Guy Avtalyon, data analyst

* What is bitcoin and why does it keep rising

* The technology behind bitcoin and its uses

* What is the difference between “trading” in bitcoin and “investing” in bitcoin time and strategies

In this article I’m going to teach you how to trade in bitcoin and ethereum.

Real profit is money in your pocket, not on some address on some internet page

- How to avoid massive drops in prices which will end up with losing your money?

And how to build your own trading budget Using a unique method I invented and improved over the years (The BBB Method).

You will also see how I almost DOUBLED my virtual money during the recordings for this tutorial.

I want to start this tutorial with some warnings and risk disclosure:

IT’S NOT EASY MONEY. THERE IS NO SUCH THING AS EASY MONEY!

But as you are about to see…

There’s a current opportunity and we can take advantage of it on time?

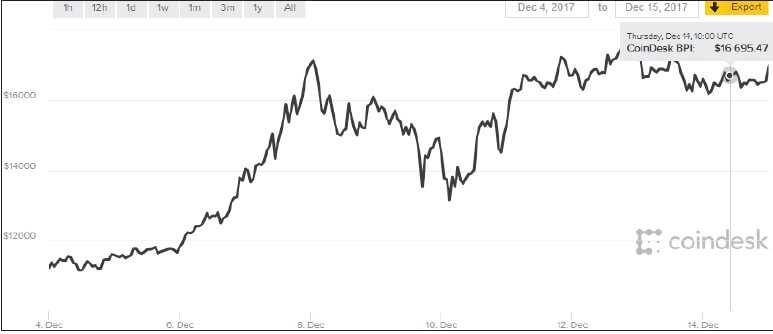

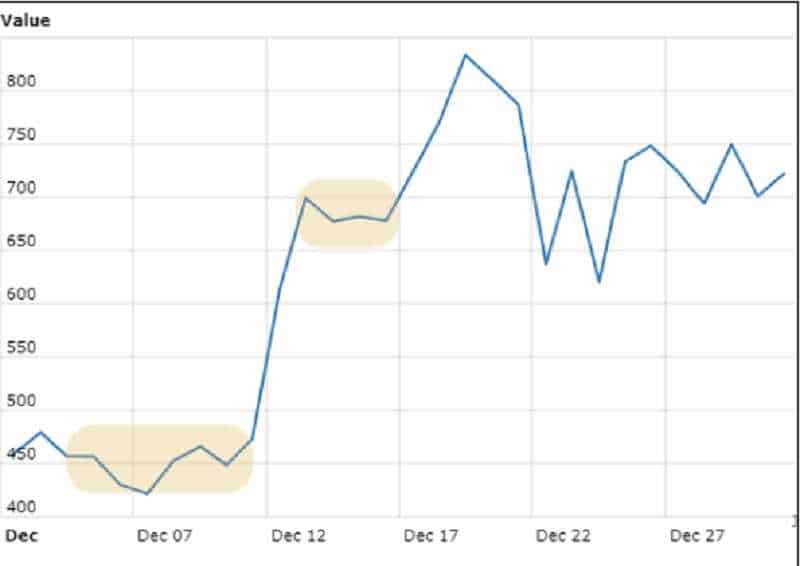

This is how trading in Bitcoin with a good strategy and risk management should look like:

This tutorial is about to show you how to:

- Trade in Bitcoin successfully

- Withdraw and save your profits for a better night’s sleep

- Come up with a smart Trading Strategy that can both profit & save us from massive drops and strong changes in the price

Sounds imaginary, right? Like I’m making it up. It’s not.

AND YOU WILL SEE EVERYTHING RIGHT NOW!

