3 min read

- Momentum stocks are among the most exciting stocks to trade.

Momentum trading refers to the tendency of stock prices to continue moving in the same direction for several months after an initial impulse. The most basic form of momentum is price momentum, where the initial impulse is simply a change in the price itself.

Momentum has been defined as a force that sustains the movement and increases the strength of that movement. This two-fold nature of momentum is seen in what traders and investors call “momentum stocks”. A momentum stock is a stock that is trading in a sustained trend, either up or down, the strength of which is expected to increase over the near term.

Momentum stocks are among the most exciting stocks to trade.

Momentum trading is inherently challenging to explain within a traditional asset pricing model. Such a model requires that high average returns are simply compensation for some form of risk. But stocks that have risen recently, or have had positive earnings surprises. Hence, typically seem to have lower risk, not higher risk as would be required for risk to explain momentum.

What is momentum trading?

Momentum trading is a technique in which traders buy and sell according to the strength of recent price trends. Price momentum is similar to momentum in physics. The mass multiplied by velocity determines the likelihood that an object will continue on its path. In financial markets, however, momentum is determined by other factors. Like trading volume and the rate of price changes. Momentum traders bet that an asset price that is moving strongly in a given direction. And it will continue to move in that direction until the trend loses strength.

British economist and investor David Ricardo used momentum-based strategies successfully in trading. He was well known in this field. How he did it? He bought stocks with strong performing price trends. And then sold stocks whose prices were performing poorly. He characterized the method with the phrase: “Cut short your losses; let your profits run on.”

Momentum trading can be classified into two categories:

Relative momentum and absolute momentum.

The Relative momentum strategy is where the performance of different securities within a particular asset class are compared against one another. Investors will favor buying strong performing securities and selling weak performing securities.

The Absolute momentum strategy is where the behavior of the price of a security is compared against its previous performance in a historical time series.

In currency trading, either relative or absolute momentum can be used. But you have to know that momentum trading strategies are more frequently associated with absolute momentum.

How to employ momentum strategy?

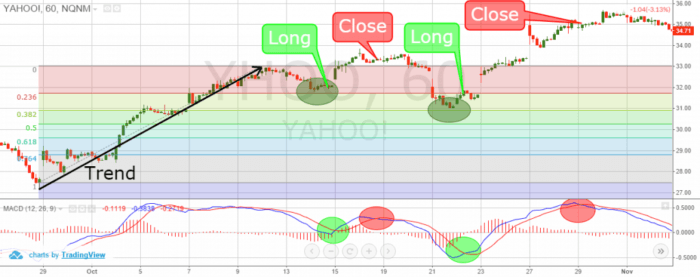

Momentum can be determined over longer periods of weeks or months, or within day-trading time frames of minutes or hours.

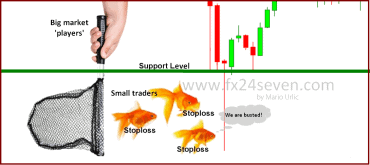

The first step traders usually take is to regulate the direction of the trend in which they want to trade. The trader can use one of several momentum indicators. Then such trader may establish an entry point to buy (or sell) the asset they are trading. After that trader has to determine a profitable and reasonable exit point for a trade. The trade must be based on the projections. And previously observed levels of support and resistance within the market.

Besides that, it is highly recommended to set stop-loss orders above or below their trade entry point. That depends on the direction of the trade. This is in order to avoid the possibility of an unexpected price-trend reversal and undesired losses.

Momentum indicators

A momentum indicator is a tool used for determining the momentum of a particular asset. They are graphics devices. Often in the form of oscillators. That can show how rapidly the price of a given asset is moving in a particular direction. Also to whether the price movement is probably to continue on its course.

The idea behind the tool is that as an asset is traded, the rate of the price movement reaches a maximum. In the moment when the entrance of new investors or money into a particular trade nears its maximum. When there is less new investment available, the tendency after the maximum is for the price trend to devastate or reverse direction.

The trader can determine the direction of momentum. The trader has to subtract a previous price out of a current price. That’s all. A positive result is a signal of positive momentum. The negative result is a signal of negative momentum.

Momentum tools typically appear as rate-of-change (ROC) indicators, which divide the momentum result by an earlier price. Multiplying this total by 100, traders can find a percentage ROC to plot highs and lows in trends on a chart. Say the ROC approaches one of these extremes. You can see an increasing chance the price trend will weaken and reverse directions.

Other momentum tools

Here are a few of the technical indicator tools that traders commonly use to track momentum. They may provide you to know whether it’s a good time to enter or exit a trade within a trend.

Moving average: It can help to identify overall price trends and momentum. How to calculate the moving average? The trader should add the closing prices over a certain number of periods. And by dividing the result by the number of periods considered.

Relative strength index (RSI): It measures the strength of the current price movement over recent periods. The aim is to show the probability if the current trend is strong. Of course, in comparison to previous performance.

Stochastic oscillator: It compares the current price of an asset with its range over a defined period of time. What we can see when the trend lines in the oscillator reach oversold conditions? They indicate an upward price momentum is at hand. And when they reach overbought conditions they indicate that sinking price momentum is ahead.

Moving average convergence divergence (MACD): It is an indicator that reveals both price momentum and possible price trend reversal points. When the lines are farther apart, momentum is strong. Therefore, when they are converging, momentum is slowing. That means the price is likely moving toward a reversal.

There are also other indicators like the commodity channel index (CCI), on balance volume (OBV), stochastic momentum index (SMI), average directional index (ADX), building block.

Is momentum trading risky?

Like any style of trading, momentum trading is risky. It’s normal to be successful when prices follow on a trend. But the problem is that momentum traders can be caught off guard. It is happening when trends go into unexpected reversals. Hence, traders should remember a few things and adopt them:

Technical analysis bases its projections of the probability of price movements on past price trends.

Prices in the market can move in an unforeseen manner at any time due to unexpected news events. Moreover, because of fears and changes in sentiment in the market.

The bottom line

Momentum is a key concept that has proven valuable for determining the chances of a profitable trade. The trader may use measurements of momentum in the short and long term. They are useful in all types of trading strategies. Several technical trading tools are available to reveal the strength of trends. Also, whether a trade on a particular asset may be a good bet.

Traders should know that momentum projections are calculated using measurements of past price trends. Actual momentum and price can change at any moment. So, it’s important to take preventative measures, such as setting stop-losses.