How is market timing possible? Read to the end.

By Guy Avtalyon

Market timing is the method of buying and selling in the market based on financial inclinations, business information, and market circumstances.

It is a kind of investment or trading strategy. It is an effort to beat the stock market by prognosticating its movements and buy and sell according to that data. While you are making moves in the financial market, changing the asset classes, you need some predictions. To make predictions you need tools, for example, technical indicators, financial and economic data, to be able to estimate how the market will move.

From these tools needed you can easily see that the market timing is in contrast to a buy-and-hold strategy.

Some investors don’t believe that is impossible to time the market. But on the other side, you have a whole range of investors, especially traders that are sure in it. Well, both sides are right, at some point. It is pretty hard to time the market, but it is possible for the short run. Seeking to time the market over the long run can be difficult and may show a lack of consistency.

Is market timing possible?

If you are a short-term trader or full-time investor, you may have some good results but you have to be an exceptional one to notice the right time to buy and sell in the market. The statistic is explicit, there is no notable success in comparison with the buy-and-hold investor.

Market timing is related to tactical asset allocation or dynamic investing.

Let’s say you want to invest $10,000 and you put $5,000 in the stock, $3,00 in the bonds, and $2,000 in the cash.

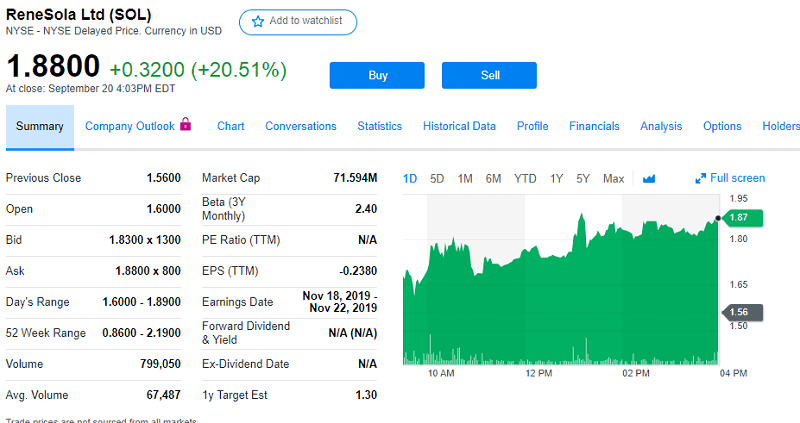

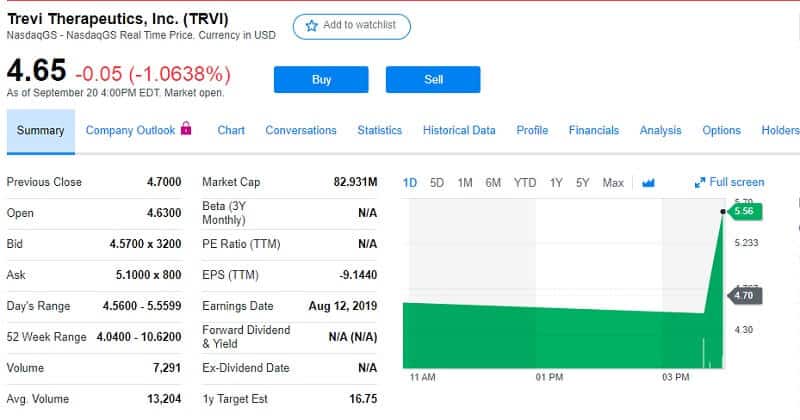

The market timer tries to sell when the price is the highest and to sell when the price is at the lowest level. So, the trader or investor confidence to market time will sell some part of stocks in case the interest rates are increasing and buy bonds. Such an investor wants to profit from something called a market “peak” for stocks and the start of growth for bonds.

The believer in market timing is sure that price movements in short-time are essential and usually predictable. That’s why the market anomalies are important to them to support their opinion. Chart patterns that are repeating are also important to them. Their investment horizon is shorter, it can be minutes, days, or months. On the other side, long-term investors, so-called buy-and-hold, prefer to estimate the long-term potential of their investments by employing fundamental analysis. They are estimating the company’s strategies, products, etc.

Market time investors will use leverage to gain returns. This will add more risk to their portfolios but their returns could be higher too.

Are there any costs for it?

Investors that practice this strategy claim that by using this method they are able to diminish losses. The principle is quite simple, they just have to move one sector before drawbacks. You see, their aim is to find a safe investment and avoid market volatility while they are holding volatile investments. Market timing investors that attempt to time entries and exits very often may underperform the long-term investors. The reason behind, it is extremely hard to gauge the next direction of the market. Despite their optimism, the real costs for the majority of them are higher than the possible gain of moving in and out of the market.

There are also extra trading commissions and capital gains taxes. The continuous analysis linked with market timing requires frequent asset reallocation and a lot of trading activity. Much more than passive investing. If you want to practice this method you will need more time and an excellent education.

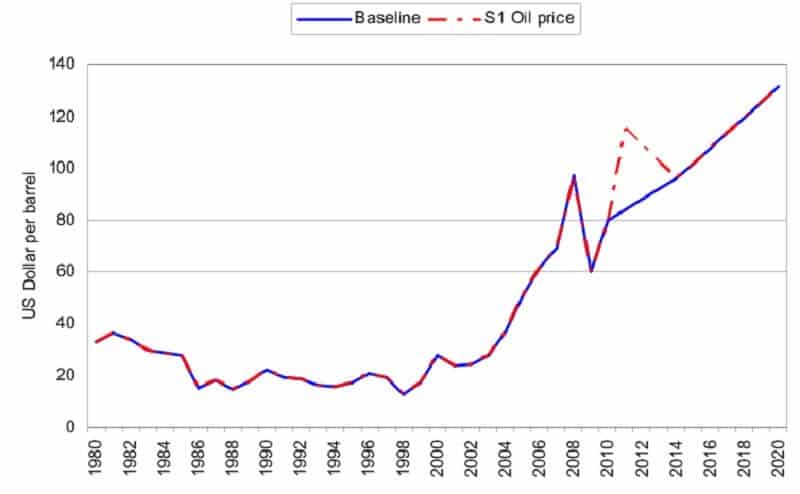

Market timing is a questionable approach. You can find a lot of very serious studies that have revealed that the market’s bottoms and tops are pretty hard to find consistently.

Moreover, long-term investors truly support the efficient market hypothesis, which claims that the prices are random and reflect all available data, so it is impossible to outperform the market in the long run. It is especially too hard in a short time since it is impossible to forecast stock prices. Although, market timing has huge and faithful followers among investors. Can we say they are enjoying the challenge to consistently produce higher-average returns? Maybe.

The most important thing for all investors is the fact that they have to watch their investments, to watch charts and they have to know the market timing method.