3 min read

- Initiative Q has adopted some of the worst elements of scammy altcoins

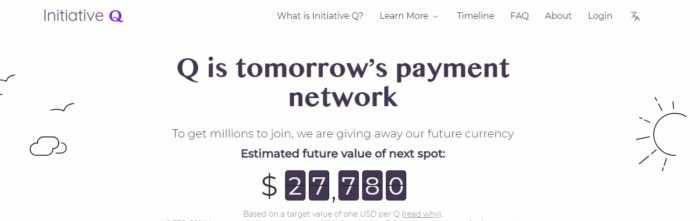

If you google Initiative Q and head to its website, you will find a giant page posture “tomorrow’s payment network”.

Social media’s got itself a new trend, it asks you to sign up to a new financial network called Initiative Q.

To attract signups, Initiative Q is using pyramid-style recruiting, aggressive social marketing. And it’s working: The project has been public since early summer, Google searches for “Initiative Q” have exploded since October 14.

You may have already been addressed by friends on Facebook or Twitter. And they told you there are only a limited amount of invites to join in on the next crypto, future bitcoin, that will potentially get you rich quickly. Despite that great interest, there is a concern that the operation might be a scam.

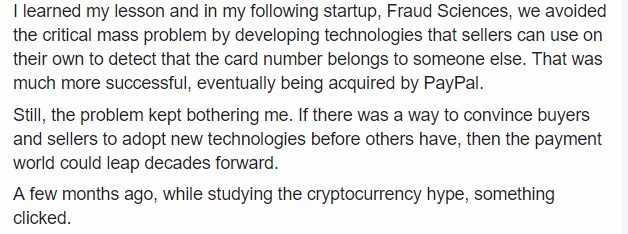

Initiative Q is a project led by veteran payments entrepreneur Saar Wilf, who contributed technology to Paypal, and George Mason University economics professor Lawrence H. White. They want to launch a digital currency but they’re very noisy about the fact that it’s not a cryptocurrency.

Initiative Q says it will be “tomorrow’s payment network.”

Wilf has started a viral social media campaign with this:

“Interested in a free $130,000 lottery ticket, which I estimate has a better than 1% chance to win?”

And below

It is evident they need to encourage mass adoption if they want success.

But, let’s put aside absurd and arrogant claims of their made-up “currency” being worth $2 trillion USD in the future. For now, they have a nice landing page. Anything can go in the world of marketing. But there are some reasonable questions we have to ask.

How could free units of a new digital currency end up being worth thousands or billions of dollars?

This is where things get interesting.

If you read through Initiative Q’s website and try to find how they got to their absurd $40,000 airdrop value you will find a long description, but here’s the summary of how they got there:

As you can see Initiative Q is different as it doesn’t ask you to invest any money. The free offering promises to collect a better financial reward if you secure one of the free slots. That means there should be no financial risk to you to join.

They are offering to set up a new payment network utilizing the very newest technology and then run a private currency ‘Q’ on that network, with a base of 2 trillion Q, which will be worth $1 per Q. This may make you think of a pyramid or Ponzi scheme, whereby a scammer will trick new investors, but no money has changed hands. Yet.

That, however, doesn’t change the fact that Initiative Q is in our opinion, a really bad idea. Initiative Q has adopted some of the worst elements of scammy altcoins, without even small simulations of technological innovation. It’s connected in general with risks.

Why does it look like a scam?

It’s premised on the hype

Initiative Q most resembles a crypto scam while active promoting of FOMO, or Fear of Missing Out. Its own marketing materials compare it to “getting free bitcoin seven years ago.”

Promoters spin estimates of the currency’s future value and they’ve built their marketing on “the earlier you join, the higher your reward.”

This rhetoric is created to attract the naive audience, and get them caught up in the excitement of easy money earning. Take a look at their Facebook profile. It also doesn’t seem like a coincidence that Initiative Q sounds like QAnon. It is a dangerous viral conspiracy theory that has taken over certain corners of social media in the past few years.

Let’s say, prop up scammers.

It’s not anonymous

Initiative Q is pointing out that they’re not selling anything. They’re just asking for your name and email address. They just want to keep you in the loop when the currency is launched. But, this trove of names and emails is a giant tank for hackers at the same time. A list of people interested in get-rich-quick schemes that could be extremely lucrative for more opened scammers. Where is the anonymity? The essence of crypto, P2P and blockchain!

