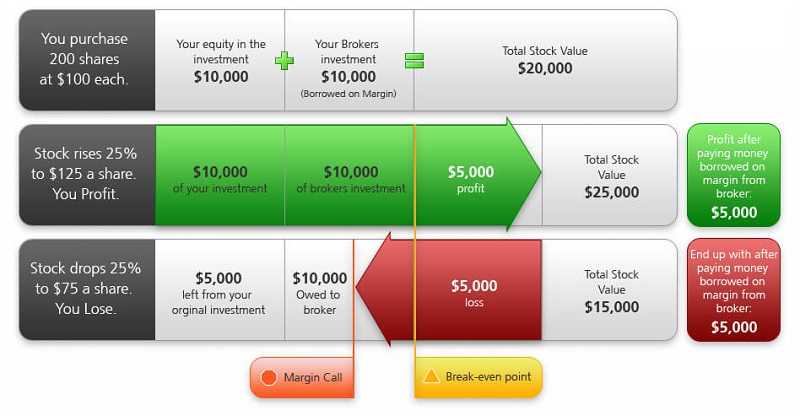

So, let’s try to understand the margin and leverage.

In Forex trading, leverage will give you the capacity to control a larger position. You will use a small part of your own funds and the rest you will borrow from your broker. Margin is the deposit demanded by your broker. He or she will ask you for margin/deposit to allow you to open a position.

Leverage is calculated by math formula:

Trade Size/Account Size = Leverage

Here is a realistic example to illustrate this.

For example, you want to enter the position with a value of $200,000. But you have $ 4,000 on your trading account. Your goal is to control $200,000 with the $4,000 you actually have.

$200,000/$2,000 = 50

Your leverage in my example is denoted as 50:1.

What will happen if you instead of $4,000 have $10,000?

You will control $200,000 with the $10,000.

$200,000/$10,000 = 20

Your average will be 20:1.

Brokers can offer from 50:1 leverage for forex trading up to 500:1. But think twice before you accept any offer. It is true that leverage may increase returns but also increase losses.

Position Sizing

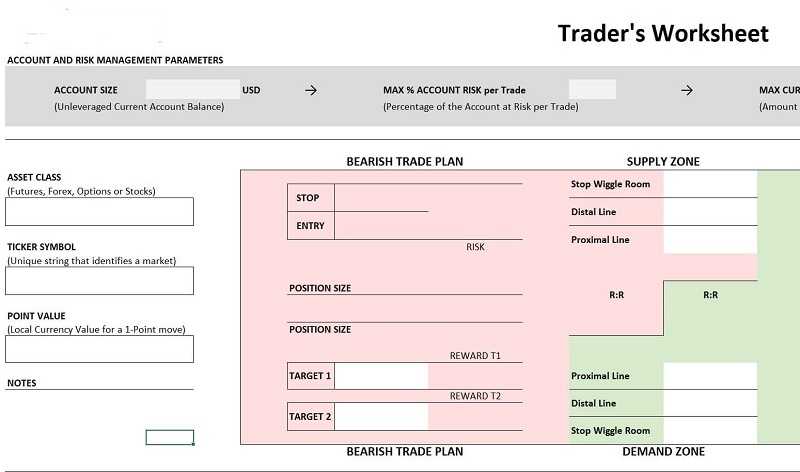

This is one of the most serious and frequent estimations that you have to make if you want to be a forex trader. Actually, before you decide to enter any trade, you have to calculate the position size. I suggest you use one of the simplest calculations. It is a fixed fractional calculation strategy. The best is to risk 1-2% per trade, 1% is better and I’ll show you why. Take it as the rule for the fixed fractional risk.

So, you have to decide how much you can afford to risk on a per-trade. When you make this decision you have to decide where to place the stop-loss.

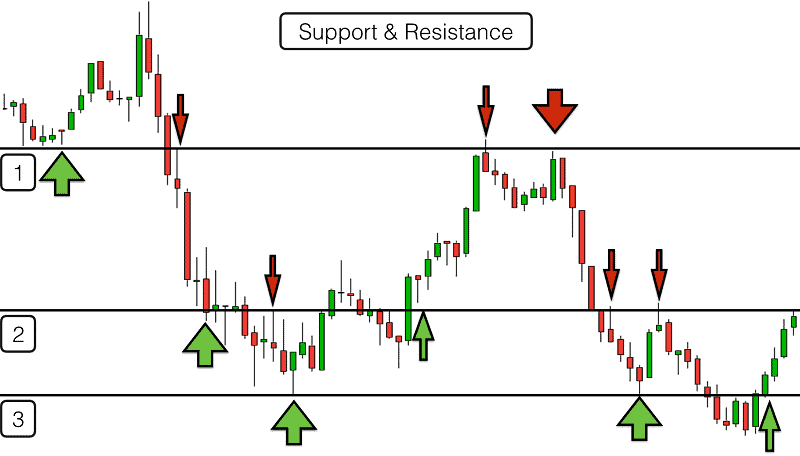

Take a look where the most current swings are. Find support and resistance points. When you settle a level where you want to place stop-loss, you have to measure the distance in pips between this level and the entry you plan. Write down that number. Then, discover the value of each pip. And you can calculate your position size.

Math is in this formula.

current account size x risk per trade/distance between entry and stop x value of the pip

Let’s say your current account size is $20,000 and the fixed fractional risk per trade is 2%. The distance between entry and stop is 100 pips

And the value of each pip is $20.

$ 20,000 x 0,2 / 100 x 20 = 0.80 lots

This is just an example and you will find different situations but the principle is the same.

This the other example.

Let’s say your current account size: $25,000 and fixed fractional risk per trade is, as I suggested, 1% per trade, which means for the account of $25,000 you may risk $250. But if you risk up to 2% it is $500 per trade.

Why 1% risk is better?

Let’s assume you have 10 lose 10 trades in a series. It isn’t so frequent but can happen. So, 10 x $250 = $2,500 and you had before entry $25,000 on your trading account and you can say you have almost all your capital intact and make great returns. A stop-loss order doesn’t promise an exit at the price you defined. In a gap in price, you could lose more than 1%. It is slippage. If you risk 1%, such harmful moves will result in a several percentage declines in the equity. It will not be a disaster. You can recover it.

A stop-loss order doesn’t promise an exit at the price you defined. In a gap in price, you could lose more than 1%. It is slippage. If you risk 1%, such harmful moves will result in a several percentage declines in equity. It will not be a disaster. You can recover fast.

For Forex trading, you measure trade risk in pips. When it comes to the stock market you have to measure in cents or dollars. Suppose you purchase a stock at $10 and place a stop loss at $9,80. Your trade risk is $0,20. You must admit it isn’t too much.

To calculate position size in stocks, use this formula.

Account Risk (€ for example) / Trade Risk (€) = Position size in shares

Suppose you have a €200,000 account. So you can risk €2000 per trade which is money equivalent of 1%. Say, you buy a stock at €200 and a place a stop loss at €198 because your trade risk is €2.

€2000 / €2 = 1000 shares.

These 1000 shares are good position size. You are risking precisely 1% of your account. The trade costs you 1000 shares x $200 = $200,000. You have just enough money to make this trade. You don’t need leverage. And your stop-loss is at €198 which guarantees you to have €2000 on your account even if your trade goes wrong.

How to trade – all secrets about trading

How to trade is the most used question we ever heard.

First of all, you must understand, trading is the younger cousin of investment. As a newcomer, you can be overwhelmed by the quantity of the data available in the stock market.

First thing first

When you simply sign up at one of these online brokerage companies, deposit an amount of money you can live with losing it, you are ready to start.

The most important decisions you’re going to have to make in your road to becoming a successful trader in the financial markets are, what your trading style is going to be.

Different trading strategies have their own collection of benefits and drawbacks. If you’re new to the trading scene and might not understand the differences in each trading style, you may be confused. This is extremely important to follow a strategy with your head and not heart!

”Damn, what I have to do?”

You have the choice to simply buy and hold positions in any market for long periods, for years or even decades. Or you can complete your trades within one 24-hour period which is easy but the most challenging and fraught with the highest levels of risk, though it can bring big rewards.

If you choose long-term trading and buy-and-hold trading, the offer is the lessened risk in exchange for fewer opportunities for reward.

”And now, what is the next thing I have to do?”

Well, you have to pick your trading days. Research has shown that the third week of the month is the best time to buy stocks. According to research, the best of the best is the period between 18. and 22. of the month.

Why is that?

The prices tend to hit their lowest monthly points at that time. Because cash flows from dividend reinvestment and pension funds are likely to be at their lowest as well in that period. That means the best time to sell stocks is closer to the beginning and end of the month when cash flowing into the system is at its highest.

Speaking about the period of the whole year, April and May are the most successful time to sell your stocks. But buying new stocks in September and October is going to get you the best price (in that time the market tends to bottom out).

If you want to be a day trader, there’s a right time for you as well.

The best time of day to trade stocks, if you are from Europe, is between 9:30 to 10:30 AM. This time frame is offering the biggest moves in the shortest amount of time (a great and efficient combination).

You can extend it out to 11:30 AM EST if you want another hour of trading.

The best time for a US-based day trader is in the late afternoon Eastern Time. Corporate earnings reports and statistical reports from the federal government regularly are published in the morning. They are visible from 1:30 pm to 2:00 pm.

”Is there any key that is successful?”

I was waiting for you here!

There are no instant solutions and you have to understand that you can’t find a secret formula or secrets about trading. If there is any secret or key, it is this: keep it simple, be systematic and get educated.