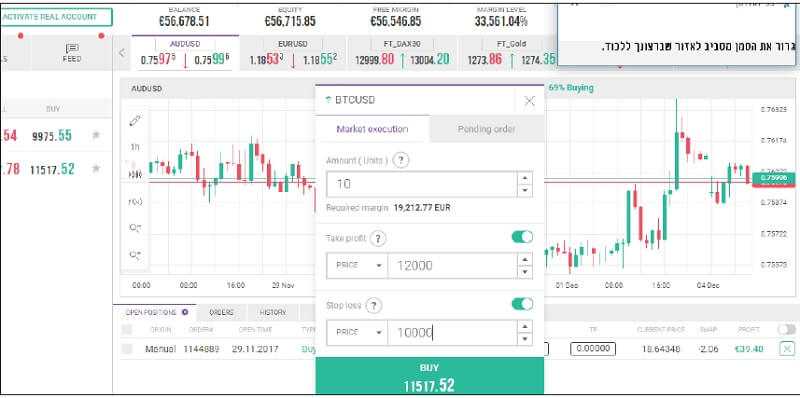

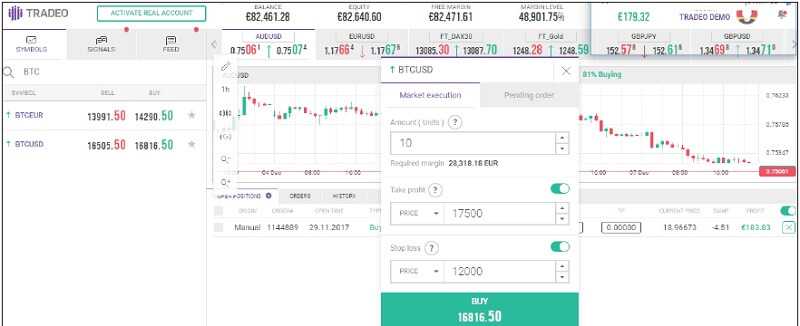

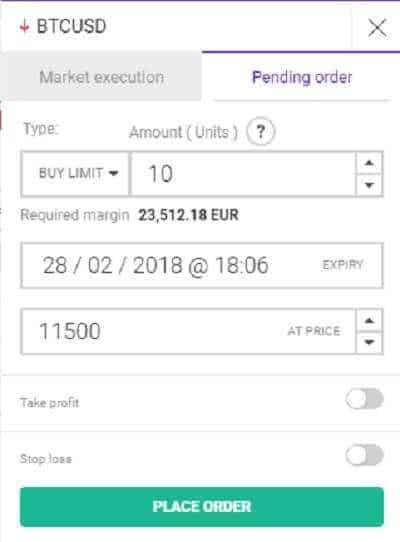

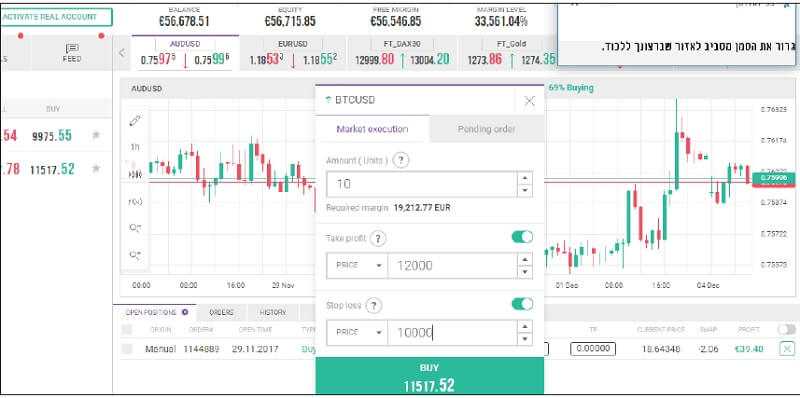

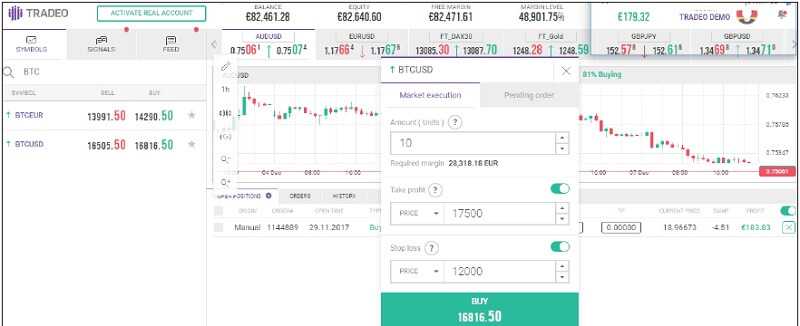

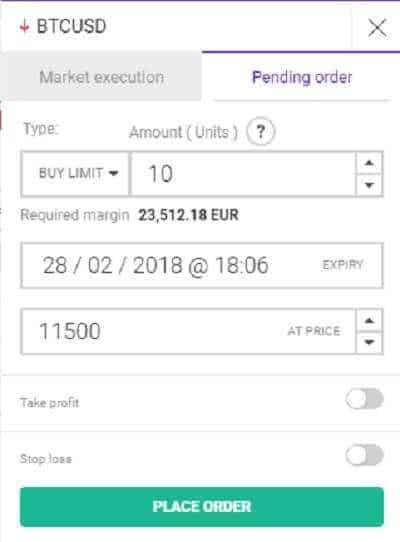

This is an example of a position where I buy bitcoin through my broker. I don’t own real bitcoin, I trade on its price while other people hold it:

After 2 hours = 1700 richer. I can live with that.

I entered a ‘long position’ (means I think the price will rise) and just two hours later I’m 1,700 EUR richer, but it’s only paper money for now, NOT realized… Not in our pocket yet. Nice to look at but don’t be fooled – Our money has to be realized (changed back from BTC to Euro or Dollar) so we can make REAL profits.

ENTERING POSITION

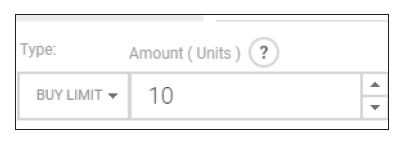

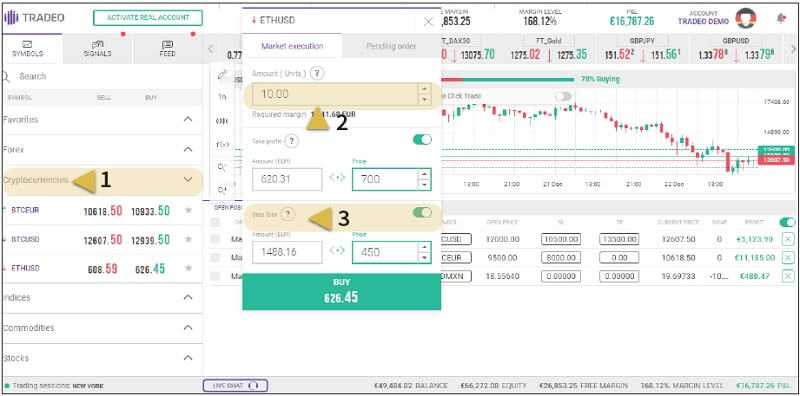

Take a look at the entering position screen:

(explanation below)

Here’s a full explanation of the image above:

Market execution means the position will start immediately at any given market price (the price it’s being traded for at this moment). We use this option most of the time. A pending order is when we want the system to automatically execute a position once it reaches a specific price we entered earlier. We use it only to control massive price drops.

For example, we’ll see later how this strategy took care of a 45% drop in Bitcoin’s price (!) that happened in the span of just two hours. (Date – 22.12.2017).

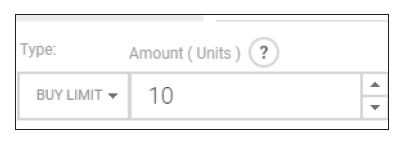

Amount – you can use as much as you want from 0.01 to 10, depending on your margin money, which is the amount of funds the broker lets you trade on. I chose the maximum at this point.

Take profit and stop loss – Always turn them on by clicking on the “switch on” button (yellow/orange arrow)

How to use those extremely important features will be explained further on.