Initiative Q seems to have missed the core source of the cryptocurrency enthusiasm they’re trying to use to leverage their really weird non-crypto. Data is valuable, and advertising companies will gladly pay heaps of money for access to good lists. Yes, they say in their privacy policy that they don’t sell our data! So does Facebook. That didn’t stop Cambridge Analytica from scraping illicit data and using it to advertise during the US 2016 election. If Initiative Q is sold to another company, they have every right to change the privacy policy. There’s no guarantee that your data is private. If there is no possibility of anonymous digital transactions what they are looking for in the world of crypto? Without the possibility of anonymous digital transactions, nobody would give a damn about cryptocurrency.

It has no technology

Initiative Q doesn’t have anything as yet, except the notion of ‘build a payment network and it’ll be awesome. Frankly, many of the things Q is promising to build already exist in the form of Apple Pay, Google Pay, AI fraud prevention, and smart card systems. What’s new? It looks like another payment app, just another payment processor. It’s utterly unclear what unsolved problem Q is meant to address. Keyword ‘unclear’! Fog! They have no idea but they want you to sign up. Smart! The most interesting thing about Initiative Q is its creators’ decision to pitch it as “sort of like a cryptocurrency, but definitely not a cryptocurrency.” So, what it is?

They have no product. Most ICOs or cryptocurrencies will explain how they plan to build their network. They ’ll draw up a whitepaper, going deep into the technical details.

What about Initiative Q? Nothing! No product, no details, no descriptions. There are some indications, signs but all unclear and obscured.

There’s an endless well of frustrated greed in the world. For a while, cryptocurrency was the vehicle and object for that greed. What Initiative Q’s creators seem to have missed is that there’s a lot more to it than that. Greed isn’t the main subject.

Its marketing is scary

Initiative Q’s authors have presented their plans to the world with all the aspects of a scam. Where’s the evidence for this?

Here! You can only join Initiative Q if you’re recruited, and each new joiner gets five invites to send out to friends. Recruiting others rewards you with more Q currency in the future. OK, there is no buy-in price, but that’s literally a pyramid scheme.

Initiative Q has been aggressive in using barrel-scraping content marketing tactics like MLM. But, unlike the MLM businesses, Initiative Q isn’t asking you to buy anything. They’re just making incredible promises about the value of the free coins they’re handing out.

Our concern is that when “get rich quick” schemes like this go viral on social media, they rust the image of cryptocurrency. They can cause confusion among the general audience. Even if Initiative Q does work out as a new system of payment, their marketing has been misleading. That “by invite, only” system for early adoption makes a false sense of exclusivity. At the same time, it can encourage people to spam their social media feeds with the Initiative Q saga.

Initiative Q is centralized

Initiative Q is a digital currency that’s not blockchain-based. According to creators, it is a payment network with a smartphone app, instant payments, and better fraud prevention than credit card companies. In fact, it links its fraud prevention specifically to the idea that it’s centralized.

They are establishing “patterns of appropriate and inappropriate behavior,” and Initiative Q will build “more reliable fraud assessment.”

What does it mean?

It is just an enhanced version of what banks and credit cards do. And that’s exactly the problem: Q isn’t an actual innovation. Initiative Q creators really just want to build a centralized payment network. And they want to take their piece of cake.

Q will be a private currency and you won’t control the money you receive. The network could shut down, the admins could move your money into someone else’s account. There is no guarantee the Q would avoid legal intervention that destroyed earlier centralized digital currencies.

Should you sign up to Initiative Q?

We won’t tell you what to do with your money. But be very cautious when it comes to Initiative Q and online promises of quick wealth.

It’s possible that Initiative Q is not a scam. It’s possible that they’re just a company orchestrating a brilliant viral marketing campaign. Nothing is wrong with that. PayPal, CashApp, Payoneer, offer referral programs to attract new users.

So, where the problem lies? There are so many ways to make money, especially in the crypto area. People are wasting their time on gambles like this.

Initiative Q’s affiliates promote this possible scam instead to do something that’s actually profitable. True wealth never comes by waiting for random internet companies to hand deliver you $40,000.