The main feature of this portfolio is the idea that most return is determined by the asset allocation of the portfolio, more than by asset selection.

No Brainer portfolio is one of the “Lazy portfolios”. No Brainer portfolio cover investments proportionately in four asset classes – US bonds, total US stock market, small-cap US stocks, and international stocks. It is very useful for investors with long-term goals. The point is that investors can favor one of the asset classes at different times. By doing so investors could gain nice risk-adjusted returns.

Designed for investors with a long time horizon that will favor each of the classes at various times, the portfolio aims to provide diversified risk-adjusted returns. This motif seeks to replicate Dr. Bernstein’s model by identifying ETFs that would be contained within the “No Brainer” asset class structure.

Dr. William Bernstein believes that asset allocation is more valuable for investors than choosing individual stocks or bonds.

This is the simplest portfolio Dr. Bernstein explains in his famous book “The Intelligent Asset Allocator”. Well, this book is generally suggested not only for the No Brainer portfolio. You can find a lot of extremely valuable info on the diversification and portfolio construction in this book. It is highly recommended among investors.

In this book, Dr. William Bernstein explores historical performance to come at an almost simple to implement a portfolio. He believes this portfolio should perform well in the long-term. No Brainer portfolio consists of four asset classes in the following proportion:

25% Short-term Bonds

25% of International Stocks

25% Small-Cap Stocks

25% Large-Cap Stocks

All you need is a simple, well-diversified portfolio

The Bernstein no-brainer tracks very strictly the “simple is better” rule. This lazy portfolio could be very suitable for any investor who dislikes monitoring the investments every day and has a longer time horizon.

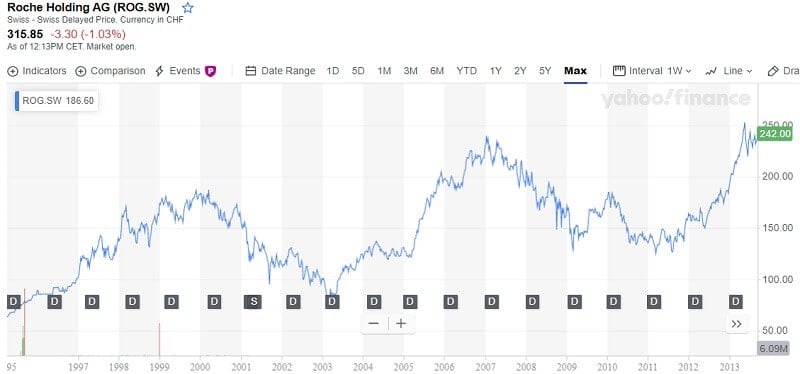

Here are some stats about the total return by using the No Brainer portfolio.

Over the past 10 years, the No Brainer portfolio has had an annual return of about 5%. Not good enough? In fact, it is in line with the S&P 500. This portfolio is a wonderful choice for anyone who doesn’t like high-risk, not-assured returns.

Why the No Brainer portfolio is so special?

Diversification! Yes, Dr. William Bernstein’s No Brainer portfolio is focused on diversification through many asset classes. It covers almost all assets. There is some interesting thing about William Bernstein, according to his own words he is asset class junkie but not only because of this particular portfolio. Dr. Bernstein is the creator of many portfolios.

So, you can imagine how broadly his portfolios display diversification. It is a 360-degree portfolio.

Among others, he created Four Pillars, Cowards Portfolio, Sheltered Sam Portfolio, etc.

For example, his Cowards Portfolio consists off:

10.00% US Large Cap Value

15.00% US Large Cap

10.00% US Small Cap Value

5.00% US Small Cap

5.00% REITs

5.00% Emerging Markets

5.00% Pacific Stocks

5.00% European Stocks

40.00% Short Term Treasuries

What are the advantages?

By applying this kind of portfolio, so-called lazy portfolios, you could minimize taxes by asset location or by adding a specific asset class such as municipal bonds. You could build such a portfolio based on your age and appetite for risk. Also, you can add employees’ stocks.

All this shows the no brainer portfolio as a very helpful model for all of your investments.

The most important, Bernstein’s no brainer portfolio will never face you with the cruel reality. Contrary, it will save you from that since from the very beginning you will know what you can expect in the returns.

Why use the no brainer portfolio?

Investing is hard but by applying some of the lazy portfolios it doesn’t have to be, investing could be easier. How is that? Let’s see!

Here, in the no brainer portfolio, you have ONLY 4 asset classes. That provides you to have a quick overview of your investments. It is simple. Why would you like complexity? It may cost a lot of money and time to watch.

Moreover, this portfolio doesn’t contain any special asset classes. So they are simple to understand. Just 4 asset classes! That’s so easy!

Who is the creator of the No Brainer portfolio?

William Bernstein was born in Philadelphia and educated in California where he earned a Ph.D. in chemistry at Berkeley. Did you know that he did it in just three years? To got the opportunity to work more closely with people, he went back to school and earned M.D. from UC–San Francisco. At that time he was the only neurologist in Coos County.

From 1980 to 1990, Dr. Bernstein treated migraines, Alzheimer’s and Parkinson’s. Ten years living all of these, he was under enormous stress and was forced to cut his working hours. Also, he wanted to pay more attention to his hobby – finances and investing. And Bernstein decided to learn more about it.

The first thing he required was data. Several years later he started to write a book with an interesting premise: people are wrongly trading individual assets instead to buy entire markets.

The book was published on his website Efficient Frontier in 1996.

and in 2001, McGraw-Hill published “The Intelligent Asset Allocator”. His “The Four Pillars of Investing” was published in 2002.

How to create a lazy portfolio

First, keep the cost as low as you can. Define your tolerance for risk and how big returns you want. Find data for historical returns to build a portfolio of index funds. They have to hold a mixture of assets that are able to produce a balance between risk and return. Investigate among different classes value stocks, small-caps, bonds, REITs, micro-caps, everything. You may think you will need a powerful software for this. Actually, a bit of common sense is all that you need. For example, pick 60% stock and 40% bonds. That will work well for investors. The other solution is to choose some low-cost fund that includes stocks and bonds both.

Sounds simple, right?

Bottom line

According to Bernstein, all you need are several skills to be a successful investor. One is understanding the financial implications of numbers since math is what lies behind investing. Also, as an investor, you must have the ability to trade without emotions. In other words: sell when the stock prices are growing, and buy when they are falling. And be independent. You have to have your opinion. Don’t believe in everything that pricey advisers say. Have trust in your basket of assets.

The lazy portfolios offer higher returns. This kind of portfolio has withstood the test of time and will be valuable for many years. And, as final words, don’t let be overwhelmed by too much information. Sometimes, you will make better choices with less info.