3 min read

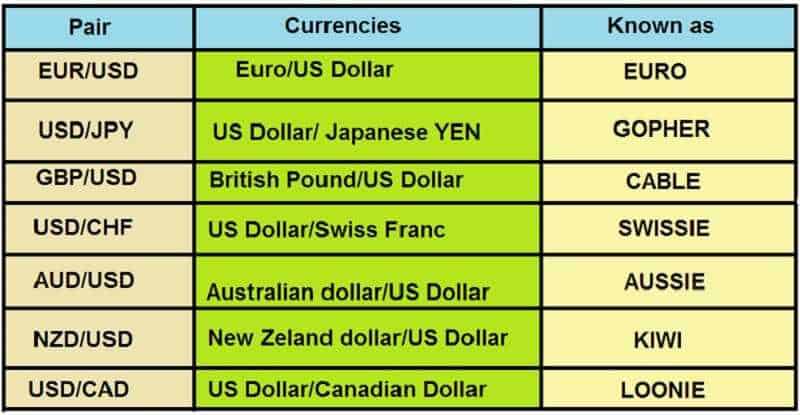

Forex trading for a living is valid for retail investors. Well, that means that trading Forex for a living is possible. The trouble for most people is that they commonly lack the needed trading skill, steadiness, training, or pragmatic mindset to make it trading Forex full time.

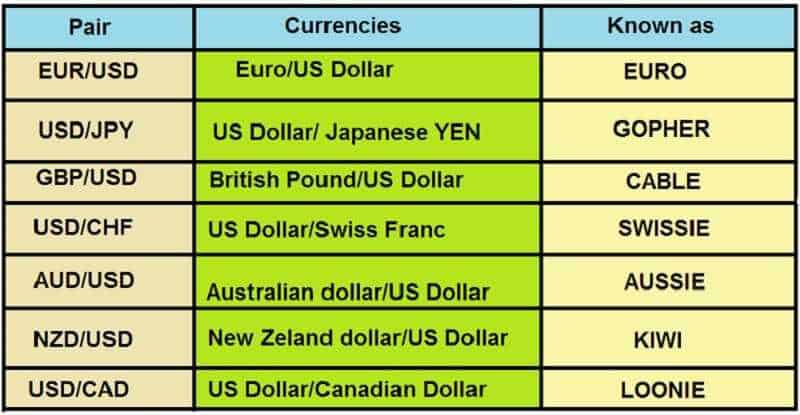

The Forex market is the most liquid market in the world. There are various shareholders from across the world trading in it.

Thanks to the Internet Forex trading is accessible for almost anyone. This means the market is no longer for the sharks of investment banks and multinational companies.

From some reasons, forex trading has a bad reputation. The reasons are well-known. Scam artists and brokers that trade against their customers are the main reason for that.

But for some people, forex trading for a living is a way of life and profession as well.

Can you trading Forex market for a living

Ambitious traders often ask is it really possible to make a living trading the Forex market.

The answer is yes.

But we owe you a true answer.

Yes, you can be trading Forex market but you have to do a lot of things in a proper way.

The key is simple. You have to learn to become a profitable trader and then act.

Easier said than done. But, you can be trading Forex market for a living, and we personally know people who make steady money in the markets.

So, there are no barriers.

So, what it takes to be able to trading Forex for a living?

To do so, however, you have to put a large number of banknotes on the market, and trading them regularly.

How much money do you need for Forex trading for a living?

If you want to make a living trading the Forex market is sufficient starting capital. If you don’t have enough you have to accept that you will not be making a living from trading Forex quickly.

The exact amount of money to trade full-time is different for everyone. Generally speaking, you will need a nice amount of money at your disposal. Of course, in order to trade a large position size and make enough money.

And, at the same time, not risking too much of your account on any one trade.

Maybe you should start as a part-time trader for extra income. It is easier to achieve in the early stages of your trading work. Instead of putting pressure on yourself to make a lot of money fast, you should focus on creating a consistently profitable track record and self-confidence.

And the money will come.

It is interesting, even when you have a large amount of money to trade with, if you do not focus on the principles of successful Forex trading, you will lose anyway.

How should you start Forex trading for a living?

Gradually! Perhaps it will take about six months to get the basic knowledge and understand how everything works.

You have to read a lot of trading literature at the time, for instance. Maybe you will talk to traders on different forums, exchange notes and ideas for the strategies and ask a lot of questions. That will be a good way to learn

This community will answer your questions and help you understand a lot of the most difficult theories.

Then, you should start with a demo account.

There you will trade without real money involved.

It’s a good plan to feel the stress of actual trading but you will not risk your real money.

You should practice trading a couple of weeks, getting how to use it, and then start an account with real money. Honestly, some traders think that trading with real money is the only way to learn.

It is a good idea to start with a small account. For example, with $20 or $25. If you gain a profit quickly, don’t worry, you will lose it faster. But it will be a good lesson.