Monetizing Bitcoin – Now the math:

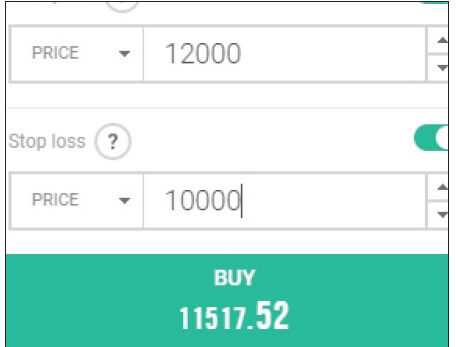

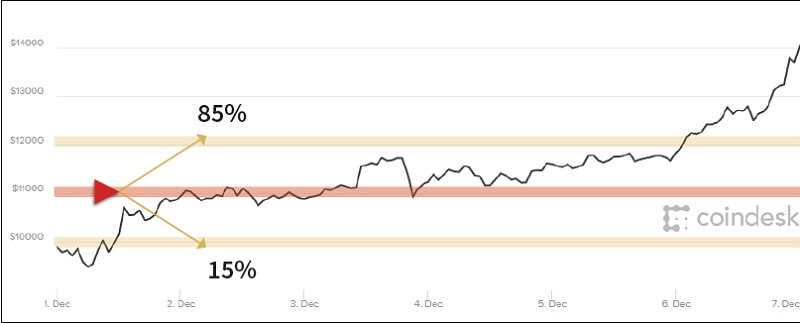

There is, for now, and at this moment, a more than 85% chance for the price to rise at any given point (Classic bubble behavior, if you ask me).

Although the price will rise before it falls, we’ll see later that drops WILL happen, and we need to know that for a FACT!

For that reason, our strategy is based on three layers, and our positions on every layer will be calculated based on how much our ‘Risk Management Budget’ allows us. (How to calculate the RMB – later on).

First layer:

Description: Fast, surer, and smaller profits.

Typically characterized by brief periods of time. Our goal is to realize as much money as we can, and this layer is designed especially for that.

Second layer:

Description: Higher profits with a bit more risk. As the chances of Bitcoin to rise stay this high, we need this layer to give us higher profit margins for the drop that will surely happen.

We use this strategy only when we have indications that Bitcoin’s price is bottomed and there’s an opportunity to “buy low”.

Those indications can be viewed in these two ways:

- Finding resistance lines using Bitcoin charts and technical analysis. A post specially designed to explore how to interpret these charts will be available on my blog (want to know when it comes out?+link).

- Following BTC news, testing theories and see what works and what doesn’t.

I use them both. I use them to make an educated guess whether or not it’s time to buy or to sell. And as you can easily see – IT WORKS!

(I send my analysis to my readers every once in a while. If you want to get it too – click here)

Third layer:

Description: The anti-drop mechanism

Last, but not least, the third layer. The important one. This layer is designed to CATCH the rise after big drops.

Because of the simple principle that says we can’t anticipate nor can we predict future prices, we have to be ready for every situation.

In case study #3 I will further explain how I used this layer to maximize my profit after the big drop that took place two weeks later!

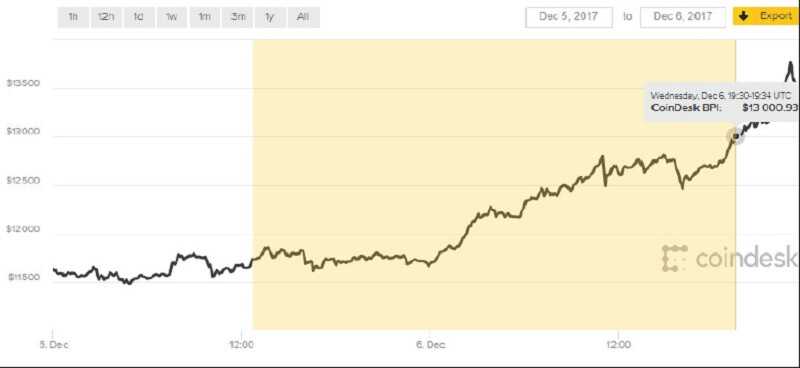

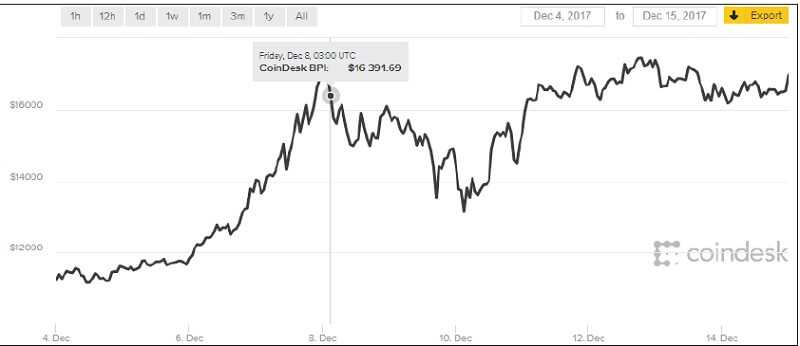

Monetizing Bitcoin – CASE STUDY #1

Small profits – First layer

1: Write BTC in search on the left side of the screen

2: Symbol: BTCEUR = Bitcoin to Euro / BRCUSD = Bitcoin to US Dollar

The main reason this is important is that some people trade only with Euros (from Europe for example) and vice versa.

Since the price is always determined by people, and people are guided and motivated by psychology and the “Joy” (or satisfaction or whatever) for nice, round and even numbers it must also be treated in our calculated opinion.

3: Sell and buy

Let’s look at the USD:

We can see the sell 11,257 and buy 11,517. This means if I buy now, at market price, the price I will pay will be 11,517 USD for 1 BTC.

If for any reason, I decide to sell it immediately, the price I will get back will be 11,257, or in other words, I will be losing $260.

This is called a Spread.