Say, you had enough capital to open a trading account. This doesn’t mean that you’re going to be successful right out of the gate. Especially if you are a beginner and if you’ve never spent a day in your life in trading before. And if you think you’ll be able to dive without educating yourself, you’re likely to end up learning the hard way. You will watch how all your investment capital disappears into the ether in exchange for a handful of stocks that end up not worth much or worse, not worth anything at all.

Keep in mind: trading is not gambling. But there are some tips.

One secret you should know: everyone is selling the stock or vice versa. But it’s obvious that someone has to be buying the stock also. At what price? It depends if the stock has a demand. If not – people will sell it at ANY price, and that is what leads to major drops.

The ultimate secret of stock trading is this, learn to identify and make your trades rational and not impulsive.

As we said, there are still some tips:

- If you are focused on odds trading and risk/reward rather than on your ideas and emotions can set the base for a very long and successful trading profession.

- The stock market will never consider your emotions or appetites. A few principles are the most important contributors to the losses made in the stock market.

- Know your risk tolerance, and trade the constant strategies. If you stay focused on these two points you can be sure you will trade for a long time.

- Don’t be risk-averse, learn to evaluate risk and learn to understand yourself.

- Trade up to the point you can bear the loss, don’t ever cross your limits. It’s better to wait for your time.

- Always have a plan, build and diversify your portfolio, stay away from all the mumbo jumbo.

- Only invest in the coins that will turn over a profit, find others that you trust to keep you properly informed, use the tools of the pros.

Use the math to trade

The usage of math in trading stocks can support you gain better results, that’s true. It’s just about identifying risks and possibilities.

Applying math to everything from finding a sweetheart to winning in the casino, you can be right if you think that math may help you win the stock market. Maybe someone has done it before. But, there is no known system, no matter how advanced it is, able to predict the future. You have to know that.

The math can do a lot and it is very important for every trader.

Complex math can estimate the chance of market or trading events. It is very useful to help you to minimize the possibility of bad events before they appear. How math can work? It’s like your insurance company. It will never be able to predict when someone is going to die but with a great percentage, it can reveal the cause of death.

Basic knowledge of mathematics can give an advantage to you. Frankly, almost all charts and trading strategies are based on mathematical theories.

Profitable trading is not about beliefs, not about a forecast, or stock tips or picks. It is all about math. The point is to make more money than you lose. Trading without following the math principles produces a lack in your trading. You have to put away from emotions and quantify a system that generates the profits. You have to be able to understand the math behind the trading if you want to achieve profitability.

The most important stage of using math is to have answers to those questions.

About the risk/reward ratio: How much money are you risking for a chance to earn $100 or euros?

Speaking about position sizing you must know how much money will you place in one position.

Do you know how did the signals you use work historically?

What is the most amount of capital you would want to lose from your equity peak?

Do you know the average annual return you want to reach?

What is the relation between your winning trades against losing trades?

What is your worst-case scenario?

Can you recognize the chances to destroy your account?

Do you know where to place the stop-loss order? Can you calculate how much will you lose if you make a mistake while placing the trade? Also, can you calculate the biggest reward if you are right when entering the trade?

Warren Buffet said that successful trading means 100% efficiency. But most successful traders are right only half the time at best. Simple math confirms that “winning” on only 4 or 5 of 10 trades can provide you a great profit. Of course, that depends on how many wins you have in comparison to losings.

Let’s say if you have you made 10 trades and you have 5 winnings with earnings of $3,000 on each. At the same time, you have 5 losing $1,000 each. Your profit is

(5x$3,000) – (5x$1,000) = $10,000

Mathematics, coupled with tolerance, creates stock market capital more surely than “big game” bets.

This is a realistic example.

Let’s say you bought 600 shares at $200 each. The market price was $1,400 per share. Let’s say the stated dividend was 25%. What is your earning percent on this investment? Here is the equation.

(25/1400)x200 = 3,57%

Or the other one.

For example, you bought 500 shares in a company 25 years ago and you paid it $200 per share. The dividend is 25%. Your capital rose cumulated up to $5 million. But 25% came from cash dividends you’ve collected over 25 years. Your 500 shares value today is exactly that amount minus dividends. But your earning is exactly $5 million minus your initial capital of $100,000.

The impressive thing about math is the strength of one right investment to defeat troubles in the market.

What would be the possible scenario if you made 25 years ago 20 different investments of $5,000 each?

But assume you were not a very skilled investor at that time and 15 of your investments went bankrupt a few days after you put your money on it. You have to know it is an extremely rare situation in every investor life but can happen.

Would you manage that? Of course. You still have your fantastic profit thanks to the compound rate. Every of your, to say survived investments provided you something about 15% of compounding rate. That is an increase of $375,000 and you invested $100,000.

So, you have 5 good investments. Honestly, just one good investment may neutralize all bad ones.

What is the point? Investing is easy and needs several right decisions. They have to be well structured, to neutralize bad decisions. The answer is to let time to work in your benefit.

Historically, that method has created the millionaires. More than any other model. Stock trading and market timing may make for some distractions but they are far away from the place where the money is made.

Stockbroker – Choosing an online

This is one of the most important decisions you will make as an investor in the financial markets. And the most powerful tool in your hands. Every trader has it’s own investment style of trading, and abundance of brokers’ offers allow individuals to choose what best fits their needs. If you’re an active trader looking to try your hand at beating the markets, you probably have a good idea of what you want from a brokerage: low costs, premium research, innovative strategy tools and a rich with features trading platform.

The era of online stock brokers makes the world as high-risk/high-reward investing available to the wide public.

Profitable investing takes time and a lot of hard work.

It also requires you to use a brokerage service that fits your investing goals, educational needs, and learning style. If you are new investors, selecting the right online brokerage can mean the difference between a breathtaking new income stream and a short-lived struggle against disappointment, followed by inevitable frustrating handover.

You have to know one thing, there’s no sure-fire way to guarantee investment returns, but there is a way to set yourself up for success by selecting the online brokerage that best suits you. I’ll try to show you all the important things you should be looking for in your ideal brokerage on your path to find the best online broker. For a starter, take a moment to focus in on what is most important to you in a trading platform, before you start clicking on brokerage ads.

You’ll be surprised!

The most important is to recognize your own needs in financial markets.

You must know them. If you are a novice, you may give advantage to the basic educational resources, easy access to support services. Maybe you want the ability to practice trades before you start with real money. An advanced investor, but one who wants to find a new broker, would seek for advanced chartings, more order options, or to trade derivatives, commodities, and fixed-income securities, all along with stocks.

And you have to be honest with yourself about where you are right now in your investing tour and where you want to go.

Do you want to try your hand at day-trading but don’t know where and how to start? Or, maybe you like the idea of tailoring your portfolio, or you want to pay a professional to provide it done right? For now, I suggest you start with these crucial deliberations as a way to determine which of the brokerage features would be the most important to you.

To help yourself to find and use the best online stocks trading platforms be honest when you are answering these questions

a) How much do you already know?

Obviously, no one knows everything. But the question is how comfortable you feel when risking your own funds. Again, I encourage you to start with a demo account (you can find at the end of this post a link to a demo account)..

b) What kind of trades will you want to execute?

Stocks? Forex? Crypto? Daily?

c) Are you an active or passive investor?

Are you the type of person who can start a trade, let it go with its strategy and leave it aside. Or you’re the type of person who checks his portfolio daily, read about it, sign up to newsletters, etc.

d) What kind of help do you need?

Do you need help in learning how to trade? On what to trade? Recommendations? Or maybe you want to do it all by yourself?

e) What are your goals?

This is an important question when it comes to financial markets. Your goal is to make a profit, of course. But, how much you’re willing to lose? How “hard and dangerous” your trades look? How much profit you want to gain and monetize and how much you want to leave at your broker account to use for more money? These questions will act as your guidelines.

Be brutally honest with yourself about how much time, energy, and effort you are willing to put into your investments when you want to enter the financial markets in this way. Your answers may change over time, no one can anticipate all their needs and goals for the rest of their lives. Just start with where you are right now and go with the flow.

Pay attention to several more things such as:

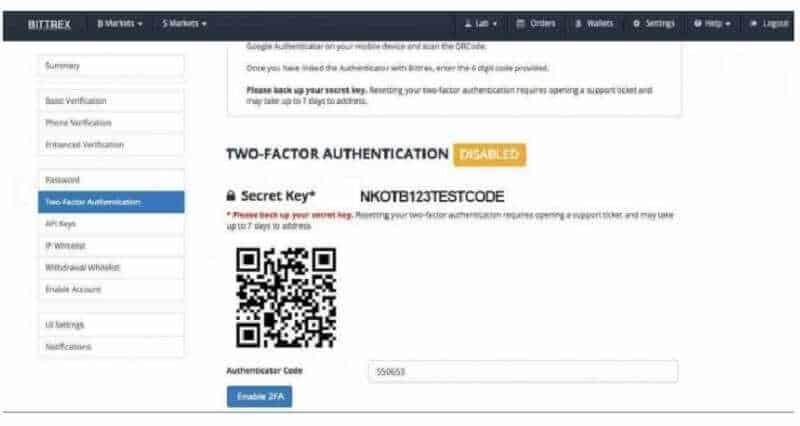

* Does the brokerage website offers two-factor authentication

* Do they clearly explain how they use encryption or “cookies” to protect your account information and how they work?

* Try searching the web for reviews of the brokerage, using keywords like “insurance claim”, “fraud protection”, “customer support”, “chargebacks”, “easy withdrawal”

* Will the company reimburse you for losses resulting from fraud? etc.