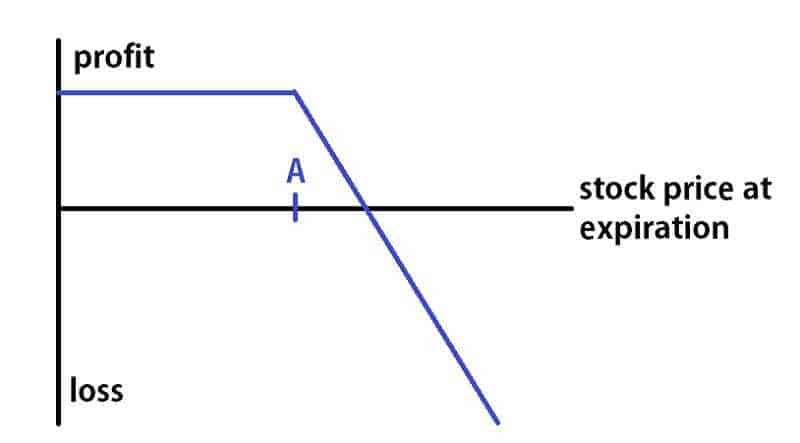

You will realize what ‘risk management’ really is and why traders think that it’s important. So, go back to the books, and try to develop your own trading strategy.

Real trading will start later, on a standard account with a $500 deposit, for example.

Basic paths on Forex trading for a living

Each path has its advantages and disadvantages. It’s up to you to consider each of them before you decide for forex trading for a living.

You have to prove to yourself that you are able to make money trading forex.

This means, you can make money consistently and you’ve increased your skills to be a successful forex trader.

After you recognize this rule, you can start to trade full time.

If you have a day job, it can be quite a challenge to trade forex full time.

In that case, you have a good cash defense to keep you going for some time.

Actually, you need to have some cash saved. The ideal situation is to have at least 2 years worth of cash to live on.

This may give you a stress-free trading environment from the start.

The determination to succeed is another path.

This is when you’ve started making some good amount of money and you think you can do it as a full-time thing.

Or maybe you already have enough money in the bank and forex trading forms an only little part of that.

For example, you have $200,000 cash in the bank and you put in $70,000 to start trading forex full time.

The $200,000 is for you to live, as a reserve, whilst that $70,000 trading account is what you try to make your living on. That’s why you might want to put that amount on Forex trading for a living.

The truth is, you need to very carefully consider all your options before you jump into the Forex market.

Frankly, you have only two options: you can succeed or you can fail.

Why do people decide for Forex trading for a Living?

For the money, of course!

We are not going to lie. People get into trading because they want to make large amounts of money and travel the world doing it. Some people trade because they obsessively love it and it is a part of their identity.

So, the reasons can be very different.

Lots of people have heard stories about people coming to the Forex market and making a killing overnight. Maybe some of those stories are what set you out on your journey to trading Forex for a living. Those stories can be true, but what they have forgotten to mention is that behind such success are the years of hard work and fight. It isn’t easy to make it to the top.

What tools do you need for Forex trading for a living?

Education. This is a big topic to consider. You can read our tutorials. If you know nothing about Forex trading then this is probably the best place to start your learning journey.

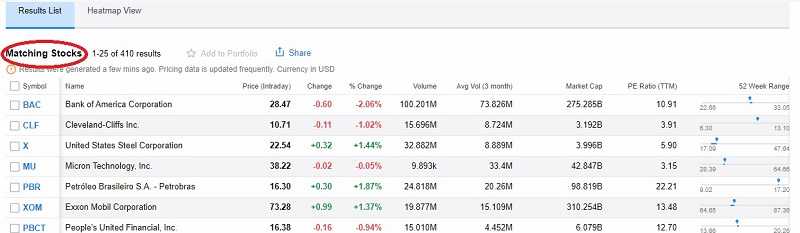

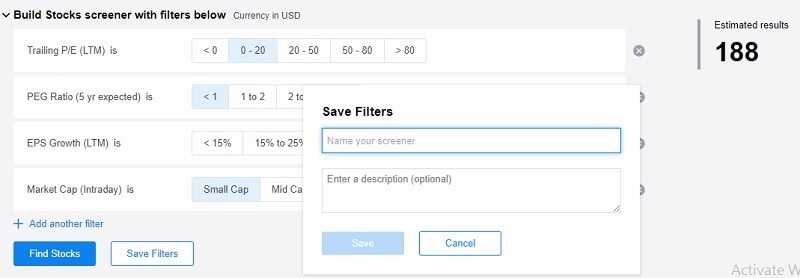

Broker and trading account. Also, you can find all about the best platforms and brokerages on our Wall of Fame.

Good platform. Once you sign up with some broker of your choice (check out our broker review page HERE.) you then need to download and install the platform. And if you are into algorithms their platform will suit you. Try using a demo account first so that you can learn how to use the platform properly.

The bottom line

Here are all the basics that you need to get started Forex trading for a living. It’s up to you to do the work and put in the time. Trading for a living requires a lot of hard work, enthusiasm, and commitment to make it work.

You have to be firm to make it work even in the times when something is going wrong.

But, if you give it your all, the rewards at the other end are unquestionably worth it. When you approach trading with the respect and commitment it deserves then you can live the dream of Forex trading for a living.

How to find the best Forex strategies and win the market? Here are some suggestions.

How to find the best Forex strategies and win the market? Here are some suggestions.