The image is taken from depositphotos.com

The image is taken from depositphotos.com

By Guy Avtalyon

Investment prediction for 2019. is in front of you, so let’s start.

Investment prediction is a really tricky job. This year has been full of market volatility, climate disasters, personal data frauds, economic insecurity.

And now, in the end, we are waiting for a fresh start? Things never go in that direction. It looks that 2019 promises to be in a mess. That’s why Traders Paradise is trying to predict what will be real in the next year. And we find this, some other guys may find something different:

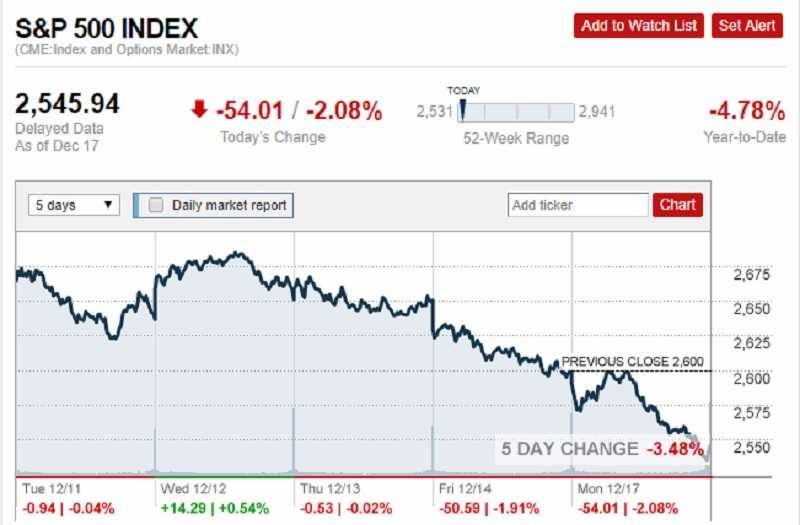

Bear market – is here

Nearly half the stocks in the S&P 500 index are in a bear market at the end of this year. They are down 20% from their highs.

The second-largest stock exchange in the world by market capitalization, NASDAQ, is officially in bear territory. If you don’t know yet how to trade- here’s our full guide.

All signs are pointing to more damage to the stocks.

Equity markets in more than 20 countries are in bear territory. Investors are worried about how bad it will be and how long it will last.

Bears are necessary and unavoidable cycles in markets and have been for centuries. But they are cruel. This will be a great theme in 2019. That is our investment prediction.

And each investor should be prepared and to diversify the portfolio.

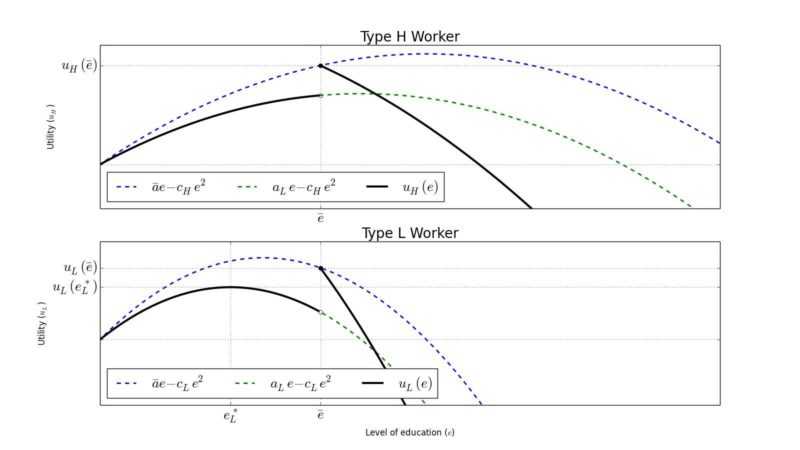

Artificial Intelligence (AI)

One investment prediction, more.

Japanese tech company Groove X introduced a robot whose task is to make people happy. The “Lovot” uses artificial intelligence. It can mimic human empathy.

This cute robot represents the revolution of artificial intelligence. “Robot” can feel emotions and communicate with people. It is 3kg tall and 43cm tall, the optical camera helps it move. And can be our new friend for $5,300. Some cost us even more.

There’s a vertiginous line of AI applications on the table right now. We expect this term will be very popular in 2019 and the list will become larger.

Obviously you can find all sort of information on the internet about machine learning and AI, like these articles on Wikipedia for example, but the concept is quite simple: You run an algorithm (there are many) on the set of data, and once the algorithm is finished, the software will know how to run by itself on new sets of data, even if it’s never been seen.