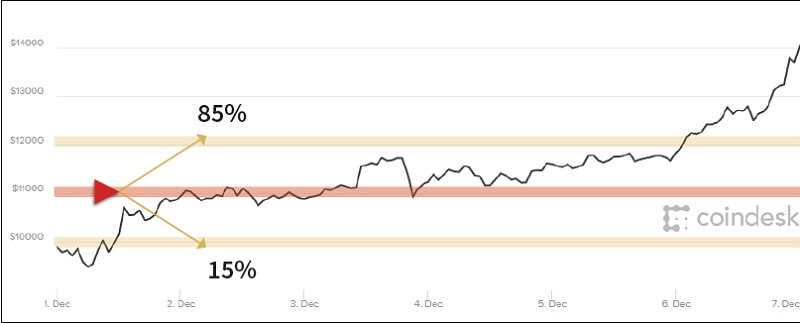

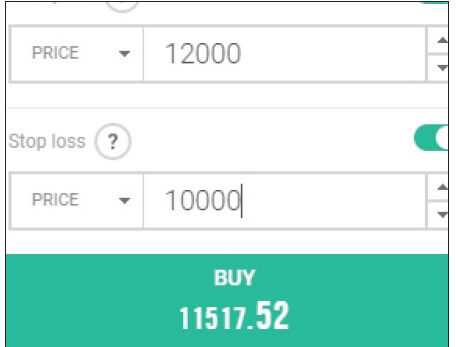

So, when I buy at 11,517 and use this strategy of:

Take Profit – 12,000 Stop Loss – 10,000

(This means that if and when the price reaches 12K the system will automatically exit the position for us at a profit. If price first drops to the 10K line – the system will close our position, but with a loss).

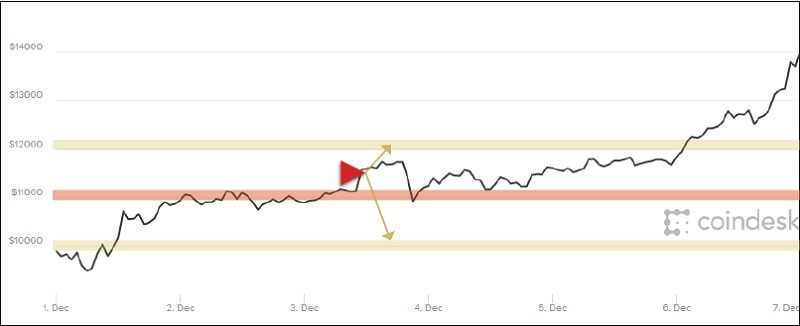

I am currently where the yellow marker is, and I put the take profit and stop loss lines as explained in the image. See the yellow marker is closer to the take profit line? This means it has better chances of reaching the take profit line before it reaches the stop loss line. This is the game – what happens first!!!

For price 11,517 = Take profit needs about $500 more to exit in profit or $1500 drop to lose. Or in math way to describe them – 1 to 3 (25%).

Take a closer look at this image again: The RED line is exactly in the middle between those two yellow lines. And the odds are mentioned:

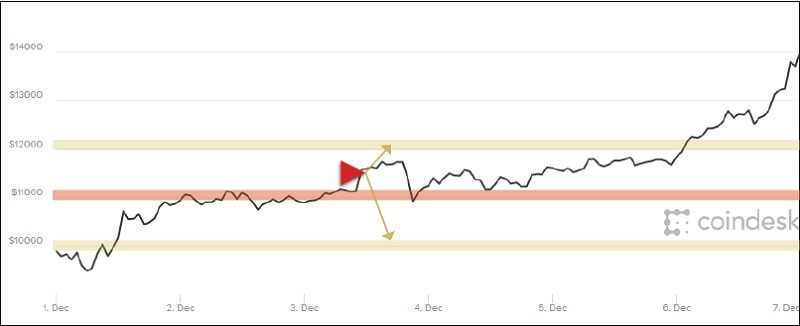

But, since 85% chance isn’t enough, I wait for the price to rise a bit, and enter the red triangle in the next image:

I immediately gain a statistical advantage that brings my success opportunity to more than 90% chance of winning.

AND AS YOU CAN SEE, THIS 90% CHANCE DOES NOT LET ME DOWN.

This is how it looked when I entered that position. At first, I’m in RED (in the circle) and that means I’m currently in “losing”. But that’s because we have to wait for the spread to close and then we’ll start being in the green (profit).

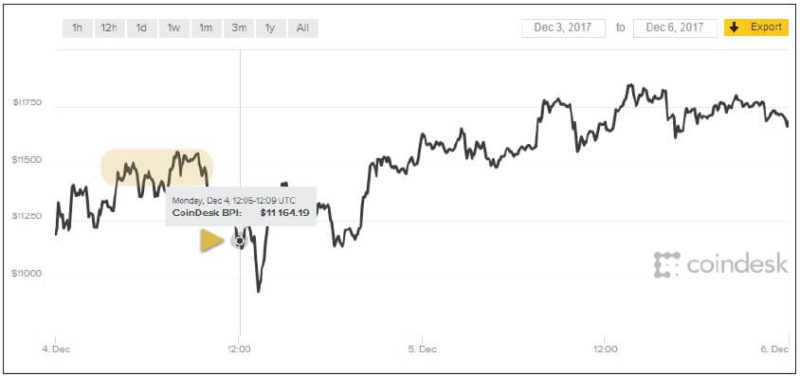

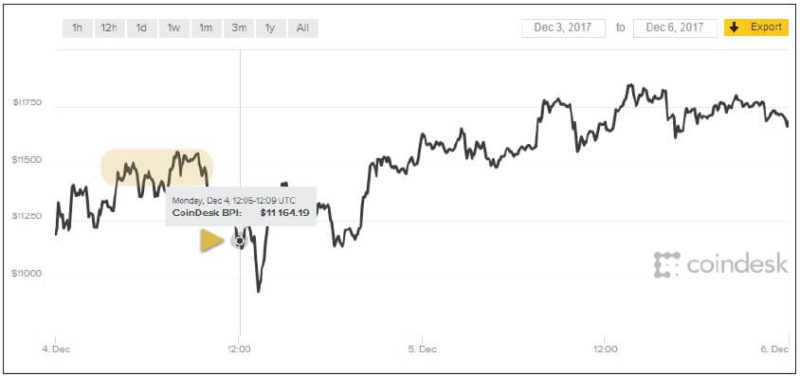

We can see in this chart what happened in the few hours leading up to my entry point and following it:

You see it stayed a while around 11,500 lines (in the yellow area?)

So, when it dropped a bit I bought (Yellow Arrow). But what happened next, I had no way to predict…

It continued dropping!

