MACD is one of the most popular indicators used among traders. It helps identify the trends direction, its speed, and its velocity of change.

MACD is short for “Moving Average Convergence Divergence.” It is a valuable tool. Traders know how important it is to use MACD as an indicator. Also, how reliable is using this tool in trading strategies. But that can wait for a while, firstly, let’s explain what is Moving Average Convergence Divergence or shorter MACD.

It is a trend-following momentum indicator that presents the correlation between two moving averages of a stocks’ price or in some other assets. We can calculate the MACD, it is quite simple.

Just subtract the 26-period EMA from the 12-period EMA. EMA is an Exponential moving average.

Here is the formula:

MACD = 12-period EMA − 26-period EMA

The 26-period EMA is a long-term EMA, while 12-period EMA is a short-term EMA.

If you need more explanation about EMA, let’s say that the exponential moving average or EMA is a type of MA, moving average. EMA puts more weight and importance on the most recent or current data points. That’s why the EMA is also referred to as the exponentially weighted moving average.

The result we get by using the calculation is the MACD line.

The MACD is useful to identify MAs that are showing a new trend, no matter if it is bullish or bearish. But it’s the priority in trading, right? Finding the trends has a great impact on your account since that is the place where you can earn money.

To recognize the trend you will need to calculate MACD as we show you, but you will need the MACD signal line, which is a 9-period EMA of the MACD and MACD histogram that is calculated:

MACD histogram = MACD – MACD signal line

The main method of reading the MACD is with moving average crossovers. When the 12-period EMA crosses over the longer-term 26-period EMA pay attention since the possible buy signal is generated.

You can buy the stocks or other assets when the MACD crosses above its signal line.

The selling signal is when the MACD crosses below this line.

MACD indicators are interpreted in many ways, but the general methods are divergences, crossovers, and rapid rises/falls.

How the MACD indicator works

When MACD is above zero is recognized as bullish, but when it is below zero it is bearish. If MACD returns up from below zero it is bullish. Consequently, when it goes down from above zero it is bearish. When the MACD line crosses more below the zero lines the signal is stronger. Also, when the MACD line passes more above the zero lines the signal is stronger.

The MACD can go zig-zag, it will whipsaw, the line will cross back and forward over the signal line. Traders who use this indicator don’t trade in these circumstances because the risk is too high. To avoid losses they usually don’t enter the positions or close them. The point is to reduce volatility inside the portfolio.

The divergence between the MACD and the price movement is a more powerful signal when it verifies the crossover signals.

Is it reliable in trading strategies?

MACD is one of the most-used technical indicators. It is a leading and lagging indicator at the same time. So it is versatile and multifunctional, so being that it is very useful for traders. But one feature of this indicator is maybe more important. The indicator has the ability to identify price trends and direction, and forecast momentum, but it isn’t complex. It is pretty simple, so it is suitable for beginners and elite traders to easily come to the result of the analysis. That is the reason why many traders view MACD as one of the most reliable technical tools.

Well, this tool isn’t quite helpful for intraday trading but can be used to daily, weekly or monthly charts.

There are many trading strategies based on MACD but basic strategy employs a two-moving-averages method. One 12-period and one 26-period, along with a 9-day EMA that assists to deliver clear trading signals.

Operating the MACD

As we said, it is a versatile trading tool and the indicator is strong enough to stand alone. But traders cannot rely on this single indicator for predictions. They have to use some other indicators along with MACD to ramp-up success in forecasting. It works great when traders need to identify trend strength or stock’s direction.

If you need to identify the strength of the trends or stocks direction, overlapping their moving averages lines onto the MACD histogram is really helpful. MACD can be observed as a histogram alone, also.

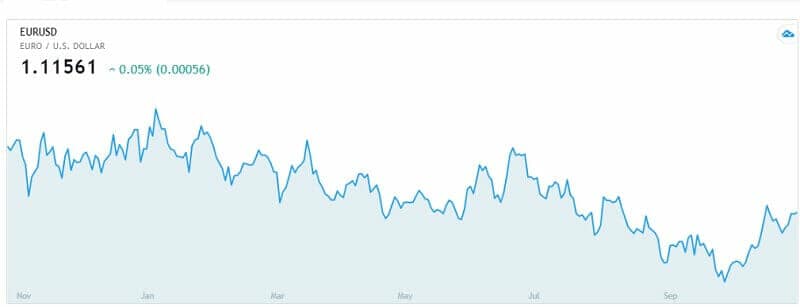

How to Trade Forex Using MACD Indicator

If we know there are 2 moving averages with diverse speeds, we can understand the more active one or faster will react quicker to price change than the slower MA.

So, what will happen when a new trend occurs?

The faster lines will act first and ultimately cross the slower ones and continue to diverge from the slower ones. Simply, they will move away. When you see that in the charts, you can be pretty sure the new trend is formed.

When you see that the fast line passed under the slow line, that is a new downtrend. Don’t think something is wrong if you cannot see the histogram when the lines crossed. It is absolutely normal since the difference between the lines at the moment of the cross is zero.

The histogram will appear bigger as the downtrend starts and the faster line moves away from the slower line. That is an indication of a strong trend

For example, you trade EUR/USD pairs and the faster line crossed above the slower and the histogram isn’t visible. This hints that the downtrend could reverse. So, EUR/USD starts to go up because the new uptrend is created.

But be careful, MACD moving averages are lagging behind price since it is just an average of historical prices. But there is just a bit of a lag. It is not enough for MACD not to be one of the favorites for many traders.

More about MACD

As you can see, the MACD is all concerning the convergence and divergence of the two moving averages. Convergence happens when the moving averages go towards each other. Divergence happens when the moving averages go away from each other. The 12-day moving average is faster and affects the most of MACD movements. The 26-day moving average is slower and less active on price changes.

MACD was developed by Gerald Appel in the late ’70s. It is one of the simplest and most useful momentum indicators that you could find. The MACD utilizes two trend-following indicators, moving averages, turning them into a momentum oscillator. So it provides traders to follow trend and momentum. But the MACD is not especially useful for recognizing overbought and oversold levels.

Bottom line

The MACD indicator is unique because it takes together momentum and trend in one indicator. This special combination can be used to daily, weekly or monthly charts. The usual setting for MACD is the difference between the 12-period and 26-period EMAs. You can try a shorter short-term moving average and a longer long-term moving average to have more sensitivity and more frequent signal line crossovers.

The drawback of MACD is that it isn’t able to identify overbought and oversold levels since it does not have an upper or lower limit to connect these movements. For example, over sharp moves, the MACD can continue to over-extend exceeding its historical heights. Moreover, always keep in mind how the MACD is calculated. We are using the current difference among two moving averages, meaning the MACD values depend on the price of the underlying asset.

So, it isn’t possible to relate MACD values for a group of securities with differing prices.

Some traders will use only on the acceleration part of MACD, some will prefer to have both parts in order.

The one is sure, MACD is a versatile indicator and every trader should have it as part of the tool kit.

How does it work?

How does it work?