3 min read

Stock screeners are tools which display the stocks a user chooses to seek out.

Stock screening is a tool that investors use to filter a large database of stocks. They can help you cut through the market noise and figure out the best stocks to buy based on your investment objective and goals.

Stock screening tools can be web-based tools or downloadable software.

You can find some free screeners, as well as more advanced programs that can be quite costly.

We will use finance.yahoo.com/screener to show you how they can be helpful.

This is discipline at its best!

When you design the stock screen model, by using an inexpensive stock screening software or free tools on the internet, you can determine which stocks meet the criteria with a single click. This is far more efficient than digesting every piece of available information. Not to mention that most stock screeners can analyze thousands of stocks in seconds. It would be difficult for even a large team of researchers to accomplish the same task in weeks.

Let’s go into more detail into each of these benefits.

How stock screeners save you time

The data set could include hundreds to thousands of stocks. And thoroughly analyzing all of them would be impossible for most investors. Delving into each company’s financial statements, ratios, multiples, and historical and future growth prospects would take entirely too long.

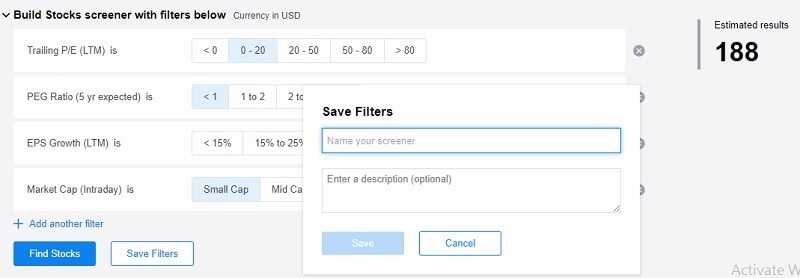

Once you determine which metrics will go into your stock screen, the screener filters out stocks that don’t meet your criteria and produces a list of stocks that do.

The stricter the screening criteria, the fewer stocks will pass the screen.

For example, if you’re looking for undervalued stocks, you may search for stocks with a price-to-earnings (P/E) ratio below a specific level. If you’re less concerned with valuation and more concerned with growth, you may look for stocks with a high level of year-over-year earnings growth.

Once you have a collection of stocks that have passed your screen, you have to determine which stocks qualify for further analysis. This may be based on fundamental analysis, additional market research, or your current portfolio’s allocation to specific sectors or industries.

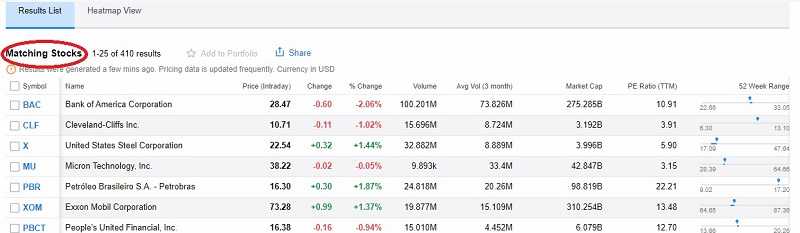

Based on your filter applied you will find what you want. Like this:

A stock screener is a powerful tool that helps to filter stocks according to a wide range of criteria. You can find a wide range of criteria, such as Price, 1-Year change, Market Cap, P/E Ratio and more. The criteria are separated into categories like price, ratios, fundamental, etc.

Stock screeners remove behavioral prejudice

Investors have natural tendencies to make foolish investing decisions. These are generally called “behavioral biases.” They can be difficult to detect and avoid. These biases can lead investors to make irrational investment decisions which may hurt returns.

For example, investors will often change their strategy so that certain stocks will fit into it. Say you really liked some company. You might convince yourself that you should buy the stock even if it had too high of a price-to-earnings (P/E) ratio or too little revenue growth.

Stock screening helps to remove these types of biases and helps investors to remain objective.

But, a stock screener won’t save you from behavioral biases entirely. For example, if you wanted that company to pass your screen, you could change your screening criteria until it passed. In other words, you can cheat yourself.

Stock screeners are just one of the many tools in the investor’s toolbox.

They can help you narrow down your potential investments. It’s important to do your own research into companies’ businesses and decide whether or not you believe in their long-term prospects. Just because a stock passes your screen doesn’t mean it’s a good investment.

Don’t waste your money.

Think you know where are the markets gonna go?

Leave a Reply