BUT…

Luckily my strategy lines had a tolerance to this small drop and from that point, it kept rising. After less than a day: (still negative, but less…)

I also measure the time the position takes. If it takes longer than regular then it means that we are currently around the resisting lines.

It’s very important to know that and this will help us out with further layers.

A few more hours in and it goes green for the first time! One step more to monetizing Bitcoin.

And it only took a few more hours for this position to finally automatically close with 4K profit:

You can see in the history tab all recently closed positions.

This position took about two days and was a bit longer than the average of 1.5 days position, and this is how it finished:

Open price 11,472 (on previous images you could see it was a bit different number. That’s because by the time it took me to capture the screen and save it), TP (take profit) exited for me at 04:23 am in the morning! If it wasn’t automatic I would have never had the chance to do it on time.

And a profit of €4,459. Not bad for 2 days of not working and with a budget of only 19,000 EUR.

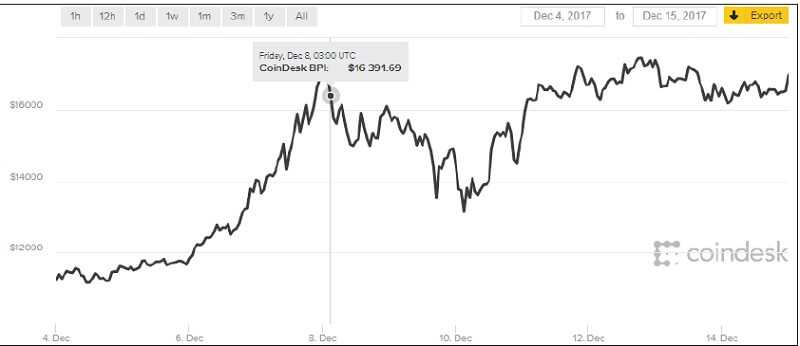

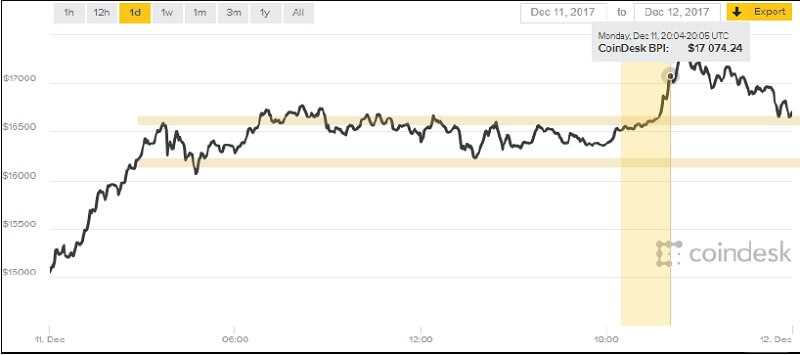

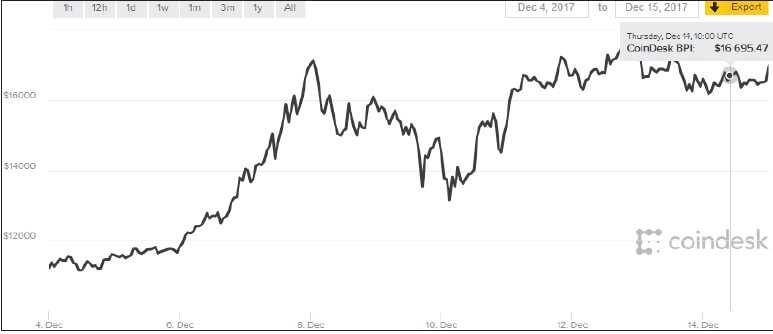

Monetizing Bitcoin – CASE STUDY #2

Further steps to monetizing Bitcoin. This strategy was easy. I showed in Case Study #1 that 12K is a strong line, so I put it for the stop-loss parameter. The TP line is very near, and this doesn’t need to take long…

BUT….

IT TOOK A WEEK!

I entered here:

And exited here:

You can see I entered at a peak!

This is also very good because that shows me the lines are around 17,000 and 12,000. That’s very interesting for us.

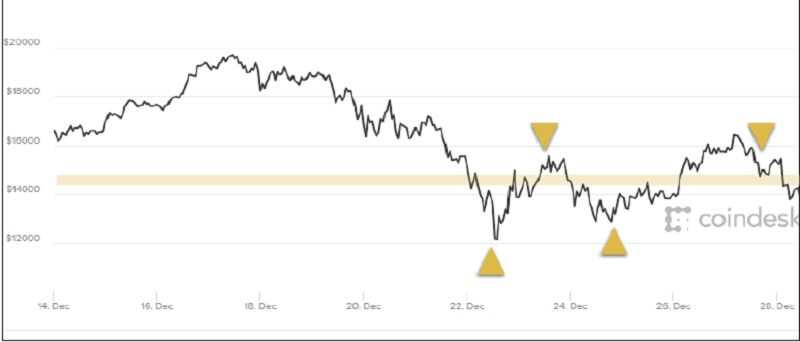

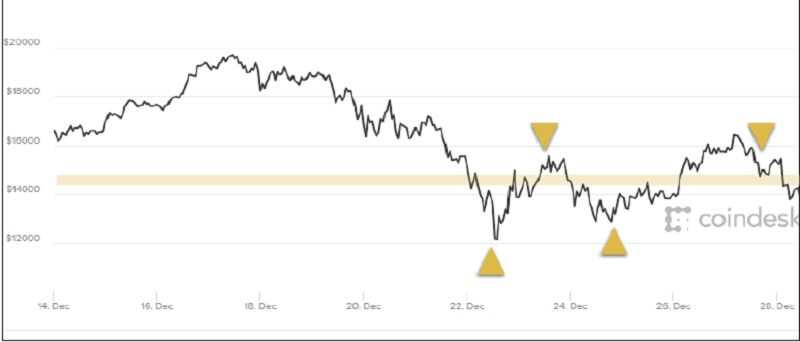

The exact middle point (14,500) is a strong point and that means every time it drops beneath it – we know it will reach and bounce back again most of the times.