There are 2 types of algorithm methods READ HERE

Socially Responsible Investing – Impact investing

Socially responsible, or ESG investing accounts for environmental, social, and governance factors. But does not necessarily result in worse performance. There are those that think ESG investing can outperform the markets, and there are those who strongly believe the contrary. There are specific examples that will back up both sides of the argument.

People are often asking us what is a social enterprise, and we are usually answering by asking “what is social investing?”. Sometimes the phrase is social impact investing; sometimes it just impacts investing.

Impact investing carries risk, that’s true. But also it generates great returns and impact. It is smart and moreover, profitable to invest in companies that actively have positive social or environmental influences. It is a step further than divesting from negative impacts. For example, allocate your investment portfolio away from fossil fuels. Instead, use your money to consciously tackle society’s challenges. And to make a financial return, of course.

Investors’ concerns

Investors sometimes ask how much return they will have to trade-off in order to make impact investments.

Firstly, there is no “impact see-saw”. Just because a business is creating a more positive impact, that does not mean they are creating a less financial return. Indeed, in many cases, because the impact is at the heart of the business model, the more impact they create, the more profit they make, and vice versa. Some research even suggested that impact-focused businesses are more sustainable and profitable in the long-term.

In any investment, there are different levels of risk and return and there are also different levels of impact. An impact investment may be riskier. It has high returns and high impact. Or, it could be less risky since it brings market-rate returns and significant social or environmental impact.

As with any investment, it depends on the business or the fund.

The statistic shows that 89% of investors making impact investments find these are meeting their return expectations, and 54% of investors are targeting market-rate or above market-rate returns.

There are many ways to get involved in impact investing. Crowdfunding has even helped retail investors, who have less risk capital, to get involved in this space.

Generally, our investment prediction that this kind of investment will be more popular in the next year.

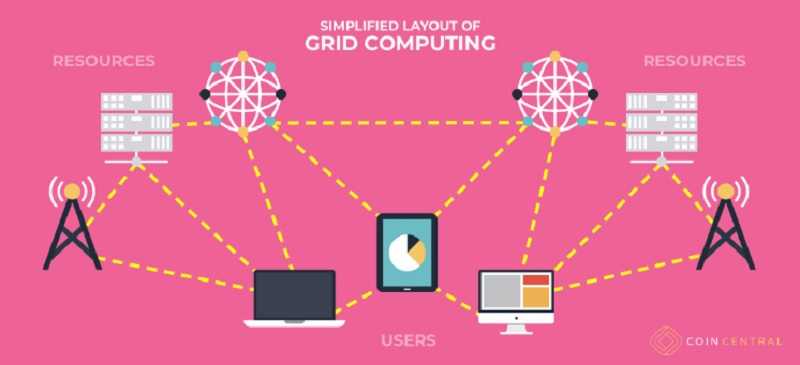

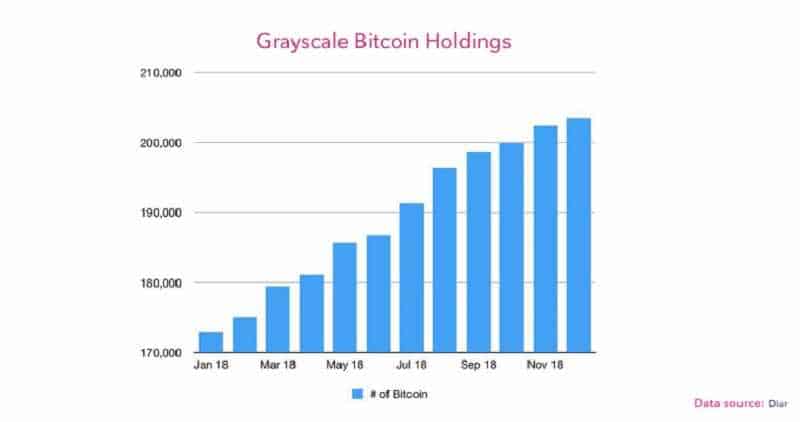

Blockchain

Traders Paradise’s investment prediction is this will be one of the most popular terms in 2019.

Blockchain technology provides a way to make transactions and transfers online without the use of an intermediary. Instead of trusting a third party to keep the transaction history safe and accurate, blockchain technology lets you seal “pages” of transactions with a key code for security.

One of the most relevant reasons that many companies are adopting blockchain technology is efficiency. We can all realize how exchanges can become quicker. And simpler too, when they don’t have to go through a third party. It’s also beginning to move document authentication toward obsolescence, removing a step in the translational process.

How To Make Money With Blockchain Technology READ THIS TOO:

Blockchain technology can also make companies feel like their information is safer and more secure. In an age where hacking banks cannot always resist off attempts to attack people’s financial privacy. Therefore, blockchain technology is a way to feel a greater sense of control over transactions.

