Dividends may be a sign of good stock but never invest in some stock just because of dividends it pays.

By Guy Avtalyon

The dividend is like interest on a loan. A company that earns real money every year operates with it on three options. First, the company can reinvest earnings to make new products, find more customers, or to make business more efficient. Some companies can buy back their stock in order to own more of the company and more profits. The third way is to return some of the money to shareholders through dividends. It is very important to understand how dividends work. Stocks that pay dividends can be great to hold.

Dividends are like interest on a loan. Assume you loan your relative $1000 for a year at 5% interest. You expect to get back your $1000 plus that 5%, which is $50 more. The dividend is that except the $1000 stays in the company because you still own part of it. It’s your part of the profit the company made.

Unfortunately, not all companies will pay dividends. Some companies don’t make the profit and they can’t pay out anything. Other companies flow all of their money back into the company to grow faster. The rule is there is no rule. What works for one business doesn’t work for others.

Is investing in dividends a good choice?

I know some people who like to receive dividend checks. For instance, some reliable companies may payout every three months. Even if the share price has small moves every year, investors still make money from these dividend payments and they don’t have to sell their shares to get that money. The check comes at the end of a certain period.

This money gets paid to all shareholders, no matter how many shares they own. The retiree who owns one share of some company gets the dividend in the same way as the wealthy hedge fund manager. The reliability of dividends gives them attractivity in investment.

Do Stock Pay Dividends?

High dividend-paying stocks have rates of 5%, 10%, or even more.

Why they are so high? It is simple to explain. Let’s see this simplified example.

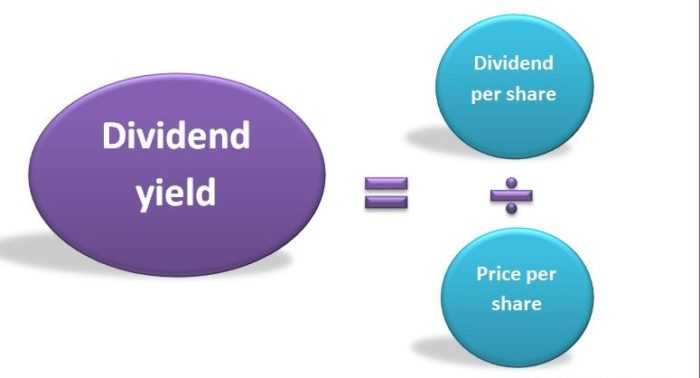

A company with a share price of $100 which pays a dividend of $1 per share every year has a dividend yield of 1%, while a company with a share price of $10 which pays out $1 per share every year has a dividend yield of 10%.

Notice that the price you pay for a stock and the growth of the business over time determine how much money you make on that stock. Keep in mind there’s no shortcut to investing little money with high returns. Unfortunately, but that’s true.

The easiest way to find if a stock pays dividends is to look at any stock research site. You will find a dollar amount for the latest dividend announced, the annual amount paid, and the current yield. Always check the dates. The point is that stock may pay out one quarter and not the next.

Is it profitable to invest in the high dividend-paying stocks?

High dividend-paying stocks are paying more than the average dividend rate. Companies that pay high dividends are considered as good companies. But they may have some other reason like to attract investors to drive up the share price. It also may be a sign that the share price has dramatically gone down recently. Sometimes this means the stock is on sale or that the company is in trouble. You can’t know this just by looking at the share price or how high is the dividend amount. You have to have better information about the company’s business and its current financials.

The company must choose to pay a dividend and the amount paid may vary. Not all companies will regularly raise the number of its dividend payments.

Is investing in stocks that pay dividends a good strategy?

Yes, especially if you want regular cash coming in reliably. Reliability is the keyword because dividends aren’t guaranteed. You still have to do your research. It is better to buy great companies, not just stocks that pay the highest dividends per share.

High dividend stocks are not necessarily a good investment. Pay attention do they pay them every year, every quarter or does a certain company follow a regular schedule for the rise of its payment amount. It is possible to make more from dividends every year per share than you initially paid for the stock. Keep in mind this the tricky part of a dividend yield of stocks; it’s always calculated relative to the current price, not what you paid. A company that pays a huge dividend is a warning sign. How does the company plan to maintain its payment strategy? Is this a temporary trick to raise the stock price to fake levels? Always think about reliability.

Does value investors make money from high dividend-paying stocks?

Dividends are excellent. And value investing looks for underpriced stocks.

“What are the best stocks to invest in?” or “What are the reasons to invest in a company?”, can be the questions you ask yourself. In that case, dividends may be a sign of a good stock. But not all great stocks pay dividends, indeed. Some never do. Some pay from time to time. It depends.

If you pick a powerful company that gives you a check every quarter and if the price is right relative to the value, then you have no problem. That gem belongs to you.

What rules every investor should follow if want to be successful? Read to the end.

What rules every investor should follow if want to be successful? Read to the end.