And then test the broker’s platform.

Every brokerage should have a decent description of what kinds of tools and resources it’s trading platform offers. But sometimes the best way to evaluate platform quality is to give it a test drive. To find brokers that allow you to open a free or demo account, it might be worth the effort to go through the signup process just to access and test the trading platform.

How Much Money Do I Need To Start Day Trading?

How much money?

This is one of the most frequently asked questions I hear from people who want to start day trading stocks, forex or futures markets.

Well, the amount of money you need depends on where you want to trade, your style of trading, do you want to trade forex, stocks, or futures.

And of course, how much money you need to start trading depends on which country you are coming from.

Capital Required to DAY TRADER STOCKS

For example, if you want to be a day trader in the USA and to trade US stocks, you need to maintain an account balance of $25,000 or more.

You have to start with at least $30,000 if you plan to make more than 4-day trades per trading week.

Four-day trades or more per week gives you “day trader status” and you’re subject to the $25,000 minimum account balance. It is recommended you start with more than $25,000, to give yourself a buffer above the minimum requirement.

If your account sinks below $25,000 you will not have the possibility to day trade until you renew your account to more than $25,000.

But in case, if the country you live or want to trade, doesn’t require the $25,000 minimum account balance, it is recommended you still deposit at least $10,000 into your day trading account.

With smaller accounts than this, commissions and fees will significantly erase profits you made. Usually, online trading platforms let you trade CFD and forex, and for those, you can start with only $250 minimum deposit.

One of the common mistakes that traders make is being under-capitalized. Losing trades happen, even to the best traders. But after taking losses you still need to have enough money to keep trading. It’s recommended risking 1% or less of your capital on a trade.

The risk is the difference between your entry price and your stop-loss price, multiplied by the number of shares of have.

Capital Required to DAY TRADE FOREX

To open an account in the forex market you will need less money because it is not regulated like stocks.

Forex gives leverage up to 50:1. However, it can be higher in some countries, but this is the usual amount. Increasing leverage means more risk but also more rewards.

Leverage is basically trading with money you borrowed from the broker. Anyway, you have to be aware of a few things.

For example, you may have $2,000 in your account, but you want to buy $10,000 worth of the EUR/USD. Your leverage is 5:1 on this trade. The brokers will not charge a fee for leveraging, but they will charge you a commission. You have to realize that leverage is a double-edged sword, increasing profits as well as losses. If you take a large position, the broker will charge you more commission and vice versa.

While the broker doesn’t charge interest, the market does.

Currency traders are subject to the interest rates prevailing in the currency they trade.

Every transaction is buying one currency and the selling of another done at the same time. You may make a few dollars a day which will grow your account over time. But you can also earn a lot of money if you open an account with a bigger amount.

Professionals suggest, if you want an income from forex day trading, start with at least $1000, and preferably $3,000 to $5,000. This amount allows you to potentially start building a monthly income. It is what the most day traders are looking for.

Capital Required to DAY TRADE FUTURES

Futures contracts are traded on oil, gold, natural gas, and stock indexes.

To trade futures, most brokers only demand a deposit of $1,000. For most brokers, you need to have at least $400 or $500 of capital in your account to take a one contract trade.

This is called day trading margin

Opening an account with only $1,000 isn’t recommended. This is the recommendation of the pros. You have to open the futures account with at least $8,000. You will need more if you day trading ES futures. The futures under the ES symbol are built on the S&P 500 stock index. It is a benchmark for U.S. stocks. Hence, your broker may require additional margin. You may wish to start day trading with at least $10,000 to provide you some flexibility in what you can trade.

You have to create a sustainable trading plan and test it with a demo account before you enter the trade with real money. Your trades have to be profitable for at least several months in a row before opening a real day trading account. This gives you time to see where you need improvements.

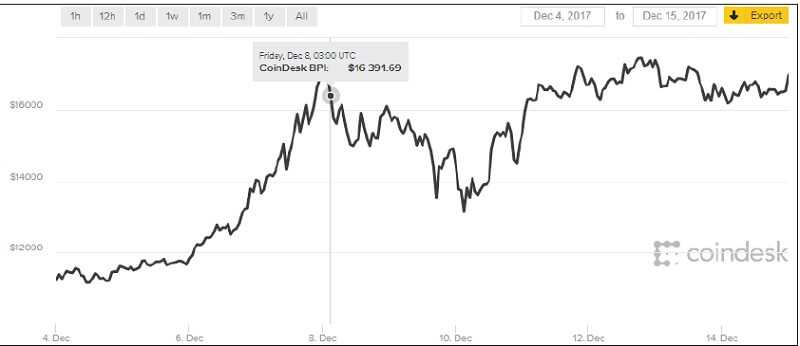

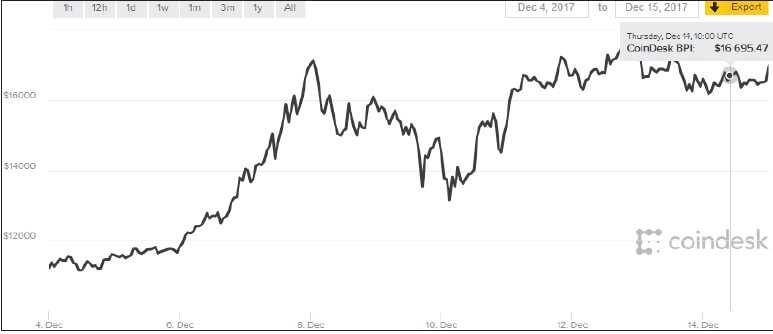

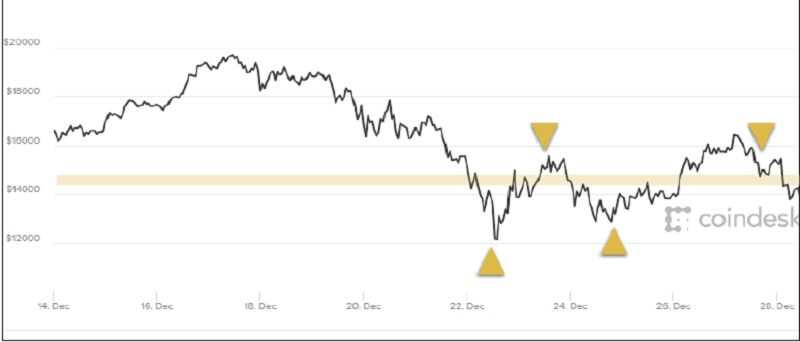

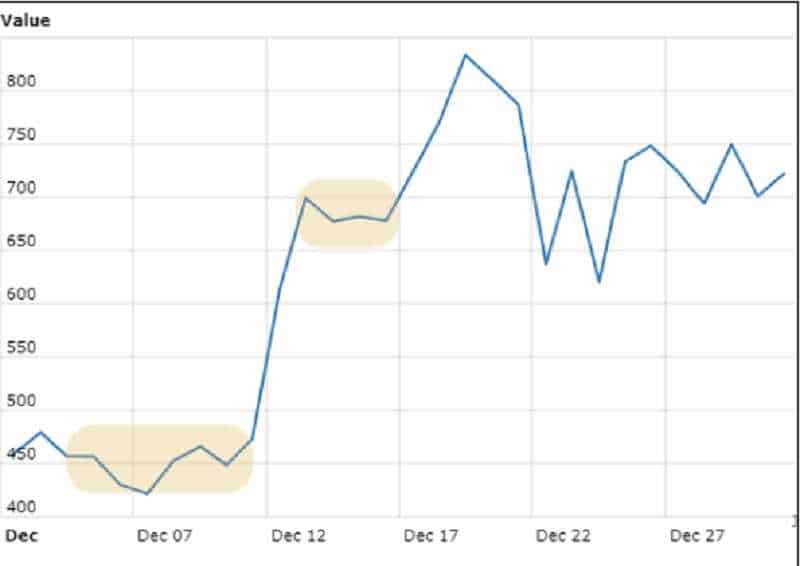

When Is The Right Time To Invest In Crypto?

