2 min read

Foretelling an economic downturn can seem as mystical and convoluted as reading the horoscope charts. However, financial experts are warning that the economic winds are changing.

There are some economic indicators causing financial analysts to prognosticate slim financial time. First, economic growth is postponed. The rate of salary increase has stagnated. As the economy continues to slow down, consumer interest rates will rise and investment earnings will lose momentum, possibly even losing money.

We have to be honest, there’s no magical way to predict just how bad things will get. Anyway, burying the head in the sand is a terrible idea. Here are a few things you can do to protect your finances against the coming economic downturn.

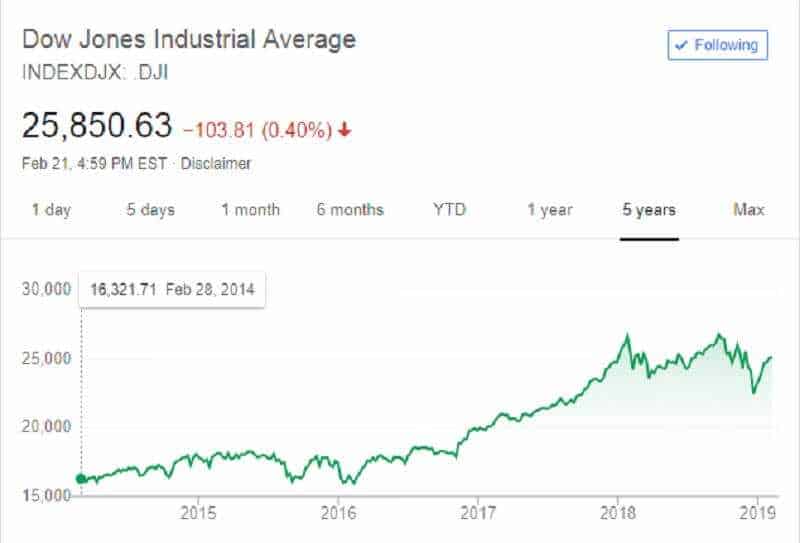

Dow Jones Industrial Average Market index

When the storm is approaching, the first thing you do is preparing your home for that attack. You cover windows and surround your home with sandbags. An emergency fund does the same thing financially. It’s the added layer of protection that can assist you when the economy drops. Also, it provides you a fighting chance to protect what you’ve increased.

Grow your emergency fund

The emergency fund is anywhere from three to six months’ worth of daily living expenses. During the meager economic time, you want to have more than the standard recommended amount.

Under normal circumstances, the average period of unemployment lasts roughly three to six months. But experts assume that number is sneaking and could double in an indolent economy.

To be more clear, when it comes, you have to plan

To be unemployed at least one month per every $10,000 you earn. So if you earn $80,000 a year, you should plan for unemployment that lasts at least 8 months. This formula is a great measure in helping you discover how much you need in your emergency fund.

Balance your budget and allocate debt

In anticipation of a natural disaster, people buy supplies and lasting food items. Balancing your budget by reducing expenses in preparation for a financial collapse follows the same principal.

Your holiday and home renovation may have to pause. The key is to prioritize your expenses. You have to recognize what you can skip. Also, you have to stop living on overtime, bonuses, and side-gig money. It is better to put that money into your emergency fund.

You must be focused on quickly paying down debt. Get rid of some of your smaller debts fast. If you reduce debt, you owe less and have more money at your control. It can be your care package during a downturn.

Increase professional skills

This is a nonfinancial thing. Let’s say you have a primary job, but you also have a bunch of hobbies. These things can be turned into job opportunities.

Take time to renew your resume and hone or add to your skill set. There are a lot of companies out there offering training.

Take those opportunities now, don’t hesitate.

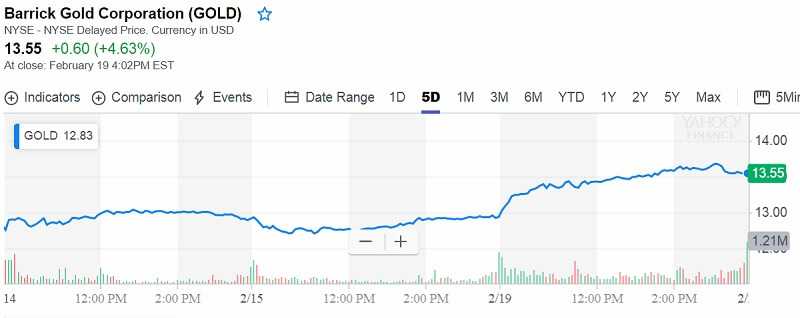

Evaluate your investment portfolio

The stock market usually becomes extremely volatile during an economic downturn. Financial experts recommend not to remove your money off an investment while you panicking. Fear should never encourage your decisions.

Look at your investment portfolio now. Try to find if there are any additions you’d like to change. Generally speaking, risky funds will probably lose money during a downturn. But truth is, they also rebound instantly during an economic restoration. Safer investments may not lose a lot, but you will not earn much too.

One method or investment technique isn’t superior over another. They all have pros and cons. The key is to evaluate yourself. Do you have a weak stomach? If so, go with something less risky. But if you’re convinced you can manage the turbulence of a risky investment, stay seated. Don’t forget to take financial advice before you decide, anyway. And remember, the knee-jerk attitude is the fastest way to lose big when it comes to investing.

Stay in control!

The bottom line

These are just a few of the small steps you can take to prepare yourself and your family for potentially difficult times, for the economic downturn.

The economy has been expanding since hitting bottom in mid-2009. That makes this recovery three years longer than the average growth cycle since 1945. If it reaches 10 years, it will match the record for the longest expansion. We have a few months to see that.

Maybe the slow pace of the recovery will allow it to run longer than usual. The odds of it ending get stronger as time goes on.

If you understand the terms overvalued and undervalued you will find plenty of stocks that look cheap

If you understand the terms overvalued and undervalued you will find plenty of stocks that look cheap

Position trades requires just a half of hour work per day, but profits can be great.

Position trades requires just a half of hour work per day, but profits can be great.

Instead of buying cryptos, you can invest in it, you just have to choose will you do it directly or indirectly. Traders-Paradise explains how to invest in cryptocurrency stocks.

Instead of buying cryptos, you can invest in it, you just have to choose will you do it directly or indirectly. Traders-Paradise explains how to invest in cryptocurrency stocks.