2 min read

Pimco wants to understand the retirement patterns and it selected Nobel Laureate, Richard Thaler as a senior adviser.

Nobel Laureate Dr. Thaler is a professor of behavioral science and economics. He is teaching at the University of Chicago Booth School of Business.

Two years ago, in 2017, he got a Nobel Prize for his “contribution to behavioral economics”.

Pimco, Pacific Investment Management Company, plans to use Thaler’s expert help in order to serve clients.

The main goal is to help them to allocate assets in a “thoughtful way”.

That includes even retirement in unpredictable circumstances.

The chief executive of Pimco Emmanuel Roman said:

“We know that understanding how we behave and the decisions we make are critical inputs to help make us better investors and better managers. Dr. Thaler’s insights will help enhance our ability to make the best possible decisions for our portfolios, our clients and our employees worldwide.”

Pimco also freshly stated long-term cooperation with the Center for Decision Research at the Booth School. The goal here is to help “deliver the best possible outcome for investors”.

Who is Nobel Laureate, Dr. Richard Thaler?

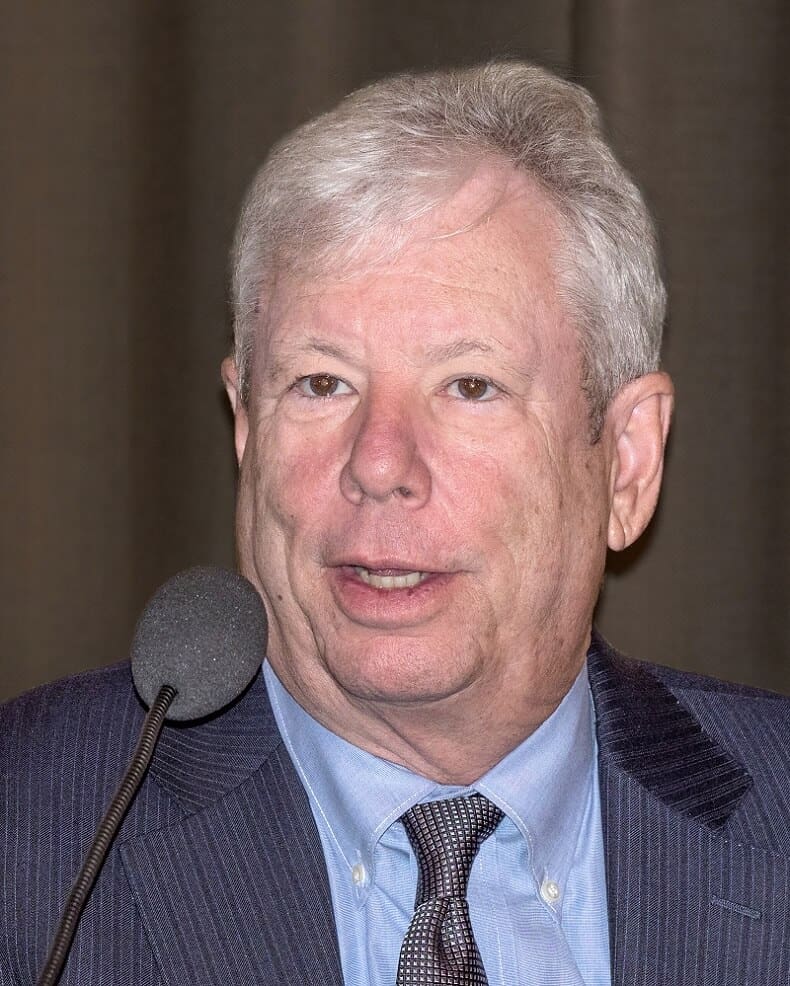

Nobel Laureate, Richard Thaler

Nobel Laureate, Richard Thaler

Thaler studies behavioral economics and finance, and the psychology of decision-making.

A very interesting subject that fills in the slot between economics and psychology.

Thaler examines the hint of the conventional economic theory that everyone in the economy is rational and selfish, instead of considering the chance that some of the factors in the economy are occasionally mortal beings.

In other words, we’re not excellent.

We all like to suppose that we are intelligent, rational beings, constantly performing in best ends. Actuality, it is the ruling economic theory.

What was left of this myth was further ruined by Nobel Laureate Richard Thaler.

And The Royal Swedish Academy of Sciences, when gave him the Nobel prize in economics.

Nobel Laureate Thaler is a pioneer in the field of behavioral economics, which studies humanity’s defects, say that.

He is seeking for the answer, why we don’t make reasonable economic decisions.

He is the co-author of bestseller “Nudge: Improving Decisions about Health, Wealth and Happiness with Cass Sunstein”. In this book, and in many other studies, Nobel LaureateThaler reveals the faults and prejudices that determine our behaviors.

The point of this theory is that you can employ mental nudges to encourage people to make better judgments.

It is particularly preferred when planning, for example, saving for retirement.

People can perform poor economic decisions based on the “endowment effect”, as Thaler described it.

It is the theory that people appreciate and value something more when they own it.

To be more exact, if we are selling something we would like to get more money than in the situation we are buying the same thing.

This correlates to another theory, identified as loss aversion.

People have a negative perception of loss more heavily than they have the positive feeling of a profit of the same volume.

For instance, when we are selling some object, our reference value is the price we paid for it.

Even if the value of that item is evincible decreased, we are anchored to the buying price. The reason is we want to bypass that feeling of loss.

This effect, called anchoring, can lead to injury in financial markets, in particular.

Sound logical and we all have been experienced this effect.

Thaler established the idea of using nudges to build alternative routes of actions.

Making good long-term decision but keep freedom of choice.

How to do that? Simply.

One method is changing the default option, switching users from opt-in to opt-out. This has been used in case of “nudge units” in the US and UK, to increase retirement savings and organ donation, for example.

So, we will see how this theory will going on practice with Pimco.

Leave a Reply