Cannabis is now legal in many countries and their number will increase. Public support for cannabis legalization is undoubted. That all can provide cannabis stocks to jump in 2020.

Even though the cannabis sector gets knocked down almost on a daily base, some pot cannabis stocks could bounce in 2020. Yes, Canadian sales missed expectations after the legalization of recreational use of cannabis and remained to stay limited globally.

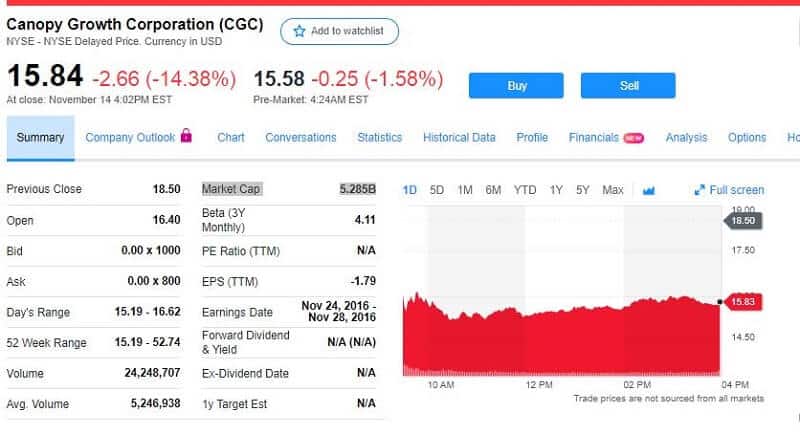

But the Canadian sector could have a great stimulus in 2020 with the Cannabis 2.0 rollout. Also, the retail store number increase is one of the trump cards. For example, Canopy Growth plans to open 40 retail stores a month during 2020 in Ontario. Great plan, indeed but will the government really open up the market to such a huge development?

The stock market wasn’t good in 2019 for cannabis stocks, and investors have to look at the chances of beaten-down stocks. But we truly believe that some of the cannabis stocks could bounce in 2020.

One of them is the Cronos Group (CRON)

The Cronos Group missed out on revenue estimates for Q3. It was $1.3 million lower. The stock followed the company’s “success”, it also has dropped and hit the new lows.

The important fact is the company still grew revenues gradually generated $29.4 million in revenues for the last nine months. Also, the company raised up the production but investors didn’t see the benefit from that. Actually, they were very disappointed by the fact that Cronos sold 8x the kilogram in September but at half the net revenue per gram. But the company ended the third quarter with $1.14 billion on the balance sheet while the company’s value was $0.7 billion. So, this cash flow is Cronos’ main advantage.

It gives the company an opportunity to invest further while the majority of the rivals don’t have such a possibility. CRON has an optimistic Buy consensus rating from Wall Street. Moreover, the average analyst price target is $13.45 and the last closing price was at $7.14.

Tilray (TLRY) Cannabis Stocks Could Bounce

Tilray is one of the most popular cannabis companies in the world. The popularity came from an unusual event after its IPO. What happened? The crazy prices followed the IPO with the stock price over $300 shortly after IPO.

Tilray was the first cannabis company in history to list directly on one of the major US exchanges at $17 per share. Only a few weeks later, the stock price hit the insane price of $300 per share. It was the hottest IPO in 2018.

But the year after…

The average net selling price per gram dropped to $3.25 last Q3, the prior price was $6.21. A gross margin of 31%, the adjusted EBITDA loss of $23.5 million, and only $122 million in cash are weak results.

But Tilray appears well-positioned in combination with the InBev JV which may be catalysts in 2020 and make these cannabis stocks could bounce.

The 2020 revenue estimates are only at $316 million but the stock has picked analysts’ optimism. They forecast a possible upside of over 40% and the stock price at $29.57. There is hope for Tilray.

OrganiGram (OGI)

OrganiGram Holdings is down from the high above $8 in May it falls to $2.5 on December, 24 but it is 1.62% more than the previous close price.

The day before, the company announced the first of its ‘Cannabis 2.0’ products have been released. Trailblazer Spark, Flicker, and Glow 510-thread Torch vape cartridges, filled with C0₂-extracted cannabis concentrate oil and botanical terpene.

Some unpleasant events occurred before this announcement.

For the quarter ended in June, OrganiGram generated revenues of $24.8 million. Everyone was expecting a great year. Instead, shipments fail to $20.0 million, the company was faced with $3.7 million in provisions, and the company forecasts revenues of only $16.3 million. The EBITDA profits were shifting into the loss.

Now, OrganiGram could raise more cash.

That’s the reason why the stock has a ‘Strong Buy’ rating. Analysts are predicting an upside potential of 225% from the current price of $2.5.

Bottom line

Why Traders Paradise is so sure that any cannabis stocks could bounce in 2020?

First of all, cannabis sales will increase.

Cannabis is now legal in more-than-ever countries and their number will increase. Some experts state that the cannabis industry has the potential to advance to $130 million per year soon. This isn’t likely to happen in 2020, but this number figure out how fast the industry is growing.

Public support for cannabis legalization is undoubted. The public is more aware of the potential benefits of cannabis. Also, we can expect new strains of cannabis. Moreover, cannabis-infused products will become more broadly available, and some of these products will be produced by companies that are well-known in the drink industry. For example, Molson-Coors and Coca-Cola both are considering to produce drinks with CBD.

Experts found that cannabis can have important benefits for people’s general health. For example, cannabis can potentially lower cancer risk. Moreover, cannabis is much safer than alcohol. Right?

All this put together, the cannabis stock could easily bounce in the year ahead.