And we can see it here:

You can see this chart that was 2 weeks later than the position you just saw!

You can see that I knew what would happen in the near future!!!

(Yellow line is about 14,500 and the arrows show that it keeps getting back there)

Those are things we must KNOW and this what this tutorial is all about.

NOW,

Let’s go back to our position:

It took us a week as you can see in the following image:

Here you see the Order number (yellow circle)

Even though I entered and exited a few more positions during that time, I decided to manually close this position and not wait until it reaches TP point.

In the end, as you can see (yellow circle and arrow)

Close price was at 16,830 which gave me smaller profit, but since I know now that 17,000 is a hard line to pass, I got out and I will wait for it to drop a bit before I enter again.

You can also see profits from the same week, and note that the average time is 1-2 days. If it takes longer – we must understand where we are.

Monetizing Bitcoin – CASE STUDY #3

After we saw how to make what we can call “easy money” we look at the other side. The losing money side.

Drops will happen and most of the time, if your strategies are good, you won’t even notice them.

BUT…

Every once in a while, there’s a massive drop, in a short period of time. Those are our enemies.

On Friday, December 22, 2017, there was a massive price drop. In two hours, the price lost 45% of its value(!!)

That day I lost 40K of profits. And many lost all their money. Searching Google shows 10,700 results from that DREADFUL day. (Following image)

BUT,

The anti-price-drop strategy proves to be very efficient. Because I got all of it back with more!!!!!

HOW DID I DO IT?

Remember I told you about the 12,000 as a limit line? And I told you about the option to give the system buying order only when it reaches a certain point?

So that’s what I did:

I simply created a pending order for a few months ahead.

This means that if price drops beneath 11500 (which is minus 500 from the 12K line we saw earlier) I automatically buy at this price.

I did it with the BTCEUR symbol so I wouldn’t get confused.

This means I used layers 1+2 with the BTC to USD position and BTC to EUR on layer 3, the anti-drop layers.

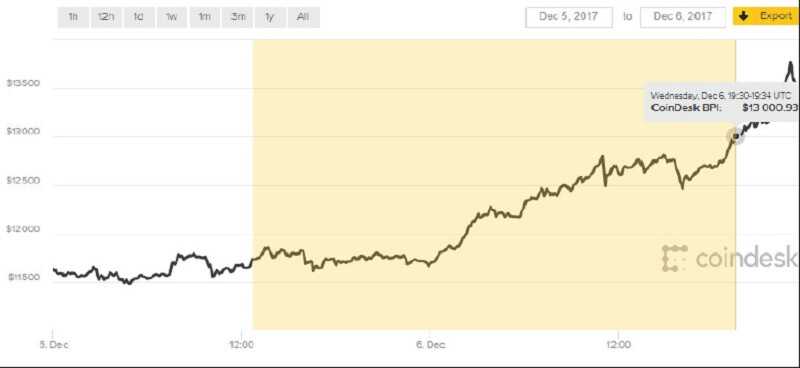

What happened that dreadful day: The price dropped from $13000 to $9000 (yellow circle)

So I put the pending order at approx. price 11900 (blue arrow) and when it dropped to 9,500 (black circle) the system automatically filled my request and bought BTCEUR

And just a few hours later

20K PROFIT!

SWEET!

IT WASN’T OVER!

Few more hours passed, and I was back at the point I was before the massive drop:

Pretty nice, isn’t it?

Monetizing Bitcoin – CASE STUDY #4

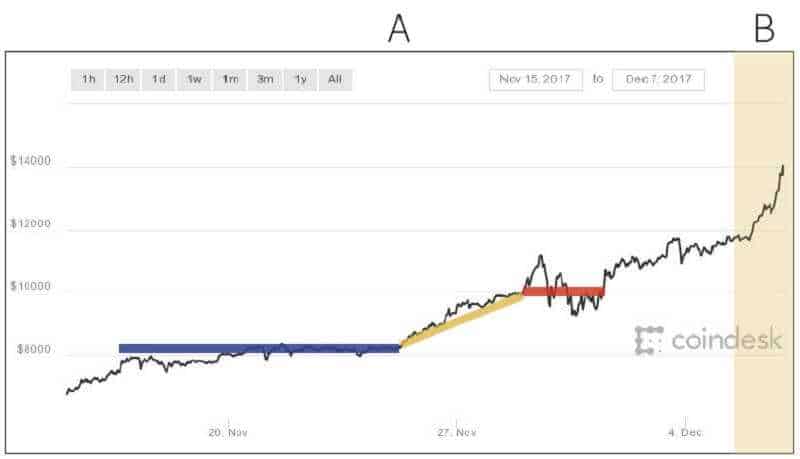

Before I show you the results of this position, I want to show you what I measured and analyzed and how it affected my decision.

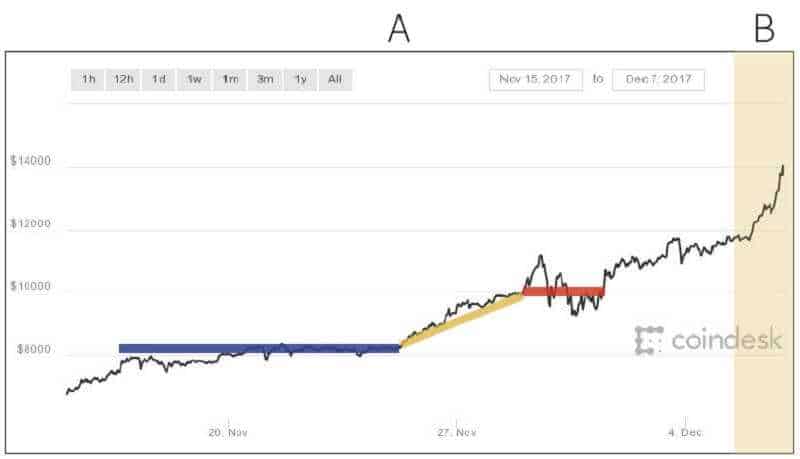

This chart (A) is what I saw before entering the position, and Chart B is the position itself.

