3 min read

Long and Short refer to whether a trade was initiated by buying first or selling first.

To be more specific.

A long trade is opened by buying with the expectation to sell at a higher price in the future and earn a profit.

But, a short trade is opened by selling, before buying, with the intent to buy back the stock at a lower price and gain a profit.

In the trading of assets, an investor can take two types of positions: long and short.

And such investor can either buy an asset (going long) or sell it (going short).

Long and short positions are further complicated by the two types of options, the call and put. So, the investor may enter into a long put, a long call, a short put, or a short call.

Furthermore, the investor can mix long and short positions into complex trading and hedging strategies.

The simplest way to classify “long” and “short” trades is to state that in any trade, you are long of that from which you will profit if it rises in relative value. Hence, you are short of that from which you will profit if it falls in relative value.

Here is the example, assume that you buy a stock of XYZ company with Euro. So, you are “long” stock of XYZ and “short” of Euro. This is because for you to profit, the value of the XYZ company stock must rise against the Euro, or alternatively, the value of the Euro must fall against the stock of XYZ company.

You should know that in a trade where you are short of a currency against some tangible asset, you would usually refer to that only as a “long” trade.

So, not saying that you were “short” of the cash denomination.

What is the Short trade

If you believe that a market is going to go down, you can make money by short trading or short selling that market.

Short selling (also known as going short or shorting) means that you’re selling the market first and then striving to buy it later at a lower price.

How can you sell a stock before you buy it?

It’s truly not as hard as it looks.

To sell a stock that you don’t own, for instance, you need to borrow it. Your broker may let you borrow a stock owned by another trader or, less commonly, owned by the broker himself.

When you’re able to exit your short position, you cover the position by buying back the stock you had shorted.

In other words, selling before you buy really means you’re borrowing the stock before you short sell it.

That’s all the wisdom.

Hence, going short can be very distinct from going long.

One thing is very important. Stocks and commodities, but particularly stocks, may have a “long bias”.

Why this is so important?

Because this nature means that their value is more likely to rise over time than fall.

Falls in stock markets, or “bear markets”, tend to be faster and more violent than rising markets, also called “bull markets”.

“Shorting” is frustrating to most new traders because in the physical world we have to buy something and later sell it.

In the financial markets, we can buy and then sell or sell then buy.

Why short trading is so exciting

Selling first and then buying later has many advantages.

The fear is a stronger emotion than greed. Hence, markets tend to go down faster than they go up.

short trading is so exciting

short trading is so exciting

When traders feel fear, they want to exit their long positions immediately. The truth is that markets can go into a free fall. Therefore it’s typically possible to make money faster by short selling than by buying.

If you short trade, you basically increase your ability to make money in different market conditions, even uncertain. When you are going short, you give yourself more chances to make money.

Moreover, shorting options can provide a hedge against your long positions.

About options READ HERE>>>

Options are less expensive than buying the stock itself and, therefore, can act as a type of insurance policy against a stock position.

Taking a short position on a stock with an option would actually involve buying a put option. That can seem a bit confusing. You have short exposure to the stock as the value of the put option rises as the stock price goes lower.

Point is, and also the benefit, that you pay a small premium, which can be viewed like a deposit that allows you to sell the stock at a higher price if the stock moves down.

Short selling also has several disadvantages

First of all, going short is more expensive than going long. When you short a stock, you’re borrowing the stock and have to pay a fee for doing so.

In theory, short selling has an endless risk.

If the market goes against you (meaning going up), there’s no limit how high the price can go.

Not all stocks are available for going short, and some of those that are accessible aren’t always possible. This reduces the space of stocks suitable for you to trade.

Further, short trade must be done in a margin account. Are you comfortable trading with borrowed money? It’s up to you to decide.

Remember, when you short a stock, you don’t own it. You’re borrowing it from your broker who still owns it.

So, the broker will want the dividend if you’re holding the short position when the company issues dividends.

What is a long trade

When the investors are in a long trade, they bought an asset with the hope the price will go up.

In a long (or buy) position, the investor is hoping for the price to rise. An investor in a long position will profit from a rise in price.

The typical stock purchase is a long stock asset purchase.

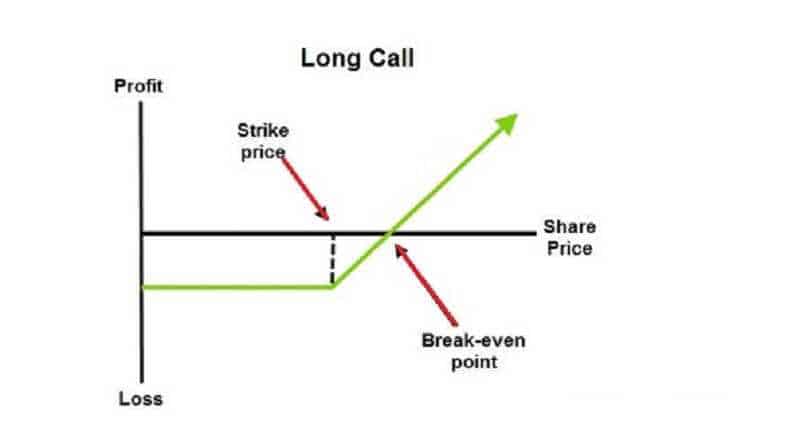

A long call position is one where an investor purchases a call option. Thus, a long call also benefits from a rise in the underlying assets price.

A long put position involves the purchase of a put option.

The logic behind the “long” aspect of the put follows the same logic of the long call. A put option rises in value when the underlying asset drops in value. A long put rises in value with a drop in the underlying asset.

The traders often will use the terms “buy” or “long”. Hence, the trading software may have an entry button marked “buy,” while other trade entry buttons marked “long.” The term often is used to describe an open position, which indicates the trader currently owns shares of some company.

Traders usually say they are “going long” or “go long” to show their interest in buying a specific asset.

When they go long, their profit potential is unlimited. The price of the asset can rise endlessly. For example, if you buy 100 shares of stock at $2, that stock could go to $4, $8, $50, $100, etc.

The traders use to trade for smaller moves.

The risk is limited to the stock going to zero. In the example above, the largest loss possible is if the share price goes to $0, resulting in a $2 loss per share.

Trading the long means that you have used a buy order as your opening trade or ‘gone long’. This means that you are anticipating a rise in price and will use a sell order to close your position.

Long and Short Forex Trades

In Forex, things are different, because whether you are making “long” or “short” trades, you are always long of one currency and short of another. If you buy or go long, EUR/USD for example, you are buying EUR with USD. You are long EUR and short USD. If you sell or go short, EUR/USD, then you are long USD and short EUR. It is really all the same.

The only significant factor regarding the long and short trades question in Forex is any interest you might need to pay to your Forex broker if you hold a position overnight, or alternatively receive from your broker. This is calculated by reference to the interest rates at which banks lend particular currencies to each other, at least in theory. Unfortunately, Forex brokers sometimes use this as a subtle way to make some extra money from their clients.

Long and Short Trade

Long and Short Trade

For example, let’s say you go long EUR/USD. You have, at least theoretically, bought EUR with USD. If the interbank interest rate for USD is higher than it is for EUR, your broker might be paying you some money each time you hold the position over the New York rollover time (i.e. daily). This is because you are getting interested in your USD greater than the interest they are getting on the EUR, and in theory, positions are “squared” at every New York rollover. On the other hand, if the interest rate on the currency you are long of is less than the rate for the currency you are short of, you will be charged some amount representing the difference every day that the position is kept open.

All about unknown terms you can read HERE

Leave a Reply