3 min read

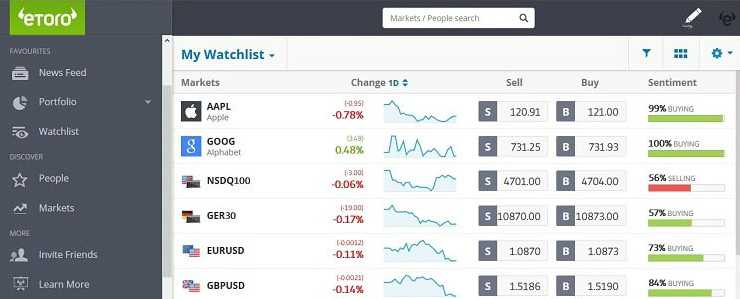

Leverage trading stocks is a concept that can enable you to multiply your exposure to a financial market without committing extra investment capital.

However, you need to understand leverage trading to help fully immerse yourself in the stock market.

The idea behind leverage trading stocks is to increase your potential payout on a play. However, it doesn’t always work out the way you want, and it can prove dangerous for your portfolio and trading account, especially when you’re new to the stock market.

Leverage is the ability to trade a large position with only a small amount of trading capital. We are sure you already find the articles that suggest that trading using leverage is risky. Also, you can find that new trader should only trade cash-based markets, like individual stock markets, and avoid trading highly leveraged markets.

Well, we disagree with this in full. Trading using leverage is no riskier than non-leveraged trading. Also, for certain types of trading, the more leverage that is used, there is the lower the risk.

What Is Leverage Trading Stocks?

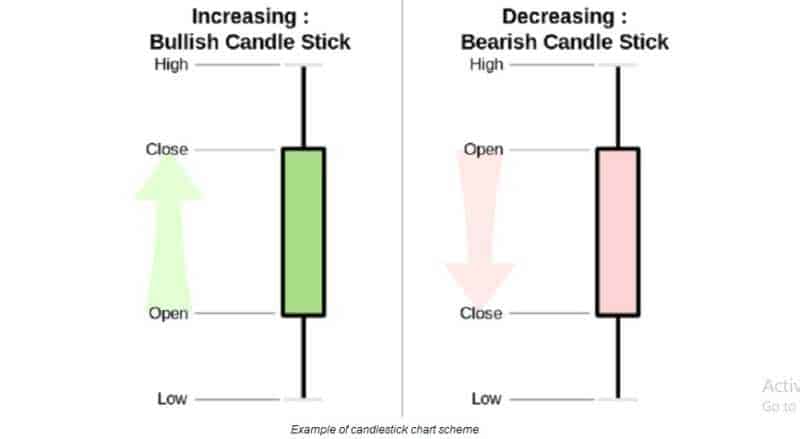

In the stock market, leverage trading stocks are using borrowed shares from your broker to increase your position size in a play. So you can potentially make more money on the other side. Options trading, futures contracts, and buying on margin are all examples of leverage trading. But buying on margin is maybe the riskiest.

When you buy on margin, you’re essentially financing your position in the stock.

Actually, it’s just like buying new furniture. For example: Say you want a new kitchen and you talk the salesperson down to $25,000. You don’t have $25K in cash, so you put $2,000 down and finance $23,000 over five years. Every month, you pay the lender your furniture note. That includes the principal, which is the amount financed, and the interest, which is money paid to the lender in exchange for financing you.

People do this every day with i.g. cars and other physical kinds of stuff.

Well, it doesn’t sound so dangerous.

But even a furniture purchase can leave you in financial trouble.

Let’s say you put $2,000 down on your new kitchen and drive it off the lot. A few days later, you lost it in a fire accident. The insurance company pays the kitchen’s market value, which has already depreciated below what you paid for it. In other words, you have to keep paying off your kitchen note even though you don’t have a kitchen.

That’s what usually goes wrong with leverage trading.

How Does Leverage Trading Stocks Work?

Leverage trading stocks work by allowing you to borrow shares in stock from your broker.

For one example:

Let’s say you have $2,000 to invest. This amount could be invested in 20 shares of Microsoft stock. But in order to increase leverage, you could invest the $2,000 in five options contracts. You would have 1000 shares instead of just 20.

Instead of investing in options contracts, you can buy a certain number of shares. Leverage is always expressed as a ratio, such as 2:1. In that case, you could double your position size by borrowing twice what you actually buy.

