Picking the good signal provider can be harder than anyone can imagine. Truly nightmare.

By Guy Avtalyon

A signal provider can help you but also ruin you. Many forex traders use forex signal providers’ services to make money. Traders who struggle to make profitable trades in the forex market can leverage off successful forex traders by using their signals in their trades.

Not every forex signal provider out there is authentic and attempting to make sense of which ones are con artists. And ones which are genuine can be an overwhelming assignment.

Finding the right signal provider is the challenge

Finding a reliable forex signal service can seem like a challenge. There are those signal providers that are professional and transparent.

And unfortunately, there are those providers that do not always have their members’ best interest in mind.

It is up to you. You have to do your due diligence. To be sure that you are working with an honest forex signals provider. The one you can trust and have faith in.

There are several things the trader would consider when are going to pick your signal provider.

A trader should be aware that there are a lot of hardcore scammers in the market. They are working very hard to provide fake, low quality, and substandard forex signals.

Most of these hardcore scammers have no background. Or training in any financial matters. And usually, feed the trader with performance statistics that are imaginary.

But yet convincing to a trader who is not smart enough.

The best way a trader can deal with this problem is by spending at least 5 minutes looking at what other traders are saying about this respective signals provider.

This will help him or her in making an informed and proper judgment.

Another way is by the trader looking at the level of detail contained in the signals provided by the forex signal provider. If he or she realizes that it just entails a few charts with a loss or profitable line, the trader has a reason to think twice before following such signals.

A trader should look for testimonials about various forex signal providers available in the market. A trader should look at what other players in the industry are saying about the available signal providers. This will enable the trader to choose the best provider in terms of accuracy, quality, timeliness, and affordability of the services offered.

What trader should check?

The trader should check the number of TPs the providers have in one trade.

Also, the trader should check how the providers put together the performance statistics.

Check if the providers have a trade by trade statistics.

The bottom line is that any trader who wants to be profitable in the long term should start learning by himself or herself about forex signals through experience and self-training.

If you search for forex signal providers on the web, you will most likely be unable to recognize the sites of scammers from genuine suppliers.

Scammers’ sites are so comparative and competitive.

Sometimes you can feel that clueless forex merchants typically get gotten in the scammer’s site rather than the genuine forex signal supplier. When they understood that the signal is not profiting, it would have been past the point of no return.

The scammers had officially taken the cash and it is past the point where it is possible to do anything.

Signal providers will give you entry and exit signals but remember you have no idea how they came up with the entry and exit points, all you have to do is follow.

With all these promises, you will be tempted to subscribe. That is the moment it will dawn on you that whatever you have subscribed to is a pack of lies.

Forex Signal providers are typically separated into two different groups

It is based on how they generate their trading ideas – technical analysis and fundamental analysts.

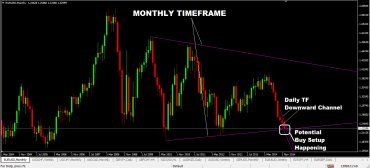

Technical Analysts base their trading decisions on chart analysis including support and resistance levels, candlestick patterns, price channels, market structure, or other technical approaches. Many technical analysts have a proprietary method for analyzing the markets. And the highly successful ones have spent many years researching and testing their methodology. All over historical data and in real-time market conditions.

Fundamental Analysts base their trading decisions on economic and news related data. This could be in the form of long-term interest rate analysis, inflation, central bank policy, employment reports, sentiment surveys, and more.

Some are longer-term position traders while many others are shorter-term traders that try to catch volatility spikes after an anticipated news release.

Some traders may think “reliable” means having a high win rate, but that is not really what you primarily want to be looking at.

Actually, win rates are not that important as a metric by itself. You must also analyze the average risk to reward in conjunction with the win rate.

There are strategies with 90% win rates that can lose money and then there are strategies with 30% win rates that can make money.

Another factor to consider is the technology the signal provider is using. Do they have a reliable platform to send out notifications and are there multiple ways for you to receive the alerts? But there is something important also. Do the trading alerts always detail the buy and sell signals, or present stop-loss levels and targets? Or do they only provide superficial information such as entries but no exit details? These are some of the factors you need to consider.

So how can you find out if a provider is reputable and worth your time?

Sign up for a Trial – Sometimes this the best way to get started is by signing up for a forex signals trial. You may get a real sense of the quality of service by diving in and taking a test drive. Many signal providers offer a 1 or 2 week trial for members.

Join their Email List – Another way to find a provider is by joining their email newsletter. You will find the value that they provide for free. So, you can evaluate whether their premium forex signals service will meet your expectations.

Check their Track Record – Every single reputable FX signal provider will implement a performance record detailing their published trades. This is a good way to find their average pip profit per month. Their risk parameters, average win percentage, and other related metrics.

Google them – Yes, simply Google them. Are they mentioned in any important trade publications or articles? What type of social following do they have?

Do everything possible to find with whom you are dealing. Just don’t be one of those naysayers.

Check it, try it, test it, and make your own conclusion.

Leave a Reply