Find how to create your first trading strategy, what to look at and how it differs from investing strategy

By Guy Avtalyon

Okay, you want to create your first trading strategy and, to be honest, I understand your dilemma. You would like to be successful and you want to know, what strategy should you choose to nail it.

Listen, there!

What is the trading strategy?

A trading strategy is a set of trading settings that serve the currency trader or stock to determine whether to buy or sell a currency or stock, where to enter and exit the position. And how much capital they invest in trade, and in doing so, earn a difference in price.

The trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets.

A broker can offer you the opportunity to enter into trades that are multiple times the value of the margin that you place. The market is fluid and you can open a trade or exit from one very quickly, so there is potential to make considerable returns.

What is the investing strategy?

The investment strategy is a set of rules, behaviors, or procedures, designed to guide an investor’s selection of an investment portfolio. People have different profit objectives, and their individual skills make different tactics and strategies appropriate.

To complicated? Wait!!! There are more!

A trading strategy can be – automated (various robots for trading, etc.) – manual (the vast majority of traders use their own trading system.)

We would like to show you some of them which are successful. We will give you a brief description of 5 simple strategies that can help you to maximize your profits:

Swing trading

You can enter a successful swing trade by timing your trade. Do that when is a breakout after a consolidation.

What does this mean? A period of consolidation occurs when a currency pair moves in an almost precisely defined price range. A breakout will occur. What really happens is that the values of the currencies “breakout” the resistance level. If you predict the breakout accurately, you’ll profit from that trade.

A swing trade uses a channel trading strategy. Trades take place between the support and resistance levels of swing highs and swing lows.

Rangebound trading

Here you will need to identify a currency pair that trades within a certain range. Then, you have to identify the support and resistance levels and then time your trade by taking these movements into account.

It is likely that there will not be a big difference between the upper and lower prices of the range. Because of this reason, you could trade in one of two ways.

The first option is to trade within the range which will limit your profits as the price difference is bound to be minimal.

The second way is to look for a breakout from the range. If this happens, you will have to react quickly. You can make a quick profit, but you can lose out. When you see a “false breakout” be extremely cautious because it may mean the market is moving against you so you’ll end up in losses.

Position trading

A position trade is not a short-term trade. It is based on macroeconomic trends. It could run over weeks or months or years. Traders take a long-term position based on an understanding of how inflation or the rate at which an economy is growing, will affect the value of a currency.

If you want to adopt this strategy, you have to stay stick to two rules. First, do not use much leverage. A maximum of 10:1 is quite good in the forex trading. Secondly, the size should be relatively small. This is because you are thinking that some large movement in the relative price of the currency pair is possible.

Carry trade

A carry trade means to enter the trade that could take advantage of the interest rate differential of the two currencies. That means you will be selling a currency with a low-interest rate and buying one that provides a greater rate of interest. Normally, you would choose a currency pair where the higher interest rate currency will appreciate to the lower interest rate currency.

Carry trades can be high-risk. They are based on a combination of technical and fundamental analysis.

Momentum trading

Well, you have to know that the price constantly lies, but momentum tells the facts.

At the simplest level, you can use momentum trading when rates are going up, then you should buy and when they are declining, you should sell and maximize your profits in the forex market.

If you want to implement this strategy, you have to identify the currency pairs that show the greatest momentum and have moved most strongly. It is possible by tracking price movements over a period of several weeks.

Then trade those pairs that show the greatest momentum.

What do you need to be successful in trading?

Let’s go back to the beginning and say a few words about how for every trader is important to use a reliable and robust trading platform. You will need an Expert Advisor (EA). It allows you to conduct backtesting of your trading strategy before you commit your funds. You will need one that functions effectively on your smartphone and your tablet as well, a versatile platform that works well under Windows, MacOS, and Linux.

A system with 100% success does not exist so that you must not expect any of these systems to get your earnings each and every time. But, while following all the rules you can only end up in the plus!

How to create the first trading strategy?

New traders start to learn trading strategies from other traders. They are mirroring strategies from experienced traders. But, how do they get started with their trading strategy?

Fun fact 1: Creating your first trading strategy is easy.

Fun fact 2: Creating a profitable trading strategy is hard.

Basically, you have to follow some basic steps while formulating your first trading strategy. Building your own can be fun, easy, and surprisingly quick.

But, don’t expect your first trading strategy will make you rich.

So, what you have to do?

Recognize the real reason why you want to enter the market and have principles.

Before you start creating your own trading strategy, you must have an idea of how the market works. Most importantly, you need to answer this question.

How to make money from trading?

To answer this question you have to read and learn about both technical and fundamental analysis. Avoid get-rich-quick offers. Take care of demand and supply. Never have trust in theories that claim that people are perfectly rational.

Your principles will define your every step in the market, so it is very important to stick with it. It will need your full attention. It is an urge to follow one principle in your first trading strategy. Never choose complicated solutions. The simpler, the better. Trade by the KISS rule (Keep It Simple Stupid).