When you exit your position, you’re responsible for paying back the broker for the shares you borrowed. Whatever you have left is your profit, minus your own initial investment in the shares.

2:1 leverage example

2:1 leverage means you can borrow twice the amount of your investment from your broker.

For example, you want to invest $50,000 in stock, but you only have $25,000 in your trading account. Using leverage, you could buy on margin at 2:1, giving you $50,000 to invest.

It doesn’t come free, of course. You have to make an initial deposit or down payment to your broker for the privilege of buying on margin.

But what happens to your investment?

Let’s say you bought $50,000 worth of stock at $50 per share. The stock climbs to $55, and you sell.

At that point, you have to return the borrowed shares or money to your broker. The brokerage firm extended $25,000, so you owe that back, plus any interest required. The rest you keep as profit.

If the stock price drops, though, you’ll still have to pay back your broker. Plus, you’ll have to cover any losses your broker incurred during the trade. And your own, too.

The Leverage is Incorrectly Considered Risky

Leverage can be highly risky because it can boost the potential profit. But also the loss that trade can make. For example, you make a trade with $1,000 of trading capital but has the potential to lose $10,000 of trading capital.

This is based on the theory that if a trader has $1,000 of trading capital, they should not be able to lose more than $1,000. Therefore should only be able to trade $1,000. Leverage allows the same $1,000 of trading capital to trade perhaps $5,000 worth of stock, which would all be at risk.

Well, this is theoretically correct. But it is the way that an inexperienced trader looks at leverage, and it is, therefore, the wrong way.

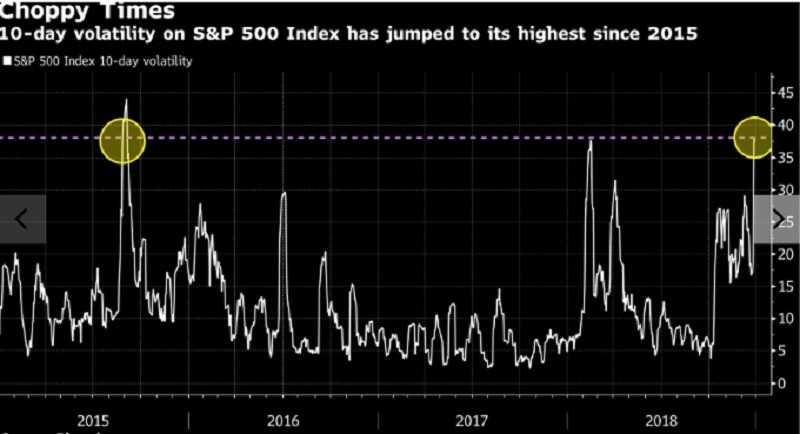

Leverage Is a High-Risk Strategy

There are no secrets, investing risk increases with reward. The higher the potential payout, the higher your risk for great losses. This is especially true when you’re trading with leverage because you’re playing with the house’s money.

Brokerage firms require margin account holders to maintain a certain minimum balance. Your cash and owned securities serve as collateral for whatever you’ve borrowed. It reduces the risk for the broker. Though, it increases your risk, because if you borrow too much on a losing position, your account can get wiped out instantly.

The Real Truth About Leverage Trading Stocks

Leverage is actually a very efficient use of trading capital. The professional traders value it because it allows them to trade large positions. Such as more contracts, or shares, etc. And with less trading capital. Leverage does not modify the potential profit or loss that trade can make. Contrary, it reduces the amount of trading capital that must be used, thereby releasing trading capital for other trades.

For example, you want to buy 1000 shares of stock at $20 per share. That would require maybe $5,000 of trading capital. So, the rest of your initial leaving the remaining $15,000 available for other trades.

This is the way that a professional trader looks at leverage. Therefore, this is the correct way.

The bottom line

Leverage trading can be a slippery slope.

On the other hand, the more leverage the better. Professional traders will choose highly leveraged markets over non-leveraged markets every time. Telling new traders to avoid trading using leverage is essentially telling them to trade like an amateur instead of a professional. Every time that pros trade a stock, they always use the highest leverage they can. They would never trade a stock without using leverage.

The next time that you are making a stock trade, consider using a leveraged market instead.

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.

Image from shutterstock.com

Image from shutterstock.com Source: Bloomberg

Source: Bloomberg