Trading on margin can be profitable but also, extremely risky.

By Guy Avtalyon

The simple answer on question what is margin could be: it is a loan from your brokerage to buy more stocks than you otherwise would be able to purchase using the amount of cash you have on hand.

The dictionary defines margin as an extra amount of something (such as time or space) that can be used if needed. Two key things are important to us in that definition: extra and if needed.

It is the difference between the full value of your position and the funds lent to you by a broker or leverage provider. It is an amount of money needed to open a leveraged trading position.

There are two types: initial and maintenance margin. The initial is the deposit required to open the position, often called just the deposit. When you open your position, you might need to add more money if your trade starts to make a loss and your deposit is no longer enough to keep the position open. If this happens, your provider will place you on a margin call, and you’ll be required to top up the funds in your account. This additional capital is known as the maintenance margin.

What is the margin?

It is the deposit necessary to use leveraged products. Using leverage can provide you to get full market exposure by putting up just a fraction of a trade’s full value. The amount of margin ordered will usually be presented as a percentage.

All of the assets in your account, as well as your personal guarantee, are held as assurance that you will repay the debt. There is no matter what happens in the trading account itself. Even if the account blasts, you are obliged to pay. No payment plan. Or negotiating terms. If you don’t pay, the broker can tow you into court. You will start getting verdicts to confiscate your other holdings. Your destiny will depend on the mercy of a bankruptcy judge. Meanwhile, your credit score plummets. Well, not always but it can happen.

What is the margin in Forex?

It is one of the most important concepts of Forex trading. In Forex it is basically a good faith deposit that is needed to maintain open positions. It is not a fee or a transaction cost, but instead, a portion of your account equity set aside and assigned as a margin deposit.

Trading on a margin can influence your trading experience both positively and negatively, with both profits and losses potentially. Your broker takes your deposit and then pools it with someone else’s margin Forex deposits. Brokers do this in order to be able to place trades within the whole interbank network.

It is often expressed as a percentage of the full amount of the chosen position. The most Forex margin requirements are estimated to be around: 2%, 1%, 0.5%, 0.25%. You can calculate the maximum leverage you can use in your trading account.

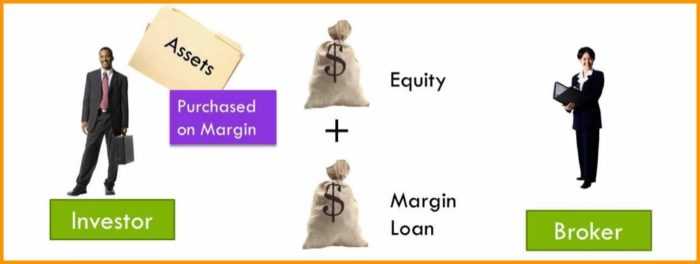

How does margin work?

In the same way that a bank can lend you money if you have equity in your house, your brokerage firm can lend you money against the value of certain assets in your portfolio. The borrowed money is known as a margin loan. It can be used to purchase additional securities or to meet short-term financial needs.

Each brokerage company can define, within certain guidelines, which stocks, bonds, and mutual funds are marginable. The list usually includes securities traded on the major stock exchanges. Hence, keep in mind that you can not borrow funds in retirement accounts or custodial accounts. Investors can use margin to purchase potentially double the amount of marginable stocks than they could use cash. Few investors borrow to that extreme. The more you borrow, the more risk you’ll take on. Margin uses the value of your marginable securities as collateral in your portfolio. If your portfolio goes up, your buying power increases. If your portfolio falls in value, your buying power decreases.

Which securities can trade?

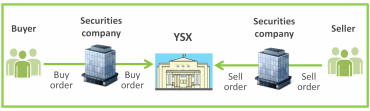

Almost every security can be traded on margin. It may be stocks, futures, commodities, or currency. For the cash market, generally, brokers provide and charge nominal interest for the same. While for the Futures market, the exchange provides the margin and there is no interest charged. Every broker has a different margin policy.

Short-term stock traders often use it in the hope of improving their stock market returns. But, it is usually avoided by long-term investors as over an extended period, a greater return would be necessary just to break even.

Traders often target stocks with more volatile price swings. As they focus on shorter time spans than investors, short-term traders need to use margin to magnify the size of those price swings to try and make a profit.

Trading is risky

Frankly speaking, when someone asks what is margin, the first thought is – it is the risk. Because it can be a dangerous beast. Of course, it can’t ever turn a bad investment good, but it can turn a good investment bad. Simply piling margin onto an investment with a small return doesn’t transform it into a good idea. It has a darker side from a value perspective as well: it has the potential to turn a good investment into a bad one! It can limit your staying power and transform a temporary impairment into a permanent impairment of capital.

A margin loan can be used to meet short-term lending needs not related to investing. Moreover, margin can also be used for investment purposes to magnify your profits as well as your losses.

This strategy can be profitable when your stocks are going up. But, the increasing effect works the other way as well. Buying stock on margin is only successful if your stocks increase enough to pay back the loan with interest. Contrary, you could lose your major capital if your stocks go down too much. However, used wisely and prudently, a margin loan can be a valuable tool in the right circumstances. If you decide it is right for your investing strategy, consider starting slow and learning by experience.

Leave a Reply