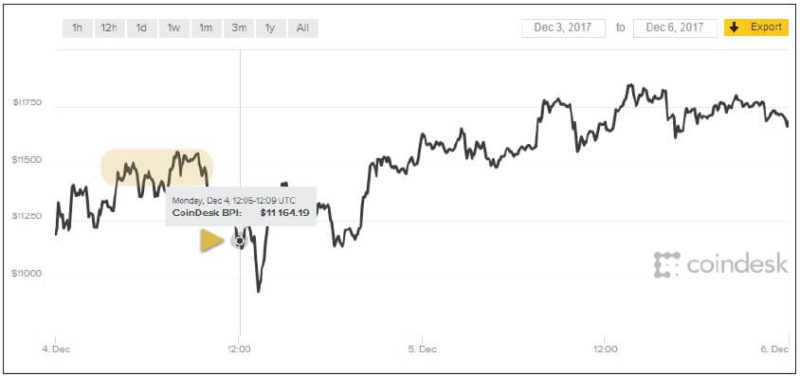

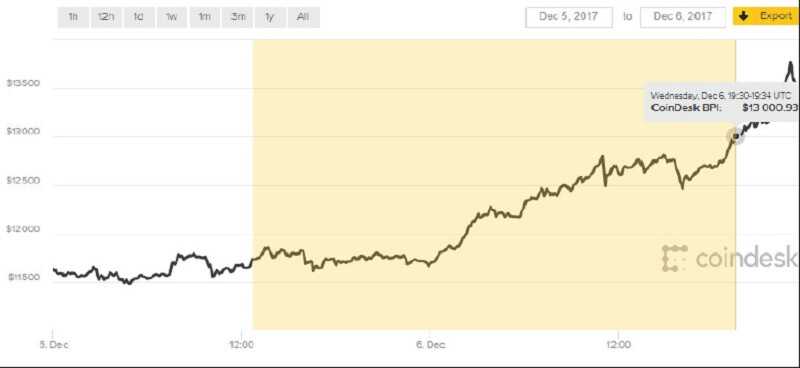

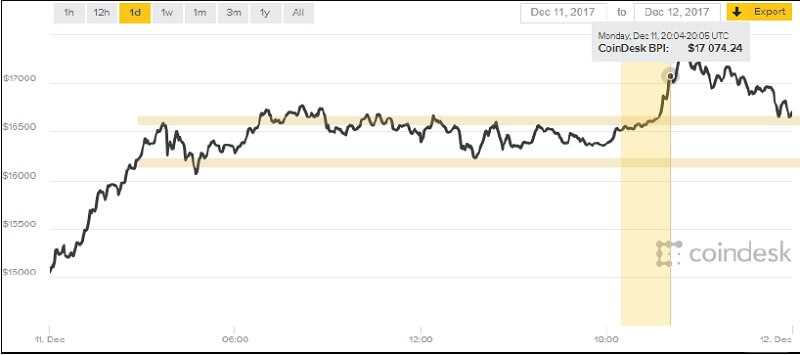

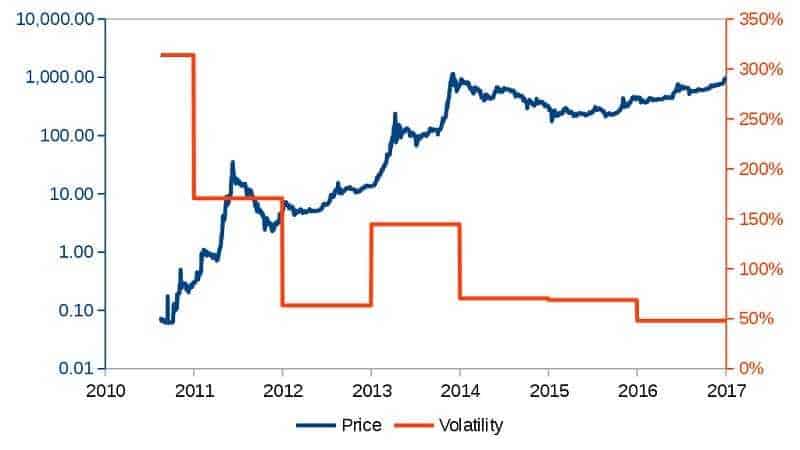

The right time? Let us be clear. For those without experience, it’s never the right time. That means you MUST have knowledge, information, and experience with a free trial demo account. After you test everything you may say it is the right time for further step: investing and trading cryptocurrencies. You can make really serious money on cryptocurrencies, that is true. But you have to take care of several things when you enter the financial markets. You would be very careful when investing in any crypto because all prices of cryptocurrencies have dramatic ups and downs.

Generally speaking, I should not advise anyone to invest if there is a misunderstanding about what they are investing in. And when the only expectation of further growth based on previous growth is present. In addition to the famous and biggest Bitcoin, you can find many other interesting cryptocurrencies on the market.

When I say ”interesting” it means that we think their concept is interesting, not the potential for price growth. For example, I don’t know when you’re reading this – but now, Facebook is working on its own crypto coin. For what will it use to exactly, is still unclear?

Before you decide to trade cryptos, keep in mind that you feel well informed. And if you are not ready to lose what you have invested, you should not even try because there is no easy earning!

Is this the right time for trading or investing cryptos?

There is an obvious difference between those two terms – trading and investing.

Investing refers to the purchase and storage of cryptos. Trading involves active participation in the stock market and frequent purchases and sales in an attempt to profit from price changes.

If you are asking me about trading, it is always a good time for professional traders, for those inexperienced and untrained it’s never the right time. Hence, my opinion is that no one should engage in trade cryptos, without basic knowledge about it.

First of all, everyone should bear in mind that it is possible to lose everything. It can happen due to bad decisions or because of the flops of the user. If you are not prepared to lose everything that you have invested, you should not invest.

When referring to crypto trading and investing – since there no REAL value, the prices may vary and go as high as 1 million dollars per coin or 0.00001 BTC per dollar. There’s no real value, but it is worth something because it solves a problem. And I may say there is a big one. It allows people to transfer anonymously the money! This means you can buy illegal services/merchandise with it – this will always have demand. But not only that, you can hide your activities and make genuine and “white” money without anyone knows it’s you or the government know. We, for example, have a supplier that we know who he is, is not doing anything illegal, but he wants to get pay in crypto.

The ONLY way the crypto industry can totally fall (and in this case – worth exactly zero) it if the technology behind it, the blockchain, will be found as useless. It hasn’t happened and it might never happen (or until a quant computer will arrive in the world, but that for another story…)

Also, you should be careful in choosing a stock exchange.

Always use strong codes and “2-factor authentication” and you should be able to think on your feet. Most popular exchanges like Binance, Bitrex, Coin Exchange, Kraken, Kucoin, HitBTC, Gate.io, and Cryptopia recommends Google Authenticator.

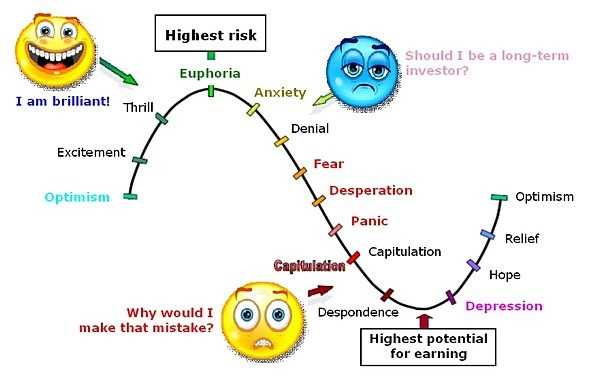

Few exchanges accept Authy and few exchanges have their own 2FA service. This is very significant for online security hence whichever exchange or trading sites you are on make sure to enable 2-factor authenticator. Do not fall into euphoria when prices rise and do not panic when they fall.

How big is the initial capital?

Also, how much money you need to start trading crypto? It depends on how much you are ready to lose, how much you expect to earn and how much you are inclined to risk. I have to emphasize that the right answer is your individual assessment.

How to track the value of cryptocurrencies?

You have to be registered on one of the exchanges where the cryptos are traded, to verify the order and deposits money. That’s all – when the money is deposited in the market, it can be traded. It is highly recommended for beginners to test their skills on some free demo account and after that, they are pretty ready to play with real money.

Is It Possible to Lose Money Trading Bitcoin and Crypto?

Losing money is possible. First of all, trading cryptocurrencies is not an easy task – it is a CHALLENGE and FIGHT! That’s the point!

Frankly, you are not the only one who lose money right now. But remember like in the war:

The lost battle is not the lost war. It shouldn’t be the question, WHY people lose money in crypto trading (it’s almost the same in every trading). The right challenge is how people manage it in general.

Crypto trading is one of the best “money-making” methods today if done right.

In order to avoid failure, we will introduce several reasons why people are losing money by trading crypto.

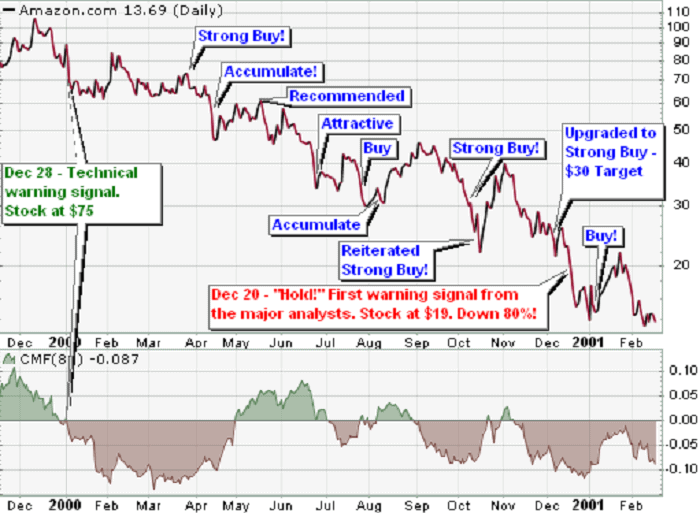

Is there a reason to get panic? Well, actually there is no reason. One of the biggest and most important tools that traders have is technical analysis. But there are so many and plenty of ways to lose your money! Trust me! For example, you can use social media predictions. Or you follow someone in the hope that he/she knows what to do.

And there can be the first catch.

You can become a victim of fake news. Because naturally, marketing always goes through these channels to keep up with the current information highway traffic. It wouldn’t be a good idea to buy coins by following “Tips” given by ICO’s or people that are trying to sell their coins to increase the value of what they have.

Right?

They’re trying to create a fake “hype” that can end up in disaster. That’s why you should always do your own research.

Clear?

