4 min read

(Updated November 2021)

Traders-Paradise got (and still get) a lot of emails with the questions: What is the truth about Forex trading? or Can you tell me the truth about Forex? or Tell me, please, is Forex profitable or it is a myth?

Okay, people, it’s time to tell you things that nobody will ever tell in one place.

First of all, the vast websites you visited searching for the answer to the question above, are sites with some Forex offers. Doesn’t matter if it is a brokerage, exchanges, system, signal providers, strategies, platforms. They all have one common interest: to present you only THE BEST. Their goal is to sell you their products. There is nothing bad in their goals and intentions, but you must be aware that some things will always stay covered and hidden from you. Until you build your own experiences.

We are giving you the shortcuts because all of us were struggling while we were novices in Forex trading. Actually, our struggle begins before we enter the Forex trading. Just thinking, measuring, asking, searching is struggle itself. And, still, you will find several sites or people ready to tell you the truth about Forex trading. Just because there are some characteristics to trading that the majority will never like to talk about.

And yes, those features of Forex trading are ugly. Some are evil and scary. But Traders-Paradise’s opinion is that we have to talk about everything, doesn’t matter if it is nice and affirmative or ugly and not-so-nice subjects.

We will share what we know to answer you what is the truth about Forex trading.

Just to give you a clear path to decide if Forex trading is for you or not. The benefits you already know, you can make a fortune trading Forex but we want to show you the other side of the same medal. One thing you must keep in your mind: none of us is going to tell you to give up.

Based on our personal experiences, the most common misconception is that you have to be some math geek if you want to trade Forex. Yes, it is beneficial if you can understand the math behind your trades but you don’t need to be genius for that. This has to be said, a lot of very successful traders never even started high education. Have you ever heard about some Forex trading college or university? Of course not. Because if you want to be a successful Forex trader you must have particular skills. You don’t need a diploma. Speaking about those skills, for the profitable Forex trader is more useful to be a strong personality, not to get panicked when trades go in an unexpected direction. If you are nervous and without self-confidence, then Forex trading isn’t for you.

Yes, numerous and complex trading strategies are out there.

And indicators, charts. OMG, Forex is for Nikola Tesla, not for me!

Just stay calm! The ability of self-control is more important. Forex markets are endless tension. Your nerves are what is really in a count, not your math knowledge.

Traders-Paradise will reveal you a secret. The winning traders very often practice one trading system. They learned that system, tested it on some demo account for several months, started the real Forex trades and VOILA! Their result is verified, the system is working, they have profit, so why change anything?

The other thing we would like to share with you is the fact that in Forex trading your entry and exit points are irrelevant. Sound like a blasphemy, right? Imagine us, we are laughing! Because it is the truth about Forex trading. How the mentioned points are important if you can place your trade while sitting in a restaurant with your friends or walking. All you have to do is to take your phone in your hand and start to trade, whenever you want. Sound crazy?

Wait, there are more!

We have heard so many times that humans generally are not good at trading.

The truth is that some are better.

Being a successful trader doesn’t mean that someone is naturally predisposed for that. That isn’t something the mother will give you with a birth.

What you have to do is to start thinking that you have to fight with the market. Just like in flight or fight situation. Imagine that the market wants to still all the money you placed there.

What does your brain tell you? Flight!

No, never if the Forex trading is for you. Your brain should command you – FIGHT! While you are sitting in front of your computer, you have to be the fighter. Or you will gain the loss. Whoever loses a profit, gets a loss. (That is wise, we should spread this sentence all over the world.)

When we are pushing the buttons to place our trades, actually we are pulling the triggers. On our brain’s command. And here is the trick. Our brains will send us variously commands. That’s why you must have a plan. It is a battlefield, you cannot just run around and shoot. That’s when you are afraid or you are disoriented.

To have winning trades you must have a logical plan while trading Forex. If you don’t, you are 100% losers.

One of the biggest lies about Forex trading is that some traders keep 100% successful trades.

No one can ever guarantee 100% success rate, no person and no algorithmic application

This truth about Forex trading you will find nowhere else:

Do you know how some brokers or signal providers, or strategy sellers want you to believe that they have a magic weapon for the markets? That’s a lie. They are lying to you. Trading isn’t so easy.

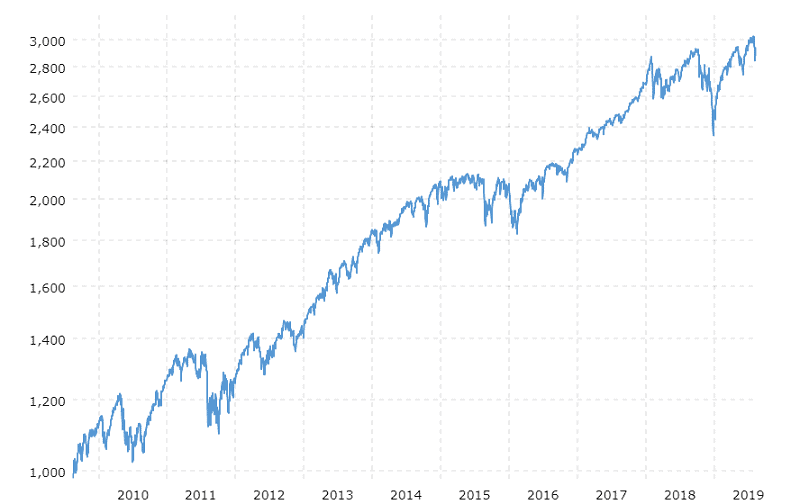

It may take years until you be able to gain a permanent profit from trading. Our aim is not to frighten you, but this is the truth. You will need months and years of analysis, testing and error corrections to be professional traders.

The biggest truth about Forex trading is that you don’t need superior software or multiple trading screen setups to be a prosperous trader. This is something that no one will tell you. Especially trading websites. All you need is a device with full access to some free charting app.

Remember, the most powerful tool in your trading armory is your brain, not trading software. Some very simple and cheap but user-friendly software can provide you more benefits than a robust one. Remember this.

Traders-Paradise revealed you the most hidden secrets about Forex trading and told you the whole truth and nothing but the truth.

Happy trading from Traders-Paradise Team!

Find us on Facebook

Follow us on Twitter

How does it work?

How does it work?