2 min read

This article is about picking good stocks by using microeconomics. This means that you look at the stocks of individual companies. Traders Paradise explains how to evaluate a company’s products, services, and other factors so that you can determine whether a company is strong and healthy.

And finally, how to pick 5 best blue-chip stocks.

We want to drive you toward those segments of the stock market that show solid promise for the coming years. That would make your stock portfolio thrive. Putting money into solid companies in thriving industries has been the hallmark of superior stock investing throughout history. It’s no different now. Everything is the same.

Where do you turn to find out about a company’s financial health? When you find the information, you’ll discover how to make sense of that data as well.

We compare buying stock to picking dog. If you look at a group of dogs to choose which ones to buy, you want to make sure that you pick the healthiest ones. With stocks, you also need to pick companies that are healthy.

This article can help you do that. To find 5 best blue-chip stocks.

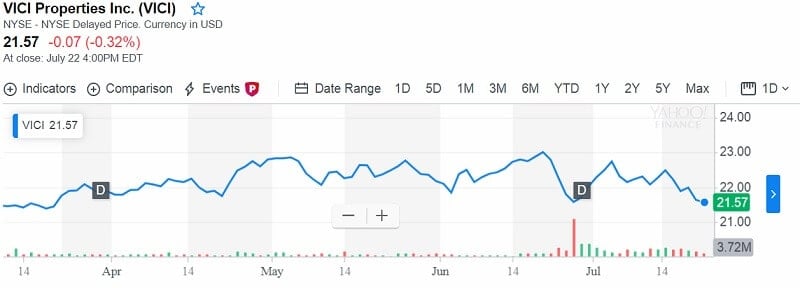

The 5 best blue-chip stocks as ranked by expected total return.

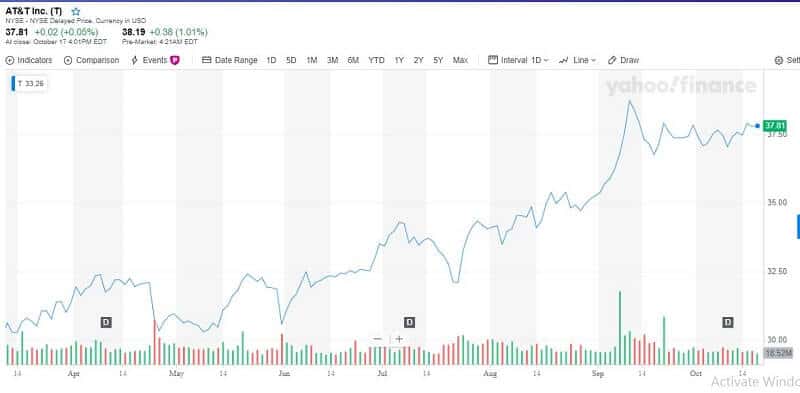

AT&T (T) is one of the 5 best blue-chip stocks

They are among 5 best blue-chip stocks. AT&T is a global provider of communications and digital entertainment services with 34 years of consecutive increases. They are offering internet access, wireless cellular, and TV services. The company was founded in its current form as a spin-off in 1984. Today, it creates $173 billion in annual revenue, driving a market capitalization of $234 billion. When they reported second-quarter earnings in July 2018, and investors were disappointed. Revenue was down 3% in comparison with the same quarter last year. But the new moment is that earnings-per-share increased by 15%. The company boosted its customers by nearly 4 million. Primarily from prepaid customers in the United States.

DirecTV Now (stylized as DIRECTV NOW, also known simply as DTV Now) is a subscription streaming television service owned by AT&T. As of July 2018, the service has 1.8 million subscribers.

Also, WarnerMedia as part of AT&T has strong growth.

The revenue expanded from $7.3 billion to $7.8 billion year-over-year. All of its segments continue to grow subscriber revenue with special strength coming from HBO.

The WarnerMedia is a significant growth catalyst for AT&T. Second quarter results last year showed that WarnerMedia is growing much more quickly than the rest of AT&T and thus, the acquisition has a bullish development.

AT&T’s competitive advantage is in its enormous participation in the United States and parts of Latin America. The company uses that scale to push wireless, TV, and internet services to millions of consumers in order to expand relationships that are existing. This diversification of AT&T’s legacy businesses and the content library of WarnerMedia is a core advantage AT&T possesses over its rivals.

The dividend is a significant draw for investors as the yield is in excess of 6%. We expect the large yield will be safe for many years to come. Moreover, we are certain that it will continue to grow as well.

AT&T looks attractive from a value and yield perspective.

Owens & Minor (OMI) is among the 5 best blue-chip stocks

Another 5 best blue-chip stocks are Owens & Minor, a healthcare logistics company specializing in contracting packages of healthcare products for hospitals. The company produces $10 billion in annual revenue from more than 200,000 customers. Besides that, the stock has a current market capitalization of just over $1 billion. They had some share price drops in 2017.

The company reported second-quarter earnings in 2018 and results in disappointed investors once again. Revenue grew 8.5% year-over-year as the Byram Healthcare and Halyard Health acquisitions boosted the top line. Adjusted operating income rose 13% but adjusted earnings-per-share fell by 25%.