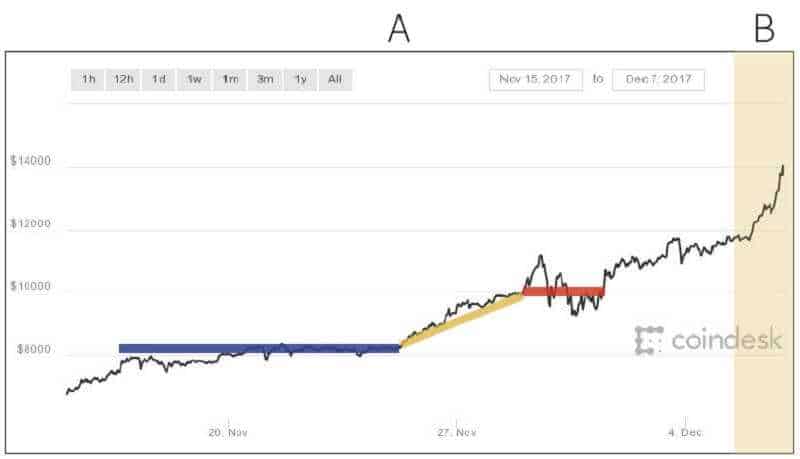

FOMO or “Fear of Missing Out” is something that most people are actually feeling today.

The Bitcoin train has long gone leaving people with doubts on which of the altcoins would be the next big star. When Bitcoin has soared up to heights that no one has ever dreamed, a lot of people were in awe and dismayed that they didn’t buy BTC earlier.

This sense of lost opportunity again triggers, always when the price of a coin goes up. It is making people buy at the wrong time (the price is high, damn) with the fear of it not going back down.

Strategy!!!

Going into the world of crypto trading without any strategy in mind is more like you are entering the cage with hungry lions! You will not survive! You should buy some books about trading strategies.

“Hold on for dear life.” HODL, damn!

Most of the exchange/trading platforms or websites have a feature called “Stop Loss”.

There you will be able to control the loss of your assets by setting a “safety net” that would stop your loss on time and not drag you down to limbo. Limbo is not a good place!

Lovely leverage and margin trading! Too much of it is bad.

Leverage or margin trading can be devastating if not used properly. If you are trading with a 20:1 leverage you can earn $20 if the price of your trade goes up by $1. But if your investment loses and it goes down $2 you will lose $40 instead of earning. A leverage trade is always expressed as a ratio: as an example, for a 20:1 leverage, you will be able to buy $20 assets with only $1. Trading on leverage is a great advantage because you can profit with the “borrowed money”. Using leverage provides you to multiply your position. For example, 100x leverage will extend your potential profit by 100 times.

Reasonably, using leverage will raise the risk, more than in a standard trade. Luckily, the risk is not proportional to the leverage. Hence, your losses will not be multiplied by 100. How is that? Well, you cannot lose more than you initially selected to the trade.

But I think you will need more examples. OMG how much I like math 🙂 Let’s imagine you want to buy a position of 1 BTC worth $10,000. To get the margin needed for the trade you have to divide the total value of the transaction by the leverage given for the trade.

margin = total value of trade/leverage

So, the value of your long position is valued at $10,000, and the margin amount for the trade at 100x leverage is calculated

($10,000/100) = $100

This means, to be able to trade a contract valued based on, in our case, BTC/USD price of $10,000 at leverage 100x you will need a deposit at $100. The added advantage of leveraged trading is that it lets you short the asset. What does it mean?

Well, you would be able to profit from the drop in the price of that asset. The short position means, you are borrowing the coin to sell it and purchase it back at a lower price. The difference in price is your profit minus the ‘debt’.

Do not ever trade more than you can afford to lose!

The most popular saying in the trading world is “making margin trading or the use of leverage to go beyond the line of betting/trading more than you can afford”. Since you are already in debt the minute you took the leverage. I believe that you have the right reason to invest some time in learning. You don’t need a degree! All you need is to read and to make a decision or you will face all ways of successfully losing money in trading Bitcoin and crypto.

Golden rules for investing in the stock market

Fast money and easy earnings are mostly what young people want to succeed in the business world. They are attracted to exchanges, money is invested in shares. However, there are many curves, curvatures, spirals and twists that, and if you don’t know how to avoid them, your trip to the stock market can be very short-lived.

What are the golden rules for investing in the stock market, which should be known primarily to beginners in this business, but also to more experienced stock traders?

* Create portfolio

You can do this in a simple way. There are many free portfolio managers on the Internet, so use some of them to make a free account.

Create a fictitious portfolio in which you would potentially invest and monitor the situation for a while, a minimum of one month. This will give you the best insight into market volatility.

Before you take the first step, the goal is to create a profitable fictitious portfolio as an investor on the stock market. This is one of the golden rules.

* Read business magazines

To successfully start investing in the stock market, you need to be aware of the world’s stock market and what are the social events that affect the rise or fall the price of shares. Many respectable business magazines are dealing with this topic (Forbes, The Economist, Kiplinger’s are some of the most famous ones). Follow the events in the global economy and finance and you will be able to swim more easily in the very turbulent waters of the stock market

* Buy stock from a field you know well

Before investing money into something, you should understand the business the company is dealing with. The first stock you will buy on the stock market should be from the sector you understand and it is familiar to you. For example, if you know the banking sector, try to explore the market and find a bank whose stocks are good and worth investing. Never invest in the action itself, but the company.

* Have realistic expectations

There may be a problem if your financial goals are based on unrealistic presumption. Try to be realistic in your ambitions and goals. In this way, there are fewer chances to lose money or be disappointed in your stock market business.

* Do your own research

You will hear from people who are dealing with the stock exchange that they have bought some stocks because the same was done by their friend or family member who understands this business.

Accept everything with reserve. Before buying a stock, do research.

If some stocks brought in earnings in the past it doesn’t necessarily mean that this trend will continue. Always believe in yourself than other people’s estimation.

* Stock exchange is NOT a money-making-machine

Most of those who want to participate in the stock market, have an unrealistic desire to double or triple investment in a short time frame. If you are one of them, then that’s not a job for you.

For those who want to invest, 10% to 12% of the earnings for a long period is quite a good investment. You need to realize that you are just a small fish in a big lake and that your success depends on many factors.

Follow the clues and make conclusions.

* 3 or 4 good stocks are enough

Don’t overplay, especially because you are a beginner in this business. More than 10 stocks are a good portfolio, but for investment funds.

They indeed make more profit, but if you make a smart and wise decision you will earn enough money.

* Don’t try to predict the stock price

Not even the biggest billionaires and owners of the largest multinational companies in the world are doing this. No one can predict, at least for a longer period, several stock market cycles. Ability to guess the moment when the stock will have the highest value is still a myth. Even for those who have an insight into the business of some companies. Therefore, for successful business and investing in the stock market, you need to acquire certain knowledge and skills.

Although, there is some artificial intelligence computer software that might not predict per-se, but can behave and act faster and more accurate way than a human being. Traders-Paradise will give you access to one of them, one of the best developers with his team is working on it.

READ more and Subscribe to get more information about AI in the financial markets.

According to the research, the risk of investing in the stock exchange is most often taken over by young people who have just finished college. But, like in every other business, the experience you get, will help you be wiser in making decisions in the future.

That’s how it works!

What Is better: Investing or Trading and what are the differences?

Investing or trading is the right question. Let us explain the differences between traders and investors, at first.

Stock traders are individuals (or entities) engaged in the trading of equity securities, or the transfer of other financial assets. They work either for themselves or on behalf of someone else. Hence, they may operate as agents, hedgers, arbitrageurs, speculators, or investors.

Stock investors are individuals (or entities) who use their own money to buy equity securities. The goal of the stock investor is to gain returns, which come in the form of income, interest, or appreciation in value also known as capital gains.

DIFFERENCES BETWEEN TRADING AND INVESTING

Investing and trading may often be classified together. But, they are both different ways of attempting to profit from the financial markets.

The goal of making investments is to progressively increase wealth over a long period of time by using the buying and holding of a portfolio of stocks, mutual funds, bonds and other methods of investment.

Trading involves short-term buying and selling of stock and commodities such as currency pairs and other instruments with the goal of earning profitable returns which outperform a traditional buy and hold investing.

For example, while most investors may be satisfied with a 10% annual return, traders may seek to achieve this per month.

Period of acting

Return on investment and payback period seem to be the two most commonly used financial metrics for making sustainability investment.

Trading is a method of holding stocks for a short period of time. It could be for a week or more often a day! The trader holds stocks until the short term high performance.

On the other hand, investing is an approach that works on buy and principle.

Investors invest their money for some years, decades or for an even longer period.

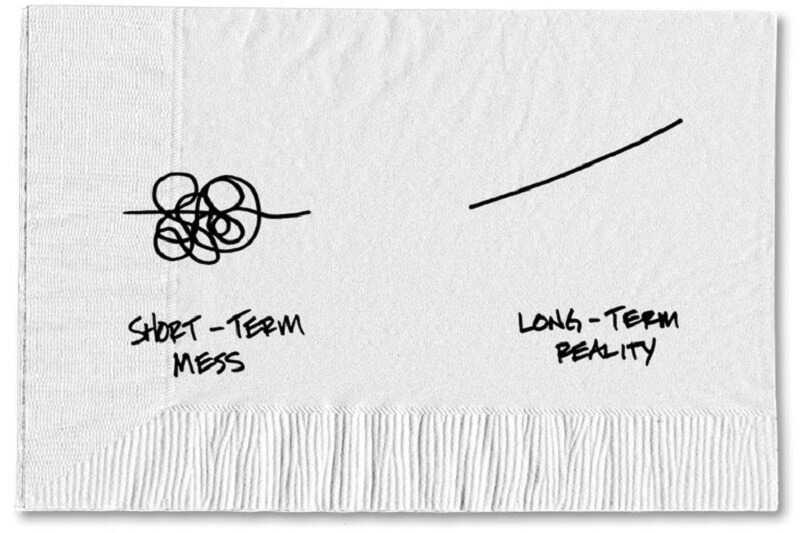

Short-term market fluctuations are irrelevant in the long-running investing.

