2 min read

- The blockchain is the mathematical structure for storing data in a way that is nearly impossible to fake.

- Blockchain technology is an important element of cryptocurrencies. Without it, digital currencies like Bitcoin would not exist.

If you are new to blockchain technology or you are already a trader, this article is for you. So, what is the blockchain? The blockchain is an absolutely brilliant invention. The idea of a person or group of people known by the pseudonym, Satoshi Nakamoto. By the time, it has developed into something greater, but still, there is a question: What is Blockchain?

Every day you can hear about Blockchain technology, Bitcoin, ICO, Ethereum. But do you understand what blockchain is?

How does it work? Can blockchain be used in business? Will blockchain change the world? This article is aimed to answer all these questions.

What blockchain is, the best explanation is through the game.

Imagine you and your friends are on a vacation. Its night, you are sitting around the pit-fire and playing storytelling. One has begun the story with a sentence, you are repeating the sentence and adding up your part, then the other player, etc. The main goal is the chain of sentences which are producing a story. If someone is not able to repeat and add his own sentence, the chain will fall down, it would end. New sentences are nothing without the initiation of old sentences. That exactly what the blockchain is. You added a sentence on your friend sentence, that was a ‘block’. Everyone approved your phrase because it referred to the old sentences, that is a shared ledger.

From the beginning

Common people started mistrusting the banks. There lies the birth of blockchain. A mysterious person named Satoshi Nakamoto created a whole new currency. He built the whole system on the principle of decentralization. He created a public ledger, which is synchronizing continuously and everyone is able to witness the process.

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.”

These are the words of Satoshi Nakamoto, the mysterious creator of Bitcoin, in a message sent to a cryptography-focused mailing list in October 2008. Included was a link to a nine-page white paper describing a technology that some are now convinced will disrupt the financial system.

Transform this into real life.

Let me ask you something. What happens when you send money from your bank account to someone else’s bank account? Your bank acts as a middleman, it verifies and approves the details of sender and receiver through its ledger (a book or other collection of financial accounts. In this case, you must trust your bank to have such transaction. Imagine, when banks are collapsing, will you send your money through banks? Will you be able to trust the middleman?

How does Blockchain work?

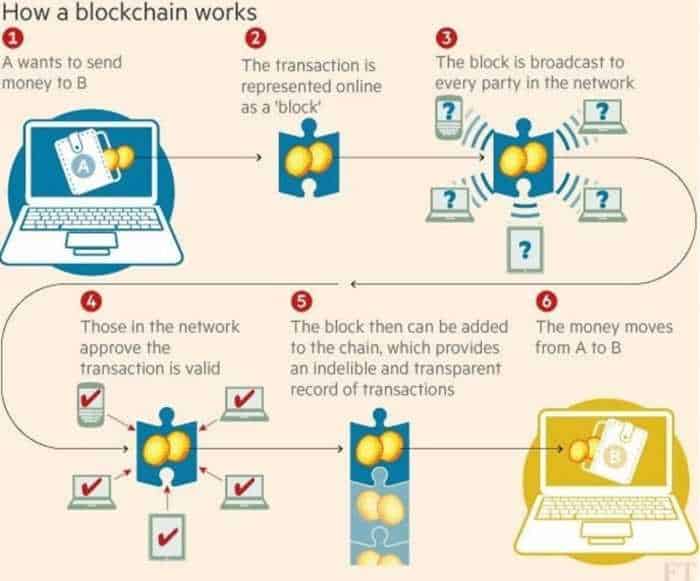

Suppose, you want to transfer some money to your friend in the other country. You will initiate a transaction, each online transaction will be a reference to ‘Block’. Because it is a public ledger, there will be broadcast to everyone in the network about the block. Constant synchronization of the ledger will be going on. If the people in the network would approve the transaction, then the ‘block’ would be added to the ‘chain’ which is a transparent record of transactions. Hence the name ‘blockchain’. This is how the money would be transferred. Satoshi Nakamoto carefully designed it to prevent the double spending of money.

What does it mean?

This problem exclusively belongs to digital currency. We can copy songs and movies from our laptops and paste them in other devices. That file will carry information. And can be copied and reproduced regarding our digital transaction. This will generate new fake currency, which is not part of our original monetary system. We can call it double spending of money.

