2 min read

Margin trading isn’t without risks involved, so pay more attention to it

Margin trading is simply the process where investors buy more stocks than they can afford to. It also refers to intraday trading in India and various stockbrokers provide this service. It can increase your profits on the upside, but also expand your losses on the downside. Margin trading means buying and selling stocks or some other assets in one single session. This process requires a trader to guess the stock change in a particular session. It is an easy way of making a fast buck. It is now accessible to even small traders.

What is margin trading?

Margin trading is also called buying on margin. It is a method of buying shares that involves borrowing a part of the sum needed from the broker executing the transaction. The collateral for the loan is normally securities in the investor’s account. The trader has to deposit an initial amount of cash or securities into a margin account with the broker. And has to keep a minimum amount of cash or securities in the account as collateral. If the balance of a margin account falls below the minimum maintenance amount, the broker makes a margin call to the trader for the funds needed. Margin balances can be adapted to follow market values by adding or subtracting variation margins.

What is buying on margin?

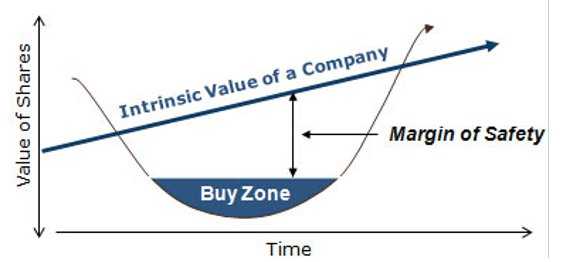

Buying on margin gives the investor leverage as any capital appreciation or dividend income is on the total amount purchased. Even after the amount borrowed has been repaid to the broker, with interest, the investor could still be better off than if he/she had personally financed the purchase of a smaller amount of shares. That depends on how much the shares gain and how much they yield. There are some risks with margin trading – if the shares fall in value, the investor suffers a capital loss while also facing potential margin calls from the broker.

An example of margin trading

Margin trading is meant for traders who are looking for a simple way to increase their earnings. And also, they have a reasonable level of risk appetite but do not have enough capital.

Let’s say you are 100% bullish for the big company and believe the stock is going to pick up. You want to buy 1000 shares of that company and each share is priced at $200. You would need a capital amount of $200,000 to enter that position.

Assuming you have $150,000 and want to borrow the rest of the capital. With margin trading, your broker can help you with the rest of the funds while charging you a specific interest percentage.

How does margin trading work?

The whole process is quite simple. Margin trading is legal buying stocks or other securities, but instead of your own money, you borrow it from your broker.

Think about buying stock on margin as buying a house with a mortgage. A margin account provides you the financial support to buy more stocks than you can currently afford. For this purpose, the broker will lend you money to buy shares and keep some amount as collateral.

If a trader wants to trade with a margin account, the first requirement will be to request a broker to open a margin account. This requires paying a specified amount of money upfront and in cash. That is so-called the minimum margin. If a trader has a losing bet and ends in losses, and fail to pay the debt, the broker will get it out from the margin account.

When you open the margin account, you’ll have to pay an initial. This is a specific percentage of the total traded value and pre-determined by the broker. Before you start margin trading, you need to keep in mind these important steps.

First, you need to secure the minimum margin (MM) through the trading session. The reason behind this: if the stock is very volatile, the price can fall more than you had expected.

Second, the broker has the right to ask you to increase the amount of capital you have in your margin account. Also, the broker has the right to sell any of your securities if feels its own funds are at risk. The broker can even sue you if you don’t fulfill a margin call or if you are carrying a negative balance in your margin account.

Margin trading if the stock price goes up

This is the best outcome for you. Let’s do some math (I adore math).

Say you bought 100 shares for $4000. But you had $2000 and broker loans $2000. If the price goes to $50 per share, your investment will be worth $5,000. Your outstanding margin loan will be $2,000. If you sell, the total proceeds will pay off the loan and leave you with $3,000. Because your initial investment was $2,000, your profit is a solid 50%. Your $2,000 principal amount generated a $1,000 profit. However, if you pay the entire $4,000 upfront without the margin loan your $4,000 investment will generate a profit of $1,000, or 25 percent. By using a margin, you could double the returns.

The stock price fails to rise

If the stock stays at the same price, you still have to pay interest on that margin loan. You are in a better situation if the stock pays dividends because that money can pay some of the costs of the margin loan if not all. In other words, dividends can help you pay off what you borrow from the broker.

When the stock doesn’t change in price it is a neutral situation, but you’ll pay interest on your margin loan for each day. Margin trading can be a good plan for traditional investors if the stock pays a high dividend. Many times, a high-payed dividend, for example, $5,000 worth stock, can exceed the margin interest you have to pay. For example, if you had $2.500 and you borrowed the other $2,500, which is 50% of stock’s value. But you expect to receive $3.000 as a dividend, so you’re safe.

Margin trading when the stock price goes down

If the stock price drops, buying on margin could work against you. What if the price in our example goes to $38 per share?

The market value of 100 shares will be $3.800. So, your capital will shrink to just $1,800 because you have to pay your $2,000 margin loan to your broker. This isn’t real trouble at this point, but you should be cautious. The margin loan is 50% of your investment. If it goes lower, you may get the margin call. The broker will demand you to keep the ratio between the margin loan and the value of the securities the same as it was when he lends you money. That’s why margin trading can be very dangerous.

How to maintain the balance in margin trading?

When you buy stock on margin, you must maintain a balanced ratio of margin debt to equity of at least 50 percent. If the debt portion exceeds this limit, you’ll be required to restore that ratio by depositing either more stock or more cash into your brokerage account. The additional stock you deposit can be from another account. If you can’t come up with more stock, other securities, or cash, you have to sell stock from the account and pay off the margin loan. For any trader, it means having a capital loss. For you also, because you lost money on your investment.

The bottom line

As you can see, the margin can increase your profits on the upside but also increase your losses on the downside. If your stock drops drastically, you can end up with a margin loan that exceeds the market value of the stock you used the loan to buy. In the bear market of 2000, for example, many people realized stock losses. The majority of these losses came as a consequence because traders did not manage properly the obligations associated with margin trading. To avoid this kind of problems you must have sufficient reserves of cash or marginable securities in your account.

For example, buying dividend yields that exceed the margin interest rate could be the right choice so the stock could pay for its own margin loan. Just keep in mind to set up your stop-loss orders. Your goal is to make money, and paying interest could eat your profits.

Leave a Reply