Growth of capital

Traders look at the price movement of stocks in the market. If the price goes higher, traders may sell the stocks.

So we can say, trading is the skill of timing the market.

But investing is an art of creating wealth by compounding interest and dividend over the years by holding quality stocks in the market.

Risk of both fields

Both, trading and investing, including risk to your capital.

But trading involves higher risk and higher potential returns. The price might go high or low in a short while.

Investing takes a while to develop (and there’s a whole course we created to explain how to do it). It involves comparatively lower risk and lower returns in a short run but might deliver higher returns by putting together interests and dividends if held for a longer period of time.

Daily market cycles do not affect much on quality stock investments for a longer time.

Essential Differences

Trading is a one day match while investing is a championship. Similarly, traders are skilled, technical individuals, they learn market trends to hit higher profits in the stipulated time.

It is related to the psychology of the market.

Investors, on the other hand, analyze the stocks they want to invest in. Investing also includes learning business fundamentals and commitment to stay invested for a longer-term.

It is related to the philosophy that runs the business.

For example: If in the company’s balance sheet you see the inventory cell is too high, that might indicate problems with selling and marketing. This also may suggest higher and unnecessary payments for containing the inventory. This usually leads to some drops in stock price.

Traders put money in stock for a short-term, buy and sell fast to hit higher profits in the market. They seek a smaller and shorter opportunity.

Missing the right time may lead to a loss. They look at the present performance to hit the higher price and book profits in the very short term.

Investors keep themselves away from trends and invest in value. They invest for a longer period of time keeping the attention of the stocks they hold. They wait till the stock reaches its potential.

You are the one to decide if your goal trading at a higher price making a smaller profit in a short time. Or holding on and sell at a much higher price, in the long run, is what you aim for.

| Trading | Investing | |

| The time required to be spent on action | Daily continuous tracking of the stock | Few hours before taking an investment decision |

| Costs | Higher due to frequent trades | Relatively lower |

| Risk involved | High | Relatively lower |

| Returns | Low (can even tend towards negative over time) | Higher |

| Taxation | Short term capital gains tax | None provided held for more than a year |

A key rule of trading

Do it only when you are certain that there is an upcoming future event which is predicted to drive the stock value of an organization or entity higher. But it is obviously not an easy task.

If you think an asset’s price will go up – it’s clear that many other traders also know what you know. So it’s important to be one of the first who starts their position. If an asset has already made its rise – it’s not the best time to buy!

When trading, there are certain strategies which must be put in place. Traders should take note of the news and use it to make an educated decision which will hopefully enable them to make a profit afterward.

This shows the difference between trading as a short-term investment and investing as a long-term method of gaining wealth.

When investing, the goal is to bank profits over the long term, with dips in value simply providing the opportunity to buy more of the commodity in question. Investing means sitting it out when the commodity rises in value as there will likely be more good news ahead for the company and more profits to be made.

If you are new to the world of investing and trading, it’s important to know which you are going to choose.

The imperative to increase your financial gain is what defines it.

Knowledge is the key. If you are knowledgeable about the stock market but have little idea about how to trade Forex, for example, you will naturally head over to the stock market for your first investment.

General advice: Don’t get investing and trading confused – it could seriously hurt your portfolio!

The Difference Between Investing and Trading Bitcoin

One of the biggest benefits of Bitcoin is its decentralized nature. There is no need for a central authority to be added. Hence, you can send money and eliminate banks. The most important, you don’t have to pay remarkable fees or wait for the money to come to your bank account. The whole process is finished in a minute. All the transactions are recorded in the public ledger.

The ledger is based on blockchain technology. That allows every user of the Bitcoin network to access the records. Therefore, all users should be protected from stealing and cheating. If something suspicious arrives, the entire network would be cautioned. Bitcoin is impressive and brilliant and unique and free of governmental control.

But before you choose to hop into investing or trading Bitcoin, you have to know a few things about its nature.

Bitcoin isn’t a fiat currency.

Hence, its price isn’t directly related to the economy or policies of a single country. Bitcoin has a difficult history of ups and downs, many of them related to worldwide events

In simple words, bitcoin trading is the buying and selling the coin.

Bitcoin trading means to gain when you buy it at a low price and sell when the price is high. The difference is your profit.

Buying bitcoin means that you spend a small amount of fiat for a big number of bitcoin. Selling bitcoin means that you get a great amount of fiat for a lower number of bitcoin.

Trading vs Investing Bitcoin

This choice should depend on the knowledge of Bitcoin and the available property.

Investing in Bitcoin can start from a small amount which can be increased with time and experience. It’s a long-term project, which might lead to accumulating a large amount of money.

Trading should be reserved for those who know the Bitcoin nature in-depth and aren’t afraid of losing. The constant fluctuation of Bitcoin can be an exciting experience for any trader. On the other hand, it can scare away those who do not know how to deal with or handle it.

In other words, the difference between investing and trading Bitcoin lies not only in the technicalities of it. But also in somebody’s character and temperament.

A lot of newcomers are hooked with an idea that they can make a lot of money and can do it quickly while trading Bitcoin.

It is a powerful scene and rates are shifting faster than in a traditional stock exchange. But it comes with higher risk. Bitcoin prices grow and decrease dramatically during the day even hours. The price is defined by exchanges. Exchanges will show you the bid price when you want to buy bitcoins. The bid price is the highest price that someone is ready to pay. The “ask” price is the lowest price for a sale. The highest and lowest prices are determined from trends covering 24-hour.

What else you have to know about trading and investing Bitcoin?

If you’re thinking about trading, you have to put a large amount of money on the market. Be careful and invest in a protected and reliable wallet.

An exchange can be ruined anytime, all with your money in a play. It has happened in Bitcoin’s beginnings. The awful fall ended in losing over 800,000 bitcoins. The bitcoin owners never get money back.

One of the most important features of Bitcoin trading is the possibility to use leverage. We already discussed leverage. It is similar to forex trading.

For example, you have a 50:1 leverage, so you can place trades 50 times higher than your current capital. But in Bitcoin’s trading, the leverage ratio is significantly lower than in forex.

The leverage can produce high returns, and also comparably losses. In essence, you are betting that bitcoin price will reach a certain level. This form of trading is almost parallel to gambling – you bet a certain amount of money that a Bitcoin’s price could reach a certain high. And there is a trick. While in forex trading currency pairs can change the price by 1% maximum over one day, in crypto trading price can increase or drop more than 30% in 24 hours.

And you can trade from home, everyone’s dream.

You may trade from your home and here is the detailed instruction on HOW

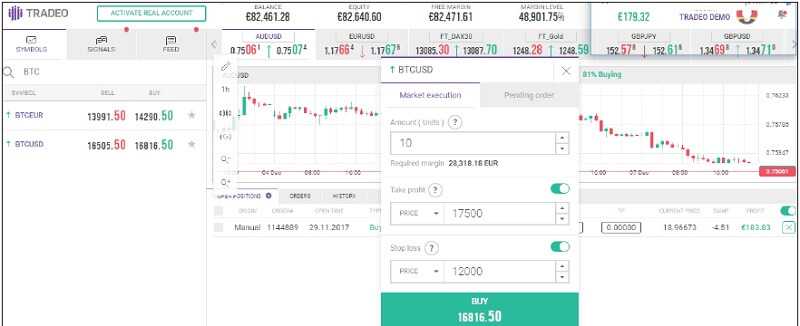

The First Trade – How To Execute It

The first trade should be like a selection of a school. You have to choose what assets or securities you want to trade. After that, you have to pick the broker or brokerage company to obtain access to the markets. That’s very important because the broker you choose will have a primary impact on securities you want to trade. Also, pay attention and check the tools the broker provides. Also, how much you will pay in fees. Hence, what returns you can expect from your trades. You have to find a broker that would charge low fees and provide you with a full package of support to make your trading easier.

And you have to choose the right strategy.

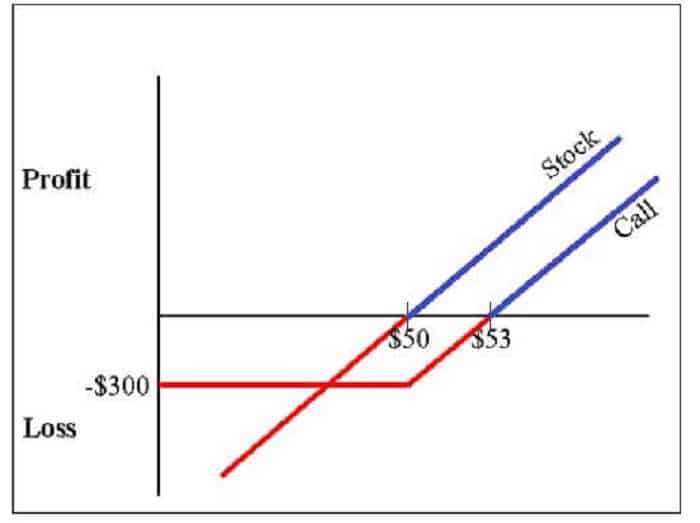

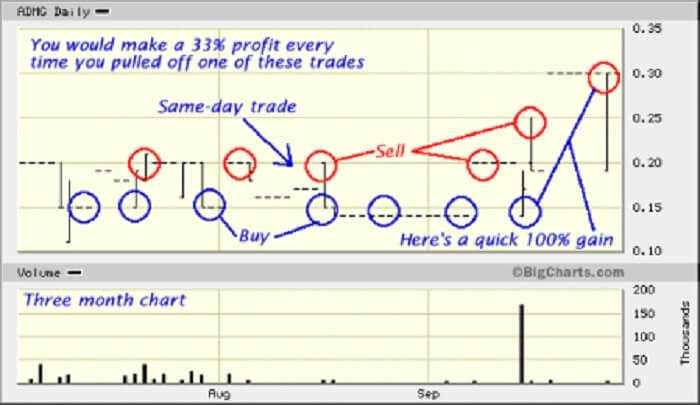

Trade execution is the simplest part. You might be surprised, but you must know what you are paying. You have to know how to recognize the highest quality trades. Let’s see the distinct components of high and low-quality trading. A high-quality trade setup provides a quick sharp movement in the wanted direction. On the other side, the average trade will struggle to achieve that.