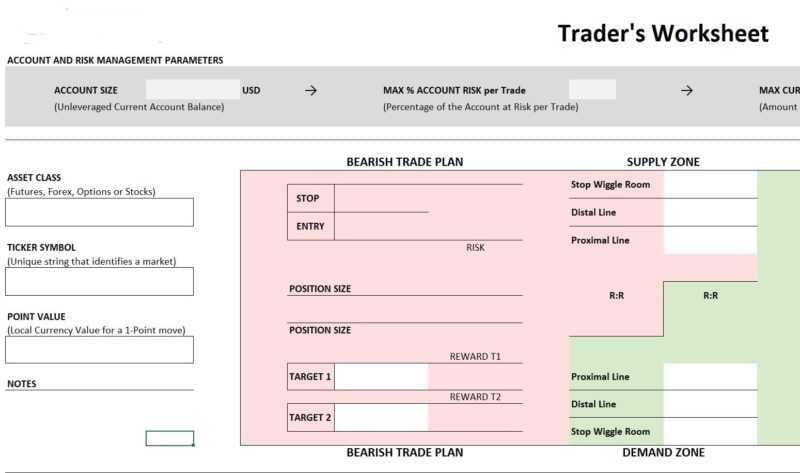

Short Selling

Many experienced investors think that short selling has an important part in the markets. It improves price discovery and rational capital allocation. At the same time, prevents financial bubbles and finding fraud.

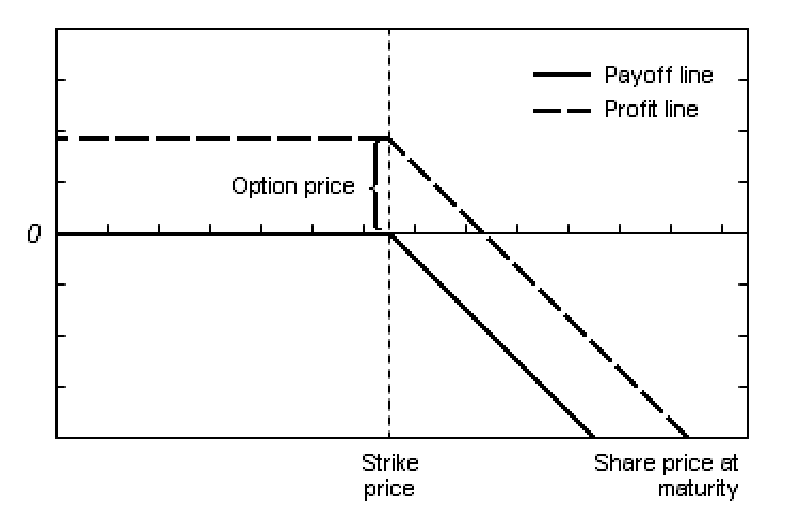

Shorting is a trading strategy where traders are selling a borrowed stock with a belief that it will drop in value. So, they can buy it back later at a lower price. Academic research has shown the stocks of companies that complain about short-sellers tend to falter.

Investment prediction can be an ungrateful job

This term is already hot. Let’s show how much on the example of TESLA.

It is a stressful time to be an investor in Tesla, of course. On September 29th shares in the electric-car manufacturer soared by 17% after its boss, Elon Musk, settled fraud charges with America’s Securities and Exchange Commission (SEC). Just days later, on October 4th, a series of belligerent tweets by the firm ’s founder sent shares tumbling by more than 7%.

You might be interested Apple is charging its batteries with Tesla’s employees

The tweets in question were targeted at short-sellers, who aim to make money by selling borrowed shares and buying them back later at a lower price. With a quarter of its publicly traded shares lent out to facilitate short-sellers’ bets, Tesla is one of the most heavily shorted companies in America. Elon Musk has publicly feuded with short-sellers for years, calling them “haters”, “jerks” and “not super smart”. Research suggests that such insults are undeserved. Short-sellers are savvy investors who help to keep the market’s exuberance in check.

So, Traders Paradise believes that short-selling may continue in the next year. The bear market just started.

So, think about this investment prediction.

Unlike Amazon stock – which we truly believe will rise and get to new highs.

Our investment predictions are based on personal research and act as an observation about what we all can expect in the coming year. But we have to admit, nothing good. We hope we are wrong.

Anyway, we wish you a healthy, happy, and fruitful new year! You can have it!

This is not something you can do over the weekend and let run happily ever after.

This is not something you can do over the weekend and let run happily ever after.

What are the benefits and disadvantages of this trading style? All explained.

What are the benefits and disadvantages of this trading style? All explained.