Satoshi Nakamoto handled this problem extremely well. He introduced public ledger and an immutable chain of blocks. Every transaction is bundled into a block, every block is processed, authenticated, time-stamped and linked to the previous block.

This creates an immutable chain

When you want to send some money from your bank account, your bank will verify and confirm the transaction. Problem is that you have only one confirmation in the banking system. But, in the blockchain, at least 6 confirmations are required for a block to be added to the chain. Contrary, it is rejected. Can you see how blockchain is more secure and transparent?

Why use blockchain?

Transparency is one of the reasons why should use this technology. It is about its open source structure. It means that other users of the network can read and confirm or not confirm the information. The essential thing of being open source is that it can’t save logged data without majority blockchain network users.

Decentralization is other. Next main blockchain reason is the lack of a central data hub. Instead of running a massive data center you save your information in decentralized net, where any user can read, check and authorize any of your actions.

User controlled networks are also advantaged, a consequence of the decentralization of the network. Instead of holding a third party for data processing, stakeholders decided to control each other and decide what to do next. For instance, the inability to achieve 80% consensus on the update, tied to the bitcoin block, lies in the fact that it was necessary to develop a plug into two separate currencies, bitcoin, and bitcoin cash.

Faster transaction settlements is another advantage. Blockchain technology works 24 hours a day, seven days a week. That means the blockchain based transaction process is faster.

When you send the transaction to traditional banks, it will take days to be completely settled. This is due to protocols in bank transferring software, and working time. You also have financial institutions located in various time zones, which delays processing times, but it’s not about blockchain.

Reduced transaction costs are characteristic. Blockchain allows you to execute transactions without a third party, which is often a bank or a central server. Since the intermediary is absent, this allows you to get rid of imposing expense items.

Where to use the blockchain

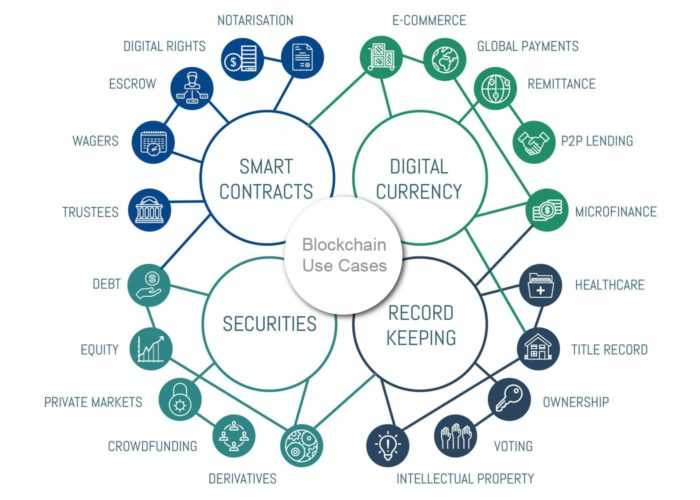

There are a lot of uses of blockchain technology. Bitcoin or cryptocurrencies is just one application of blockchain. We have Ethereum, which is a platform where different applications can be built, it is more like an Operating System. And other altcoins too, are based on the blockchain. And many other fields. The blockchain is not only about cryptocurrencies.

In healthcare, the use of digital signatures based on blockchain data allows access only with the permission of several people and full compliance with keys, also allows to regulate the availability and maintain the confidentiality of medical records.

As a protection, the blockchain technology is creating an impregnable network with the impossibility to get access from the outside. The blockchain technology can improve transparency, speed up work and check corruption in governments all around the world. Probably one of the most popular uses of blockchain technology in the modern world is energy. In order to maximize the rational use of the generated energy, blockchain technology provides to see how much energy we use, at what hours, etc. There are lots of opportunities with blockchain technology and its immeasurable potential for improving the quality of service provision improving the confidentiality and integrity of data at the same time.

Bottom line:

So, what is blockchain? Maybe the best answer is this quotation: ‘The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.’ said Don & Alex Tapscott, authors Blockchain Revolution (2016).

The blockchain technology is extremely powerful and can disrupt many existing organizations. No matter what happens with Bitcoin, Blockchain technology is here to stay, in a more refined and sophisticated manner.