If you want to know how to defeat the bear market read this post to the end.

By Guy Avtalyon

Who wants to know how to defeat the bear market? Are you scared about the bear market? Yes, you should be scared. A bear market is one of the cruelest events that can happen to investors.

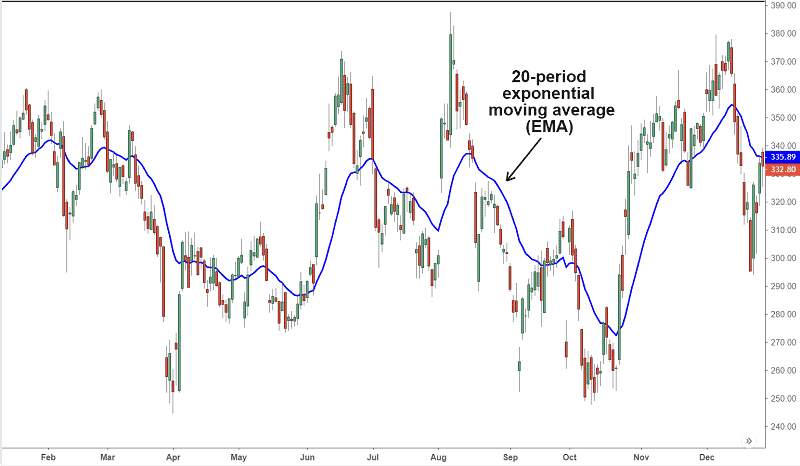

Let’s make clear what the bear market is. A bear market is when the price of stocks falls at least 20% or more from its 52-week high.

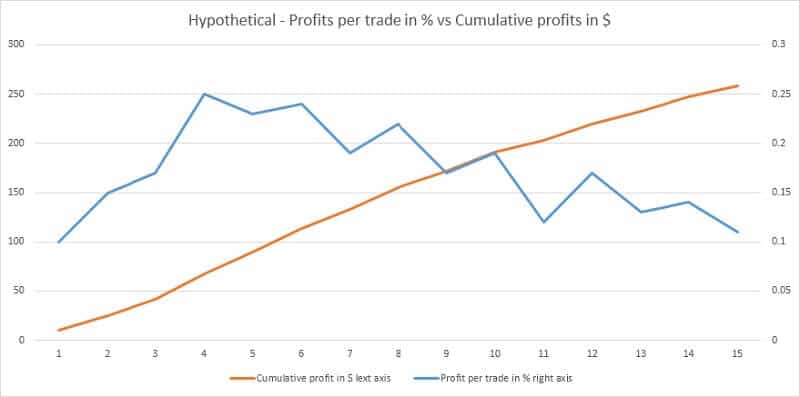

It is essential to understand the order of stock market returns, actually the range of return. Investors who do not understand the order may experience lingering effects that will reduce their profits for a lot.

Where the bear market may occur?

In short everywhere. Stocks, bonds, currencies, gold, oil. Literally everywhere where the trade occurs. Of course, when the prices of computers drop we can’t speak about the bear market. We will rather speak about deflation in such a case.

The bear market is brutal and dangerous. It can blot out everything you made in the bull market. The main goal for every investor during the bear market is to keep as much as it is possible the earning and investment.

I hope you know how to survive a bear attack. Do you really know? Did anyone tell this before to you? Well, the best way to survive a bear attack is to pretend you are dead. Just lay down, don’t breathe, don’t move, keep your eyes open to know what is the next bear’s move, but don’t move them. Clear?

Do it all but without panic.

The same comes when the stock market is down during the bear period. Stay calm and don’t panic.

How not to panic when the stock prices are going down?

Just keep in mind that it is the period. Yes, it is a period when the prices are dropping. A slump in investor confidence will indicate the attack of a bear market. You will see them running away as if chased by a pride of hungry lions. They are selling stocks with the speed of light. Oh, how wrong they are! Where they are going when the bear market is full of investing opportunities.

People, there is no need to get panicked.

That’s the natural condition of the market. To paraphrase a famous investor Peter Lynch, if you don’t understand that recessions can occur or the stock market may drop, you are not ready to enter the market, or at least, you will not do well there.

But we’re all on the same ship. There is no reason to panic. You have to know one thing. The market isn’t the Titanic. It will not crash so easily. This boat will correct itself. It will not happen overnight. So you have to be patient and stay calm. Remember how to survive a bear attack? That is exactly how to defeat the bear market.

During the bear market, most stocks will fall. How to stay in stocks in such circumstances? Just count!

Will it be better to have money in a savings account with a zero interest rate? Nope! Even when the price decline, your stocks will give you a better return.

The secret strategy on how to defeat the bear market is to buy and hold. Investing shouldn’t be the last trump card in your hand. You must have more options in your overall financial situation. You can’t defeat the bunch of enemies with one shot.

Except, of course, if you’re Luke Skywalker on the bombing run against the air vent of the Death Star.

How to defeat the bear market?

Buy now! Notice, be greedy when others are afraid. You should buy the stock when everyone else is selling. Evaluate the companies, their historical data, don’t read the news for a while (trust me, I know how journalists can produce breaking news, and highlight the headlines). Just be calm and let it appear. Let the right decision to come to you. The doors will be opened. Enter! Take your position! Ignore the jerks! Don’t listen to them, find your sweet spot. And don’t panic, again!

In the worst-case scenario, which is the most extreme, you can sell all your stocks and put cash to the bank account (to be honest, I don’t think it is smart, but still) or reinvest the money in more stable assets such as short-term bonds. But you have to know, if you sell all your stocks it is capitulation. It is the official term not my opinion about your investing. But if you do so, how will you come back, how will you rebound? You will be lost out. And it will be very hard for you to enter the stock market again.

The best way is to take a defensive strategy. This means to buy the stocks of big, stable companies. They are strong enough to defend your portfolio from the bear market. Their share prices are less sensitive to a bigger decline. For example, food businesses.

A bear market is a feeling about a particular market mood.

The bear market received its name for the behavior by which bears attack their victims. So, just pretend you are dead when the bear market occurs.