The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.

The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.

By Guy Avtalyon

The high-frequency trading algorithm or HFT is one of the two main types of algorithms. The other is the execution algorithm.

HFT trading means to engage multiple algorithms in order to examine various markets. The orders execution is based on market conditions.

It is a program trading platform that utilizes robust processors to conduct a large number of orders very fast. Actually, the whole operation takes less than one second.

And it is a very important feature for traders.

The speed of trade execution will decide if you are a profitable trader or you are not. The logic behind this is that HFT provides you a fantastic speed in trading. So, you can gain your targeted price faster than, let’s say, ancient trader, is going to do.

The advantage of high-frequency trading is that it provides you a permanent view on markets condition because it follows market data in real-time.

Is a High-frequency trading set in today’s markets?

But there are some misunderstandings yet.

HFT is very often a cause of disagreement among traders. The traditional traders don’t like algo trading at all.

Yes, we understand why is that.

HFT leads to some effects, very unknown to some market experts. Their opinion about the algo trading is the same.

First of all HFT trading provides traders more advantages in the main processes.

HFT applications can hit even a very small profit from huge numbers of executions. You must know that there are a million executions every single day in the markets all over the world.

High-frequency trading will never hold the position for a long time.

The old-fashioned traders say it can cause great volatility and results with losses when it goes wrong.

Well, their opinion is not quite mistaken.

Let’s say it is possible. And we will recall the year 2012 when really was tricky.

HFTs caused the knockdown to Knight Capital Group. After that accident, in many countries, HFT was reduced. For example, Italy has the rule to tax 0.02% on the transaction that takes less than 0.05 seconds. The rule was launched in September 2013.

The other problem with HFT is there is no generally recognized definition. So, that can open the space for some confusion.

The truth is that the digital era requires digital work for which we need digital equipment. This digital tool leads us to speed business and the trader’s business is to execute their trades fastest as it is possible. But the principle is the same as centuries before: when you are in the market, you would like to buy or to sell. And HFT provides traders to do it. Fast, very fast.

Let’s break down HFT trading.

What is high-frequency trading?

The high-frequency trading is called ”black box” trading.

It indicates to automated systems that regularly use complicated algorithms to buy and sell securities. Extremely fast!

In the same manner, the algorithms do it at a much larger range than any individual is able to do.

Previously we said that HFT provides a very small profit from huge numbers of executions, but thanks to the high speed and large volume they produce great returns to traders.

How does it work?

The algorithm follows a “quote level” that is created including bid and ask. In volatile markets, the quote level can be changed in a second. Honestly, it could happen several times in a very short frame time.

And the algorithm is going to do what? It will place your trade in the right direction and faster than you can do it by yourself.

Without the algorithm, you will not be able to recognize all the opportunities. You might miss something extremely significant.

Yes, you can tell how and when your trades should go, but even you are fast-acting on your mouse or mobile interface, it will take time.

Moreover, the algorithm will buy and sell the same stock multiple times in a brief period of time. This means the algorithm will trade several hundred times in a single day.

Yeah, here is some problem with that. Say, you are paying $1 commission. WOW! Be careful with your HF trading! But returns you can gain are bigger.

Remember, you are using artificial intelligence.

You have to know that 75% of US stock trades are placed by algorithms. This number will expand soon and it will continue.

Why we are so sure of that?

We people, humans, will never have such ability to process that volume of data, we will never have the possibility to estimate all information required to make a trade before our rivals. Sometime we will do that, but most of the time we will not. And to make a good decision we need time.

Algorithms are able to operate with a million bits of data in one millisecond, at the same time they are able to make decisions and act.

All alone! Of course, when you turn it on.

So, why to use High-frequency trading (HFT)?

High-frequency trading demands the lowest latency in order to keep a speed advantage over the retail traders. Complex algorithms are at the core of these programs. The algorithms give directions for acting to market circumstances based on highly automatic signals.

Behind these programs lays very complicated coding. Millions, even billions of lines of code. Some of the biggest HFT companies have a continual profit during 1,000 trading days without a single loss.

The speed, access, capital, and no holding time make advantages. And risk-averse and latency too. Latency is the time it takes for data to reach its endpoints. When latency is low that means higher speed.

HFT has led to tighter bid-ask spreads.

It makes transaction costs lower. The liquidity increased and pricing efficiency is raised. The main concerns about HFT are the ability to accent and stimulate market changes.

For example, there is some risk with some out-of-control algorithm. Also, there are traders who can manipulate the market because they are scammers familiar with programming. That’s why every trader who wants to employ HFT has to be very careful when downloading such apps.

Happy trading!

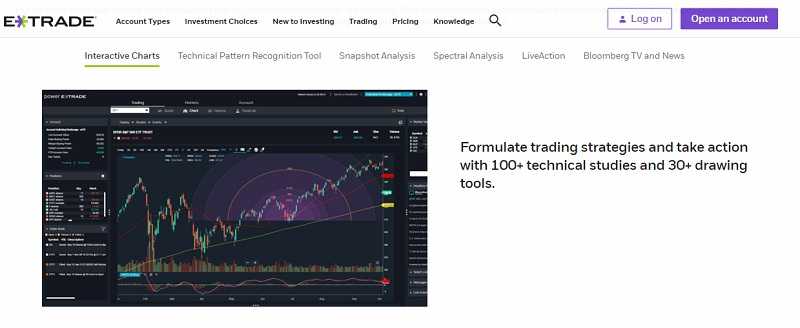

Here are Traders-Paradise’s suggestions for the automated trading software we examined.

Here are Traders-Paradise’s suggestions for the automated trading software we examined.