You see that almost half of the time the price is around the $8000 line, right? (Big blue line…) Then, it skips $9000, straight to $10000 (Yellow line)

Now, if you were at this point of time and saw it going over $11000 and then $11500 you could have believed it’s now about to reach $12000…

BUT…

As I keep teaching my students, at this time there are people who bought at $8000, and we saw it spent A LOT of time on that line (blue line), so they will realize their Bitcoin! Remember?

That’s what WE ARE DOING!

Trying to realize funds… And as this is the best strategy out there, we have every reason to believe many more people do the same.

So that’s why we see it moving around the $10000 line (Red line) for few more days and then when it popped the $11500 line again, I entered at $11750.

My strategy was:

TP (Take Profit): 13,000 SL (Stop Loss): 10,000

There was a chance it will get back to 10K. I know. But I wanted it to end as soon as possible…

This is the position (Marked in yellow fill):

See the nice 10K profit!

It did end up higher later on, and if I were to put TP at 15,000 it would probably end up in approx. 30K profit right into my pocket, but this was a layer one – easy and small profits for short periods of time.

WE CAN NEVER REGRET OUR STRATEGIES.

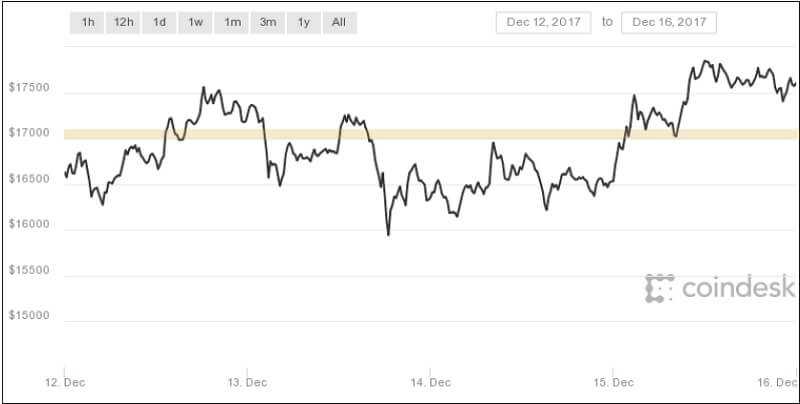

Monetizing Bitcoin – CASE STUDY #5

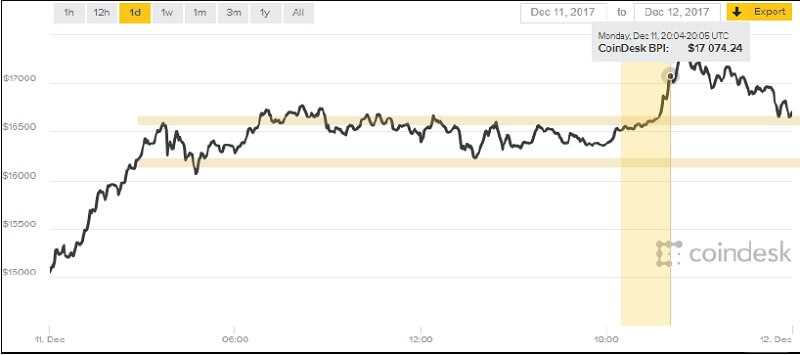

One of the best trades I did! (Marked in yellow fill)

And that’s the profit I ended up with (€4,137.14).

But how did I know when to enter??

I saw it staying on 16,500 lines and bounce back, never reaching 17,000 nor 16,000 (yellow lines) So when it reached 16,500 after few hours…

I entered this position:

TP: 17,000

SL: 16,000

Where it’s an 85% chance of winning, but I also measured time so…

When it ended after just a few hours, I knew 17,000 is a good line and in the near future, the price would touch this line a few more times.

NOTICE: I didn’t know if it would rise above that line.

BUT (!!)

I know some people are willing to pay $17,000 for 1 Bitcoin – and that tells me a LOT.

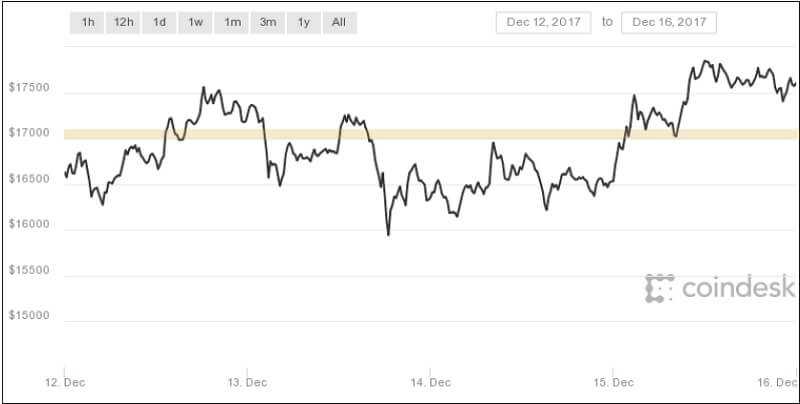

This chart shows 4 days after the position and my conclusion:

The yellow line shows the 17,000 lines, and how the price kept “touching” it.

A good strategy was: Pending order

Enter at 16,000

TP: 17,000

SL: 15,000

But a better strategy was:

Enter at 16,500

TP: 17,000

SL: 15,000

Why was that a better strategy? Three reasons:

- The price moved around 16,500 a lot more than 16000. This raised our chances of catching something at all…

- Since the distance the price has to go in order to reach TP point is way lower than the SL point, the chances of it reaching our stopping point before reaching profit point drop exponentially.

- It happened a few times, so potentially we could have profited from the same rise in price a few times!