In the beginning, you don’t want to be astounded by a complex strategy. Besides, a trading strategy with more moving parts is harder to manage and improve.

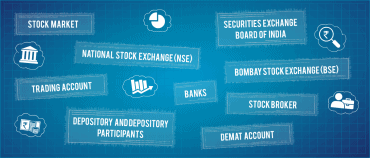

How to choose a market for first trading strategy?

What do you want to trade: Forex, Options, Futures, Equities?

If you want to trade forex, you have to understand what you are buying and selling with a currency quote. You have to learn about the different models of forex brokers. You have to know how the margin is calculated. If you want to trade equities, you must know what a share means or the difference between a blue-chip and penny stock.

There’s a lot to learn about each market but you can not start to learn until you choose your trading market. The rule of thumb is that you must understand the market you choose to trade.

Define a trading frame

Yeah, I know.

It’s not easy to decide on a trading time frame. At first, you will not know if you like more quick scalping or daily swing trading.

Maybe an idea to try intraday trading isn’t bad. You’ll be able to watch the market for long-term periods. But you have to know, when you trade fast time frames, you get fast feedback which shortens your learning period.

If you are not able to watch the market for long-term periods, start with end-of-day charts. With some effort, you can learn enough to decide if swing trading is for you.

What have you to define?

Entry trigger. – It will help you enter the market without hesitation or demur. Both, bar and candlestick patterns are useful triggers. If you prefer indicators, oscillators like the RSI and stochastics are good solutions also.

You have to plan your exit trigger. – The market can go against you, causing you limitless losses. Having a stop-loss option is crucial. You need to plan when to exit if things go wrong and also you need to plan when to exit if things do go your way. The market will not go in your favor always. That’s why you have to know when is the moment to take profits.

Take care about the position size

Set your risk limit. – Once you have your entry and exit rules sorted out, you can work on limiting risk. The basic way to do so is by position sizing. This means that for a certain trading setup, your position size determines how much money you are putting on the line. If you double your position size, and you will double your risk. You should be very careful about your position size.

And it’s time to choose a tool to determine the trend. – You don’t trade when you see a Pin Bar (shortener for ‘Pinocchio Bar,’ a single candlestick set up that clues price action traders into potential reversals in the market). Trade only when the market is rising, and you should use a bullish Pin Bar to trigger your trade. You don’t trade when you see a Gimmee Bar (price action reversal candle formation). Trade only when you conclude that the market is going sideways, and you use a Gimmee Bar to enter the market.

You have to decide on a tool to help you judge the market context, trending or not, up or down. For example, choose price action tools like swing pivots or trend lines. You can also use technical indicators like moving averages and MACD (Moving Average Convergence Divergence).

Write down your first trading plan

Write down your trading rules. – It is always good advice. Your trading strategy is still simple and you might be able to memorize the trading rules. But you must write down your trading rules. If you write down the trading plan you will get a robust and trustworthy method. Just in order to ensure discipline and consistency. It also gives you a record of your trading strategy. You will find it useful when you have to improve it.

When you have written rules, you can backtest the strategy. – When you have a discretionary trading strategy, backtesting can be an arduous process. Discretionary trading is decision-based trading where the trader decides which trades to make based on current market conditions, and system trading is rule-based trading where the trading system decides which trades to make, regardless of current conditions. So, if you have a discretionary trading strategy you need to replay the market price action and record your trades manually.

But if you have a mechanical trading strategy and a coding background, you can speed up this stage. Looking through the trades one by one is a fantastic way to develop your market instincts. This can also help you think of ways to improve your trading strategy.

Should you be worried if the first trading strategy is not profitable?

It’s okay. Your trading strategy is not fixed, it is a living thing. As your experience and knowledge grow, your trading strategy will improve. Try to avoid radical changes to your trading strategy.

Your goal is to achieve a positive expectancy with every trade. Not positive profits for each trade. Statistics have to work for you.

One thing is the most important when you create your first strategy and enter the market for the first time.

Don’t be stubborn on the market. That could be the biggest mistake.

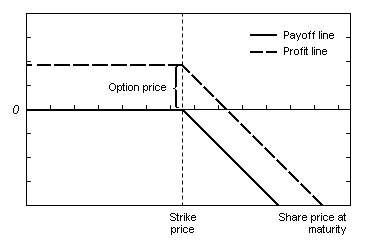

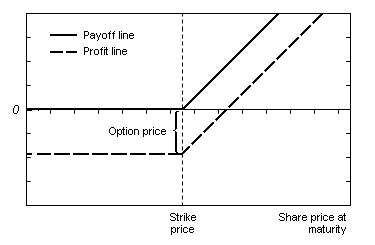

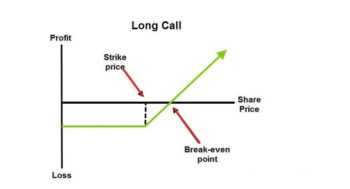

Writing or selling a call option

Writing or selling a call option P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid