The stock market average return of 10% is exactly that – an average, while the returns for any particular year may be lower or higher.

The average stock market return was about 10% annual for the past almost 100 years. But when we take a look at any year particularly we could notice that the returns weren’t always average. And that is the truth about the average stock market return, it is average rarely.

Historical data shows the average stock market return is 10% but when you look at year-to-year it can vary. For example, this rate should be reduced by inflation. Inflation can vary too let’s say from 2% to 3% which is a regular rate.

But when we talk about investing and investors we usually think about long-term investments. To be honest, the stock market likes long-term investors. They are keeping their investments five or more years.

Keep in mind: the stock market’s returns aren’t average and could be far from average. For example, over the past 80 years, you could find that the average stock market return was from 8% to 12% only several times. Due to the volatility of the stock markets, most of the time the average stock market return was higher or lower. So, returns can be positive even when the market is volatile but the average stock market return will not rise every year. Sometimes it will be lower sometimes higher.

What is the average stock market return?

The average stock market return actually is about 7%. If we take into account the periods of highs, for example, the 1950s the returns were up to 16%. But we had the negative returns of 3% in the 2000s.

For example, from 1998 to 2018, we had an average stock market return of 6.88%. The lower return came from the enormous loss in the market in 2008.

But, over the last 50 years, the average stock market return was 10.09%.

The stats may help here, the Dow Jones – by May 25, 2018, the average annual return was 5.42%. On January 6, 2012, a 25-year period ended with an average return of 7.55% per year. But if we look at data from the beginning of 20 century, the average stock market return was around 4.3% respectively.

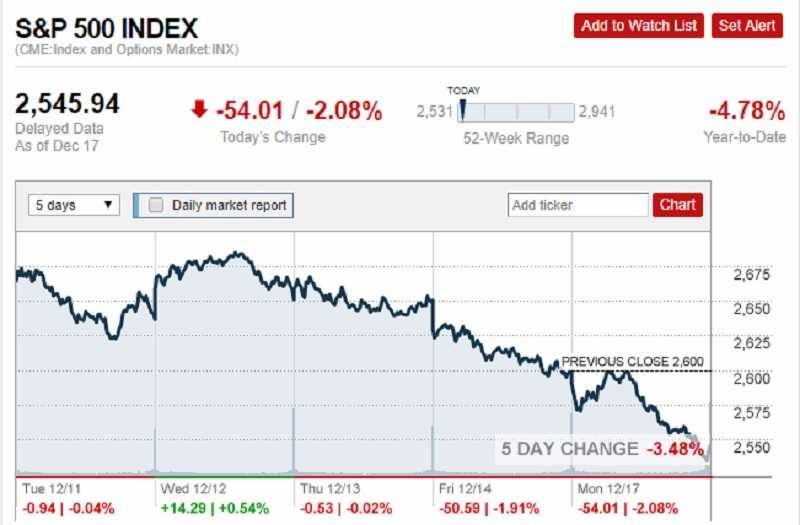

On the other hand, the S&P 500 index had average returns from 1957 through the end of 2018 about 7.96%. But, the average annual return from its inception in 1926 through the end of 2018 was about 10%. Last year, 2019 was great with a return of 30.43%. If we include dividend reinvestment, the S&P 500 return was 33.07%.

How to calculate the average return on stocks?

The average return on your stocks’ portfolio should reveal to you how well your investments have run in a particular period. This can also help you to predict future returns. Remember, this measure isn’t the annual compound growth rate.

So, to calculate the average return on stocks you will need to calculate the return for each period. The next step is to add returns together and divide the result by the number of periods. That’s how you will get the average stock return.

Calculate the average rate of return

Firstly, what is the average rate of return?

It is the percentage rate of return that is expected on an investment but compared to the initial cost.

The formula is quite simple. Divide the average annual net earnings after taxes or return on the investment to get the average annual net earnings and then display in percentage.

The average rate of return formula = (Average Annual Net Earnings – Taxes) / Initial investment x 100%

Here is the explanation of what we did:

Firstly, determine the earnings from stock for a particular period, let’s say 10 years. Now, you have to calculate the average annual return. Do that by dividing the total earnings after 10 years by the number of years.

Further, if you have a one-time investment, find the initial investment in the stock. If you want to calculate for regular stock investments, take the average investment over life.

And finally, divide the average annual return by initial investment in the stock.

Also, you can do all of this and get the same result if you divide the average annual return by average investment in the stock but expressed in percentage.

Let’s take the example of a stock that is likely to generate returns of 10% per year after taxes and for a period of 3 years.

The initial investment $10.000

First-year’s net earnings $1.000

Second-year net earning $2.100

Third-year net earnings $3.310

Use formula

The average rate of return formula = (Average Annual Net Earnings – Taxes) / Initial investment x 100%

After 3 years your initial investment will be increased by 64% or you will have $6.420 more in your account.

What does this mean for investors?

As always, computing dividends is important and you have to account for them. If you reinvested received dividends, even better. That’s compounding on compounding!

The truth be told, those who have stayed invested in stocks have largely been rewarded.

The understanding of the concept of the average rate of return is important because investors make decisions based on the possible amount of return expected from an investment. Based on the average rate of return, you can decide will you enter into an investment or not. Moreover, the return is used for ranking the stocks and ultimately you will choose per the ranking and include them in the portfolio.

In a few words, the higher the return, the better is the stock.

But let’s examine one different case of the average stock market return.

Let’s say your initial investment is also $10.000 but (this isn’t easy to say) in the first year you lost 20% of the initial investment. That’s bad news. But in the second year, you gained 20% of the initial investment. Oh, how nice it is!

Yes, nice but your gain is zero.

(-20+20) = 0

What do you think? Do you still have your $10.000? Things never move in that way.

Here is why.

When you lose 20% of your initial investment you ended up with $8.000. Right? That amount became the amount of your investment. On that amount, you gained 20% or $1.600. So, after two years you have $9.600 in your hands and you are short for $400 compared to your initial investment of $10.000. You lose money and your return isn’t zero. Your return is minus and you will need more gains in bigger percentages to cover that loss.

The stock market average return isn’t misleading. That is how you have to calculate it.

Bottom line

This means that investors MUST have a financial plan and investing strategy.

There are no guarantees for big gains in the stock market and never were. The average return of 7% or 10% is great if you are a long-term investor. It is reasonable to expect a good return on the current stock markets if you reduce your enthusiasm when the good times come.

That’s nice, you’re making money. But, when stocks are jumping, remember that not so good time may come. Especially keep this in your mind over the bull market cycle.

You can get the average return only if you buy and hold but not if you trade frequently. Even a few percent per year can produce nice gain over the years.