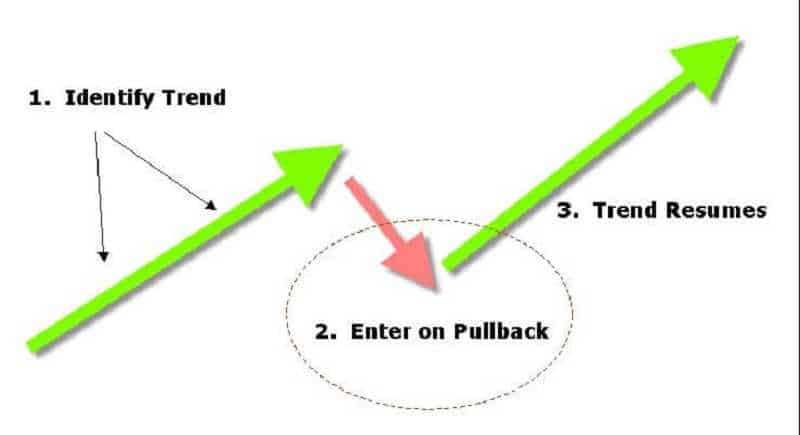

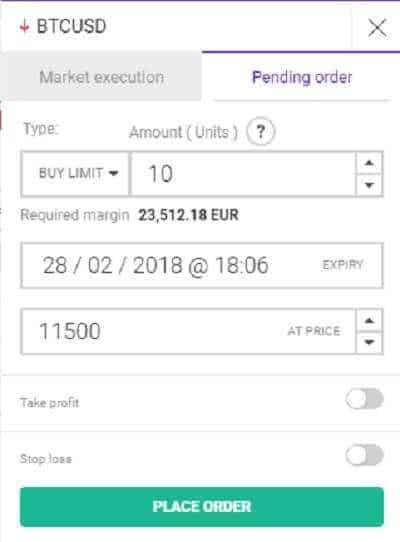

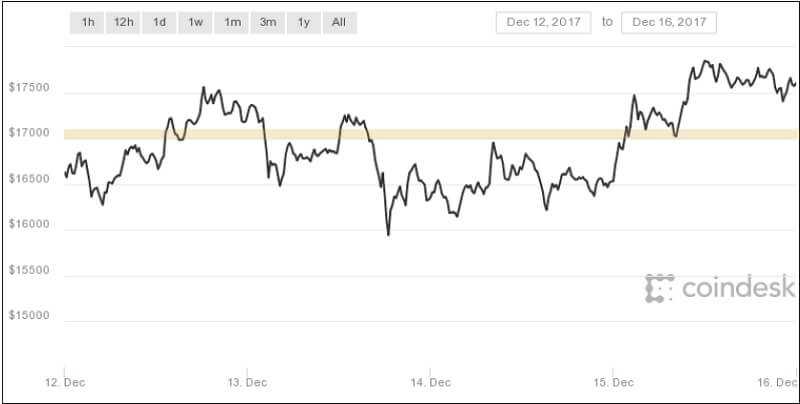

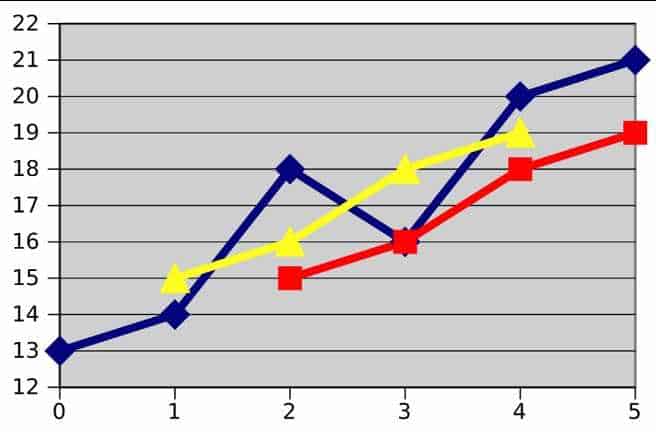

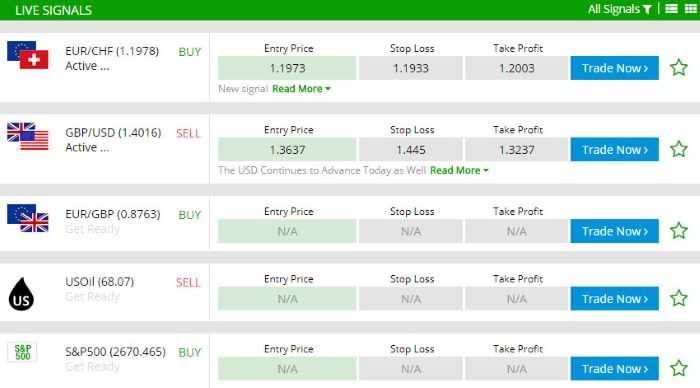

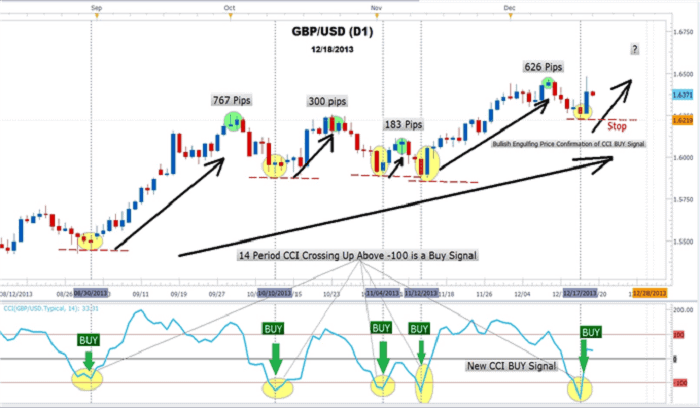

The chart above illustrates an example of a high-quality trade setup.

Can you see the price is moving to the north? That provides fewer barriers for short-term side to side support and resistance levels. Hence, there are no obstacles for the price to increase and it will do it quick. Trades that go straight into near-term support and resistance levels can be more inclined to conflict. Hence, it is more difficult to make a sharp move out of in the wanted direction.

But trades that have more capacity to run and are not promptly interrupted by a near-term support and resistance levels have a better position to bring you to wanted result.

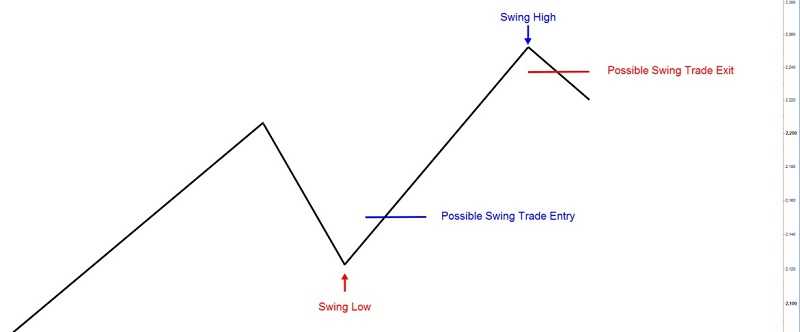

Here is the chart for more evidence. Notice the bearish pin bar. This is exactly what you have to look for when trading pin bars. But a short trade after this formation resulted in a ‘tight’ trade. That was caused by a prior resistance level. That will result in a drawdown on the trade for a short, before finally moving in favor of your trade.

FEW WORDS ABOUT TRADING STRATEGIES

The main difference between trading and investing is that a trader explores out market changes for profit. On the other hand, an investor tends to profit from long-term price changes in the assets. A trader will make numerous trades over one week, the investor will buy and hold for years.

The first move in building your trading strategy is to have a trading plan

The trading plan is like writing a business plan for some entrepreneurs. A trading plan will help you to make a realistic decision in periods of rapid market movement when your emotions might lead you to make impulsive decisions.

The trading strategy should include specific goals such as: getting out of debt, retiring early, making your first million. Also, your trading strategy should include your asset allocation and diversification moves.

As a beginner, you should have up to 5% of your trading funds on any single trade. Make sure your trading strategy contains a mix of fundamental analysis of global events, like wars that impact oil prices.

But also technical analysis like trading rules based on price and volume transformations. It is important because you can use this information to determine your entry into trades, your exit when the trade goes your way, and your escape when the trade goes against your plans.

For you, your best interest is to incorporate stop/limit loss orders into every trade you place.

New traders can use technology to lower the entry barriers to trading by automating many of the activities.

