When you decide to trade the forex market, so you’ll need a Forex broker.

When you decide to trade the forex market, so you’ll need a Forex broker.

By Guy Avtalyon

But what is a Forex broker?

Let us explain this. That is a company that monitors and advises investors on current conditions in the forex market including conversion rates. Forex brokers may also provide a trading platform and other brokerage services for traders.

A forex broker is a company that buys and sells currencies on behalf of retail traders. It usually does through a forex trading platform. Like stockbrokers, they charge a fee in order to execute orders placed by their clients. It is regularly in the form of a spread instead of commission.

But, unlike stockbrokers, forex brokers place trades in the OTC market instead of on an exchange.

What is the forex broker’s role

A forex broker is a mediator that executes the transaction orders on behalf of his client as we said.

They are called intermediaries. Their job is to intercede between the market, on one side, and investors and traders on the other.

What is the forex broker’s tasks?

– to provide customers the market prices of the various financial instruments, through trading platforms or in some cases, by phone.

– The broker has to find a counterparty in order to satisfy the transaction request received from the client.

– Also, the forex broker has to send to the market the trading orders executed by his clients.

– Such a forex broker has to return information about the order outcome if it has been executed or rejected.

– Some forex brokers also act as governing agents. They calculate and pay taxes for the trader on the realized capital gains.

The forex broker operates as a middleman between the trader and the market.

In simple words, in order to find a buyer or a seller of currencies, the trader can go to a broker and find either a respective seller or a respective buyer.

Here you can find respective broker>>>>

Forex broker is not just the middleman between traders and another buyer or seller. Forex broker is also the middleman between traders. That is called a “liquidity provider”.

How to interact with a forex broker?

In its original sense, a forex broker is someone that you phoned in order to buy or sell currencies. But, the development of the Internet allows you to communicate with a broker through a trading platform or trading software.

If you are looking for a trustworthy, regulated broker, please check out this>>>

Retail Forex

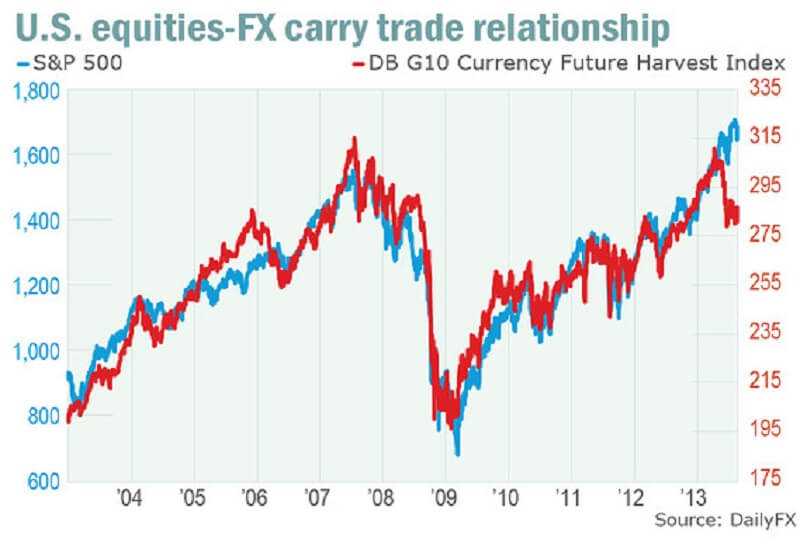

A key concept for modern individual traders is retail forex. Traditionally, foreign exchange has been traded on the interbank market by larger clients such as banks and multinational corporations. They need to trade currencies for business purposes and hedging against international currency risks.

But, retail forex is the forex that is traded through dealers, often by smaller or individual investors. These firms are also known by the term “retail aggregators.” This became popular in the late 1990s with the development of internet-based financial trading. That allows smaller traders to get into markets that were before confined to businesses and financial institutions.

A retail forex broker allows traders to set up an account with a limited amount of assets and let them trade online through trading platforms.

If you are looking for a trustworthy platform, check out this >>>

Most trading is done through the spot currency market.

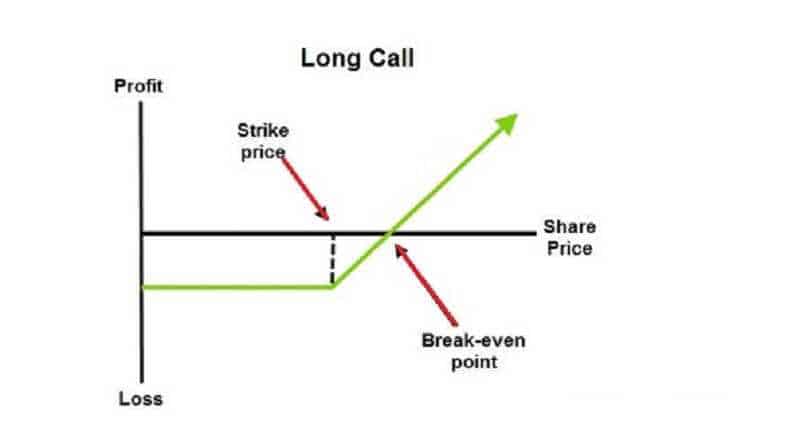

Forex trading is popular among individual traders because brokers have offered them the chance to trade with margin accounts.

These allow traders to borrow capital to make a trade and multiply the principal. They use it to trade by large amounts, up to 50 times their initial funds.

The brokerage industry means extreme competitiveness.

Even among those companies, the competition is extremely high. Picking the right type of brokerage house is a difficult choice.

How about the things retail traders need to know before deciding the broker to use? What are the conditions that make a good broker and what would be a perfect Forex broker?

Find HERE>>>

Honestly, choosing a Forex broker should be a simple process. Traders should not end up spending a lot of time looking for the right broker. Forex brokers offer an essential service for markets, especially for retail forex traders.

With an internet connection and a computer or mobile phone, traders can now open an account and trade in a market. Brokers also offer services that can be valuable in assisting traders to understand price movements and potentially make profits.

Don’t waste your money!