But the company is solving its issues in a variety of ways. That includes cost rationalization programs and acquisitions. By the way, the acute care setting provides an enormous market Owens & Minor can grow into in the coming years. This should enable the company to continue to grow revenue. Also, it should improve its margin profile over time.

Owens & Minor’s competitive advantages include its established position with hospitals, as well as its recession-resistance.

Owens & Minor sells necessities that are used in high volumes regardless of economic conditions.

So, Traders Paradise sees this as a great advantage.

The stock is yielding in excess of 6% today. We can see modest dividend growth moving forward, but the payout is reasonably well-covered by earnings. Thus, Owens & Minor should be attractive to income investors for this year.

Owens & Minor as producing mid-20% total annual shareholder returns. It is consisting of the high current yield, high single-digit earnings-per-share growth and a double-digit tailwind from a rising valuation. We, therefore, rate Owens & Minor a strong buy for investors seeking growth, value or high current yield. So, they are 5 best blue-chip stocks for 2019.

Cardinal Health (CAH)

Cardinal Health services more than 24,000 pharmacies across the USA and nearly all of its hospitals. In addition, Cardinal is present in more than 60 countries. It employs 50,000 people. And it produces $140 billion in annual revenue. Cardinal Health has a market capitalization of $16 billion. And has 32 years of consecutive increases.

The company’s results in 2018, were mixed. Revenue rose 7%, as did gross profit, but adjusted earnings-per-share fell 23% compared with the same period in 2017.

Cardinal struggled with some negative margin impacts. They announced mail-order customer’s contract, investing in its IT platform. But margins in the company’s generic business continue to fall.

Management is sitting for nothing. However, some of the initiatives it is undertaking to combat these troubles. The management is working on controlling costs as well as successfully integrating the Cordis business. The best side of everything, Cardinal remains committed to returning capital to shareholders over share repurchases and dividends. The dividend yield is 3.7% today. It makes Cardinal a strong choice for investors.

Traders Paradise expects total annual shareholder returns in excess of 20% moving forward. We rate Cardinal as very favorable for long-term investors.

Walgreens Boots Alliance (WBA)

They have 42 years of consecutive increases.

Walgreens is the largest retail pharmacy in the United States and Europe. The company is present in 25 countries around the globe, employing almost 400,000 people. They have a wide and deep customer base. The company is servicing more than 200,000 pharmacies, doctors and other healthcare centers annually, along with its more than 13,000 retail stores.

The company reported third-quarter earnings last year and results were strong. Revenue rose 14% and earnings-per-share increased by 15%. But, operating income rose just 5.5%. Walgreens announced a new $10 billion share repurchase program and boosted its dividend by 10%.

The company is already in a dominant position in the United States and Europe, and the Rite Aid acquisition should serve to support that position. Walgreens’ business continues to grow in the developed world. So, Traders Paradise takes a stance, it should hold up well during economic downturns.

The dividend was raised last year, and the yield is now 2.6%.

The payout currently makes up less than one-third of total earnings. Traders Paradise expects continued growth in the dividend for many years to come. Indeed, Walgreens has at least 50 years of consecutive dividend increases.

We forecast very strong total shareholder returns for Walgreens in the coming years to 20% annually. This stock is highly undervalued as well as high single-digit earnings-per-share growth. We rate Walgreens a buy for its combination of growth, value, current yield, and dividend growth. Yes, they are one of the 5 best blue-chip stocks.

Altria Group (MO)

Altria Group has long been a source of high rates of dividends for shareholders. It has boosted its payout for 48 succeeding years.

The share price has fallen significantly in 2018 because of the company’s exposure to cigarettes. It caused some angst among investors. However, new products, such as its heated tobacco and E-Vapor products are driving new growth.

The company’s earnings for the first half of 2018 grew by 24%. Yes, revenues were down slightly. Volume declines in the core cigarette segment continue to be an issue but Altria is busy diversifying away in an attempt to mitigate the potential damage.

The worst year was 2017 with 9.4% of shareholders returns. But, the share price has continued to rise and today stands at 5.5%. Considering the yield has been increased for nearly 50 successive years and that the dividend is covered well by earnings, Traders Paradise sees the dividend as a primary source of total returns moving forward.

Altria’s competitive advantage is in its Marlboro brand cigarettes. Marlboro is near the top of global cigarette sales by brand.

Also, Altria is innovative each year.

The best example is its heated tobacco products.

We have to say, the cigarette volume is declining over time. More and more. So, Altria will need to continue to adapt to a market.

The IQOS and MarkTen products are producing strong growth but they are just a small fraction of total revenue. Altria’s story is still about a cigarette/tobacco.

Traders Paradise is forecasting those mid-teens investors have the unique chance for earnings-per-share growth. And for the mid-single digit dividend yield. We rate Altria’s blue-chip stock worth to buy. They are definitely among the 5 best blue-chip stocks.

The bottom line

The blue chips have the highest value in the poker game. But investing should be far removed from gambling. So, we can say that the term “blue chip” has stuck for a select group of stocks.

Why?

Blue-chip stocks are established, safe, dividend payers. They are often market leaders and tend to have a long history of paying rising dividends. Blue chip stocks tend to remain profitable even during recessions. Think about that!

Risk Disclosure (read carefully!)