HERE ARE SOME OF THEM:

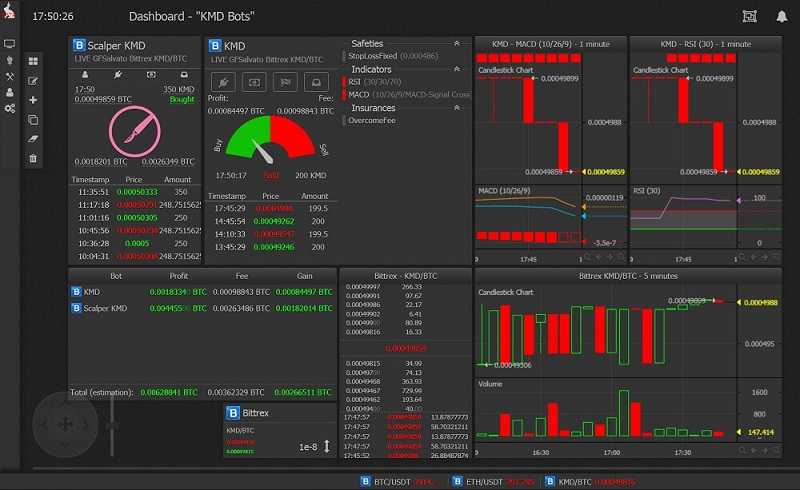

* Trading bots

This is simply computer programs with instructions based on a predetermined set of market indicators and parameters.

You can use automated trading systems to trade stocks, options, futures, and foreign exchange products.

It is based on a predefined set of rules, which determine when to enter an order, when to exit a position and how much money to invest in each trading product. Trading bots are especially helpful to beginner traders and sometimes, a bot can be an important market ally for reducing your losses.

* Stock screeners

That can help you filter the stocks in the market to narrow down potential winners before their big breaks.

This will help you identify top gainers and losers, stocks on turbo momentum, and stocks that are about to break out above resistance or break down below support lines.

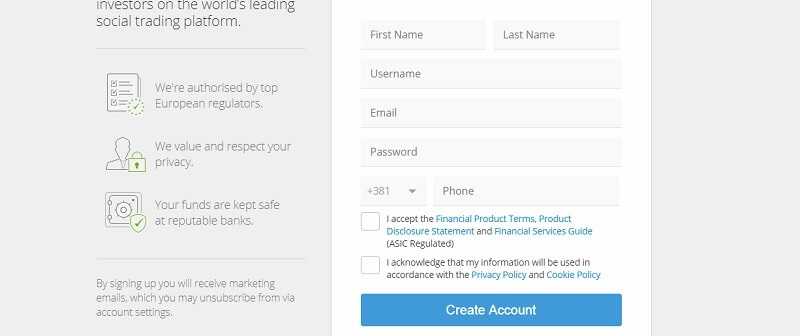

* Social trading

This is simply a type of trading in which traders rely on user-generated financial content, collected from a variety of networks.

Social trading provides you the platform to be part of a community of successful traders and you can purify the wisdom of the crowd and make you able to make your own trading decisions.

WHAT YOU HAVE TO REMEMBER ABOUT FINANCIAL MARKETS

Always use a trading plan, don’t underestimate the importance of a trading journal, change trading strategy after every trade. Test your trading skills on a demo account in a social trading environment before you start risking your own money. Practice trading strategies so that when you’re ready to enter the real financial markets, you’ve had the practice you need.

How do financial markets help you? Speaking about financial markets, you must know a few things.

First, there is no quick and easy money. If that is what you want, you should get to the casino.

Second, education is crucial. Without it, you will never become a great trader.

Third, be aware. Scammers are lurking around.

Financial markets perform an open and regulated way for companies to get the capital. This is done through the stock and bond markets. Also, the financial markets support these businesses to balance risk. Further, the financial markets are public. They consider all available knowledge about everything traded. So, we can say, the financial markets are placing where companies can find the buyers or someone willing to sell.

We hope you enjoyed this article about financial markets. It was made for a total beginner in the financial markets. We tried not to use too many complicated terms, and for those – you will have to buy our other books and courses.

Be smart, invest only as much as you can lose.

Our Facebook page Traders Paradise Facebook

and find us on Twitter Traders-Paradise

We are preparing a lot of surprises for you.

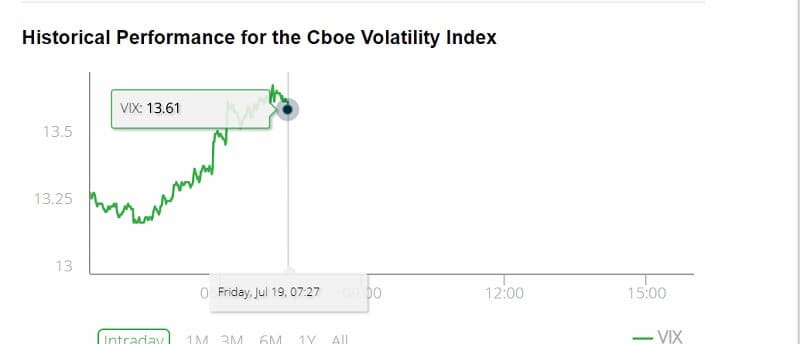

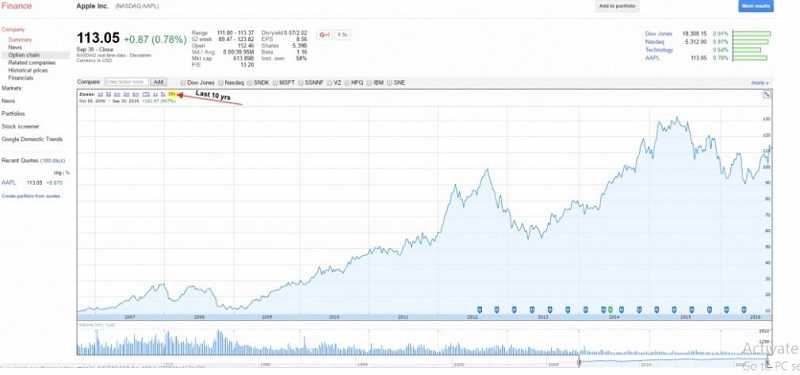

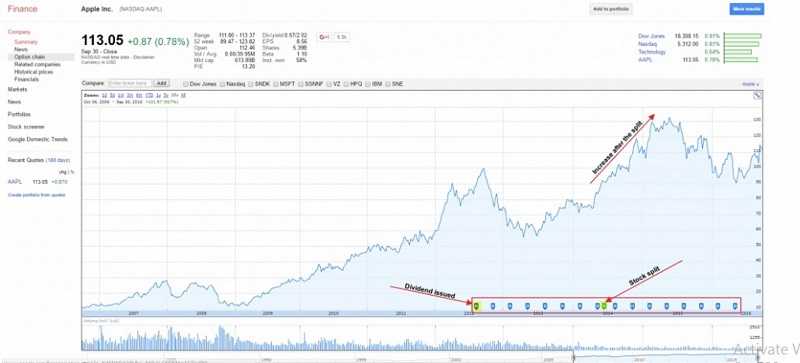

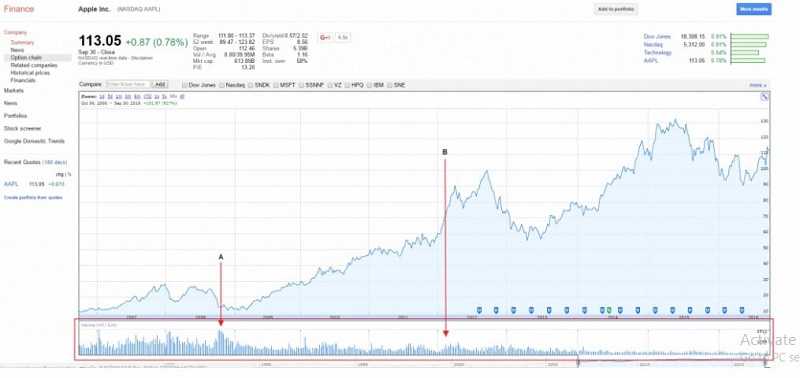

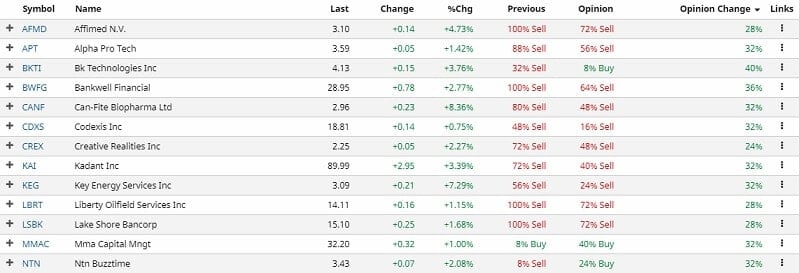

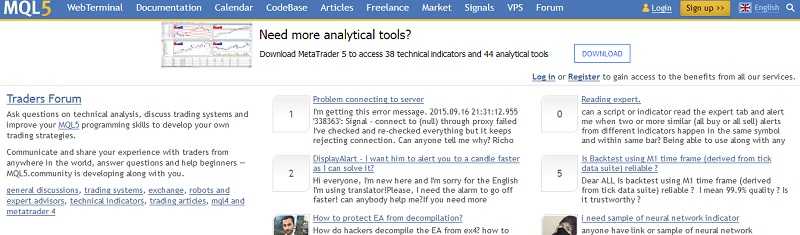

image source: screenshot from Yahoo finance

image source: screenshot from Yahoo finance