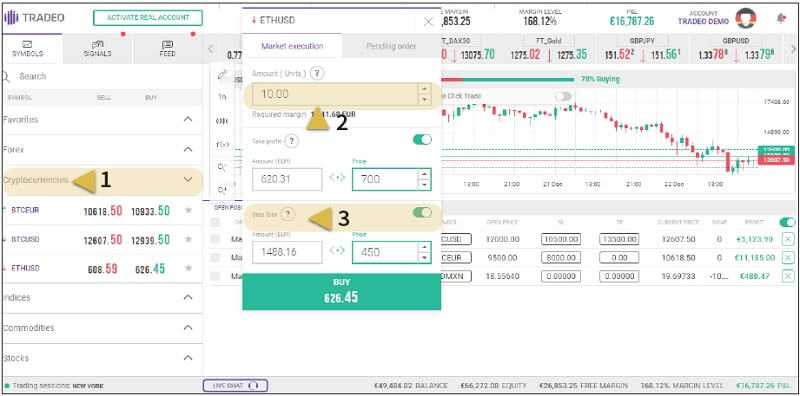

Monetizing Bitcoin – CASE STUDY #6

Buying Ethereum

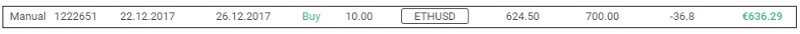

This is a way to show you that you can also trade Ethereum using the same principles and profit:

- Under Cryptocurrencies see ETHUSD

- In the amount window, we can buy only 10 units (like Bitcoin). I don’t know why it is but that’s a fact. That’s why I prefer trading Bitcoin for higher profits…

- The strategy I created: See the following image:

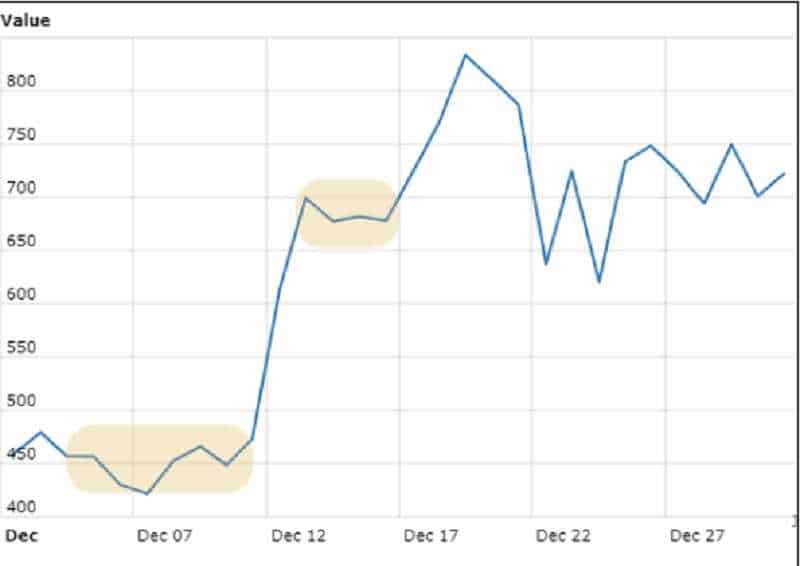

This is a chart from two weeks before my position:

That was easy. See it reached over $ 800?

So it means there are people who believe it’s worth that much…

So when it was down at about $650 I bought with this strategy (Also in the previous image where I got lucky and the price kept dropping so I ended up buying in about $625)

Strategy:

TP: 700

SL: 450

Why 700 – because that’s a price it already spent time on (Green circle) so it will probably reach there again.

Why 450 – Because it’s also where it spent time, and if it drops beneath I wouldn’t want to be around there… (Red circle)

All in all, after 4 days – a nice profit of 636 EUR…

You can copy this method to other cryptocurrencies.

HOW TO CREATE A GOOD STRATEGY BUDGET FOR Monetizing Bitcoin

OKAY, THIS IS THE MOST IMPORTANT STEP. AND… IT’S REALLY EASY!

The formula I’m about to show you will save you a lot of time:

How to invest your money wisely on strategies:

You’re probably looking for a simple solution like:

30 % Layer one 40 % Layer two 30 % Layer three

And you are not all that mistaken,

BUT…

It’s a bit more complicated than that because it HAS to be dynamic.

So I developed a method for Trading in Bitcoin. I call it Bubble Bubble Boom (the BBB Method) and it’s so simple it’s almost a crime not to share it with others…

HERE IT IS:

For every position, we risk no more than 50% of our Balance.

If there’s a loss (it will happen 15% of the time) – We stop all trades and start building our Layer three strategy.

Since strategy in layer three is Pending Order we again risk only 50% of the balance. If it’s a win – we continue normally

If it’s a lose – We stop all Bitcoin trades and wait 2-3 weeks to see developments over the media Overall, we allow only 2 stops before we take this down for a few weeks for reorganization.

And start all over again, until the bubble pops…

FINAL WORDS ABOUT MONETIZING BITCOIN

I’M SO GLAD TO SEE YOU HERE!

This means you found my tutorial interesting and you probably want to learn more.

First of all, visit my blog to see what is new (I write daily), and if you become a subscriber you’ll have a 90% chance to make more money by the end of the year!

I’m kidding, I can’t promise that…

BUT…

I can promise my subscribers already got strategies that made all around over 3.5 million USD in net positions, so for sure it will be fun!

And of course you can reach me there if you have any questions about this tutorial, or you want to share your ideas or anything you want – I’m here for everyone!

PLEASE ALWAYS REMEMBER: NEVER TRADE / INVEST / PLAY ON MORE THAN 0.5%-2% OF YOUR NET WORTH. NEVER EVER.

How to choose a broker?

I keep getting asked questions on how to trade, and where, and who is reliable… So I decided to finally share my portfolio!

In order to trade and also get paid for it, you have to have a broker. There are several brokerages and you won’t find it hard to find a broker. Google can help you with that.

I work with two different in this analysis of Monetizing Bitcoin. Each one for my different needs.

In this tutorial, I showed you Tradeo platform and that’s what I use to trade BTC because it’s easier.

Although this tutorial was made on a different platform. Anyway, you should try on some demo account to test out our Case Studies of monetizing Bitcoin above.

I recommend that wholeheartedly, a demo account is extremely important for trial and error free of charge.

HOPE YOU ENJOYED IN OUR JOURNEY OF MONETIZING BITCOIN!

risk disclosure

About the author

Guy Avtalyon is a data researcher that uses statistic models and unsupervised machine learning algorithms to determine trends in the market.

”The truth lies within the data.’